Tiq 3-Year Endowment Plan: Up to 4.80% p.a. Guaranteed Returns if Held to Maturity (2023)

22 December 2023 Update

The current Tiq 3-Year Endowment Plan has closed. Do keep a look out on Seedly as we will be covering the launch of Endowment plans like the Tiq 3-Year Endowment Plan as and when they drop.

In the market for a short-term investment?

Considering that the Singapore Savings Bond (SSB) gives you returns that are somewhere around 3.06% per annum (p.a.)…

Have you ever considered an endowment plan like, say…

Etiqa’s latest Tiq 3-Year Endowment Plan?

The Tiq 3-Year Endowment Plan sales have opened and are based on a first-come-first-served basis.

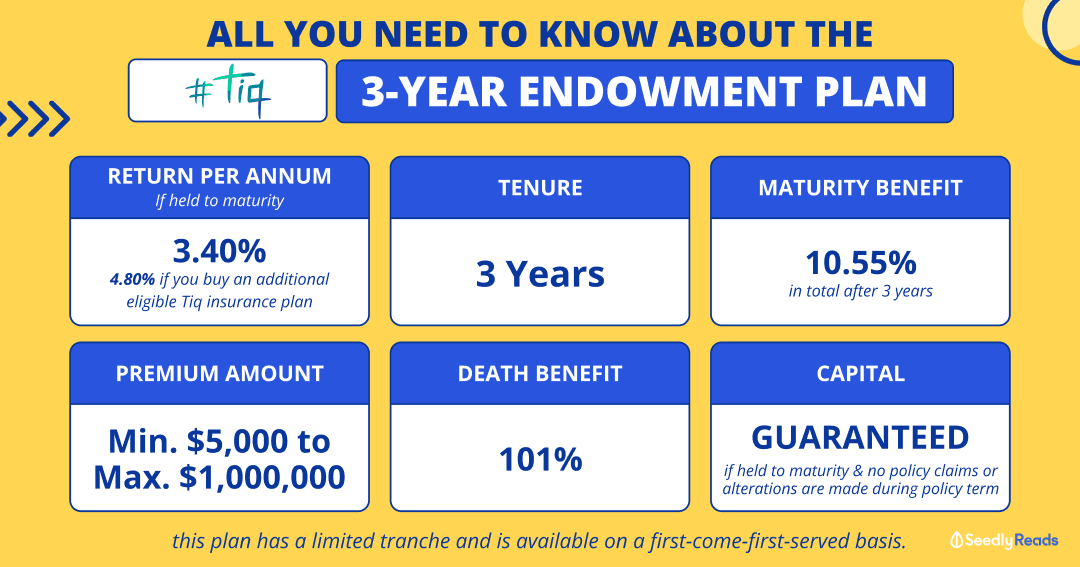

This policy has a three-year policy term and a guaranteed return of 3.40% p.a. ONLY if you hold it to maturity. And an additional 1.40% p.a. when you purchase an eligible insurance plan.

It doesn’t sound too shabby, huh?

Let’s find out more!

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

The precise terms, conditions, and exclusions of products are in the policy contracts. This policy is protected up to specified limits by SDIC (applicable for Income products that fall under the Policy Owners’ Protection Scheme). Information is correct as of 24 August 2023.

TL;DR: Tiq 3-Year Endowment Plan Review — Key Features and Benefits Explained

The Tiq 3-Year Endowment Plan is a single-premium, non-participating life insurance savings plan:

| Details | Tiq 3-Year Endowment Plan (Jan 2023) |

|---|---|

| Coverage | 3 years |

| Capital Guaranteed | From the start of the third policy year |

| Premium | Single premium (one lump sum) $5,000 (min) to $1,000,000 (max) |

| Base Guaranteed Maturity Benefit | 3.40% p.a. |

| Additional Guaranteed Maturity Benefit for Purchasing Eligible Insurance Plan | 1.40% p.a. capped on the first $20,000 single premium |

| Base + Additional Guaranteed Maturity Benefit | 4.80% p.a. on the first $20,000 single premium |

| Death Benefit | Pays 101% of your single premium upon your demise (But exclusions like death from pre-existing conditions & suicide within the first 12 months etc. apply) |

| Policy Protection | Up to specified limits by SDIC |

| Credit Rating of Insurance Company by Fitch (as of 3 Apr 2023) | A |

The guaranteed return is 3.40% p.a.* or 10.55%* if you held it to maturity (three years).

With the additional 1.40% p.a. interest from purchasing an additional eligible insurance policy from Tiq, the 4.80% p.a. total yield is better than the current fixed deposit promotions or current T-bill yields.

It’s a product worth considering if you plan to put aside a minimum of $5,000 and up to $1,000,000 for at least three years.

Note: If you’re unsure if you should commit to such a product, we highly encourage you to seek proper advice from a certified financial advisor.

*The guaranteed maturity benefit of 10.55% of the single premium is based on the guaranteed yield at maturity of 3.40% p.a., which will be paid out at the end of the three-year policy term provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

Click to Teleport:

- What is an Endowment Plan?

- Is This Endowment Plan Safe?

- Can You Withdraw From an Endowment Plan?

- Pros and Cons of Tiq 3-Year Endowment Plan

- So… Should I Invest in the Tiq 3-Year Endowment Plan?

- How Buy the Tiq 3-Year Endowment Plan?

What is an Endowment Plan?

An endowment plan is a life insurance policy that gives you a death benefit and helps you save simultaneously.

Basically, you either pay regularly or make a lump sum payment (AKA “single premium”).

Etiqa’s Tiq 3-Year Endowment Plan is an excellent example of a single premium endowment plan.

In return, you get life insurance coverage.

Once your policy matures, you’ll be able to collect your principal plus any accrued interest.

Think of it as a hybrid between insurance and investing.

However, the insurance coverage an endowment plan provides is usually a little too basic to rely on.

So, if you want to be adequately protected, you’ll need to look at getting an actual life insurance plan instead.

Is The Tiq 3-Year Endowment Plan Safe?

Similar to the Singlife Account, this endowment is protected under the Policy Owners’ Protection (PPF) Scheme administered by the Singapore Deposit Insurance Corporation (SDIC).

The PPF Scheme provides 100% protection for the guaranteed benefits of your life insurance policies, subject to caps where applicable.

According to SDIC, the amount insured (amount deposited) has a guaranteed surrender value at the point of failure that is capped at $100,000.

There is also a cap of $500,000 for the aggregated guaranteed sum assured.

The coverage is automatic, and no further action is needed from you. You can also check out the SDIC site or the Life Insurance Association (LIA) site for more information about the benefits and caps of the PPF scheme.

Can You Withdraw From an Endowment Plan?

Technically, some endowment policies allow you to withdraw cash annually after the plan has built enough cash value.

For the Tiq 3-Year Endowment Plan, you must commit to the full three years before getting your returns.

The Benefits of the Tiq 3-Year Endowment Plan

Guaranteed Issuance

The issuance of the Tiq 3-Year Endowment Plan is guaranteed, as no medical underwriting is required.

Capital Guaranteed

Your capital is guaranteed ONLY if you hold the endowment plan to maturity.

In return, you’ll get a guaranteed maturity yield of 3.40% p.a.* or 10.55%* if you hold it to maturity (three years).

So, assuming you pay a single premium of $10,000.

Three years later, you can receive a guaranteed maturity benefit of $11,055.

*The guaranteed maturity benefit of 10.55% of the single premium is based on the guaranteed yield at maturity of 3.40% p.a., which will be paid out at the end of the three-year policy term provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

Is There a Limit to Endowment Plans?

You’ll be glad to know that you can purchase up to $1 million worth of the Tiq 3-Year Endowment Plan.

Additional Tiq 3-Year Endowment Plan Yield

Customers who have purchased a Tiq 3-Year Endowment Plan and any additional eligible insurance plan from 24 August to 27 September 2023 from the table below will also be entitled to an additional 1.40% p.a. in yield capped at the first $20,000 single premium. This means you’ll get 4.80% p.a. or 15.10% p.a.* in total for the whole three-year tenor.

So let’s take, for example, a single premium of $50,000 of the Tiq 3-Year Endowment Plan. The first $20,000 single premium will be entitled to a guaranteed maturity return of 4.80% p.a. The Remaining $30,000 single premium will be at a guaranteed maturity return of 3.40% p.a.

So, assuming you pay a single premium of $10,000.

Three years later, you can receive a guaranteed maturity benefit of $11,510.

But do take note of the $10,000 minimum annualised premium amount for the additional eligible insurance plan as explained below.

This means you must buy an insurance plan with annual total net premiums of ≥$10,000, which is a huge ask and would not make sense for most people.

| Eligible Insurance Plans (Including Attaching Riders) | Minimum Annualised Premium^ | Reward |

|---|---|---|

| Essential Cancer Care | $10,000 | A guaranteed maturity return of 4.80% p.a. on Tiq 3-Year Endowment Plan capped at the first $20,000 single premium |

| Essential term life cover | ||

| Essential whole life cover | ||

| Invest builder | ||

| Invest smart flex | ||

| Invest starter |

*The guaranteed maturity benefit of 15.10% of the single premium is based on the guaranteed yield at maturity of 4.80% p.a., which will be paid out at the end of the three-year policy term provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

^‘Minimum Annualised Premium’ is defined as the total net premiums paid in the first policy year of an Eligible Insurance Plan, including attached cash-paying riders, if any. Premiums can be combined from two (2) or more Eligible Insurance Plans provided it is under the same policy owner.

Note: Each eligible customer is only entitled to one (1) Reward per Eligible Insurance Plan. If you have two (2) or more Tiq 3-Year Endowment Plan policies and one (1) Eligible Insurance Plan, the Reward will only be provided to one (1) Tiq 3-Year Endowment Plan policy with the highest single premium, but not to all the policies.

Additional Cashback

Customers who have purchased a Tiq 3-Year Endowment Plan via www.tiq.com.sg or Tiq by Etiqa mobile app from 24 August 2023 to 27 September 2023 will be entitled to a cashback of up to $250 as follows:

- $100,000 to $200,000 premium amount: $100 cashback

- $201,000 and above premium amount: $250 cashback.

Terms and Conditions: To qualify for the Cashback, customers will need to enter the promotion code ‘GETCB’ in the ‘Promo Code’ field upon application. The promotion code is only valid for the Qualifying Period. Etiqa reserves the right to disqualify any entry that does not have the promotion code or with an incorrect promotion code. The Cashback is limited to once per customer.

Death Benefit

While the policy is in force, you’ll enjoy a life protection benefit of 101% of the single premium.

This means that if you paid a premium of $10,000 and unfortunately meet your demise…

Your named beneficiaries will receive $10,100.

Yep, and this is why I mentioned earlier that if you want adequate protection for your loved ones.

You’ll want to consider more robust life insurance since this endowment plan only provides basic coverage.

Disadvantages of the Tiq 3-Year Endowment Plan

Sizeable Capital Needed

You’ll need $5,000 lying around to do this — and that’s not chump change.

Surrender Charge

You’ll notice that I’ve repeatedly pointed out that the guaranteed maturity benefit will ONLY be paid if you hold the endowment plan to maturity.

Assuming you pay the premium of $10,000:

| End of Policy Year | Surrender Value | Total Premiums Paid to Date | Surrender Value | Death Benefit (Guaranteed) |

|---|---|---|---|---|

| 1 | 60% | $10,000 | $6,000 | $10,100 |

| 2 | 70% | $10,000 | $7,000 | $10,100 |

| 3 | 80% | $10,000 | $8,000 | $10,100 |

This means that if you, for some reason, decide to surrender your Tiq 3-Year Endowment Plan before the end of your three year policy term, you’ll incur a surrender charge and receive less than what you initially paid.

The takeaway here?

If you decide to go with this endowment plan, ensure that you die die don’t need this sum of money for the next three years.

Who Needs an Endowment Plan (Tiq 3-Year Endowment Plan)?

It’s not so much a should you but more of a can you?

If you’re looking for a short-term, low(er) risk investment where you expect to use the money for, say… the downpayment of an HDB BTO or a wedding three years later.

This is an option you can consider besides fixed deposits, SSBs and T-bills. But if you need the money within six months or a year or shorter, fixed deposits, SSBs and T-bills are better.

Tiq 3-Year Endowment Plan Base Interest Rate vs T-bills vs Fixed Desposits vs Singapore Savings Bond

| Tiq 3-Year Endowment Plan | T-bills | Fixed Deposits | Singapore Savings Bond | |

|---|---|---|---|---|

| Interest Rate (p.a.) | Base: 3.40% p.a. Base + Bonus: 4.80% p.a. | Determined during auction 3.73% p.a. (Based on the latest 17 Aug 2023 auction) | 2.70% to 3.75% p.a. (Based on the best Aug 2023 rates) | 3.06% p.a. (Based on SSB issued on 1 Sep 2023) |

| Tenor | 3 years | 6 months | 1 year | Typically 3 months to 2 years | 10 years |

| Minimum Investment Amount | $5,000 | $1,000 | $500 to $20,000 typically | $500 |

| Liquidity | Few days after documentation has been submitted. Surrender charges will be incured. | Low. Not redeemable for the tenor and the only option is to sell on the markets which is hard to do. | Within one working day (But with early withdrawal fees) | Can withdraw anytime without penalty. But you will only receive funds from the second business day of the following month from date of withdrawal request (Plus a $2 transaction fee) |

At first glance, most of us would be thinking, why even bother with such a low base interest rate of 3.40% p.a. compared to what’s out there right now?

However, you must consider that T-bill interest rates, fixed deposits, and Singapore Savings Bonds (SSB) interest rates have been dropping:

You will also need to consider that such endowment plans have a tenor of three years, which is very different from the other products mentioned.

Moreover, We might see lower interest rates in 2024 and 2025 as the Fed is likely to pivot from their all-time high Fed funds rate of 5.25%-5.5% in July 2023 in tandem with inflation in the U.S. slowing.

In July, the U.S. consumer price index increased by 3.20% compared to the previous year, which was slightly lower than anticipated. The core CPI, which measures inflation excluding volatile factors, grew at a yearly pace of 4.70%, also falling short of predictions. Both indices showed a monthly increase of 0.2%. Despite a significant drop from the peak inflation levels seen in mid-2022, the current inflation rate remains significantly higher than the Federal Reserve’s target of 2.00%.

However, if there’s a chance that you might need the money anytime before three years, this is not an ideal option because you’ll have to pay a surrender charge and might get less than what you initially forked out.

So it all boils down to when you need the money and the purpose of the money you have set aside to grow.

Tiq 3-Year Endowment Plan Base + Additional Interest Rate vs T-bills vs Fixed Desposits vs Singapore Savings Bond

But let’s say you have done your due diligence (E.g. consulted your financial advisor) and realised that you need one of these insurance policies:

| Eligible Insurance Plans (Including Attaching Riders) | Minimum Annualised Premium^ | Reward |

|---|---|---|

| Essential Cancer Care | $10,000 | A guaranteed maturity return of 4.80% p.a. on Tiq 3-Year Endowment Plan capped at the first $20,000 single premium |

| Essential term life cover | ||

| Essential whole life cover | ||

| Invest builder | ||

| Invest smart flex | ||

| Invest starter |

Purchasing any one of these additional policies means you’ll get an additional 1.40% p.a. in yield capped at the first $20,000 single premium. Thus, you’ll get 4.80% p.a. or 15.10% p.a.* in total for the whole three-year tenor.

*The guaranteed maturity benefit of 15.10% of the single premium is based on the guaranteed yield at maturity of 4.80% p.a., which will be paid out at the end of the three-year policy term provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

^‘Minimum Annualised Premium’ is defined as the total net premiums paid in the first policy year of an Eligible Insurance Plan, including attached cash-paying riders, if any. Premiums can be combined from two (2) or more Eligible Insurance Plans provided it is under the same policy owner.

So, if you really need one of these policies, getting the Tiq 3-Year Endowment Plan with the additional yield from purchasing an additional policy makes sense if you die die don’t need the money for the next three years.

After all, securing 4.80% p.a. for the next three years is pretty great compared to the Fixed Deposits and T-bills, which only offer about 3.75% p.a. for one year and 6 months, respectively.

But do take note of the $10,000 minimum annualised premium amount for the additional eligible insurance plan. This means you must buy an insurance plan with annual total net premiums of ≥$10,000, which is a huge ask and would not make sense for most people.

Insurance Coverage

In terms of insurance coverage… If you want this as protection for you and your family, it might be a little too basic for your needs.

As always, even these endowment plans are only available on a first-come, first-served basis.

Take a moment to review your insurance, finances, and needs before buying anything.

After all, you’re not going to buy something JUST because it’s available for a limited time only, right…

Who is Eligible to Purchase the Tiq 3-Year Endowment Plan?

Before applying, you’ll need to fulfill the following criteria:

- Be a Singapore Resident with a valid NRIC or FIN or

- Be a foreigner with a valid Work Permit, Employment pass, or Social pass.

- Be between ages 17 to 70 (age next birthday)

How to Apply for and Purchase the Tiq 3-Year Endowment Plan

You’ll also need to prepare a couple of things like:

- Verification: Either via MyInfo or a photograph of your NRIC or FIN pass

- Proof of address: A copy of your bill or statements (for non-Singaporeans only)

As for payment, you can make it via :

- DBS/POSB Direct Debit

- PayNow

- Pay Later Options: FAST (Fast and Secure Transfers) or PayNow UEN

The current Tiq 3-Year Endowment Plan tranche will close on 22 December 2023, 11.59pm.

Related Articles:

- Great Eastern Endowment Plan GREAT SP Series 11: 3.5% p.a. Guaranteed Returns at Maturity After 1 Year

- Income Gro Capital Ease: 3-Year Insurance Savings Plan With 3.55% p.a. Guaranteed Returns at Maturity

- Ultimate Insurance Savings Plans Comparison: Dash PET vs Dash EasyEarn vs GIGANTIQ vs Singlife Account

Advertisement