How To Do Your Own Insurance Claims Should You Be UNLUCKY Enough To Get A Lousy Agent?

Your insurance coverage is put to a real test when it comes to having to claim it.

A Facebook Post on Inactive Insurance Agent

A recent post on Facebook with regards to an insurance agent being inactive during an urgent claiming process has taken over the internet for a bit.

Here’s a quite summary of what happened (without mentioning names):

- Client A buys all her policies from Agent X. Policies include hospitalization for all her kids including rider.

- Client A’s son was diagnosed with slow in development. Insurance purchased covers it.

- Unfortunately, Client A’s son was diagnosed with “Jobert Syndrome” which is a brain disorder years down the road.

- Client A messaged Agent X with regards to the hospitalisation of her son.

- Agent X’s response was slow and claims could not process.

- Here are some original photos to exhibit the inactiveness during urgent times:

- Client A changes agent after 6 months.

On 7 September 2018

- Client A’s son got admitted due to persistent fever.

- E-filing could not be done over the counter.

- New agent went on to help with the claims.

- Client A told to change hospital by the insurance company’s claims department as there seems to be an issue with the insurance policy.

- Client A now has to foot a total bill of $7,000.

- And because of the complications involved, Client A has been paying for a policy that was not able to offset the bill when needed.

Before we dive straight into the claiming process, here are some things we need to find out about our policy.

Insurance billing methods

There are typically two types of billing methods when it comes to claiming of insurance:

Direct billing

- Direct billing is a common billing method for a health insurance plan.

- This method requires the policyholder to pay nothing up front.

- The hospital bill is settled directly with the insurer.

Reimbursement

- This method requires the policyholder to pay their hospital bill upfront

- After which, submit your claims to your insurance agent or insurance with receipt of the bill after which.

What can you do if your insurance agent is not active with the claiming process?

When it comes to claiming through the reimbursement billing method, having your agent is definitely way more convenient than doing it on your own.

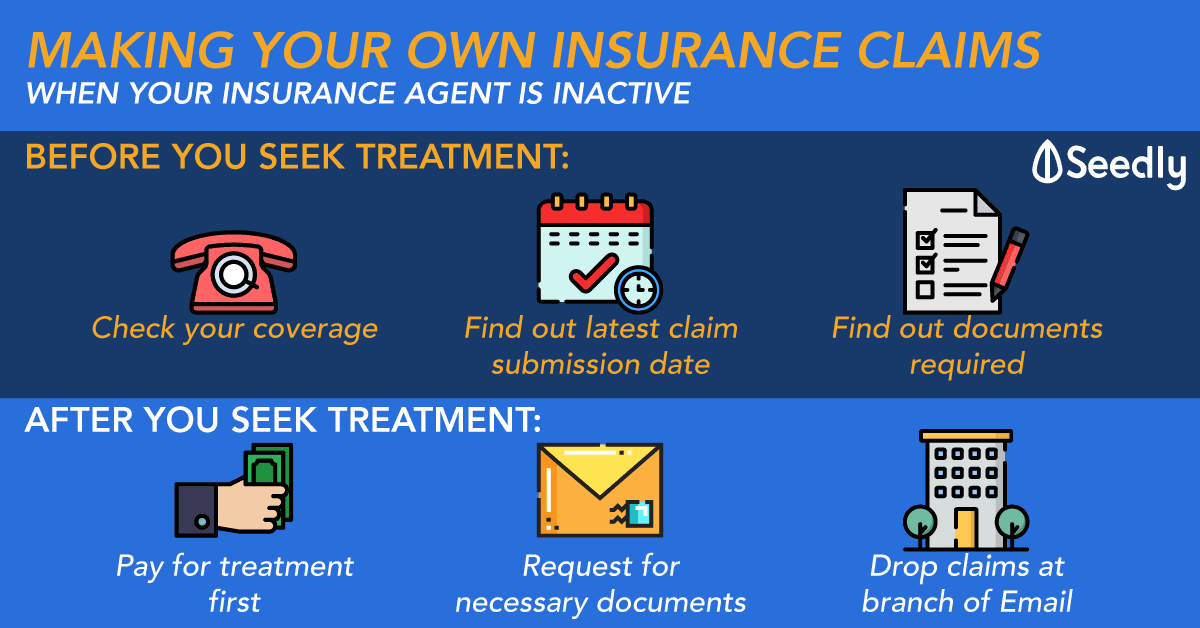

If making your insurance claim through an agent not be an option, here’s a step-by-step guide to claiming your insurance on your own.

Before you seek treatment

- It is important to make sure that the procedure or treatment which you are going to go for, is covered under the policy you bought.

(Imagine going for a treatment that incurs a huge cost, and end up not being able to claim.) - Know exactly when is the deadline or latest date to submit your claim.

- Find out what are the documents required for a successful claim submission.

After your treatment

- Should direct billing be not available, one will need to pay for the cost of treatment upfront first.

- Make sure the necessary documents required to claim your insurance policy is obtained too.

Some of the common documents include receipts, medical report and a completed claims form from your insurance provider. - Submit the documents.

There are a few ways to submit the necessary documents. One can either drop it off at the insurance company’s offices or submit it online.

A good habit will be to take note of the date of which the claim is submitted. Should the process be taking a little too long, do drop them a reminder to get an update on the process.

Editor’s Note: One does not always have to approach the agent whom you purchased your policy from, to assist with the claim. Any representative of the insurance company can help you do so.

Food For Thought

While it is easy to make it as an insurance agent (check out our advisors to population ratio and you will know why), it is difficult to be a GOOD insurance agent.

Most insurance agents as time past end up not making the cut for survival and eventually leaves the industry.

In the above example, we understand that unfortunate events as such can occur at any time of the day and the agent needs to react to it as soon as possible to ensure that their clients are in good hands.

Advertisement