New Proposed Singapore Crypto Regulation by MAS: Risk Tests, No Leverage, Segregation of Assets & More

●

As evidenced by the high-profile collapses of Singapore-linked Cryptocurrency companies like Hodlnaut, Terraform Labs (creators of TerraUSD) and Three Arrows Capital (3AC) this year, the world of cryptocurrencies is still the ‘Wild West.’

This is why the Monetary Authority of Singapore (MAS) has constantly reiterated that:

‘trading in cryptocurrencies (also known as digital payment tokens or DPTs) is highly risky and not suitable for the general public.’

But, since cryptocurrencies play an essential support role in the wider digital asset ecosystem, it would not be practical to ban them.

Still more needs to be done.

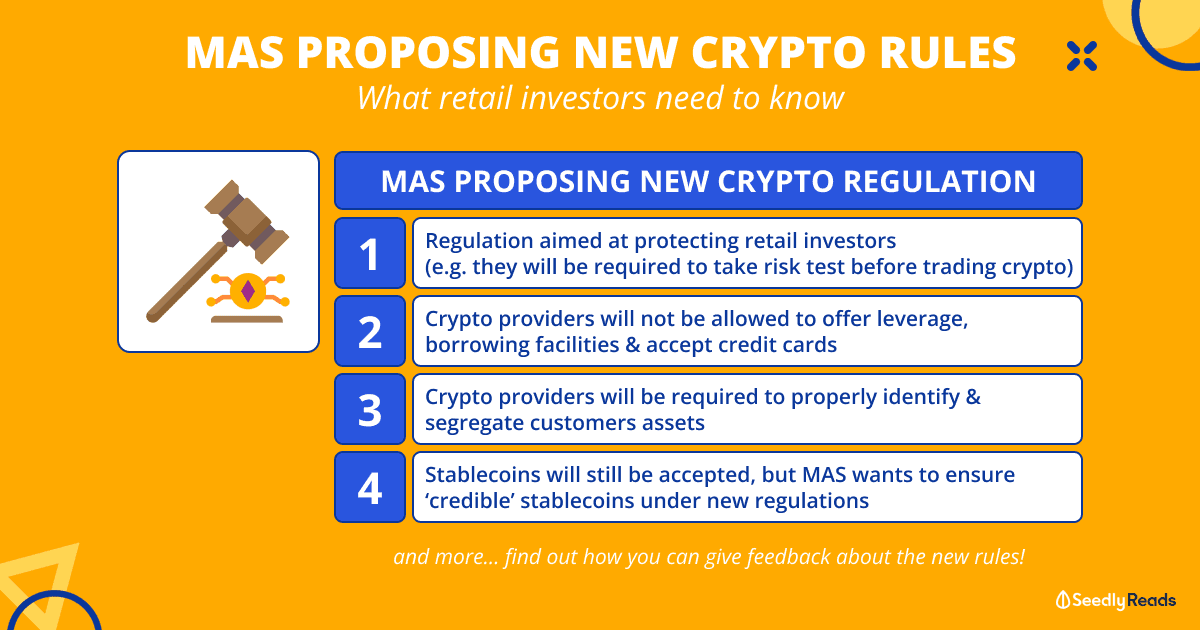

In a bid to protect retail investors and reduce the risk to consumers from speculative trading in cryptocurrencies, the Monetary Authority of Singapore (MAS) published two consultation papers proposing regulatory measures to reduce the risk of consumer harm from cryptocurrency trading and to support the development of stablecoins as a credible medium of exchange in the digital asset ecosystem.

These papers, published yesterday (26 October 2022), stated that MAS will require that DPT service providers ensure proper business conduct and adequate risk disclosure.

Here’s what you need to know!

TL;DR: New Proposed Singapore Cryptocurrency Regulation by MAS to Protect Retail Investors

MAS has categorised the measures into three broad areas:

• Consumer Access. DPT service providers will be required to provide relevant risk disclosures to enable retail consumers to make informed decisions regarding cryptocurrency trading. They must also disallow the use of credit facilities and leverage retail consumers for cryptocurrency trading.

• Business Conduct. DPT service providers will be required to segregate customers’ assets properly, mitigate any potential conflicts of interest arising from their multiple roles, and establish complaints-handling processes.

• Technology Risks. Like other financial institutions such as banks, DPT service providers will be required to maintain their critical systems’ high availability and recoverability.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Seedly does not recommend that any cryptocurrency should be bought, sold, or held by you. Readers should always do their due diligence, consider their financial goals before investing in any investment product, and consult their financial advisor before making any investment decisions.

Click to Teleport

- Consumer Access

- Business Conduct Measures

- Stablecoin Regulation

- Which Act Regulate Cryptocurrencies or Digital Tokens in Singapore? Is Cryptocurrency Regulated by MAS?

- How to Give Your Feedback About Proposed Cryptocurrency Rules

Consumer Access Regulation

The first consultation paper address retail investors and consumer access.

MAS is concerned that the average retail investor may not have the financial means to bear the significant losses likely to occur with the speculative trading of cryptocurrencies that they do not understand.

To allay these concerns, MAS is proposing a set of consumer access measures for consumers who are:

- Residents in Singapore (in the case of an individual) or formed or incorporated in Singapore (in the case of a partnership or corporation)

- And are not accredited investors (AI) or institutional investors.

The DPT Service Providers (DPTSPs) will then have to apply these measures to retail customers.

The measures are as follows:

1. Risk Awareness Assessment

MAS is proposing more robust risk awareness assessments for retail investors. DPTSPs will have to assess their customers (via a test) and ensure they have sufficient knowledge of the risks of DPTs before providing any DPT service to customers.

The regulatory body considered that it could be helpful for the DPTSPs to assess the retail customer’s knowledge of the following risks:

- Sharp fluctuations in the prices of DPTs and the loss of all monies put into

DPTs; - Inability to readily sell their DPTs, such as during illiquid market conditions or

system outages; - Losing access to their DPTs in the event of a technological or operational issue,

such as if private keys are lost or irretrievable; and - Losing their DPTs in the event of fraud, theft, sabotage or cyber attack.

If the customer does not have adequate knowledge about these risks, MAS is asking DPTSPs to consider the following steps to take:

- Providing educational materials to the retail customer to strengthen the customer’s knowledge of the risks of DPT services. This should not be limited

to those questions to which the retail customer answered incorrectly; - Having the appropriate processes to facilitate and encourage retail customers to review the educational materials and improve their knowledge of risks, such as cooling off periods between assessments; and

- Having the appropriate processes to ensure a fair and robust assessment, such as using a diverse question bank that generates different questions for subsequent assessments.

2. Restriction on Offering of Incentives

MAS proposes that DPTSPs should not offer any monetary or non-monetary incentives to retail customers to participate in a DPT service; or (b) to any person (e.g., an existing customer or a celebrity) to refer a DPT service to retail customers.

This means no signup bonuses or referral programmes where consumers will get incentives like a free amount of cryptocurrency, trading credits etc., for signing up for a DPT service or referring their friend.

This extends to celebrity endorsements as well.

These proposed measures are in addition to the current ban on cryptocurrency platforms from publicly advertising their products and services in Singapore.

3. Restrictions on Debt-Financed and Leveraged DPT Transactions

That’s not all.

MAS is proposing that any form of credit and leverage in the trading of DPTs be banned.

Thus MAS proposes that DPTSPs should not:

- Provide to a retail customer any credit facility (whether in the form of fiat currencies or DPTs) to facilitate the retail customer’s purchase or continued holding of DPTs;

- Enter into any leveraged DPT transaction with a retail customer or facilitate a retail customer’s entry into any leveraged DPT transaction with any other person; nor

- Accept any payments made by the retail customer using a credit card or charge card in connection with the provision of any DPT service.

Business Conduct Measures

Additionally, MAS is proposing some additional measures to regulate DPTPS.

Segregation of Customers’ Assets and Risk Management Controls

In addition, MAS is proposing that DPTSPs will need to see to it that their client’s assets are segregated, be transparent and reduce any potential conflicts of interest in their various businesses, as well as come up with better procedures to deal with customer complaints.

Managing Technology and Cyber Risks

DPTSPs will also be required to ensure that the technical risks associated with the availability and recoverability of their critical systems be reduced as much as possible.

Stablecoin Regulation: Is Cryptocurrency Legal in Singapore?

Moreover, MAS is proposing new measures to regulate stablecoins.

As an asset class, cryptocurrencies are known for being infamously volatile when priced against fiat currencies.

However, this volatility makes them highly risky, and speculative investments that are not useful for payments as the cryptocurrencies price could go up or down significantly after the transaction goes through.

But not all cryptocurrencies have this problem.

Enter stablecoins: a category of cryptocurrencies that try to peg their market value to an external asset like fiat currencies, precious metals or other cryptocurrencies to stabilise the price.

FYI: Fiat currencies are the Government-backed currencies (e.g. Singapore dollar) that we use daily.

Typically, the organisations behind the stablecoin will have to ‘back’ up the supply of stablecoins with a securely stored reserve of real-world assets like fiat currencies or precious metals.

The real-world assets function as collateral for each stablecoin. In other words, each stablecoin is backed by a real-world asset.

In theory, stablecoin owners can exchange one unit of a stablecoin for one unit of the asset that backs it.

Thus, this makes the stablecoins stable and reduces price volatility as their value is pegged to a more stable asset.

However, MAS reckons that some stablecoins still have potential if they are appropriately regulated and securely backed.

Currently, the regulation of stablecoins in Singapore is governed under the Payment Services Act. But, they are mainly regulated to prevent money laundering and terrorism financing and to mitigate technological risks.

MAS is asserting that this is not “not adequate” as these regulations do not cover the peg and any other types of mechanisms used to manged the peg.

MAS Cryptocurrency License

The regulatory body plans to focus its regulatory efforts on single-currency pegged stablecoins (SCS) issued in Singapore with a circulation value of S$5 million and above. Non-bank financial institutions that fall under this criteria must comply with new disclosure, insolvency and stability protections and obtain a Major Payment Institution license to operate.

Whereas the other types of stablecoins, like algorithmic, commodity-backed, multi-currency and other types of stablecoins, will be classified as DPTs as they are more volatile.

SCS issuers offering MAS-regulated SCS must hold reserve assets to back the SCS issued. MAS proposes the following key requirements in relation to the reserve assets:

- Reserve assets must be valued on a marked-to-market basis daily and be equivalent to at least 100% of the par value of the outstanding SCS in circulation (including those held by the issuer) at all times.

- Reserve assets can only be held in the form of cash, cash equivalents, or debt securities with no more than three months residual maturity and are issued by (i) the central bank of the pegged currency; or (ii) organisations that are of both a governmental and international character with a credit rating of at least “AA–”.

- Reserve assets must be denominated in the same currency as the pegged currency.

- The stablecoin issuers will be required to undergo third-party audits and will need to ensure that SCS holders can redeem their SCS promptly.

- Issuers must also be audited by an external party and ensure timely redemption at par value for holders of its SCS.

In addition, MAS proposes only allowing the issuance of SCS pegged to the Singapore dollar or Group of Ten (G10) currencies at the start.

These stablecoin issuers will also need to produce a whitepaper about their SCS on their website with details like the rights and obligations of the issuer and holders and any potential destabilising risks that may affect the SCS’s value.

This information will also need to be regularly updated.

Which Act Regulate Cryptocurrencies or Digital Tokens in Singapore? Is Cryptocurrency Regulated by MAS?

All these proposed regulations mentioned above will be integrated into the Payment Services Act; an essential piece of legislation for the regulation of cryptocurrency in Singapore.

How To Give Your Feedback About Singapore Cryptocurrency Law (Proposed)

Got any thoughts about the proposed rules for cryptocurrency by MAS?

You can submit your comments on the proposals by 21 December 2022, 11.59pm, via this link.

Read More

Advertisement