Great Eastern Endowment Plan (2024) GREAT SP: 3.20% p.a. Guaranteed Returns After 2 Years

Are you a risk-averse investor looking for guaranteed returns? Look no further than endowment plans, such as the latest Great Eastern GREAT SP Endowment Plan, which also gives you a little bit of insurance coverage!

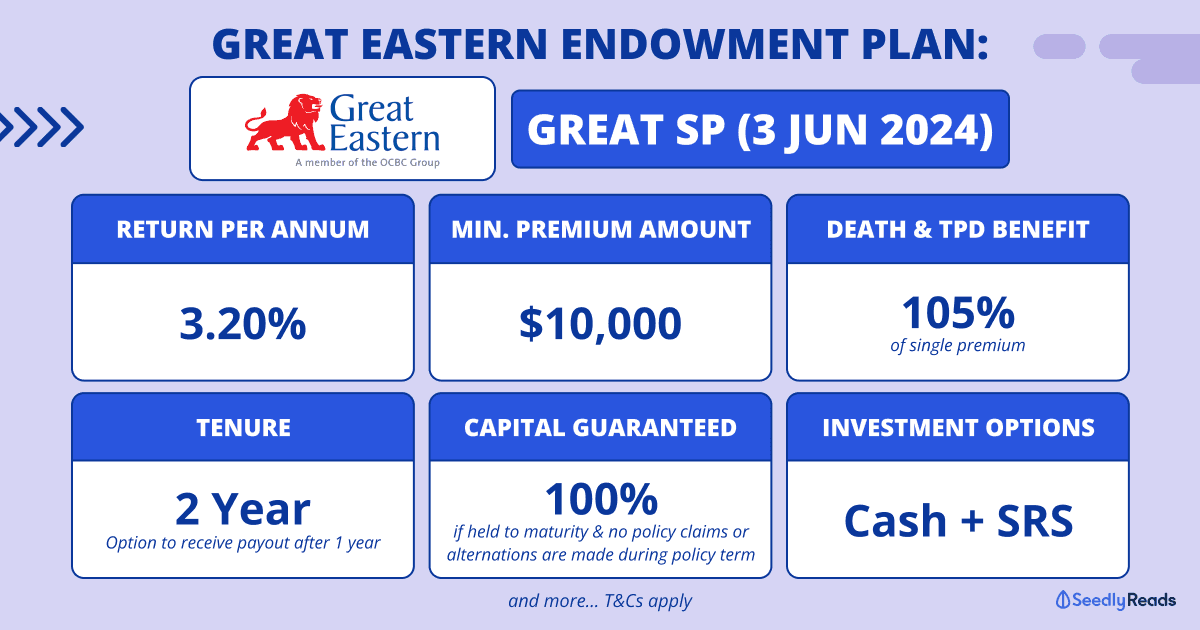

Great Eastern’s GREAT SP:

TL;DR: Great Eastern SP — Short-Term Endowment Plan With Guaranteed Returns of 3.20% After 2 years

For the uninitiated, Great Eastern (GE) just launched a GREAT SP Series single premium non-participating endowment plan, which will be available until further notice.

What Are the Risks of Endowment?

So if you have short-term financial goals and are unwilling to take on much investing risk (GE is rated AA- by S&P), this might be a decent way to grow your savings.

But I digress. Here’s all you need to know about the latest Great Eastern GREAT SP:

| Details | Great Eastern GREAT SP |

|---|---|

| Policy Term | 2 Years |

| Guaranteed Yield at Maturity (2-Year Policy Term) | 3.20% p.a.¹ |

| Capital Guaranteed | 100% guaranteed if held to maturity, and no policy claims or alterations are made during the policy term |

| Single Premium | One lump sum Can be purchased online with a minimum single premium of $10,000² |

| Payment Options | Cash, (Bank transfer or eGIRO) or Supplementary Retirement Scheme (SRS) funds |

| Payout Options For Returns (E.g. $100,000 premium) | Paid-Out option Year 1: $3,200 Year 2: $103,200 Accumulation option Year 1: $3,200 (reinvested) Year 2: ~$106,502 |

| Death and Total and Permanent Disability Benefit | 105% of single premium³ |

| Issuance | Guaranteed acceptance regardless of health condition |

| Entry Age | 17 - 80 (age next birthday) |

| Policy Protection | Up to specified limits by the Singapore Deposit Insurance Corporation (SDIC) |

¹ Guaranteed survival benefit equivalent to 3.20% of the single premium will be payable annually on survival of the life assured at the end of each of the two policy years.

² The minimum single premium amount will depend on the entry age (as of next birthday) of the life assured and the payment method.

³ If the life assured dies or suffers from Total and Permanent Disability (TPD), Great Eastern will pay 105% of the single premium or the surrender value of the policy, whichever is higher, less any indebtedness under the policy. For TPD that takes the form of total and irrecoverable loss of the: (a) sight in both eyes; (b) use of two limbs at or above the wrist or ankle; or (c) sight in one eye and the use of one limb at or above the wrist or ankle, the life assured will be covered for the whole of the policy term. For other forms of TPD, it must occur before the life assured is age 65 next birthday. You are advised to refer to the product summary for more details.

Click to Jump

- GREAT SP Returns

- GREAT SP Minimum Amount

- GREAT SP Payment Methods

- Death and Total Permanent Disability (TPD) Benefits + Surrender Value

- Endowment Plan Great Eastern: GREAT SP Returns and Payout Options

- Pros & Cons of GREAT SP

- Should I Invest in GREAT SP

What Are Endowment Plans?

Before we begin, let me provide some context.

An endowment plan is basically a life insurance policy.

But apart from covering the life of the insured.

It also helps you save over a period of time so that, ultimately, you get to collect a lump sum (principal + interest) upon policy maturity.

Usually, you’ll have to contribute regularly or pay a lump sum (a ‘single premium’), which most financial advisors will term ‘forced savings’.

An endowment plan is typically used if you wish to save up money towards a specific financial goal.

Great Eastern SP Review (OCBC Great SP): What is the Rate of Return for an Endowment Plan?

I know, I know. The GREAT SP, with its 3.20% p.a. guaranteed returns and a short-term commitment of just two years, won’t help you achieve (FIRE) Financial Independence. Retire Early in a hurry.

FYI: For the uninitiated, OCBC currently owns 88.4 per cent of Great Eastern’s total shares, making Great Eastern a subsidiary of OCBC.

This is not that kind of investment.

But if you have a short-term financial goal like saving for your wedding, home renovation, a car, or your first home, etc.

This 100% capital-guaranteed endowment plan (after 2 years) is a decent option, as preserving the money invested should be your top priority when saving for a short-term goal.

Great Eastern SP Single Premium 2024

You will need to put in a minimum of $10,000 in terms of the investment amount.

How Much Should an Endowment Plan Cost?

This means there’s no cap on the amount you can invest, provided you meet the minimum amount of $10,000 for each policy.

You can also buy multiple Great Eastern Singapore GREAT SP plans.

Invest with Cash (Bank Transfer, GIRO, Paynow, or Cheque) or SRS

The good news is you can buy the GREAT SP endowment plan with cash through bank transfer or General Interbank Recurring Order (GIRO) and your Supplementary Retirement Scheme (SRS) funds.

However, if you’re considering making payment using your SRS funds, note that the prevailing yearly contribution limit for SRS is $15,300 for Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs) and $35,700 for foreigners.

As such, please ensure sufficient balance in your SRS account before proceeding with this.

Purchasing this policy is also pretty simple, as you can choose to buy this policy online.

Who Can Buy This Policy

Purchasing this plan is simple and hassle-free, as you can do so online via this link using Singpass MyInfo.

Note that you must be between 17 and 80 (age next birthday) to purchase GREAT SP.

Death and Total Permanent Disability (TPD) Benefits + Surrender Value

GREAT SP also offers added Death and TPD protection with guaranteed acceptance, i.e. no medical assessment is needed.

Unfortunately, suppose the life assured dies or suffers from Total Permanent Disability (TPD).

In that case, Great Eastern will pay out 105% of the single premium or the surrender value of the policy, whichever is higher, less any indebtedness under the policy.

Short-Term Investment Plans: GREAT SP Returns and Payout Options

To illustrate the returns which you will be getting, we will be using a single premium of $100,000 over two years as an example of this short-term investment plan

Are Endowment Plans Worth it?

To help you decide if this endowment plan will be worth it, let’s look at the Pros and Cons of the GREAT SP.

Pros of GREAT SP Tranche

- Guaranteed returns of 3.20% p.a. and 100% capital Guaranteed after holding the Endowment plan to maturity (2 years)

- Short tenure

- Hassle-free online application with no medical check-up required

- Basic insurance coverage for death and TPD without a medical assessment.

Cons of GREAT SP: What is the Disadvantage of Endowment Fund

- A high minimum investment amount of $10,000

- Your money is locked in for two years, and withdrawing early will result in your losing money.

Remember, you know your financial situation the best, so plan ahead and ensure your cash flow works!

Great Eastern Exclusive Endowment Plan vs SSB vs Fixed Deposit

If you were previously looking at low-risk investments like the Singapore Savings Bonds (SSB) and Fixed Deposits:

You might also want to consider the GREAT SP endowment plan.

This assumes you have money ready to be locked in for the next two years.

If you want liquidity, you should not look at the GREAT SP, as SSBs can be withdrawn after a month, and Fixed Deposits have tenures starting from two months.

Why do People Buy Endowment Plan: Watch Out For The “Consumer Mentality”

Also, it’s essential for us as consumers to approach a financial product objectively. This would ensure that we do not purchase something that we don’t need just because they’ve used buzzwords like:

How Good Are Endowment Plans: Don’t Fall for the “Limited Tranche Only” Mentality

Do not feel pressured or give in to FOMO (Fear Of Missing Out) and take up these policies just because.

The rate at which insurance providers release these short-term endowment plans is probably more regular than when my dog tries to run out of the house when the gates are left unattended (read: A LOT).

So, even if you missed this, we might see another or an even better one next time!

In short, DON’T buy into something just because you think you will be losing out if you don’t. There are plenty of other financial products around.

Like every financial product and financial planning, there is no one-size-fits-all solution to your personal finance journey. However, with careful research and continuous learning, you will better plan your finances.

As always, read all terms and conditions for any policies or investment instruments.

Before making any decision, approach a professional (like your trusted financial advisor) to review your portfolio and clarify clauses and questions you might have missed.

If you are keen, you can head on over to Great Eastern to apply for the GREAT SP here:

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not consider the specific objectives or particular needs of any person. The above is for general information only. It is not a contract of insurance.

The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

This plan is available for a limited period only. Availability is on a first-come-first-serve basis, with premiums fully paid to The Great Eastern Life Assurance Company Limited. The Great Eastern Life Assurance Company Limited reserves the right to reject an application and refund the single premium. Do note that for entry age 81 and above, it has to be bought through a financial representative.

This policy is protected under the Policy Owners’ Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Read More

- Tiq 3-Year Endowment Plan: 3.00% p.a. Guaranteed Returns if Held to Maturity

- NTUC Income Gro Capital Ease: 3-Year Insurance Savings Plan With 3.55% p.a. Guaranteed Returns at Maturity

- Latest Singapore Savings Bonds (SSB) Guide: SSB Interest Rate (2024), SSB Info, & How To Buy SSB Singapore

- Best Fixed Deposit Rate Singapore (2024): UOB, OCBC, DBS, Maybank & More

Advertisement