Is Singapore Heading Towards a Recession?

The short answer to the question will be a possible yes.

How do we know?

Well, because he said so…

Prime Minister Lee Hsien Loong urged Singaporeans to brace for impact, given that post-Covid recovery is clouded and recession could hit us within the next 2 years.

On top of that, there are signs of it.

The daily chart of the S&P500 looks very similar to the chart from the 2008 crash. For context, the S&P500 fell 56% from its high over a course of about 510 days.

On top of that, we have the Russia-Ukraine war, China’s strict zero-covid regime, UST stablecoin losing its peg etc.

Now, even the price of chicken is getting expensive.

The Ultimate Compilation of Past Recessions

With all that is happening right now, we thought we take a swipe at past recessions to make a sense of Singapore’s report card when it comes to dealing with economic challenges.

| Recession | Date | Duration | GDP Decline (Singapore) | GDP Decline (U.S.) | Peak Unemployment Rate (U.S.) |

|---|---|---|---|---|---|

| The Roosevelt Recession | May 1937 - June 1938 | 13 months | - | 10% | 20% |

| The Union Recession | February 1945 - October 1945 | 8 months | - | 10.9% | 5.2% |

| The Post-War Recession | November 1948 - October 1949 | 11 months | - | 1.7% | 5.7% |

| The Post-Korean War Recession | July 1953 - May 1954 | 10 months | - | 2.7% | 5.9% |

| The Eisenhower Recession | August 1957 - April 1958 | 8 months | - | 3.7% | 7.4% |

| The Rolling Adjustment Recession | April 1960 - February 1961 | 10 months | 3.1% | 1.6% | 6.9% |

| The Nixon Recession | December 1969 - November 1970 | 11 months | Positive GDP growth: 13.9% | 0.8% | 5.5% |

| The Oil Crisis Recession | November 1973 - March 1975 | 16 months | Positive GDP growth: 4% | 3.6% | 8.8% |

| The Energy Crisis Recession | January 1980 - July 1980 | 6 months | Positive GDP growth: 10.1% | 1.1% | 7.8% |

| 1985 Economic Crisis (Singapore's first post-independence recession) | March 1985 - 1986 | Not confirmed since Singapore increased growth by 1987 | 0.6% | -1.8% (year 1982) Singapore experienced it later | 10.8% (year 1982) |

| The Iran Crisis Recession | July 1981 - November 1982 | 16 months | Positive GDP growth: 7.1% | 3.6% | 10.8% |

| The Gulf War Recession | July 1990 - March 1991 | 8 months | Positive GDP growth: 6.7% | 1.5% | 6.8% |

| The Asian Financial Crisis | July 1997 - December 1998 | 18 months | 2.2% | Positive GDP growth: 4.5% | 5.0% |

| The dot-com bust/ 9/11 Recession | March 2001 - November 2001 | 8 months | 1.1% | 0.3% | 5.5% |

| 2008 Global Financial Crisis | December 2007 - June 2009 | 18 months | Positive GDP growth: 0.1 | 4.3% | 10.0% |

| The COVID-19 Recession | February 2020 - Ongoing | Ongoing | 5.4% | ~9.1% | 13.0% (May 2020) |

We put in the unemployment rate and GDP decline of U.S., just to give a bit more context on the amplitude of these recessions.

For context, Singapore gained independence in the year 1965 and has experienced good growth ever since. The year 1985 was the first time Singapore experienced her first post-independence recession.

In case you are wondering, Singapore’s GDP growth was at 4% in the year 2003, despite the SARS outbreak.

Well done, Singapore!

How Have Past Recessions Impacted Singapore’s Unemployment Rate?

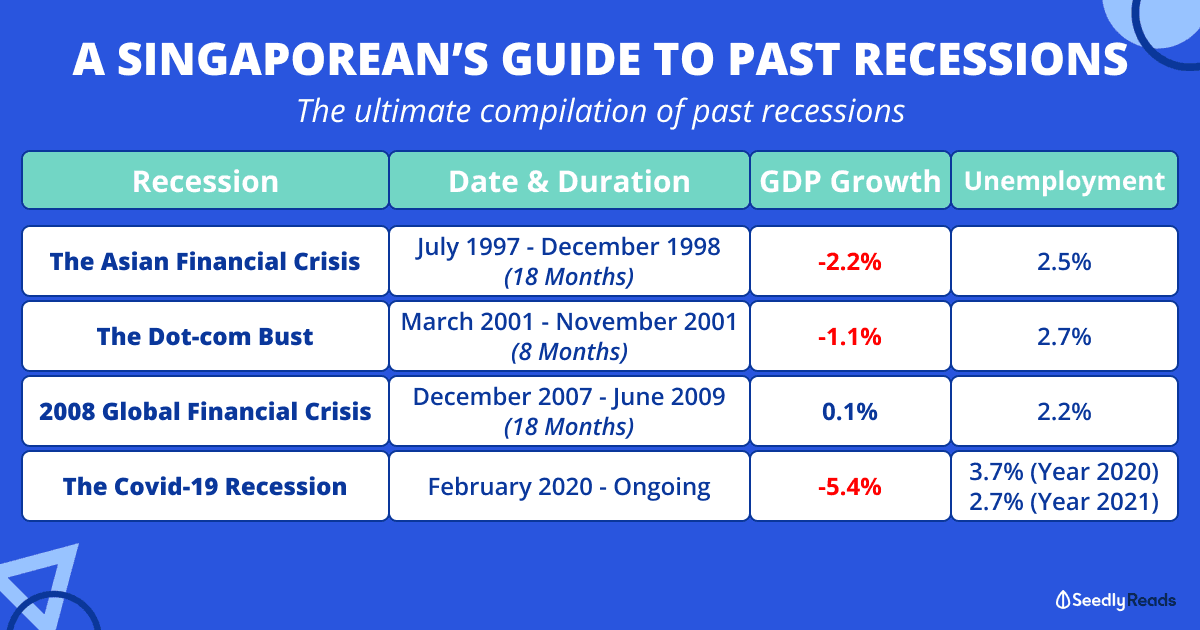

Closer to our hearts, we also look at how past financial crises have impacted our unemployment rate.

| Recession | Date | Singapore's Unemployment Rate |

|---|---|---|

| The Asian Financial Crisis | July 1997 - December 1998 | 2.5% |

| The 9/11 Recession | March 2001 - November 2001 | 2.7% |

| 2008 Global Financial Crisis | December 2007 - June 2009 | 2.2% |

| The COVID-19 Recession | February 2020 - Ongoing | 3.0% (Year 2020) 2.7% (Year 2021) |

Singapore generally managed to maintain quite a healthy unemployment rate throughout these crises. For context, many considered the natural unemployment rate to be at 4% to 5%. The natural rate of unemployment, also known as the minimum unemployment rate, is defined as the number of people who are unemployed due to labour movements or voluntary unemployment.

How Did Singapore Managed Past Recessions?

To better understand how Singapore managed to produce a relatively good report card over the past recessions, we look into what are some of the policies that were implemented.

| Year | How did Singapore managed it? |

|---|---|

| 1985 Economic Crisis | Reduced employers' Central Provident Fund (CPF) contribution by 15% Enforced wage restraint for public sector. Reduce personal income tax rates Incentives for investments for firms Cutting corporate tax from 40% to 30% |

| 1997 Asian Financial Crisis | Reduced employers' Central Provident Fund (CPF) contribution Wage cuts Rebates on property and corporate tax Decrease government fees and charges Funding of skills training and enterprise development Rebates on HDB charges and rentals Suspending government land sales Increase government spending on education and infrastructure |

| 2008 Global Financial Crisis | Expanding public sector recruitment Workfare Income Supplement Programme to encourage skills upgrading Tax concessions for businesses Direct assistance for households Increase support for charitable organisations and community Increased targeted help for vulnerable groups Upgrading education and healthcare infrastructure Enhanced sustainable development programmes Rejuvenating public housing estates |

Source: lkyspp.nus.edu.sg

Surviving Recession

While Singaporeans have been experiencing a cushioned impact from the economic issues, it is important that we realised that we are treading uncharted waters. Singapore generally has been able to weave through past recessions like a boss, and hopefully, we will be able to do so moving forward.

While past experiences can equip us with the necessary skills to tide through difficult times, every recession is different. In short, whatever got us here may not be the way forward.

If you have yet to check out our guide to surviving a recession, you can do so.

Adding on, I would personally look to invest in safer investments with guaranteed returns and are highly liquid. Singapore Savings Bonds can be one of such instruments.

In times of recession, we need to be able to access our rainy day funds almost immediately.

Given that cash is king, you might want to consider saving up more as we go through the challenges ahead.

Advertisement