We will let you in on a little secret.

The cost of getting a home in Singapore has officially put marriage on hold for a lot of Singaporeans.

When you decide to get married, you are looking at hosting a wedding banquet that will cost around $27,610. This is followed by the need to pay for your spanking new BTO flat, where -unless you’ve got ~$341,500 lying around for a 4 room BTO- you will need to get a mortgage loan to pay for your flat.

Selecting the right mortgage loan is hard, and the process of choosing the right one for you may be a bit of a headache. If you need a little help to compare the various mortgage loans in Singapore, here’s a compilation just for you.

A Quick Recap: Should I Go For An HDB Loan Or A Bank Loan?

A quick recap on the differences between an HDB Housing Loan vs Bank Loan:

HDB Loan | Bank Loan |

|

|---|---|---|

| Interest Rate | Currently 2.6% (0.1% above the CPF Ordinary Account interest rate) | Currently 3.25% - 4.70% (Depends on the bank and benchmark, interest rates fluctuates) |

| Downpayment | 20% in CPF or Cash | At least 5% in cash+ 20% in cash or using CPF OA savings |

| Maximum Loan | New flats: 80% of the purchase price Resale flats: 80% of the resale price or market valuation, whichever is lower | 75% of the purchase price |

| Minimum Loan | None | Usually $100,000 |

| Late Payment Penalty | Currently 7.5% per annum | Depends on individual banks. Usually less lenient than HDB. |

| Eligibility | Income + citizenship requirements | No restrictions, although a bad credit score might hinder your application |

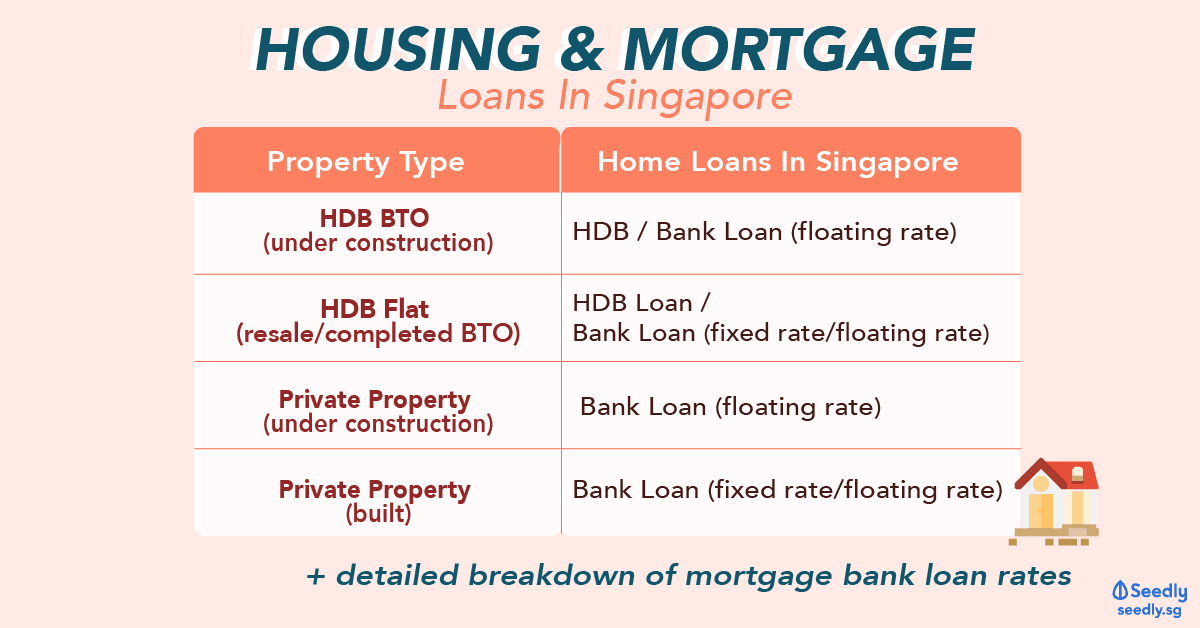

What Kind Of Home Loan Can I Get?

| Property type | Home loans in Singapore |

|---|---|

| HDB BTO (under construction) | HDB loan / bank loan (floating rate) |

| HDB flat (resale / completed BTO) | HDB loan / bank loan (fixed rate) / bank loan (floating rate) |

| Private property (under construction) | Bank loan (floating rate) |

| Private property (built) | Bank loan (fixed rate) / bank loan (floating rate) |

Fixed Rate vs Floating For Your Home Loan

Having made up your mind to settle for a bank loan, a major consideration will be choosing between a fixed or floating interest rate package.

What Is Fixed Rate For Mortgage/ Housing Loans?

For fixed rate packages, the same interest rate is maintained throughout the lock-in period.

Here’s what this means:

- During the lock-in period which usually ranges from 1 to 5 years, the interest rate is fixed.

- This is regardless of the market condition, even when it is a rising interest rate environment.

- After the lock-in period, the interest rate will be converted to a floating interest rate.

- This is a good option if interest rates and low and when the buyer wants to budget with certainty over the initial lock-in period.

What Is Floating Rate For Mortgage/Housing Loans?

As for floating rate, the rate changes from time to time.

Here’s what this means:

- The interest rate is influenced by the SIBOR and SOR rate.

- In a rising interest rate environment, one may end up paying more for his loan.

- Consumers can choose between 1-month, 3-months, 6-months and 12-months SIBOR or SOR rates to peg their interest to.

Which should you choose? Fixed Rate vs Floating Rate

Here are some factors which should influence your decision when it comes to choosing between a fixed rate or a floating rate.

Interest Rate environment

- In a rising interest rate environment, a fixed rate mortgage loan will be a better option as we lock our interest rate to the current one. In contrast, in a declining interest rate, a floating rate is better for consumers.

Financial Certainty

- For someone who prefers to be certain about the amount he needs to pay for his loans moving forward, a fixed rate mortgage loan offers that certainty.

- For someone who understands the market and is more than happy to monitor the fluctuation of SIBOR and SOR rates, a floating rate works best.

Banks are pegging their interest to these rates!

Banks use various benchmark to peg their loan interest rates, this makes comparing of loans even harder!

This will be further demonstrated in the compilation below.

Before we head over to the mess, it is good to understand the different rates bank uses:

- SIBOR

SIBOR is defined as the Singapore interbank offered rate. It is based on the interest rates used by banks in Singapore and the rate they charge one another when they borrow from each other.

Loans are pegged in denominations of 1,3,6 and 12 months, depending on the bank. - Board rates

These are rates that are determined by the bank internally. - Fixed Deposit Pegged Rate (FDPR)

Fixed deposit rates of the bank. Banks usually use the rates between 6 to 12 months instead. Do note that individual bank uses a different name for this. DBS, for example, uses FHR8. - SOR

The effective cost of borrowing in Singapore Dollars synthetically by borrowing USD for the same maturity.

Best Home Loan For HDB (Fixed rate)

Before we kick off with the comparison, here are some assumptions we made:

- Assuming a loan size of S$350,000

- For a period of 25 years

- Loans are for completed HDB

| Bank | Fixed rate Lock-in period | Interest rate p.a (Year 1) | Interest rate p.a (year 2) | Interest rate p.a (year 3) | Interest rate p.a (thereafter) | Loans pegged to |

|---|---|---|---|---|---|---|

| Hong Leong Finance | 2 Years | 1.65% (fixed) | 1.70% (fixed) | 1.97 (HHR - 2.90) | 2.20 (HHR - 2.65) | HDB Home rate (HHR) 4.85% p.a. as of June 2020 |

| 3 Years | 1.75% (fixed) | 1.80% (fixed) | 1.95% (fixed) | 2.20 (HHR - 2.65) |

||

| HSBC | 2 Years | 1.55% (fixed) | 1.55% (fixed) | 1M SIBOR + 1% p.a | 1M SIBOR + 1% (thereafter) | 1M SIBOR |

| 3 Years | 1.55% (fixed) | 1.55% (fixed) | 1.55% (fixed) |

|||

| Citibank | 2 Years | 1.78% (fixed) | 1.78% (fixed) | 1 Month SIBOR + 1% | 1 Month SIBOR + 1% | 1 Month SIBOR |

| 3 Years | 1.78% (fixed) | 1.78% (fixed) | 1.78% (fixed) | 1 Month SIBOR + 1% | ||

| Bank of China | 2 Year | 1.75% (fixed) | 1.75% (fixed) | 3 months SIBOR + 0.85% | 3 Months SIBOR | |

| DBS | 2 Years | 1.50% (fixed) | 1.50% | FHR24 + 0.90% p.a | FHR24 | |

| 3 Years | 1.50% (fixed) | 1.50% (fixed) | 1.50% (fixed) | FHR24 + 0.90% p.a | ||

| 5 Years | 1.50% (fixed) | 1.50% (fixed) | 1.50% (fixed till year 5) | FHR24 + 0.90% p.a | ||

| Standard Chartered | 2 years | 1.55% (fixed) | 1.55% (fixed) | 3 Month SIBOR + 1% | 3 Month SIBOR | |

Best Home Loan for HDB (Floating Rate)

Assuming the same assumptions:

- Assuming a loan size of S$750,000

- For a period of 25 years

- Loans are for a completed property

| Bank | Lock-in period | Interest rate p.a (Year 1) | Interest rate p.a (year 2) | Interest rate p.a (year 3) | Interest rate (thereafter) | Loans pegged to |

|---|---|---|---|---|---|---|

| CIMB Bank | 2 Years | 1M SIBOR + 0.150% = 1.90% | 1M SIBOR + 0.600% = 2.35% | 1 Month SIBOR | ||

| CitiBank | 2 Years | 1-mth SIBOR + 0.28% = 2.02% | 1-mth SIBOR + 0.45% = 2.19% | 1-mth SIBOR + 0.60% = 2.34% | 1 Month SIBOR | |

| DBS | 2 Years | DBS FHR8 + 1.13% = 2.08% | DBS FHR8 + 1.13% = 2.08% | FHR8 (DBS) |

||

| Hong Leong Finance | 2 Years | HHR - 3.25% = 1.60% | HHR - 2.65% = 2.20% | HDB Home Rate (HRR) | ||

| HSBC | 2 Years | 1 Month SIBOR + 0.25% | 1 Month SIBOR + 0.35% | 1 Month SIBOR + 0.75% | SIBOR | |

| 2 Years | TDMR24+0.98% = 2.38% p.a. | TDMR24+1.08% = 2.48% p.a. | TDMR24+1.18% = 2.58% p.a. | TDMR24+1.38% = 2.78% p.a. | TDMR (HSBC) |

|

| Maybank | 3 Years | Maybank SRFR - 2.82% = 2.03% | Maybank SRFR - 1.85% = 3.00% | SRFR | ||

| OCBC | 2 Years | 3-mth SIBOR + 0.30% = 2.07% | 3-mth SIBOR + 0.40% = 2.17% | 3-mth SIBOR + 0.50% = 2.27% | 3-mth SIBOR + 0.60% = 2.37% | 3 Month SIBOR |

| 2 Years | OCBC MBR + 0.60% = 2.10% | OCBC MBR + 0.60% = 2.10% | OCBC MBR + 0.60% = 2.10% | OHR (OCBC) |

||

| Standard Chartered | 2 Years | 1-mth SIBOR + 0.30% = 2.04% | 1-mth SIBOR + 0.30% = 2.04% | 1-mth SIBOR + 0.35% = 2.09% | 1-mth SIBOR + 0.50% = 2.24% | 1 Month SIBOR |

| 2 Years | 3-mth SIBOR + 0.35% = 2.12% | 3-mth SIBOR + 0.45% = 2.22% | 3 Month SIBOR | |||

| 2 years | FDR36(SCB) + 0.540% = 1.91% | FDR36(SCB) + 1.280% = 2.65% | FDR36(SCB) + 1.780% = 3.15% | FDR36(SCB) + 1.780% = 3.15% | FDR36(SCB) | |

| UOB | 2 Years | 3-mth SIBOR + 0.20% = 1.97% | 3-mth SIBOR + 0.25% = 2.02% | 3-mth SIBOR + 0.35% = 2.12% | 3-mth SIBOR + 0.40% = 2.17% | 3 Month SIBOR |

| 2 Years | UOB MLCR + 1.13% = 1.98% | UOB MLCR | ||||

Best Home Loan For Private Residential Property (Fixed rate)

Before we kick off with the comparison, here are some assumptions we made:

- Assuming a loan size of S$750,000

- For a period of 25 years

- Loans are for a completed property

| Bank | Fixed rate Lock-in period | Interest rate p.a (Year 1) | Interest rate p.a (year 2) | Interest rate p.a (year 3) | Interest rate p.a (thereafter) | Loans pegged to |

|---|---|---|---|---|---|---|

| Bank of China | 2 Years | 2.25% (fixed) | 2.25% (fixed) | 3M SIBOR + 0.700% = 2.47% | 3M SIBOR + 0.700% = 2.47% | 3 Month SIBOR |

| State Bank of India | 2 years | 2.50% (fixed) | 2.50% (fixed) | Board + 2.750% = 2.75% | Board + 2.750% = 2.75% | BD (SBI) |

| Citibank | 2 years | 1.81% (fixed) | 1.81% fixed) | 1M SIBOR + 0.650% = 2.40% | 1M SIBOR + 0.650% = 2.40% | 1 Month SIBOR |

| 3 years | 1.82% (fixed) | 1.82% (fixed) | 1.82% (fixed) | 1M SIBOR + 0.500% = 2.25% | 1 Month SIBOR | |

| 3 years | 1.84% (fixed) | 1.84% (fixed) | 1.84% (fixed) | 1M SIBOR + 0.650% = 2.40% | 1 Month SIBOR | |

| DBS | 2 Years | 1.90% (fixed) | 1.90% (fixed) | FHR8(DBS) + 1.030% = 1.98% | FHR8 | |

| 2 years | 1.86% (fixed) | 1.86% (fixed) | FHR8(DBS) + 1.030% = 1.98% | FHR8 + 1.75% | ||

| UOB | 2 Years | 1.86% (fixed) | 1.86% (fixed) | MLCR(UOB) + 1.130% = 1.98% | MLCR(UOB) + 1.130% = 1.98% | MLCR (UOB) |

| 3 years | 1.86% (fixed) | 1.86% (fixed) | MLCR(UOB) + 1.210% = 2.06% | MLCR(UOB) + 1.210% = 2.06% | ||

| 3 years | 1.88% (fixed) | 1.88% (fixed) | 2.06% (fixed) | MLCR(UOB) + 1.210% = 2.06% | ||

Best Home Loan for Private Residential Property (Floating Rate)

Assuming the same assumptions:

- Assuming a loan size of S$750,000

- For a period of 25 years

- Loans are for a completed property

| Bank | Lock-in period | Interest rate p.a (Year 1) | Interest rate p.a (year 2) | Interest rate p.a (year 3) | Interest rate (thereafter) | Loans pegged to |

|---|---|---|---|---|---|---|

| CIMB Bank | 2 Years | 1M SIBOR + 0.150% = 1.90% | 1M SIBOR + 0.600% = 2.35% | 1 Month SIBOR | ||

| 2 years | 1M SIBOR + 0.200% = 1.95% | 1M SIBOR + 0.600% = 2.35% | ||||

| 2 years | 1M SIBOR + 0.250% = 2.00% | 1M SIBOR + 0.600% = 2.35% | ||||

| Maybank | 2 years | Board + 2.030% = 2.03% | Board + 3.000% = 3.00% | Board Rate | ||

| DBS | 1 year | FHR8(DBS) + 1.130% = 2.08% | FHR8 | |||

| UOB | 2 years | MLCR(UOB) + 1.200% = 2.05% | MLCR (UOB) | |||

| HSBC | 2 Years | TDMR(HSBC) + 0.980% = 2.38% | TDMR(HSBC) + 1.080% = 2.48% | TDMR(HSBC) + 1.180% = 2.58% | TDMR(HSBC) + 1.380% = 2.78% | TDMR (HSBC) |

| 2 Years | 1M SIBOR + 0.300% = 2.05% | 1M SIBOR + 0.300% = 2.05% | 1M SIBOR + 0.400% = 2.15% | 1M SIBOR + 0.750% = 2.50% | 1 Month SIBOR | |

| OCBC | 2 Years | 3M SIBOR + 0.300% = 2.07% | 3M SIBOR + 0.400% = 2.17% | 3M SIBOR + 0.500% = 2.27% | 3M SIBOR + 0.600% = 2.37% | 3 Months SIBOR |

| 2 Years | MBR2 (OCBC) + 0.600% = 2.10% | MBR2 (OCBC) + 0.700% = 2.20% | MBR2 (OCBC) | |||

| Citibank | No Lock-in | 1M SIBOR + 0.100% = 1.85% | 1M SIBOR + 0.120% = 1.87% | 1M SIBOR + 0.500% = 2.25% | 1M SIBOR + 0.500% = 2.25% | 1 Month SIBOR |

| 2 years | 1M SIBOR + 0.480% = 2.23% | 1M SIBOR + 0.480% = 2.23% | 1M SIBOR + 0.500% = 2.25% | 1M SIBOR + 0.600% = 2.35% | ||

| Standard Chartered | 2 years | 1M SIBOR + 0.300% = 2.05% | 1M SIBOR + 0.300% = 2.05% | 1M SIBOR + 0.350% = 2.10% | 1M SIBOR + 0.500% = 2.25% | 1 Month SIBOR |

| 2 years | 3M SIBOR + 0.300% = 2.07% | 3M SIBOR + 0.450% = 2.22% | 3 Month SIBOR | |||

Advertisement