Is Our Nasi Lemak Subjected to GST? An insight on how GST Increment Affects Cost Of Living For Poorer Singaporeans.

” We are seriously considering a career switch to be a fortune teller.”

In December, we predicted that Goods and Services Tax (GST) is likely to increase. That news became official when it was announced at The Budget 2018.

Singaporeans this have a longer 3 years to prepare for the hike, away from the usual 1.5 years.

Above: “What we interpreted from Heng Swee Keat’s speech.”

Well, most rationale Singaporeans would have expected it, there were actually a few telltale signs:

- Prime Minister Lee Hsien Loong mentioned the need to raise taxes to fund government spendings

- GST has yet to increase since the year 2007

- GST is the second-largest source of revenue for the government

The Impact Of GST In Layman’s Terms

To indicate the impact of a GST hike on an average Singaporeans’ lives, we asked a simple question on our Seedly Personal Finance Community:

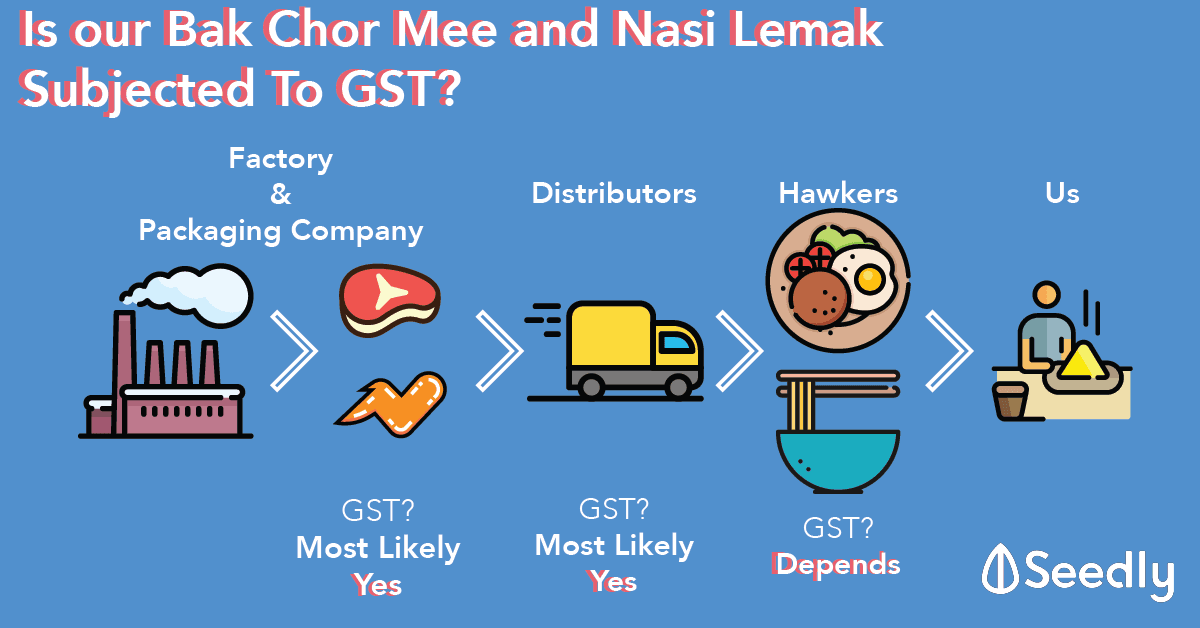

Is our Bak Chor Mee and Nasi Lemak Subjected to Goods and Services Tax (GST)?

- Ruth Lim:

Not directly but hawkers’ suppliers could be paying GST and the cost is built into our noodles. - Kenneth Chan & Alvin Chow:

If their turnover is more than $1 million! - Rave Ong:

Punggol Nasi Lemak does charge. They did mention that they charge GST. - Ahbang Yang:

Their suppliers will pass down the GST increase to the hawkers. There is no escape. - Charmaine Ng:

Yes, it is. Even if it is not shown on the receipt, it is already incorporated into the calculation by the vendors. - Rais Bin Mahmud:

Does it matter? You will still eat them, regardless of GST or not.

A simple move such as a GST rate hike can affect an average Singaporean through his simple meal of Nasi Lemak or Bak Chor Mee.

Where do we stand?

It is argued that even by raising our GST rate to 9%, we are still below the regional average of 10.5%.

The Organisation for Economic Cooperation and Development (OECD) average rate is at 19%.

Here’s where we stand around the region in terms of GST rate:

| Countries | Standard rate |

|---|---|

| Singapore | 7% (going 9%) |

| Malaysia | 6% |

| Indonesia | 10% |

| China | 17% |

| Vietnam | 10% |

| Thailand | 7% |

| Japan | 8% |

Who takes the biggest hit?

With the increase in the cost of living, we expect the lower income to take the biggest hit.

[infogram id=”01467958-f6c2-481c-979e-b8d31005ec9f” prefix=”Mos” format=”interactive” title=””]

Read more: How Poor Are Singaporeans: Monthly Household Income vs Household Expenditure

Impact of GST hike on the lower 20% earners in Singapore

For better illustration, we exclude the impact of inflation for the example below:

- The lower 20% earners in Singapore’s income is less than their monthly expenditure.

- An average household’s expenditure for the lower 20% is at $2,286.30 per month.

- With the additional GST, it is going to increase to $2,329.04 per month, an additional cost of $42.74.

- That adds up to an additional cost of $512.81 each year.

How can this 20% lower income earners survive?

Again, linking back to our illustration, the bottom 20% income earning households are actually earning less than their monthly expenditure.

- The bottom 20% households earn an average of $2,071.22 per month.

- This amount is already lower than their monthly expenditure before the GST hike.

- With the new GST hike and expenditure to increase to $2,329.40 per month, they will need a 12.47% pay increment to break even.

(well, try going to your boss today to ask for a more than 10% pay increment due to GST hike and see what they say)

Will the Ang Bao be enough?

As bad as it sounds, the government will be giving out a one-time SG bonus for eligible Singaporeans.

- The annual income of the lower 20% earning Singaporean should be less than $28,000 which means that they are eligible for the S$300 SG Bonus.

- Assuming two members in a household, that will add up to be S$600 worth of SG Bonus.

- We calculated before that S$512.81 is the additional cost incurred from the increase in GST, S$600 looks like a sufficient number to cover it.

Do take note that we did not take into account inflation cost and menu costs of vendors.

Example of menu cost can be:

Example of menu cost can be:

- The actual ingredient cost of cooking a bowl of Bak Chor Mee is $2.00, and they charge the consumers $2.50.

- This means a 25% profit for the Bak Chor Mee owner.

- When costs of ingredient increase with GST, the cost of making a bowl of Bak Chor Mee increases to $2.04.

- The vendor now needs to charge about $2.55 to make the same percentage of profit, but they will not do so.

- Bak Chor Mee will instead cost $2.60, due to menu cost.

Anticipating possible price increment in future and owner lazy to change menu again

And also, who uses 5 cents coin these days?! So $2.60 sounds like a nice number.

Businesses required to register for GST?

- As a business, one will need to register for GST when their taxable turnover exceeds $1 million.

Further Reading: More About Singapore’s Goods and Service Tax (GST)

GST rate is the second-largest source of revenue for the Singapore’s government:

| Source of government revenue (Singapore) | Weightage |

|---|---|

| Corporate Income Tax | 19.6% |

| Government Service Tax (GST) | 16.2% |

| Personal Income Tax | 15.5% |

| Vehicle Quota Premiums (COE) | 9.4% |

| Assets Taxes | 6.3% |

| Fees and charges | 4.7% |

| Customs and Excise Taxes | 4.5% |

| Betting Taxes (TOTO, 4D etc.) | 3.9% |

| Stamp Duty | 3.9% |

| Motor Vehicle Taxes | 3.9% |

| Withholding Tax | 1.9% |

| Statutory Boards' Contribution | 0.4% |

| Other Taxes | 9.3% |

| Others | 0.4% |

GST stood at 7% for the past 10 years:

| Year | 1994 | 2003 | 2004 | 2007 |

|---|---|---|---|---|

| GST rates | 3% | 4% | 5% | 7% |

Is GST A Lazy Option?

With GST being the second-largest source of government revenue, most Singaporeans would go on and ask, “why not increase the one bringing in the most revenue?”

The answer is simple.

Corporate Income Tax brings in the highest percentage of our revenue. While it sounds easy to increase Corporate Income Tax, the impact might be devastating, should Singapore loses its edge to attract foreign investment.

Are there other options available? Maybe, but they all come with their pros and cons too. Increasing the GST can be a rather difficult option too, with the ruling party putting the risk of losing precious votes on the line. Yet, if they went ahead with it, it might indicate the lack of a feasible solution to our increase in country’s expenditure moving forward.

Budget Allocation: Country X

So something interesting happened on Seedly Personal Finance Community as we were sharing the breakdown of our government’s spending for Financial Year 2017.

A community member of ours shared with us a breakdown of Country X’s government’s spending and remind us Singaporeans to be happy with what we have.

Country X spends 83.6% of their revenue on administration and the remaining on the development of a country.

There is probably no perfect policies and countries, Singaporeans should come together and help one another. Surrounding yourself with friends to embark on a well-researched personal finance journey is definitely a good way to go about it. If not, there is always Seedly Personal Finance Community. We got your back!

Advertisement