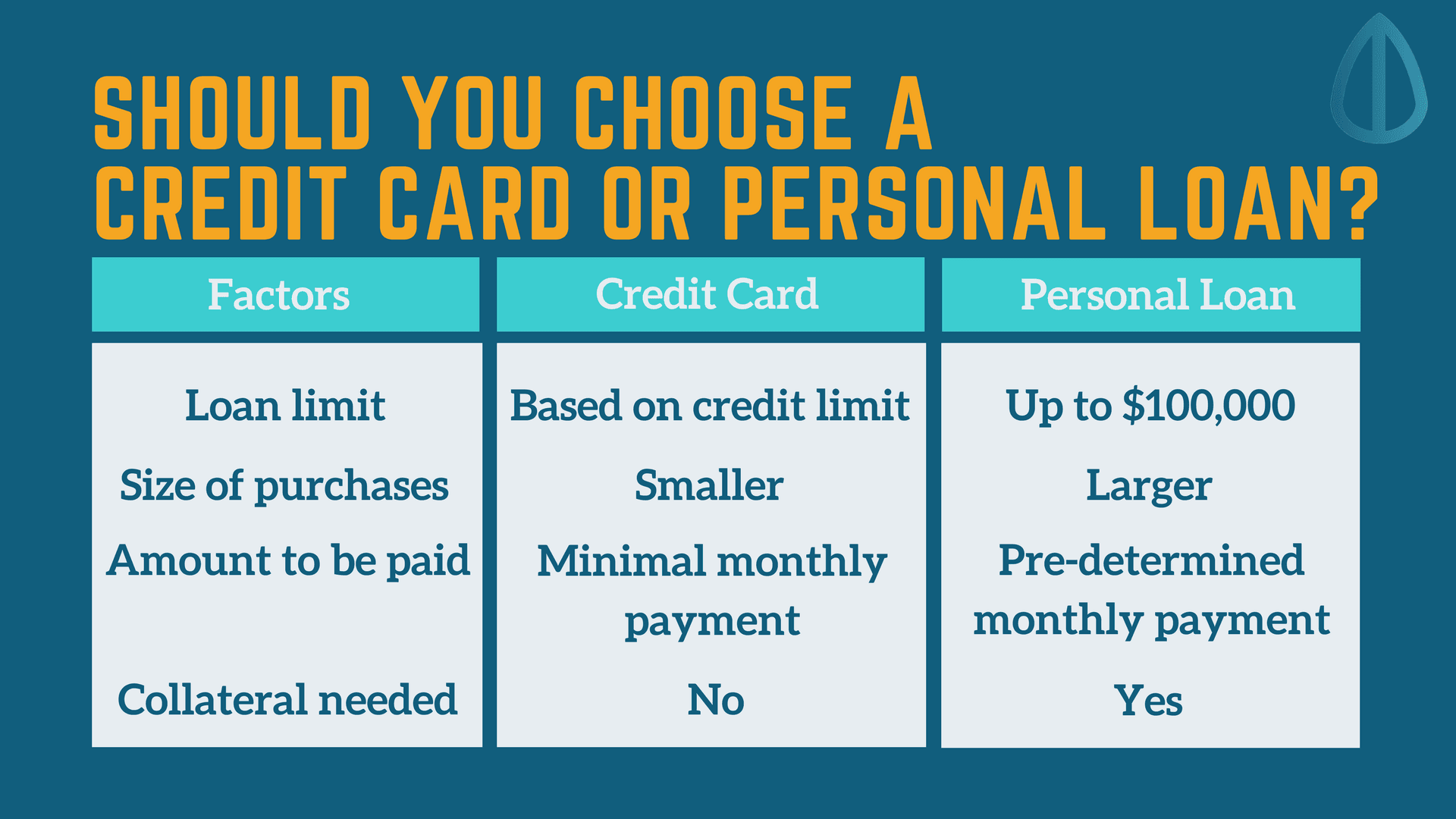

If you check out our articles, we have so many posts on how to clear your debts, which credit cards to choose or even misconceptions that people have about loans but as someone new to personal finance, my biggest question before reading such articles would be which loan should i take? This article will focus on the two most common loans, credit card and personal loans!

Credit Card or Personal Loan

Credit Card or Personal Loan

Credit Card

A credit card is also known as “revolving debt”, you have a pre-determined credit limit set by your financial institution. At the end of every month, you will be required to pay a minimum on the expenses charged to that card (usually 1% to 5%) once that is done, you are free to continue spending on that card.

With interest rates going up to double digits, credit cards are better used for smaller purchases but if you do intend to use your credit card for bigger loans, ensure that you are able to pay them off if not this could affect you credit score. Check out 5 reasons why you should have a good credit score!

Personal Loan

A personal loan, known as an “installment debt” means you receive a large sum of money (could be up to $100,000 at times) which you will then pay back in fixed monthly payments usually lasting 2 to 7 years. With a lower interest rate than a credit card, personal loans are best used for long-term expenses or larger expenses.

| Advantages | Disadvantages | |

|---|---|---|

| Credit Card | Continuous spending (As long as minimum monthly payment is met) 0% Interest rate ( with good credit score) Rewards available | Credit card limit Interest rate is higher than 10% Temptation to overspend |

| Personal Loans | Lower interest rate Debt has an end date (Due to a payment schedule) Cheaper in the long-term | Longer application process Inflexible payments Minimum loan amount |

Debt – Secured or Unsecured

Secured Debt

A secured debt is when the borrower puts down a certain amount or collateral such as property or a vehicle. This is done because the lender takes on a risk when they give away their money, therefore the collateral put down by the borrower will be claimed by the lender if the borrower is unable to pay their debt.

Unsecured Debt

An unsecured debt would require no collateral to be put down for a loan. This is based solely on the borrower’s creditworthiness and promise to repay. Due to this, interest rates are higher as well as the eligibility for approval.

Which Should I Take?

It all boils down to this question. The best way to determine which kind of loan you should take is to identify the needs that you have, will you be spending a lot or not as much? You also need to know if you would be able to pay off your debt in time because be it secured or unsecured debt, if you do not handle your finance properly you may just find yourself unable to repay your debts, leading to a growing debt over time. Take a look at methods to clear your debts or schemes that could help you pay off your debt!

Additionally, keep track of your finances using our Seedly app and join our community where we discuss personal loans, savings and more!

Advertisement