Here's How Much Singaporeans are Saving According to Age (And Why It Shouldn't Matter)

●

Are you wondering how much your peers have saved up based on your age?

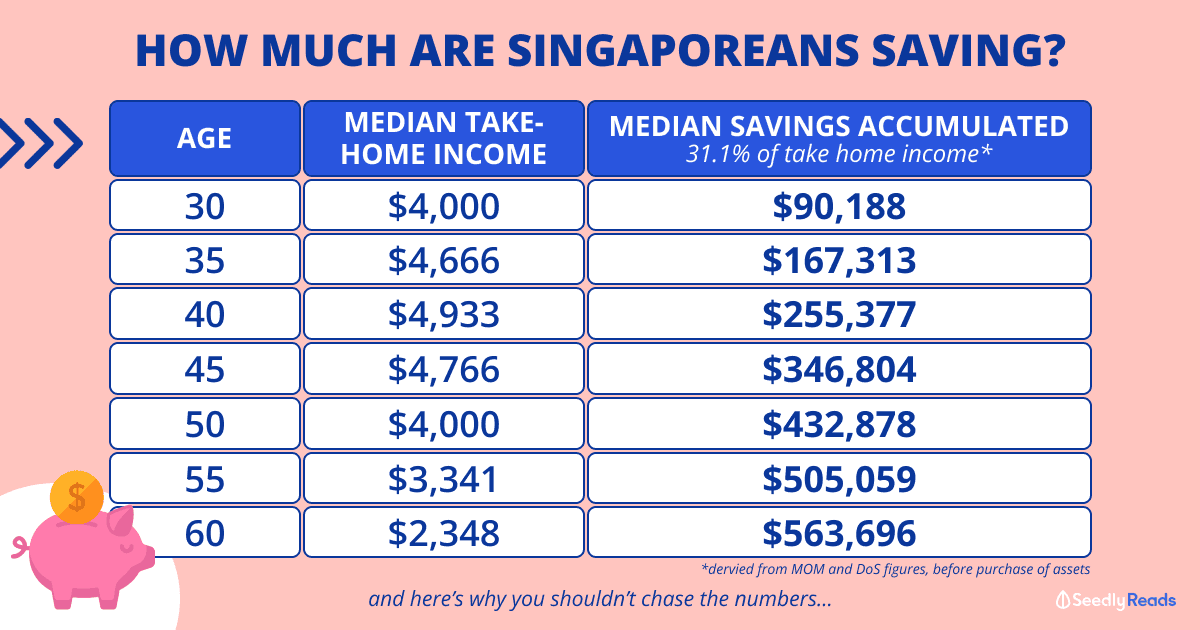

Using the latest salary figures from MOM and the personal savings rate from the Department of Statistics, we can estimate how much a typical Singaporean has saved up according to age!

TL;DR: Here’s How Much You Singaporeans Are Saving According to Age

Disclaimer: The savings shown are calculated with the personal savings rate and median salary (excluding employer CPF) from Singstat and MOM respectively.

The median savings rate every quarter for the past 10 years is 31.1 per cent.

In general, if you are constantly saving 20 per cent to 50 per cent of your income (or more), you are on the right track!

Then again, this is entirely dependent on your financial situation. Remember that personal finance is personal!

How Much Singaporeans Are Saving According to Age

To estimate how much Singaporeans are saving by age, we first need data about the personal savings rate of Singaporeans and the median income of Singaporeans by age.

But what exactly is the personal savings rate?

As defined by the Department of Statistics Singapore:

Personal Disposable Income:

Personal disposable income measures the income of the personal sector (e.g., compensation of employees, self-employment income, gross operating surplus on ownership of dwellings and non-profit institutions serving households), after accounting for net property income received (i.e., interests and dividends), net current transfers received and personal income tax paid.

Personal Saving:

Personal saving refers to the amount of available funds after consumption and before the purchase of assets or repayments of debts. Personal saving is not directly computed, but derived as the difference between personal disposable income and private consumption expenditure on goods and services.

In other words, your personal savings are the amount left after you spend on things like groceries, dining out, a concert ticket or even bigger ticket items like a wedding. However, personal savings is the amount available BEFORE purchasing assets such as your house and/or investments.

According to the Department of Statistics Singapore, the median personal savings rate of Singaporeans for the past 10 years, from Q1 2014 to Q4 2023 is 31.1 per cent.

According to the latest salary figures from MOM, the following table shows the median salary based on your age (excluding employer CPF):

| Age | Median Gross Monthly Income from Work (Excluding Employer CPF) | Take-Home Income |

|---|---|---|

| 20 - 24 | $2,604 | $2,083 (20% CPF) |

| 25 - 29 | $4,000 | $3,200 (20% CPF) |

| 30 - 34 | $5,000 | $4,000 (20% CPF) |

| 35 - 39 | $5,833 | $4,666 (20% CPF) |

| 40 - 44 | $6,167 | $4,933 (20% CPF) |

| 45 - 49 | $5,958 | $4,766 (20% CPF) |

| 50 - 54 | $5,000 | $4,000 (20% CPF) |

| 55 - 59 | $3,978 | $3,341 (16% CPF) |

| 60 & Over | $2,654 | $2,375 (10.5% CPF for age 60 to 65) |

With this information, we can then have a rough estimate of how much savings Singaporeans have accumulated based on age! However, there are many assumptions we have to make:

- You start work at 23 and get a median salary

- You expect to retire at 63

- You save a constant percentage of your income

- The latest wages by age group stay constant from now till your retirement.

Moreover, our calculations do not consider:

- The value of purchased assets (housing, investments)

- CPF savings

- Effects of inflation

- Wages before 2023

- Value of SGD.

Even with these assumptions and conservative calculations, remember that these are only estimates. So take them with a pinch of salt!

| Age | Median Take-Home Income | Savings for the year (31.1% of take-home income) | Savings Accumulated |

|---|---|---|---|

| 23 | $2,083 | $7,774 | $7,774 |

| 24 | $2,083 | $7,774 | $15,548 |

| 25 | $3,200 | $11,942 | $27,490 |

| 26 | $3,200 | $11,942 | $39,432 |

| 27 | $3,200 | $11,942 | $51,375 |

| 28 | $3,200 | $11,942 | $63,317 |

| 29 | $3,200 | $11,942 | $75,260 |

| 30 | $4,000 | $14,928 | $90,188 |

| 31 | $4,000 | $14,928 | $105,116 |

| 32 | $4,000 | $14,928 | $120,044 |

| 33 | $4,000 | $14,928 | $134,972 |

| 34 | $4,000 | $14,928 | $149,900 |

| 35 | $4,666 | $17,414 | $167,313 |

| 36 | $4,666 | $17,414 | $184,727 |

| 37 | $4,666 | $17,414 | $202,140 |

| 38 | $4,666 | $17,414 | $219,554 |

| 39 | $4,666 | $17,414 | $236,967 |

| 40 | $4,933 | $18,410 | $255,377 |

| 41 | $4,933 | $18,410 | $273,787 |

| 42 | $4,933 | $18,410 | $292,197 |

| 43 | $4,933 | $18,410 | $310,607 |

| 44 | $4,933 | $18,410 | $329,017 |

| 45 | $4,766 | $17,787 | $346,804 |

| 46 | $4,766 | $17,787 | $364,590 |

| 47 | $4,766 | $17,787 | $382,377 |

| 48 | $4,766 | $17,787 | $400,164 |

| 49 | $4,766 | $17,787 | $417,950 |

| 50 | $4,000 | $14,928 | $432,878 |

| 51 | $4,000 | $14,928 | $447,806 |

| 52 | $4,000 | $14,928 | $462,734 |

| 53 | $4,000 | $14,928 | $477,662 |

| 54 | $4,000 | $14,928 | $492,590 |

| 55 | $3,341 | $12,469 | $505,059 |

| 56 | $3,341 | $12,469 | $517,528 |

| 57 | $3,341 | $12,469 | $529,996 |

| 58 | $3,341 | $12,469 | $542,465 |

| 59 | $3,341 | $12,469 | $554,933 |

| 60 | $2,348 | $8,763 | $563,696 |

| 61 | $2,348 | $8,763 | $572,459 |

| 62 | $2,348 | $8,763 | $581,222 |

| 63 | $2,348 | $8,763 | $589,984 |

| 64 | $2,348 | $8,763 | $598,747 |

| 65 | $2,348 | $8,763 | $607,510 |

That said, striving for these numbers is not realistically possible for everyone.

So here’s my opinion on savings goals.

Savings Goals Are Great for Motivation, Not Competition

In recent years, the idea of saving $100,000 by 30 has been popping up and became a new savings goal for many.

The idea of saving $1 million by 65 also gained a sizeable following as well.

These new numbers managed to kickstart a wave of individuals sharing how they managed to achieve these goals, whether it was through growing their income or by making smarter personal finance decisions.

It also cultivated a driven community, where individuals were excited to learn new financial knowledge and were eager to hit new personal targets.

However, such wonderful movements were also slowly breeding unhealthy competition.

People started comparing these figures just based on face value.

Reaching a point where if you have a bigger number at a younger age, it simply meant that you are more successful.

In some instances, it simply became bragging rights or even resulted in a holier-than-thou attitude.

We Often Forget That Personal Finance Is PERSONAL

Personal finance, as its name suggests, is HIGHLY personal.

Everyone’s circumstances are different, and everyone has different financial needs and wants.

We all come from different backgrounds as well.

For instance, one might have heavy financial obligations such as having to take care of their parents’ needs at home.

Or only being able to graduate at 35 due to their own personal struggles and responsibilities.

Another might have had his/her parents’ financial backing throughout their studies, and was able to graduate debt-free.

The point is, with these absolute figures in mind, it became rather easy to take these numbers out of context.

Having goals ain’t a bad thing for sure, but blindly chasing these figures is.

Because in such situations, it could be counterintuitive and even be demoralising.

Always remember that is your own personal finance journey, not anybody else’s.

Remembering What Your Own Priorities Are

Different people also value different things as well.

For instance, someone might gain satisfaction from seeing how his/her bank accounts grow in figures.

For another, satisfaction might come from spending on experiences.

Everyone has different priorities.

My colleague, Ken has done a brilliant article on this, and wrote the following phrase:

What we value in life influences the kinds of goals we set. In turn, our goals will define the tactics we choose to reach them.

Understanding your own priorities, or what you value in life would be very helpful in your own personal finance game.

Knowing how to manage your money and being financially responsible is definitely important (in fact, that’s what Seedly is here to help with).

But if what you prefer is spending that $10,000 on travel experiences instead of seeing it being clocked in the bank, chucking it into your high-yield savings account and reaching that financial goal slightly earlier might not be the key to your version of ‘success‘.

And your version of ‘success’ isn’t any less than anyone else’s.

(As long as you’re spending within your means and not becoming someone else’s financial burden.)

Are You Saying You’re an Anti- ‘$100k by 30’ Person Then?

Of course not.

To be honest, having such success stories around mostly gave me a huge motivation in getting my financial sh*t in order.

It not only provided me with helpful advice but also created this inner drive for me to strive toward my own financial goals.

It also reminded me of how important it is to have financial stability so that I could afford to face unexpected obstacles and still sleep well at night.

Having that is extremely important to me, and so having a substantial amount of savings is one of my priorities in life.

With that, knowing my own priorities allowed me to push my own limits and set my own personal finance targets.

For instance, I knew I wanted to bring my family on a trip within my first five years as a working adult, and fully fund for it.

So even though that target would set me back in my pursuit of $X in my bank, it is something I valued more than hitting that magic number.

Besides that, such saving trends also reminded me of the privilege of being able to choose to pursue a side hustle.

This might not be the case for some, as they might have additional duties to fulfil.

Conclusion

Most of us realise the importance of money, and how more money would allow more options in life.

But the amount you have in your bank should never be the sole indicator of your success.

So if you’re one with numbers in your bank that aren’t seen as ‘ideal’ in the current society…

While society celebrates the financial achievements of these individuals, know that you are not alone.

You might have different financial commitments, started your personal finance journey later, or simply just have different priorities.

And as long as you’re working hard, pushing your own limits and being financially responsible…

You should be proud of yourself. 🙂

Related Articles

Advertisement