A Singaporean's Ultimate Guide to HDB Lease Buyback Scheme

Are you planning your parents’ retirement income?

Or are you worried that you won’t be able to hit your CPF Full Retirement Sum by the time you turn 55? I still am…

You might have heard of the HDB Lease Buyback Scheme (LBS), but don’t know how it can complement the above scenarios?

Well, we’re here to help!

The HDB Lease Buyback Scheme allows flat owners to increase their retirement income by monetising their flat.

Eligible flat owners who choose to take up the LBS are able to choose the length of the lease they wish to retain, based on the age of the youngest owner.

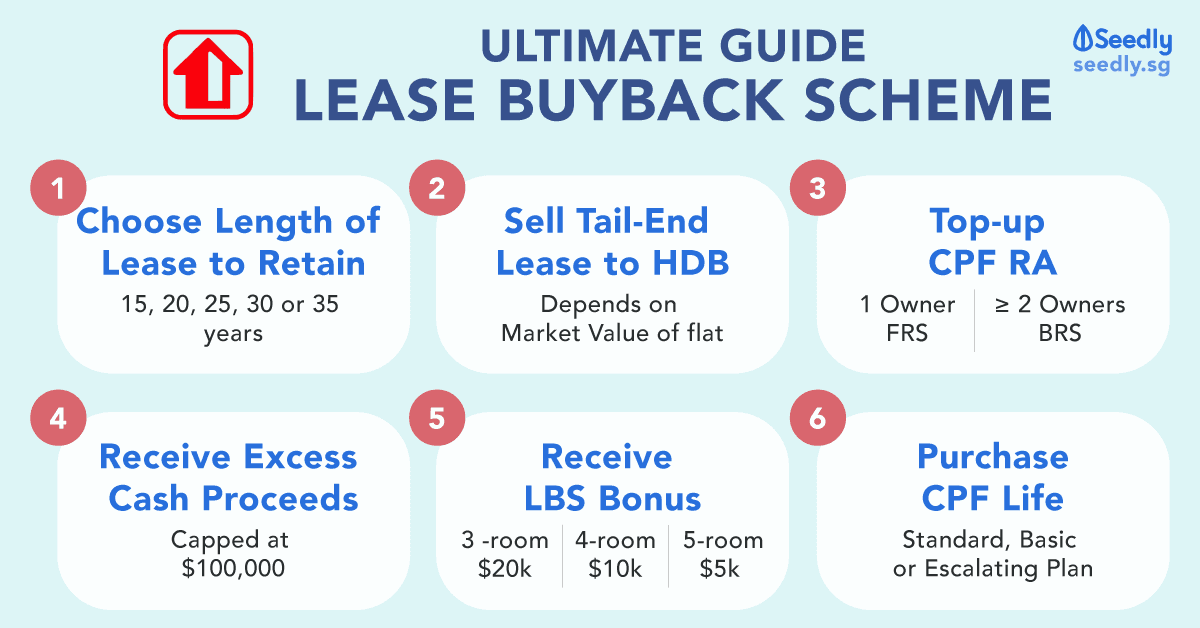

TL;DR – The Ultimate Guide To HDB Lease Buyback Scheme

Before you start plotting to use the HDB Lease Buyback Scheme to beef up your retirement income, you’ll first have to hit the eligibility conditions:

- All flat owners must meet the eligibility age, currently at age 65

- At least one flat owner is a Singapore Citizen

- Gross monthly household income lower than $14,000

- No concurrent ownership of second property

- All owners have been living in the flat for at least 5 years (Minimum Occupation Period)

- At least 20 years of lease to sell to HDB

- All flat types except short-lease flats, HUDC flats and Executive Condominiums

Depending on the age of all flat owners, there are different options for the length of lease you can retain.

| Age of Youngest Owner | Lease Retained | |

|---|---|---|

| Minimum Length of Lease | Other Lengths of Lease | |

| 65* - 69 *Current Eligibility Age | 30 years | 35 years |

| 70 - 74 | 25 years | 30 years 35 years |

| 75 - 79 | 20 years | 25 years 30 years 35 years |

| 80 and above | 15 years | 20 years 25 years 30 years 35 years |

Unless your CPF Retirement Accounts are already at your Full Retirement Sum, you will have to first top-up your CPF Retirement Account after selling the lease back to HDB.

Once you’ve topped up to your Basic or Full Retirement Sum, you can then receive any excess proceeds in cash.

Based on your household and amount of proceeds topped up, your household will also receive the LBS Bonus.

| Flat Type | Flat Owners' Total Top-Up to CPF | |

|---|---|---|

| $60,000 or more | Less than $60,000 | |

| 3-room or smaller flats | $20,000 | $1 for every $3 CPF top-up |

| 4-room flats | $10,000 | $1 for every $6 CPF top-up |

| 5-room or bigger flats | $5,000 | $1 for ever $12 CPF top-up |

Finally, the balance in your CPF Retirement Account will then be used to purchase your CPF Life Plan, where you’ll receive monthly payouts for your retirement years.

Who Qualifies For The Lease Buyback Scheme?

There are several conditions that your household needs to meet before you can qualify for the LBS.

All owners, whether single or joint ownership, must be age 65 and above (current eligible age), and at least one of the owners have to be a Singapore Citizen.

A gross monthly income ceiling of $14,000 applies to the household, and you must not be owners of a second property.

With the exception of short-lease flats, Housing and Urban Development Company (HUDC) flats and Executive Condominiums, all flat types are eligible for the LBS. However, flat owners have to meet a minimum occupation period of 5 years, with at least 20 years of lease remaining to sell to HDB.

How Does the Lease Buyback Scheme Work?

Step 1 – Choosing Length of Lease to Retain

Hang on a moment, before anything can be processed, you’ll first need to choose the length of your lease to retain.

Why leh?

How else will they be able to calculate how much money you get back right?

Your household can choose how long they wish to retain the lease based on the age of the youngest owner.

| Age of Youngest Owner | Lease Retained | |

|---|---|---|

| Minimum Length of Lease | Other Lengths of Lease | |

| 65* - 69 *Current Eligibility Age | 30 years | 35 years |

| 70 - 74 | 25 years | 30 years 35 years |

| 75 - 79 | 20 years | 25 years 30 years 35 years |

| 80 and above | 15 years | 20 years 25 years 30 years 35 years |

Older households may choose to retain a shorter lease, which will give them higher payouts. While younger household may have to choose to keep more lease for themselves since life expectancy is increasing.

Step 2 – Sell Tail-End Lease

Once you’ve decided how many years of the lease you want to keep, you’ll sell the remaining tail-end of your lease back to HDB.

Unfortunately, there’s no online calculator that can give you an estimate of the potential proceeds.

You’d have to make an appointment with HDB, where they will calculate an estimated amount. The actual valuation only happens after you’ve made the application.

What we do know though, is that the proceeds are calculated as follows:

Proceeds

= Market Value of Tail-End Lease – Outstanding Housing Loan

= (Market Value of Flat – Value of Lease Retained) – Outstanding Housing Loan

Since property values generally depreciate, the value of the tail-end lease will be lower than the value of the lease you retained.

| Flat Purchasing Scheme | Distribution of Net Proceeds |

|---|---|

| Joint Tenancy | Split equally amongst flat owners |

| Tenancy-in-Common | Split according to flat owners' shares |

Do note that your proceeds are subjected to an administrative charge of $100 and legal fees, which varies depending on your flat type and the flat’s market value.

Step 3 – Top-Up CPF Retirement Account

If you thought you were going to get everything back in cash, well, fat hope ah.

What comes out from CPF goes back to CPF!

Depending on your housing situation, you’ll be required to use the proceeds to top up your CPF Retirement Account to either the Basic or the Full Retirement Sum.

| Flat Owner's Age | Top-Up Requirement for 1 Owner: | Top-Up Requirement for 2 or more Owners: |

|---|---|---|

| Current Full Retirement Sum (FRS) | Current Basic Retirement Sum (BRS) |

|

| 65* - 69 *Current Eligibility Age | $176,000 | $88,000 |

| 70 - 79 | $166,000 | $83,000 |

| 80 and above | $156,000 | $78,000 |

Only if your Retirement Accounts are already at the Full Retirement Sum, then you are able to withdraw your net proceeds in cash.

Step 4 – Receive Excess Cash Proceeds

Actually not bad lah, you’ll still get some cash proceeds from the scheme.

Most likely, you will still have excess proceeds after topping up your CPF Retirement Account, and the rest is yours!

There’s a tiny catch though.

If your excess proceeds are $100,000 or more, you’ll keep the $100,000 and top-up the remaining to your CPF Retirement Account to the current Full Retirement Sum.

Guys, don’t rage, they probably just want to make sure that we have sufficient income to sustain us during our retirement years.

Step 5 – Receive Household’s LBS Bonus

Depending on the combined top-up to CPF by all the flat owners, your household will either receive the full LBS or pro-rated bonus.

| Flat Type | Flat Owners' Total Top-Up to CPF | |

|---|---|---|

| $60,000 or more | Less than $60,000 | |

| 3-room or smaller flats | $20,000 | $1 for every $3 CPF top-up |

| 4-room flats | $10,000 | $1 for every $6 CPF top-up |

| 5-room or bigger flats | $5,000 | $1 for ever $12 CPF top-up |

The LBS Bonus is payable by households instead of individual flat owners, but the amount each of you will receive is proportionate to the amount you topped up to your CPF Retirement Account.

There are two scenarios where your household may not receive the LBS Bonus:

- If the household had previously applied for Silver Housing Bonus

- If your CPF Retirement Accounts were all at the FRS, and you withdrew your net proceeds in cash

Step 6 – Purchase CPF Life Payouts

You guessed it!

With your CPF Retirement Account topped up to the Retirement Sum, you’ll then be able to buy a CPF Life Plan.

Yeap, the Lease Buyback Scheme and CPF Life come hand-in-hand.

Well, unless you’re 80 years old and above, you won’t be able to purchase your CPF Life as you would have exceeded the maximum entry age.

Depending on your age and the balance in your Retirement Account before and after your LBS, the scenario is slightly different.

| Age | Current Scheme you are Eligible for Before LBS | What Happens? |

|---|---|---|

| Below age of 80 | CPF Life | Top-up to Retirement Account under LBS will be used to buy an additional CPF Life policy |

| CPF Retirement Sum Scheme | Less than $60,000 in Retirement Account: Remain on CPF Retirement Sum Scheme with higher payouts |

|

| Remaining Balance & Top-up to Retirement Account under LBS more than $60,000: Join CPF Life |

||

| Age 80 & above | CPF Life or CPF Retirement Sum Scheme | Top-up to Retirement Account will be streamed out as an additional monthly payout |

So, if your parents didn’t have sufficient savings in their CPF Retirement Accounts previously, applying for LBS for them may potentially unlock the CPF Life plan for them.

As for yourself, well, I’m confident that if you’re reading Seedly articles, you will have more than the Full Retirement Sum when you reach age 65. If you choose to apply for LBS, then yay, double the income for you!

What Do I Need To Take Note Of?

Apart from the eligibility conditions for LBS, you might want to include the following restrictions before making your decision to apply.

Age Eligibility

ALL flat owners must be 65 years and above before the household can apply for the LBS.

However, since there is usually an age gap between spouses, the household will have to wait until the youngest flat owner turns 65.

Can I Sell My Flat After LBS?

Under the LBS, you will not be able to sell the flat on the open market or rent out the whole flat. However, you will still be able to rent out spare bedrooms, if any.

What If I Want To Return My Flat Prematurely?

It’s possible!

You’ll receive a refund of the remaining lease, but it’ll definitely be pro-rated and based calculated based on depreciation.

Fret not, you’ll still continue on your CPF Life as per normal.

Similarly, if you’ve previously used your CPF savings to finance your flat, the refund will also have to be allocated back to your CPF account.

What If I Outlive My LBS Lease?

Well, we can never predict the future and we might have chosen to retain a shorter lease but end up outliving it.

When that happens, HDB will help to determine the appropriate housing arrangement for you.

Family comes first, so they’ll definitely work with your family members to see if an arrangement can be worked out.

Otherwise, referrals to social agencies will be made for individuals with no family support.

What If I Pass On Within My LBS Lease?

In the event that you pass on before your LBS lease expires and you have surviving flat owners or occupiers, they can choose to live in the flat until it expires.

Otherwise, they can also choose to return the flat to HDB prematurely, similar to the situation above, just that the refund will be distributed to your beneficiaries.

The HDB Lease Buyback Scheme is just one of the many ways to build the retirement portfolio for yourself and your loved ones.

Sometimes, you may not choose to keep your current flat if it’s only you and your spouse and may choose to buy a smaller flat.

C’mon, we all know it’s painful to clean a big house. #firstworldproblems

What are your thoughts? Are you planning to apply for the LBS for yourself or your parents?

Advertisement