A Singaporean’s Milestone: Having $100k in Savings

Saving $100,000 by 30 years old.

It’s a pretty common goal amongst many Singaporeans.

But is it even possible?

I mean, my take-home salary is miserable.

I even have to think thrice before asking the uncle to add more noodles to my Bak Chor Mee (Hokkien: minced meat noodles).

Instead of getting into the whole argument of, “Why $100k? Why not $500k? Why not $1 million?” and so on.

Let’s just say that it’s a BIG enough goal that seems within reach of most Singaporeans…

But if you don’t have a proper strategy and discipline to stick to it.

You might not be able to reach this seemingly simple financial goal.

Curious to see if it’s possible?

Let’s run some numbers and see if this big hairy goal is possible…

Or not.

TL;DR: How to Save $100,000 by 30 Years Old

As scary as this goal might seem.

It’s actually very possible.

Note: I’ll be looking at the savings in your bank account ONLY; whatever is in your CPF doesn’t count

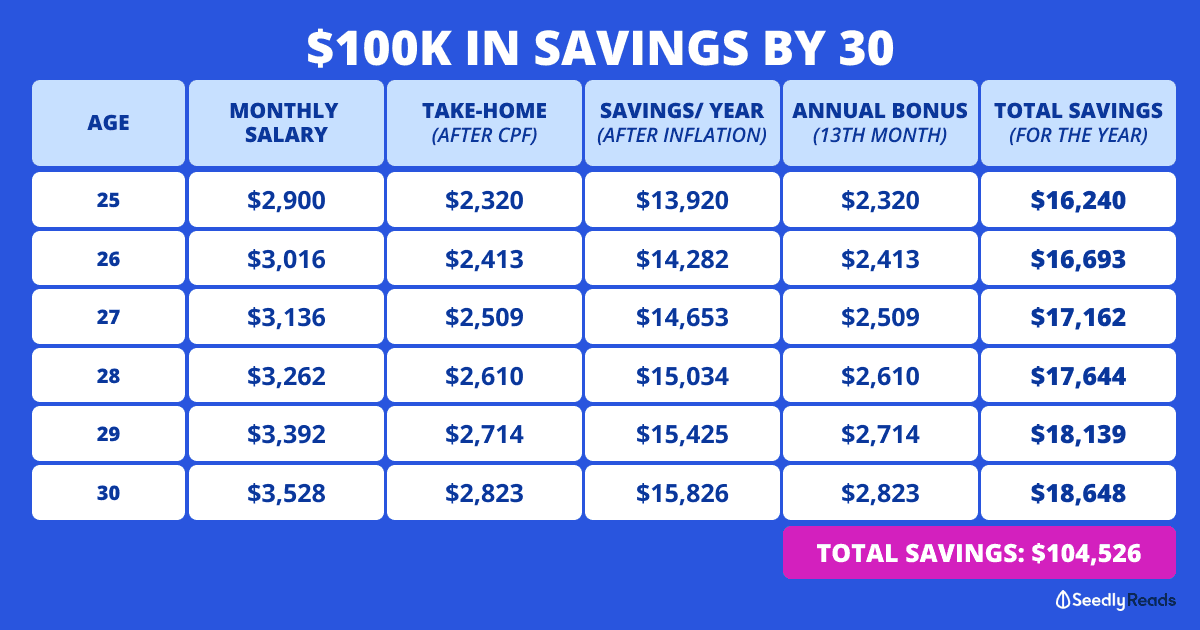

Let’s assume you:

- Start working at 25 years old with $0 savings

- Earn a monthly salary of $2,900 a month, and your take-home is $2,320

- Save 50 per cent of your salary

- Get a salary increase of 4 per cent every year — after factoring in inflation of ~ 1.4 per cent a year, you only save 2.6 per cent

- Receive an Annual Wage Supplement (AWS) in the form of the 13th Month Bonus

- Use a ridiculously lousy savings account that gives you a 0 per cent interest rate

- Do not invest at all

Here’s how much you will have accumulated by 30 years old:

| Age | Monthly Salary | Monthly Take Home Salary (After CPF) | Savings Per Month (Taking into account inflation) | Savings Per Year | Annual Bonus | Total Savings For That Year |

|---|---|---|---|---|---|---|

| 25 | $2,900 | $2,320 | $1,160 | $13,920 | $2,320 | $16,240 |

| 26 | $3,016 | $2,412.80 | $1,190.16 | $14,281.92 | $2,412.80 | $16,693 |

| 27 | $3,136.64 | $2,509.31 | $1,221.10 | $14,653.20 | $2,509.31 | $17,162.51 |

| 28 | $3,262.11 | $2,609.69 | $1,252.85 | $15,034.20 | $2,609.69 | $17,643.89 |

| 29 | $3,392.59 | $2,714.07 | $1,285.43 | $15,425.16 | $2,714.07 | $18,139.23 |

| 30 | $3,528.29 | $2,822.63 | $1,318.85 | $15,826.21 | $2,822.63 | $18,648.48 |

Total savings?

$104,527.11.

The first step to saving $100K is believing.

The next is actually doing something about it.

Think about it, if you can’t set your sights on achieving a (relatively) simple financial goal like this.

How’re you going to save up for bigger things like purchasing your first property or retiring early?

Factors Affecting Your $100k Savings Journey

I know what some of you are thinking.

We all come from different backgrounds and lead very different lives.

True.

In fact, here are some factors which might affect your rate of savings.

1) Education Level

Your education will be a huge factor that determines when you’ll start working.

Generally, polytechnic graduates will enter the workforce a lot earlier as they have a diploma that they can immediately use to seek employment.

Of course, there are those who go on to pursue higher tertiary education too.

If you do so, that’ll add about 2 to 4 years more — depending on your course of study.

Before you enter the workforce as a university graduate.

2) National Service

Your gender will also affect your savings timeline.

If you’re a male Singaporean, serving the mandatory 2-Year National Service (NS) means that you’ll enter the workforce slightly later than your female counterparts.

3) Amount of Savings When Starting

The amount of savings you start with before embarking on this “$100k by 30 years old” challenge will also affect how fast you can reach the end-goal.

Ever heard of the magic of compound interest?

If you’re privileged enough to have been given seed money by your parents, which you’ve put aside diligently, then great.

Maybe you’re not born a Baller, but you’re a Hustler at heart.

And you’ve saved up a bit from your side hustles — maybe you gave tuition or worked part-time.

You might not be starting out with the same resources as the Baller.

BUT that doesn’t mean that you can’t become one in the future…

How to Save $100k by 30 Years Old

Being in your 20s has lots of benefits.

Other than having the physical stamina to turn up for work — despite working side jobs 4 times a week.

You usually have very little commitment.

Your largest worry is probably your student loan.

Here are some tips to help you save more before you hit the big 3-0.

- Build alternate sources of income through freelance or event-based jobs

- Save at least half of your monthly salary

- Use a high-interest savings account to maximise your interest rate

- Save on your monthly necessities by using the cheapest SIM Only plan or switching to an open electricity market retailer

- Invest!

So… is Saving $100k Possible for Singaporeans?

Let’s look at 4 different scenarios, involving 4 different types of fresh graduates.

All of whom are about to enter the workforce.

And all of them find jobs that pay less than $3,000 – because times are bad.

Note: let’s take it that everyone finishes their Secondary school education by 16 years old

Polytechnic Graduate (Singaporean Male)

If you choose to go to poly (3 to 4 years) instead of JC (2 years).

You’d be about 21 years old after you complete your NS liability.

Assuming you:

- Start working at 22 years old

- Earn $2,500 a month as Post-NS Poly Grad — after CPF contribution, you take home $2,000

- Save 50 per cent of your salary

- Get a salary increase of 4 per cent every year — after factoring in inflation of ~ 1.4 per cent a year, you only save 2.6 per cent

- Receive an Annual Wage Supplement (AWS) in the form of the 13th Month Bonus

- Use a ridiculously lousy savings account that gives you a 0 per cent interest rate

- Do not invest at all

Here’s how much you’d save by 30:

| Age | Monthly Salary | Monthly Take Home Salary (After CPF) | Savings Per Month (Taking into account inflation) | Savings Per Year | Annual Bonus | Total Savings For That Year |

|---|---|---|---|---|---|---|

| 22 | $2,500 | $2,000 | $1,000 | $12,000 | $2,000 | $14,000 |

| 23 | $2,600 | $2,080 | $1,026 | $12,312 | $2,080 | $14,392 |

| 24 | $2,704 | $2,163.20 | $1,052.68 | $12,632.16 | $2,163.20 | $15,795.36 |

| 25 | $2,812.16 | $2,249.60 | $1,080.05 | $12,960.60 | $2,249.60 | $15,210.20 |

| 26 | $2,924.65 | $2,339.72 | $1,108.13 | $13,297.56 | $2,339.72 | $15,637.28 |

| 27 | $3,041.63 | $2,433.30 | $1,136.94 | $13,643.28 | $2,433.30 | $16,076.58 |

| 28 | $3,163.30 | $2,530.64 | $1,166.50 | $13,998 | $2,530.64 | $16,528.64 |

| 29 | $3,289.83 | $2,631.86 | $1,196.83 | $14,361.96 | $2,631.86 | $16,993.82 |

| 30 | $3,421.42 | $2,737.14 | $1,227.94 | $14,735.28 | $2,737.14 | $17,472.42 |

A grand total of $142,106.30.

Polytechnic Graduate (Singaporean Female)

Since you don’t have to serve NS.

You’ll be about 19 years old when you graduate with your diploma.

Assuming you:

- Start working at 20 years old

- Earn $2,270 a month as a Poly Grad — after CPF contribution, you take home $1,816

- Save 50 per cent of your salary

- Get a salary increase of 4 per cent every year — after factoring in inflation of ~ 1.4 per cent a year, you only save 2.6 per cent

- Receive an Annual Wage Supplement (AWS) in the form of the 13th Month Bonus

- Use a ridiculously lousy savings account that gives you a 0 per cent interest rate

- Do not invest at all

Here’s how much you’d save by 30:

| Age | Monthly Salary | Monthly Take Home Salary (After CPF) | Savings Per Month (Taking into account inflation) | Savings Per Year | Annual Bonus | Total Savings For That Year |

|---|---|---|---|---|---|---|

| 20 | $2,270.00 | $1,816.00 | $908.00 | $10,896.00 | $1,816.00 | $12,712.00 |

| 21 | $2,360.80 | $1,888.64 | $931.61 | $11,179.30 | $1,888.64 | $13,067.94 |

| 22 | $2,455.23 | $1,964.19 | $955.83 | $11,469.96 | $1,964.19 | $13,434.14 |

| 23 | $2,553.44 | $2,042.75 | $980.68 | $11,768.18 | $2,042.75 | $13,810.93 |

| 24 | $2,655.58 | $2,124.46 | $1,006.18 | $12,074.15 | $2,124.46 | $14,198.61 |

| 25 | $2,761.80 | $2,209.44 | $1,032.34 | $12,388.08 | $2,209.44 | $14,597.52 |

| 26 | $2,872.27 | $2,297.82 | $1,059.18 | $12,710.17 | $2,297.82 | $15,007.99 |

| 27 | $2,987.17 | $2,389.73 | $1,086.72 | $13,040.63 | $2,389.73 | $15,430.36 |

| 28 | $3,106.65 | $2,485.32 | $1,114.97 | $13,379.69 | $2,485.32 | $15,865.01 |

| 29 | $3,230.92 | $2,584.73 | $1,143.96 | $13,727.56 | $2,584.73 | $16,312.29 |

| 30 | $3,360.15 | $2,688.12 | $1,173.71 | $14,084.48 | $2,688.12 | $16,772.60 |

A grand total of $161,209.39.

University Graduate (Singaporean Male)

To simplify things, I’m going to take it that the university grads chose the JC route instead.

That’s why they HAVE to get a degree in order to be employable.

After JC, your NS, and university education.

You’d be about 24 to 25 years old, depending on your course of study.

Assuming you:

- Start working at 25 years old

- Earn $2,900 a month — after CPF contribution, you take home $2,320

- Save 50 per cent of your salary

- Get a salary increase of 4 per cent every year — after factoring in inflation of ~ 1.4 per cent a year, you only save 2.6 per cent

- Receive an Annual Wage Supplement (AWS) in the form of the 13th Month Bonus

- Use a ridiculously lousy savings account that gives you a 0 per cent interest rate

- Do not invest at all

Here’s how much you’d save by 30:

| Age | Monthly Salary | Monthly Take Home Salary (After CPF) | Savings Per Month (Taking into account inflation) | Savings Per Year | Annual Bonus | Total Savings For That Year |

|---|---|---|---|---|---|---|

| 25 | $2,900 | $2,320 | $1,160 | $13,920 | $2,320 | $16,240 |

| 26 | $3,016 | $2,412.80 | $1,190.16 | $14,281.92 | $2,412.80 | $16,693 |

| 27 | $3,136.64 | $2,509.31 | $1,221.10 | $14,653.20 | $2,509.31 | $17,162.51 |

| 28 | $3,262.11 | $2,609.69 | $1,252.85 | $15,034.20 | $2,609.69 | $17,643.89 |

| 29 | $3,392.59 | $2,714.07 | $1,285.43 | $15,425.16 | $2,714.07 | $18,139.23 |

| 30 | $3,528.29 | $2,822.63 | $1,318.85 | $15,826.21 | $2,822.63 | $18,648.48 |

A grand total of $104,527.11.

University Graduate (Singaporean Female)

Since you don’t have to serve NS.

You’ll be about 22 to 23 years old when you graduate with your degree.

Assuming you:

- Start working at 23 years old

- Earn $2,900 a month — after CPF contribution, you take home $2,320

- Save 50 per cent of your salary

- Get a salary increase of 4 per cent every year — after factoring in inflation of ~ 1.4 per cent a year, you only save 2.6 per cent

- Receive an Annual Wage Supplement (AWS) in the form of the 13th Month Bonus

- Use a ridiculously lousy savings account that gives you a 0 per cent interest rate

- Do not invest at all

Here’s how much you’d save by 30:

| Age | Monthly Salary | Monthly Take Home Salary (After CPF) | Savings Per Month (Taking into account inflation) | Savings Per Year | Annual Bonus | Total Savings For That Year |

|---|---|---|---|---|---|---|

| 23 | $2,900 | $2,320 | $1,160 | $13,920 | $2,320 | $16,240 |

| 24 | $3,016 | $2,412.80 | $1,190.16 | $14,281.92 | $2,412.80 | $16,693 |

| 25 | $3,136.64 | $2,509.31 | $1,221.10 | $14,653.20 | $2,509.31 | $17,162.51 |

| 26 | $3,262.11 | $2,609.69 | $1,252.85 | $15,034.20 | $2,609.69 | $17,643.89 |

| 27 | $3,392.59 | $2,714.07 | $1,285.43 | $15,425.16 | $2,714.07 | $18,139.23 |

| 28 | $3,528.29 | $2,822.63 | $1,318.85 | $15,826.21 | $2,822.63 | $18,648.48 |

| 29 | $3,669.42 | $2,935.54 | $1,353.14 | $16,237.68 | $2,935.54 | $19,173.22 |

| 30 | $3,816.20 | $3,052.96 | $1,388.32 | $16,659.86 | $3,052.96 | $19,712.82 |

A grand total of $143,413.15.

Is It Really Possible?

Looking at the math.

Well… the numbers don’t lie.

It just takes a little discipline, proper salary allocation, and living within your means.

In order to save $100k by 30 years old.

It’ll be even faster (and more) if you use a high-interest savings account, optimise your savings, and invest that money for your future.

With that $100k, you can easily afford the downpayment for your first home.

Get married.

Pursue higher education.

Or do whatever you wish to do or achieve in life.

Even if you live like a monk and you don’t need that money for anything in the future.

It’s always nice to have an emergency fund that you can rely on when things don’t go your way.

The biggest takeaway here?

No matter how much you decide to save.

Give yourself a slightly scary financial goal AND really commit yourself to it.

Who knows?

You just might surprise yourself.

Advertisement