What's The Best Way To Pay For Your MRT/Bus Rides? EZ-Link VS EZ-Reload VS SimplyGo

I’ve had a long-standing record of being a klutz. That said, as a frequent rider of SMRT and SBS, I rarely get out of the buses/MRT looking like this:

Taking public transport can be quite a stressful situation, especially when I am fumbling to extract my EZ-Link card out of the murky depths of my bag. However, with the increase in e-payment options, more and more people scanning their phones and smartwatches as a form of payment!

If you’re wondering what are the different ways you can pay for your MRT/Bus rides, here are some options you can consider!

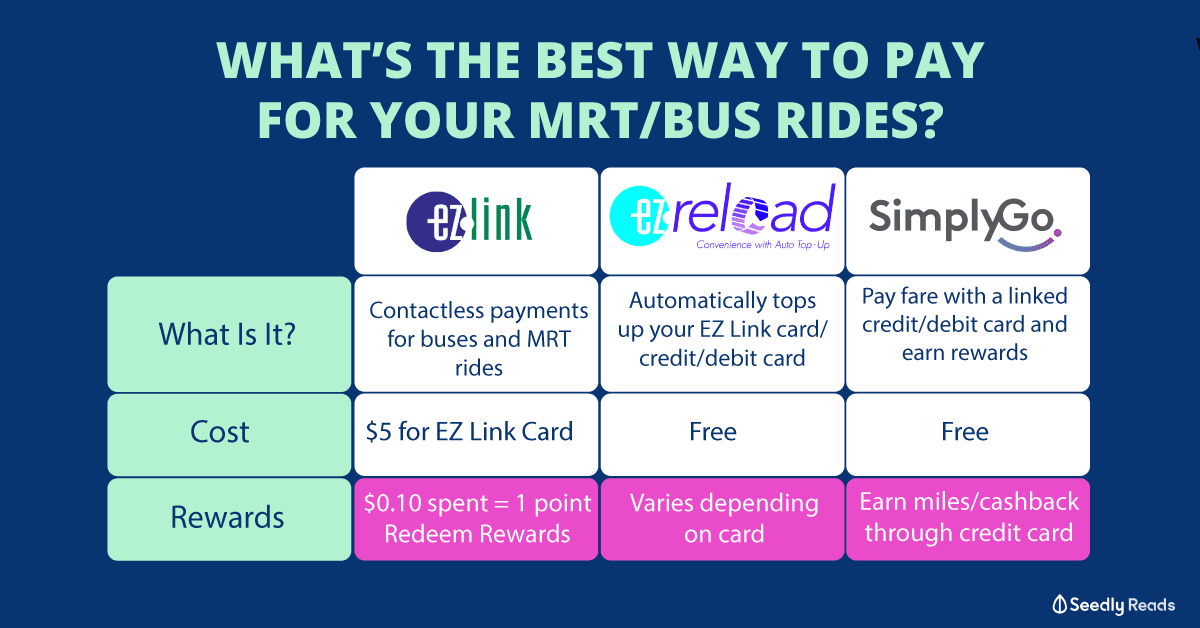

TL;DR: What’s The Best Way To Pay For Your MRT/Bus Rides?

| Ticketing Method | EZ-Link | SimplyGo |

|---|---|---|

| What Is It? | The usual EZ-Link card used on buses and MRTs | 1) A service where you can link your debit/credit card with the SimplyGo app, and pay for your transport with your credit/debit card You can earn credit card rewards such as cashback and miles along the way 2) Buy a SimplyGo EZ-Link card (formerly known as Account-based EZ-Link cards) |

| Cost | EZ-Link card: $10 ($5 non-refundable deposit per card) EZ-Link charm: Varies | NIL |

| Rewards | 1 point per 10 cents spent via EZ-Link | Varies, depending on the credit or debit card used |

| Has Auto Top-up? | Yes, need to be linked to an account-based card | Yes, need to be linked to an account-based card |

Advantages and Disadvantages of EZ-Link, EZ-Reload, and SimplyGo

| Advantages | Disadvantages | |

|---|---|---|

| EZ-Link | Better segregate your money into different cards. Good for those who may risk losing EZ-Link cards. You can get cards / EZ Link charms with unique prints | Additional $5 or more for purchase of EZ Link card or charms. No auto-top up. You will have to face the hassle of topping up your card every time. |

| EZ Reload | Earn EZ Link points to change for rewards, where you will get 1 point for every $0.10 spent. You can link your DBS/POSB Bank accounts via GIRO More payment options compared to SimplyGo | EZ-Link Rewards for EZ Link and EZ Reload are not as attractive as SimplyGo- no cashbacks to be earned. Application procedure is longer |

| Simply Go | Depending on the cards linked, you can get 5% cashback or up to 4.4 miles per $1 spent. Convenience of paying through your mobile phone/ smart watch. You can view travel history and expenditure on the go. | While you enjoy the additional perks when paying with your credit card, late payment of fees may result in high charges that may cancel out, or even outweigh existing perks and rewards. More convenient application procedure |

What is EZ-Link, EZ-Reload, and SimplyGo?

For those who don’t know what these are, EZ-Link, EZ-Reload, and SimplyGo are different ways of contactless payments that you can use while paying for your public transport. Both EZ-Reload and SimplyGo offers auto top-up functions, allowing you to avoid the hassle of topping up your cards!

EZ-Link

When I was in school I was a loyal user of the EZ Link card. So often do I face the hassle of manually topping up my EZ Link card, but being the clumsy, rather-absent-minded student that I was, this was the best choice when faced with the risk of losing my EZ-Link card.

While most people are familiar with the EZ-Link card, many do not know that you can earn points and rewards from it! You can refer to the different types of rewards you can redeem via your EZ-Link card below!

EZ-Reload

EZ-Reload is a service provided by EZ-Link that automatically top-ups your EZ-Link / debit or credit card with your desired amount, whenever your balance is zero.

To do this, you can apply to link your debit or credit card through the EZ-Link app (Mastercard and Visa only) or website (for AMEX cards). You can also link your EZ-Link card to a DBS /POSB bank account using GIRO via one of the AXS machines available island-wide.

SimplyGo

To put it simply, you can now use your contactless bank card or mobile payment (eg. Apple Pay, Fitbit Pay, Google Pay, Samsung Pay) to pay for your commute. Yep, say goodbye to your EZ-link card as well as the need for upfront top-ups.

Currently, ALL Mastercard and Visa bank contactless bank cards are accepted. But you’re probably wondering, “Which card should I use and got promo not?”

We’ve got a list for you!

Rewards: EZ-Link & EZ-Reload VS SimplyGo

EZ-Link Rewards

Did you know, you can earn 1 reward point for every $0.10 spent on all your EZ-Link transactions? This includes public transport rides, retail/vending machine purchases, or ERP/ carpark payments.

Do note that these reward points are mainly awarded from transactions. Simply topping up your card will not give you additional points.

By accumulating points, you will be able to redeem it for rewards. Here’s a non-exhaustive list on the different rewards offered on EZ-Link Rewards:

| Merchant | EZ Link Rewards | Points to Redeem (1 Point = $0.10 spent ) |

|---|---|---|

| FWD | 30% off Travel Insurance | 20 |

| Starbucks / Foodpanda | 50% off Starbucks for new Foodpanda users | 100 |

| Foodpanda/ Gongcha | $5 off Gong Cha for new Foodpanda users. | 100 |

| Foodpanda | $8 off first order with Foodpanda. Minimum spend $15. | 100 |

| Adventure Cove | $5 off admission ticket | 150 |

| Super Park | $5 off regular day entry | 150 |

| My Art Space | Intro Art Workshop at $30 | 350 |

| River Safari | $7 off admission ticket with 2 boat rides. | 350 |

| Miam Miam | Free Dessert of the Day | 500 |

| Singapore Cable Car | 25% off Cable Car Sky Pass | 500 |

| Bowlfull | Free cookie/beverage | 500 |

| Old Chang Kee | Free Curry Puff | 800 |

| Cafe de Paris | $10 off min $50 spent | 900 |

| CATCHPLAY+ | Unlimited Movies, $9.90 for first 3 months of subscription. | 1000 |

| Foodpanda | $5 off | 2000 |

| Golden Village | 1 Pair of GV Movie Vouchers | 11000 |

SimplyGo Rewards

For SimplyGo, the rewards you reap are greatly dependent on the type of credit card you use. As with credit card rewards, they are much more attractive as you can make use of your public transport fare to hit minimum spending, get cash rebates, as well as clock miles from it.

| Credit Card | Reward | Remarks |

|---|---|---|

| DBS Live Fresh Card | 5% cashback | Min. monthly spend $600 |

| DBS Altitude Card | 1.2 miles per $1 | - |

| POSB Everyday Card | 15% cashback on SimplyGo transactions | - |

| Maybank Family & Friends Card | 5% or 8% cashback | Min. monthly spend of $500 or $800 |

| Maybank Platinum Visa Card | 3.33% cashback $100/quarter | Min monthly spend of $300, $1,000/month |

| Maybank Barcelona FC | 1.6% cashback | - |

| HSBC Advance Card | 1.5% cashback 2.5% cashback | Spend $2,000 of below every month. Spend $2,000 or more every month |

| Standard Chartered Spree Card | 2% cashback | - |

| Standard Chartered Unlimited Card | 1.5% cashback | - |

| UOB One Card | 3.33% cashback /quarter 5% cashback per quarter | With minimum monthly spend of $500/$1,000 and $2,000 respectively |

| UOB Lady’s Card | Earn 10x Points, equivalent to 4 miles per $1 spent | - |

| UOB PRVI Miles Card | 4.4 miles per $1 spent on bus/train rides via mobile contactless Otherwise, 1.4 miles per $1 spent | Capped to $80 worth of rides per month |

| UOB KrisFlyer Card | 3 miles/ $1 spent on transport card 1.2 miles per $1 spent (if conditions not met) | With min $500 spend on Singapore Airlines and related transactions per year. |

So…Which One Should I Choose?

Suffice to say, the monetary benefits of switching from EZ-Link to EZ-Reload or SimplyGo are not immediately obvious. For those with credit cards, linking your card with SimplyGo would make the most sense, as you can count your public transport transactions to hit your minimum spend, and accumulate cashback, rebates or miles along the way. Of course, each option has its potential advantages and disadvantages:

Advantages and Disadvantages of EZ-Link, EZ-Reload, and SimplyGo

| Advantages | Disadvantages | |

|---|---|---|

| EZ-Link | Better segregate your money into different cards. Good for those who may risk losing EZ-Link cards. You can get cards / EZ Link charms with unique prints | Additional $5 or more for purchase of EZ Link card or charms. No auto-top up. You will have to face the hassle of topping up your card every time. |

| EZ Reload | Earn EZ Link points to change for rewards, where you will get 1 point for every $0.10 spent. You can link your DBS/POSB Bank accounts via GIRO More payment options compared to SimplyGo | EZ-Link Rewards for EZ Link and EZ Reload are not as attractive as SimplyGo- no cashbacks to be earned. Application procedure is longer |

| Simply Go | Depending on the cards linked, you can get 5% cashback or up to 4.4 miles per $1 spent. Convenience of paying through your mobile phone/ smart watch. You can view travel history and expenditure on the go. | While you enjoy the additional perks when paying with your credit card, late payment of fees may result in high charges that may cancel out, or even outweigh existing perks and rewards. More convenient application procedure |

What’s The Best Card To Use With SimplyGo?

If you’re looking for something that’s straightforward, POSB Everyday card gives you 15% cashback on SimplyGo transactions, which is very substantial considering that most cashback cards give you ~5% cashback.

Those with the DBS Live Fresh Card can also consider linking your transactions with SimplyGo, as a 5% cashback is pretty substantial to help hit the $600/month minimum spend.

For miles users, you can consider the UOB PRVI Miles card, which gives you 4.4 miles user if you spend on bus/train rides via the mobile contactless payment method.

Those whose phones are not compatible with SimplyGo’s contactless payment system, you can consider the UOB Krisflyer card or the UOB Lady’s cards, which gives you 3 miles/$1 spent and points equivalent to 4 miles/ $1 spent respectively. Do note that these cards do require a minimum spend from $500.

UOB Krisflyer card requires a minimum $500 spend on Singapore Airlines and related transactions per year, so if you are a frequent flyer, you can make use of these rewards.

Should I Get A Credit Card To ‘Save’ On Public Transport?

It’s never a good idea to get a credit card just to save on your public transport transactions. Rather, linking your credit card for public transport transactions may be a great idea if you already have an existing credit card that is compatible.

After all, there are other ways to save on your public transport expenses, such as tapping in before 7.45am to save you $0.50 off your MRT fares, or purchasing a concession card.

Advertisement