Maybank Family and Friends Card Review (2024): Best Cashback Credit Card for Families?

Seedly

Seedly●

When it comes to credit cards, finding the perfect fit for your lifestyle and spending habits can be quite a challenge. For many families and individuals in Singapore, the Maybank Family & Friends Card has become a popular choice due to its attractive cashback benefits and family-centric rewards.

In this comprehensive review for 2024, we’ll delve into the features, pros, and cons of the Maybank Family & Friends Card to help you decide if it’s the right card for you.

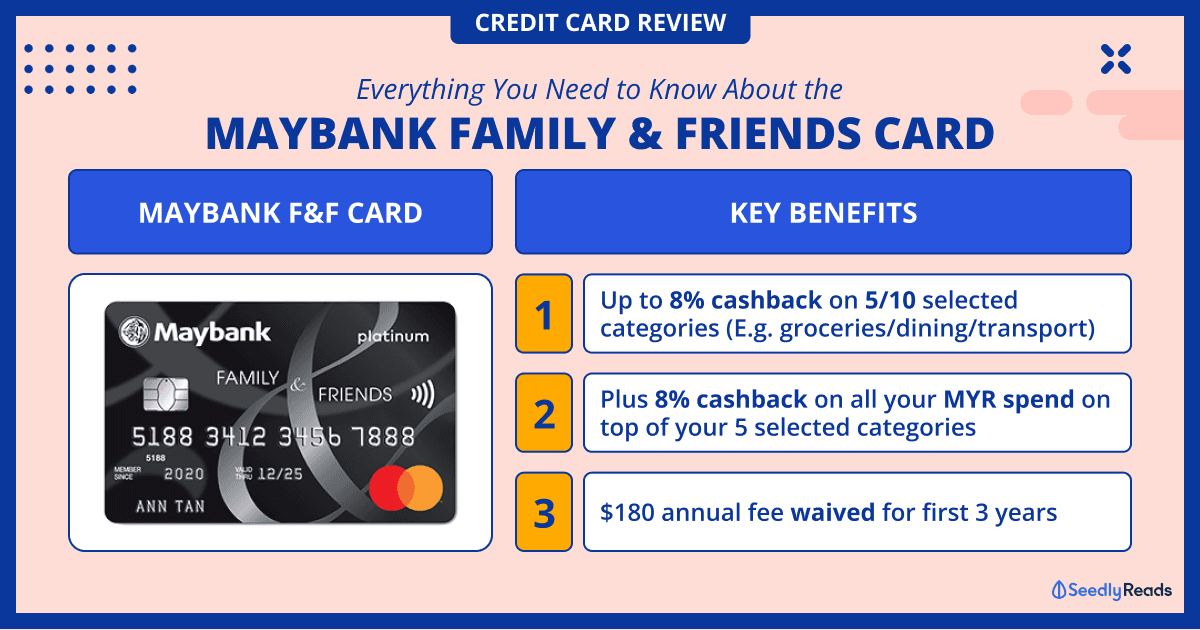

TL;DR: Maybank Family & Friends Card Review 2024

- Cashback:

- 8% on five out of 10 selected categories

- Minimum Monthly Spend: $800

- Cashback Cap: $125 ($25 for each bonus category) on up to $1,875 monthly spend

- Annual Fee: $180 (first three years waived)

- Effective Interest Rate: 26.90% p.a.

- Income Requirement:

- $30,000 per year for Singaporeans or SPR

- $45,000 for Malaysians in employment for at least 1 year

- $60,000 for Foreigners in employment for at least 1 year

- Minimum Age: 21.

Maybank Family and Friends Card Key Features

With the Maybank Family and Friends Card, you can earn 8% cashback globally on five out of these 10 cashback categories:

| Eligible Categories For Local, Overseas and Online Spend | Description |

|---|---|

| Groceries | NTUC FairPrice/Finest/X‐tra, Cold Storage, Giant, Market Place, Jasons, Sheng Siong, DON DON DONKI, HAO Mart, RedMart, Amazon Fresh and all other grocery stores and supermarkets globally |

| Dining & Food Delivery | Restaurant dining, Foodpanda and Deliveroo globally |

| Transport | Petrol stations, Contactless bus and train rides, Limousines, Taxi, Grab/GOJEK rides, other passenger transportation services and automotive-related services globally |

| Data Communication & Online TV Streaming | StarHub, Singtel, M1 Limited, Circles.Life, MyRepublic, Disney+, Netflix and/or other telecommunication, pay television, cable and radio services globally. |

| Retail & Pets | POPULAR Bookstores, Toys 'R' Us and Yamaha Music, pets and veterinary related services globally |

| Online Fashion | Online purchases on Apparels, Shoes, Accessories, Leather goods, Luggage and other fashion purchases globally |

| Entertainment | Bars, Drinking places, Cinemas, Motion Picture Theatres, Theatrical Producers and Ticketing agencies globally |

| Pharmacy | Guardian, Watsons, Unity, GNC/LAC, other drug stores and pharmacies globally |

| Sports & Sports Apparels | Sports/Riding apparels, Sporting goods, Bicycle shops, Recreation & sporting camps, Athletic fields, Commercial sports, Professional sport club, Golf courses, Country clubs and Membership (Athletic/Recreation/Sports) globally |

| Beauty & Wellness | Massage parlors, Health & beauty spas and Barber shops globally |

FYI: Selected Categories will take effect on the first day of the following calendar month. The Selected Categories will apply to the Cardmember for three months from the effective date (“Lock-In Period”). Maybank reserves the right to amend the length of the Lock-In Period from time to time without prior notice or liability to any person.

To get the 8% cash rebates, cardholders must spend a minimum of $800 per calendar month.

Any monthly spending from $0 – $799 will only receive 0.3% in cashback.

Also, after reaching the monthly cashback cap for a selected category, the 0.3% cashback will be applied to further spending that month, and the 0.3% cashback will be applied to all other spending on non-selected categories.

There is also a total cashback cap of $125 ($25 for each category).

Bonus Category for Maybank Family and Friends: Additional 8% cashback on Malaysian Ringgit Spend

Those who love going to Johor Bahru for a weekend getaway can now earn an additional 8% cashback on top of your five preferred categories!

After reaching your monthly cashback cap, the 8% cashback will be applied to the Malaysian Ringgit for the selected category spending that month and all other Malaysian Ringgit spend on non-selected categories in the month:

| Min. monthly spend | Cashback on five selected categories | Cashback on Malaysian Ringgit on other spends (above and/or outside of selected categories) |

| $800 | 8%

(Up to $125 in total per calendar month, capped at $25 per category) |

8% (Additional cap of $25) |

| $0 – $799 | 0.3% | 0.3% |

More specifically, according to the card’s terms and conditions, the Malaysian Ringgit bonus category and cap applies to:

- Eligible retail transactions charged in Malaysian Ringgit on his/her Card that are not transactions which fall under Cardmember’s Default Categories or Selected Categories (as the case may be); OR

- Eligible retail transactions charged in Malaysian Ringgit on his/her Card which also fall under one of the Cardmember’s Default Categories or Selected Categories (as the case may be) after the Cardmember has charged more than $312.50 to that Default Category or Selected Category (as the case may be) during that calendar month.

However, note that Malaysian Ringgit transactions will incur a 3.25% foreign transaction fee. But, the 8% cashback if you hit the minimum spend of $800 more than covers it.

Choosing Your Cashback Categories

One of the most appealing aspects of the Maybank Family & Friends Card is the ability to choose your cashback categories. Here’s how you can customise your cashback rewards to fit your spending habits:

- Assess Your Spending Habits: Look at your spending in the past few months to identify where you spend the most. This will give you a clear idea of which categories will benefit you most.

- Select Up to 5 Categories: The card allows you to choose up to 5 cashback categories from a list that includes groceries, dining, transport, petrol, utilities, and data communications.

- Customize Regularly: Your spending habits might change over time. The Maybank Family & Friends Card lets you update your selected categories periodically, ensuring you always get the maximum cashback based on your current lifestyle.

- Optimize for Family Spending: If you share expenses with family members, consider their spending habits as well. For example, if a family member frequently uses the card for petrol, ensure that petrol is one of your selected categories.

- Utilise Promotions and Offers: Keep an eye on Maybank’s ongoing promotions and offers. During promotional periods, certain categories might offer special cashback rates or additional benefits.

Travel Insurance

The card offers complimentary travel insurance coverage of up to $1,000,000 when travel expenses are charged to the card. This includes coverage for accidental death, medical expenses, and travel inconvenience.

Contactless Payments

The Maybank Family & Friends Card supports contactless payments via Visa payWave, making quick and secure transactions convenient.

Maybank TREATS

Through the Maybank TREATS program, cardholders can enjoy additional discounts and privileges at participating merchants, including dining deals, retail discounts, and travel offers.

Next we will examine the pros and cons of this card.

Maybank Family & Friends Card Pros

1. High Cashback Rates

One of the standout features of the Maybank Family & Friends Card is its generous cashback rates. You can earn up to 8% cashback on categories such as groceries, dining, transport, and petrol. This makes it an excellent choice for families looking to save on everyday expenses.

2. Flexible Cashback Categories

The card offers flexibility in cashback categories, allowing you to choose up to 5 preferred categories to earn the maximum cashback. This customization means you can tailor your spending to maximize rewards based on your unique lifestyle.

3. Waived Annual Fee

The annual fee of $180 is waived for the first three years, providing significant savings for new cardholders. After the initial three years, you can still get the annual fee waived with a minimum annual spend of $12,000.

4. Complimentary Travel Insurance

Cardholders enjoy complimentary travel insurance coverage of up to $1,000,000. This is a great perk for frequent travelers, providing peace of mind and added value without extra cost.

5. No Foreign Transaction Fees

Unlike many other credit cards, the Maybank Family & Friends Card does not charge foreign transaction fees. This makes it an excellent card for those who frequently shop online from overseas retailers or travel abroad.

Maybank Family & Friends Card Cons

1. Minimum Spend Requirement

To enjoy the maximum cashback benefits, you need to meet a minimum spend of $800 per month. This might be challenging for some users, especially those with lower monthly expenses.

2. Cashback Cap

The cashback earned is capped at $125 per calendar month. While this cap is relatively high compared to some other cards, the really heavy spenders might find this limiting.

3. Limited Cashback Categories

Although the card offers flexibility in choosing cashback categories, the selection is somewhat limited. If your spending habits fall outside the predefined categories, you might not fully benefit from the high cashback rates.

4. Annual Fee After Waiver Period

After the initial three-year waiver period, the annual fee of $180 is quite steep. While it can be waived with a minimum annual spend of $12,000, this might not be feasible for everyone.

Comparison with Other Similar Credit Cards

UOB One Card

- Cashback Rate: Up to 10% on selected categories

- Minimum Spend: $500 – $2,000 per month

- Annual Fee: $192.60 (waived for the first year)

- Pros: Higher cashback cap, easier to achieve higher cashback rates with lower minimum spend

- Cons: More complex cashback structure, lower overall cashback rates compared to Maybank Family & Friends Card

DBS Live Fresh Card

- Cashback Rate: Up to 5% on online and contactless transactions

- Minimum Spend: $600 per month

- Annual Fee: $192.60 (waived for the first year)

- Pros: Focus on online and contactless spending, attractive for tech-savvy users

- Cons: Lower cashback rates, fewer categories covered

OCBC 365 Credit Card

- Cashback Rate: Up to 6% on selected categories

- Minimum Spend: $800 per month

- Annual Fee: $192.60 (waived for the first year)

- Pros: Wide range of cashback categories, including dining, groceries, transport, and online shopping

- Cons: Similar minimum spend requirement, slightly lower cashback rates

Conclusion

The Maybank Family & Friends Card is a strong cashback credit card market contender, particularly for families and individuals with diverse spending habits. Its high cashback rates, flexible category selection, and additional perks like travel insurance and no foreign transaction fees make it a compelling choice for many Singaporeans.

However, the minimum spend requirement and the annual fee after the waiver period are important considerations. Evaluating your spending patterns and determining if you can consistently meet the minimum spend to maximize the card’s benefits is essential.

Compared to similar cards, the Maybank Family & Friends Card stands out for its high cashback rates and family-centric rewards, though it may not be the best fit for everyone. By carefully weighing the pros and cons outlined in this review, you can make an informed decision about whether this card aligns with your financial goals and lifestyle.

Overall, the Maybank Family & Friends Card is an excellent option for those looking to earn significant cashback on everyday expenses, provided they can meet the card’s requirements.

Advertisement