When I was 25 and fresh out of uni with zero savings, I assumed that the best way to reach $100,000 in savings before turning 30 was learning how to be a great investor.

I voraciously consumed books and sites about investing, spent weeks on end monitoring the stock market and stressing out when my investments started to lose money.

Turns out, I was an idiot – this is what I wished I knew then.

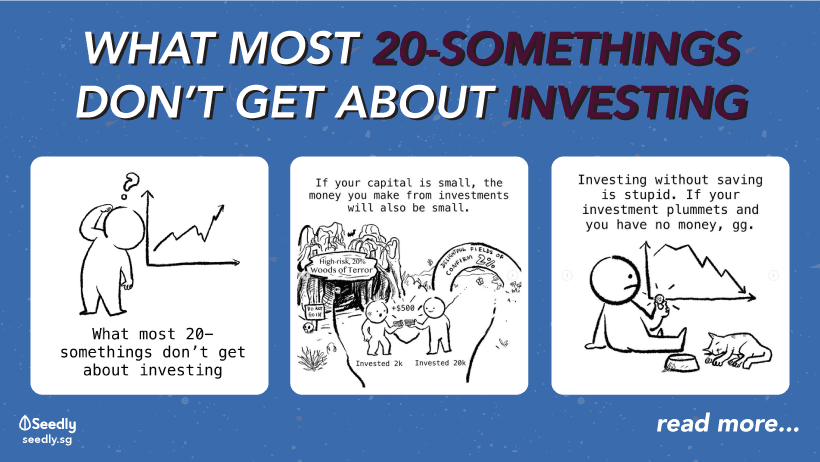

If your capital is small, the money you make from investments will also be small.

If all you have $2,000, then investments aren’t going to do much for you. Even if you manage to get a super impressive 20% from high-risk investments a year, that only adds up to … $500.

Instead of obsessing over the complicated stock market trying to figure out how to earn $500 a year and potentially losing it, I could’ve just driven Grab, delivered food or worked part-time to get that extra $500 in a month. Indeed, one year down the road with $20,000 saved up, I could easily get that $500 on low-risk investment, such as The Singapore Savings Bonds. Or even more from something like an index fund or REIT.

What I did to fix it: I decided to become a passive investor via index investing and focus on how I could earn more money first. The less time I spent fussing over the stock market, the more time I had to earn extra money.

Investing without saving is incredibly stupid

Markets go up, and markets go down. (But they generally tend to go up in the super-long-term)

The longer you can go without income, the longer you can wait for loss-making investments to turn profitable. Having nothing to weather a storm is a sure-fire way to lose money.

Let’s say you have zero savings, and your hypothetical pet cat needs an operation to stay alive. You will be forced to sell your investments at a loss to pay the vet.

You literally ‘afford’ risk with money

In contrast, if a millionaire loses $10,000, they’d shrug and go to sleep.

They can literally afford the risk – you can’t.

Look, we’re not saying investing is not important.

It is super important and you need to start.

We are saying that you need to save money and build capital before you invest. There’s a sequence you need to follow and it kinda looks like this:

Stay Woke, Salaryman

This article first appeared on The Woke Salaryman and is part of a content syndication agreement between The Woke Salaryman and Seedly.

For this series of comics that are related to all things personal finance, the Seedly team worked closely with The Woke Salaryman to bring you useful sh*t which you can apply to your everyday life.

The Woke Salaryman is the brainchild of a Singapore-based duo that aims to help people reach financial independence early. It is the quintessential page for people living in Singapore who earn the median salary and didn’t inherit their fortunes from their parents.

If you have any questions with regard to personal finance and retiring early, feel free to discuss them with the friendly Seedly Community!

Advertisement