Financial Blogs That Singaporeans Should Be Reading in 2024 & Beyond

“Nobody reads the newspaper anymore.”

There is a mind-boggling amount of information made available online, where we spend most of our time obtaining information from. Being constantly fed with “propaganda-filled” advertisements that may not act in our best interests, Singaporeans turn to financial blogs to get an alternative (and hopefully unbiased) view.

Thus, the Seedly team shares our favourite past time reads which we believe Singaporeans should be reading and things to look out for when getting your personal finance content online.

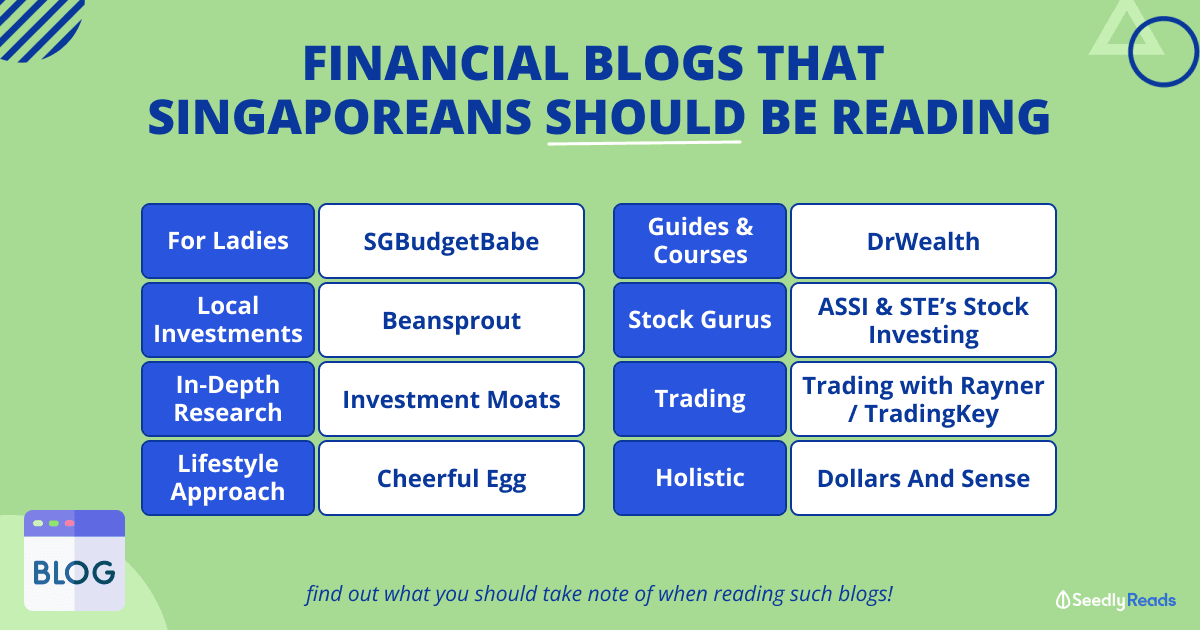

TL;DR: Different Financial Blogs for Different Interests

- Personal finance for ladies: SGBudgetBabe

- Investing in the Singapore Market: Beansprout

- If you are a fan of well-researched articles: Investment Moats

- Over a cup of coffee or tea: Cheerfulegg.com

- If you love guides and courses: DrWealth

- To learn from stocks gurus: A Singaporean Stocks Investor and STE’s Stocks Investing

- To learn to trade:

- For a holistic view of personal finance: Dollars and Sense

Financial Blog for the Ladies

SG Budget Babe

Budget Babe is always looking for cost-effective ways to live a fulfilling life in amidst Singapore’s rising costs. Her content mainly revolves around how Singaporeans can take charge of their own finances.

- A lady striving to achieve financial freedom before the age of 45.

- Practical personal finance tips and easily digestible content on money and lifestyle.

- From savings, investing to organising budget weddings, Budget babe got it all covered on her blog.

Having worked with Budget Babe on a few events, her sharing sessions are always enriching, well thought out and straight to the point. Budget Babe believes in giving back to society in the form of sharing her knowledge through events and talks at least once a year.

Financial Blog for Investing in the Singapore Market

Beansprout

Beansprout is a team of local experts when it comes to Singaporean assets. You can find insightful articles on investments such as REITs, government bonds, local stocks and more!

- Team of Singapore-based professionals that put out solid investment insights for the Singaporean Market.

- It has useful tools to help you compare REITs, savings accounts, brokerage accounts, and more.

- Quick dashboard of hot stocks in Singapore.

When it comes to local investments, especially when using CPF to invest in T-bills or Singapore Savings Bonds, I often find myself using their tools to help me make smarter financial decisions!

Financial Blog for the Number Lovers and to Get All the Financial Tools You Need

Investment Moats

Kyith from Investment Moats has been writing about personal finance for more than 10 years. He aims to share his experiences making sense of money, how money works and ways to grow his money.

- The creator of many financial tools such as Dividend Stock Screener and Property Investment Calculator, just to name a few. All these tools are available to his readers for free!

- Offers good advice on wide range of topics, from investing, CPF to savings.

- His advice is usually backed and illustrated using solid formulas or numbers.

Kyith is an active contributor to communities on top of his frequent content. He is on BIGS World and Seedly Personal Finance Community where he answers questions of members and shares meaningful content.

Financial Blog for Weekend Cuppa

Cheerful Egg

Lionel from CheerfulEgg.com aims to help young executives hatch richer lives!

- Very lifestyle approach towards heavy personal finance topics.

- Take note of the way he writes, it’s awesome!

- Readers can get their free guide on “How To Start Investing In 3 Days”.

I remember when I first read a piece by Cheerful Egg, I enjoyed it so much that my 5 minutes toilet break ended up being a half-hour one.

Financial Blog if You Love Guides and Courses

Dr Wealth

Dr Wealth is an investor-centric platform providing education and portfolio management tool.

- The content provider of many comprehensive guides to STI ETF, Singapore Savings Bond, and more.

- Their Dr Wealth Portfolio Tracker mobile app provides a tool for readers to track their investments at a glance.

- Provides courses on topics on Personal Finance, REITs investing, just to name a few. These courses, unlike most, do not cost an arm and a leg.

Definitely bookmark the guides by Dr Wealth. Courses they provide are value for money and ” non-salesy”, mainly for educational purposes.

Financial Blogs to Learn From the Stocks Gurus

A Singaporean Stocks Investor (ASSI)

“Don’t ask barbers if we need a haircut”. With this famous quote of his, AK appeals to Singaporeans that we should be careful and watch out for our money.

- For more advanced readers

- Shares his take on particular stocks or REITs on his blog, backed with great insights

- Casual tone, and shares his take on life too. A wise old man that most of us should learn from.

- Post regularly and responds to questions and comments quickly.

What personally garnered my utmost respect for him is when I saw one of his readers shared a sponsored content (without knowing that it is sponsored) from a reputable personal finance blog and he was quick enough to shoot it down in the interest of the reader.

STE’s Stocks Investing Journey

A typical example of someone who has been there done that. STE’s portfolio accumulated an impressive dividend and interest income of S$146,097 in the first three-quarters this year.

- His blog is generally quite visual and uses graphics, chart, table and quotes to explain his thoughts and ideas.

- Rather transparent about his investments and updates his portfolio to his readers regularly.

- Like A Singaporean Stocks Investor, his content is a bit on the high touch. Readers be prepared to be in for a steep learning curve when reading their content.

Personally, STE’s portfolio is to die for!

Financial Blog for Those Who Think They Can Trade

Trading with Rayner

Trading with Rayner is the go-to for readers interested in trading. Through his blog content, Facebook public group and videos, he created a system for traders wannabe to obtain knowledge on trading.

- Almost weekly posting of videos on trading. Each video is short and enriching, perfect for readers who hate going through a long essay of charts and advance finance lingos.

Being an ex-professional trader (not a profitable one, of course), I understand the temptation to get rich through trading. A quick advice will be that “everyone thinks that they can trade, but most of them actually can’t”. Should you be interested to pick up trading, read up a lot more before diving into it. Trading with Rayner will be a good place to start.

TradingKey is an up-and-coming one-stop financial platform dedicated to providing investors and traders with tools and insights. From beginners to technical know-how, this platform distils financial concepts and the latest news to keep their readers informed.

For those who are interested in Forex, commodities, cryptocurrencies, and trading (note: trading, not investing), this platform provides learning materials that help you fill out your knowledge gaps.

The experience of reading the online courses felt much like reading a book, and there’s also much to explore with the latest analysis on topics such as Bitcoin hitting a new high after the US presidential elections.

Financial Blog for a Holistic View on Personal Finance

Dollars And Sense

Dollars And Sense aims to help Singaporeans make better financial decisions. They are also actively contributing to the community in their Insurance Discussion SG Facebook group to promote transparent and honest discussion relating to insurance in Singapore.

- A one-stop website that covers all aspects of personal finance

- Articles are published regularly on a daily basis

Things to look out for

When it comes to personal finance articles on financial blogs, there are a few things that readers should look out for:

- Is the article sponsored content?

Under the Digital and Social Media Advertising Guidelines, sponsored content has to be disclosed to the public. Readers should pay attention to the headers or footers of their articles. Unless the content provider is someone they trust, more time to research the topic is necessary. - Is it from a credible source?

Numbers and statistics found in articles should be taken with a pinch of salt if they are not taken from a credible source. News providers and SingStat are some of the reliable sources.

Tools that can help you with your read your content better

Below are a few apps we personally use to compile all our favourite financial blogs. Do try them out.

- Feedly.com – compiles all the content of your favourite blogs in one place

- Pocket – Saves articles to view later

Related Articles

Advertisement