Best Broker for US Stocks in Singapore and How to Invest in US Stocks

Sudhan P

Sudhan P●

Do you wish to invest in U.S. stocks but don’t know how to?

Have you heard about how U.S. stocks can offer higher growth potential than Singapore-listed ones?

If you would like to invest in the U.S. market, let us break down the nuances in this one-stop guide to investing in U.S. shares!

TL;DR: Best Broker for US Stocks in Singapore — How to Buy US Stocks in Singapore

Before we look at buying U.S. stocks, let’s explore the following topics (click to jump):

- Why U.S. Stocks?

- What Are the Different Indices Available?

- What Time Does the US Market Open and Close?

- Do I Have to Buy 100 Shares at a Time In the US Too?

- Best Brokerages for Investing in US Stocks

- Are There Taxes Involved?

- How to Research US Stocks?

- Forex Risks

Note that the information is accurate as of 5 July 2023. Prices and promotions are subject to change without prior notice.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer owns shares in Starbucks.

Why U.S. Stocks?

Just imagine the vast geographical reach of U.S. companies against Singapore companies.

A quick Google search shows Singapore’s landmass is 721.5 km² while that of the US is 9.834 million km².

As for population size, Singapore has 5.6 million people, while the U.S. has roughly 60 times more people at 334.5 million, the third most populous country globally, behind China and India.

Those statistics show just how much growth companies in the U.S. have.

A company starting out in a small area in the U.S. can expand into various cities in the state and then to multiple states in the country. There’s just so much growth before the company is “forced” to expand overseas.

In comparison, a Singapore company can probably expand from one town to another and hit saturation point quickly in our country.

And, of course, most of us know that the U.S. is still the world’s largest economy with big names such as Meta (Facebook), Tesla, Coca-Cola, Apple, Amazon and so on.

As a case in point, let’s explore the stocks of four different food and beverage companies — two from Singapore and two from the U.S.

Those companies are Old Chang Kee (SGX: 5ML) and Jumbo Group (SGX: 42R) vs Chipotle Mexican Grill (NYSE: CMG) and Starbucks (NASDAQ: SBUX).

Over the past five years, the U.S.-originated companies of Chipotle and Starbucks have grown tremendously compared to the local companies of Old Chang Kee and Jumbo.

Although there are many differences between the companies that drive stock returns, with the vast difference in performance, we can safely attribute geographical reach to be one key difference.

Having said that, U.S. stocks do not fit all investor profiles.

If you are looking for income, Singapore stocks could be the better choice.

We are not taxed on dividends here compared to buying U.S. dividend stocks (more on taxes later).

There are also other risks involved with investing in U.S. stocks, such as currency risk, which investors should be aware of.

How to Buy US ETFs in Singapore: What Are the Different Indices Available?

As a Singapore investor, you might be familiar with our local stock market benchmark, the Straits Times Index (STI).

Similarly, in the U.S., there are three major indices, and they are:

The S&P 500 index, as the name might suggest, includes 500 of the top US companies in leading industries.

The Dow Jones Industrial Average is a stock market index tracking 30 large companies listed on two major U.S. stock exchanges, of New York Stock Exchange (NYSE) and the Nasdaq.

The Nasdaq Composite Index consists of over 2,500 companies listed on the Nasdaq stock exchange. Many of those companies are involved in the technology sector.

What Time Does the US Market Open and Close? NASDAQ Opening Time Singapore and More

The New York Stock Exchange (NYSE) and the Nasdaq have the same market hours.

They open at 9.30am/10.30am Eastern Time (ET) and close at 4pm/5pm ET (depending on daylight savings) from Monday to Friday.

This is 9.30pm/10.30pm to 4am/5am in local Singapore Time (SGT).

The exception is during stock market holidays, of course.

Trading can occur outside of normal stock market hours as well.

There is “pre-market” trading, which is from 4am/5am to 9.30am/10.30am ET and “after-hours” sessions, which typically span from 4pm/5pm to 8pm/9pm ET (depending on daylight savings).

This is 4pm/5pm to 9.30pm/10,30pm and 4am/5am to 8am/9am SGT.

But do note that trading outside of the normal hours means you have to deal with less liquidity, wider spreads, more competition from institutional investors, and higher volatility.

So, to keep things simple, retail investors should focus on buying and selling shares during normal stock market hours.

Do I Have to Buy 100 Shares at a Time In the US Too?

For U.S.-listed stocks, we can just buy 1 share.

This is unlike Singapore stocks, where we have to buy 100 shares at a go.

The low barrier to U.S. shares also allows us to position and size our portfolio better.

And manage our risk exposure to a particular stock better.

Let’s say you are starting out with a S$5,000 portfolio.

If you were to buy 1 share of Meta Platfroms Inc. (NASDAQ: META), you would spend around US$286 or ~S$386 without commission.

That equates to 7.7% of the portfolio.

However, if you were to invest in DBS Group (SGX: D05) at a share price of S$31.50 per share, you would need to fork out S$3,150, excluding fees, to buy 1 lot or 100 shares of the bank.

The outlay translates to 63% of your portfolio size.

Therefore, we may end up exposing our portfolio to higher risk than we would like.

Best Brokerages for Investing in US Stocks / Best Platform to Buy US Stocks

To buy U.S. shares, you must open a brokerage account that allows access to the U.S. market.

To choose the best brokers (on top of low commissions), Seedly’s online brokerage reviews are where it’s at!

Over there, you can sort according to “Most Popular”, “Most Reviewed”, and “Highest Rating”.

Once you have chosen the broker for you, you can simply head over to the broker’s site to start opening an account.

The brokerages can be generally broken down into traditional Singapore brokers and overseas brokers.

Let’s look at each category here (for online trades only).

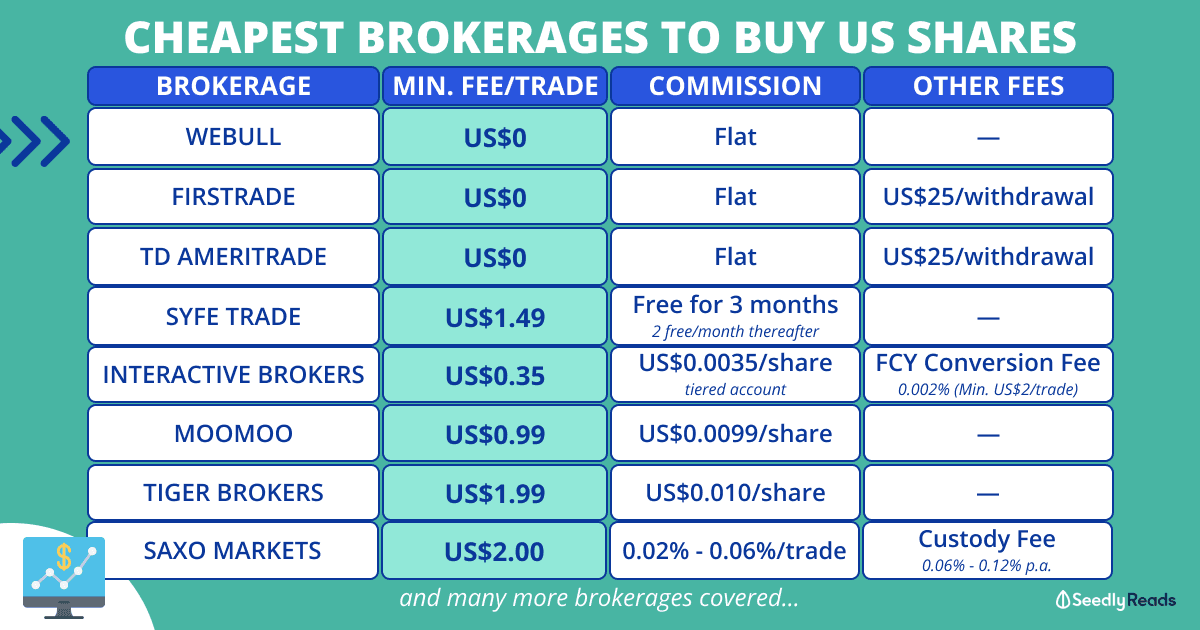

Cheapest Trading Platform Singapore for US Stocks and Types of Fees

| Brokerage | Min. Fees/Trade (US$) | Trading Commissions/Trade | Custodian Fees |

|---|---|---|---|

| Cash Funded Trading Accounts | |||

| Syfe Trade | Introductory Offer: Unlimited free trades for the first three months After three months 2 free trades / month, US$1.49 / trade thereafter | Flat | No inactivity, withdrawal or platform fees |

| SAXO Markets | to | 0.02% (Diamond) to 0.06% (Bronze) | 0.12% p.a. (Classic + Platinum) to 0.06% (VIP) |

| OCBC Online Equities | to 20.00 (Post-trade settlement) | 0.12% (Upfront payment) to 0.15% (Post-trade settlement) | S$2 per counter per month (subject to prevailing GST if applicable) Invoiced quarterly in arrears up to a maximum of S$200 per quarter (or a maximum of S$67 per month) (subject to prevailing GST if applicable) Custody fee will be waived: 1. For the month if you execute at least 2 trades in that month. 2. For the quarter if you execute at least 6 trades in that quarter. 3. If the foreign security is delisted at the point when we are computing the fees |

| ProsperUs (by CGS-CIMB) | 5.00 | Flat | No custodian fee |

| Phillip Securities (POEMS Cash Plus) | 3.88 (SG$0 - S$29,999 asset value) 2.88 (SG$30,000 - S$249,999 asset value) 1.88 (>S$250,000 asset value) | Flat | Waived until 31 Dec 2023 Charges thereafter: S$2 + GST per counter/month (capped at S$150/quarter) or Waived with minimum 2 trades done per month or 6 trades per quarter or minimum S$132 brokerage per quarter for the Account |

| FSMOne | 8.80 | 0.08% | No custodian fee |

| Maybank Kim Eng Securities (Pre-funded) | 10.00 | 0.12% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

| Standard Chartered | 10.00 + GST (Personal Banking Clients) 0.00 (Priority Banking Clients) | 0.25% (Personal Banking Clients) 0.20% (Priority Banking Clients) | No custodian fee |

| DBS Vickers (Cash Upfront) | 19.44 (Cash upfront rates applicable to Buy trades and Multi-currency Accounts only) | 0.15% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

| CGS-CIMB Securities iTrade (Cash Upfront Trading) | 18.00 | 0.18% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter(end Mar, Jun Sep, Dec) Duration of a suspended Counter |

| UOB Kay Hian (UTRADE Edge) | 13.00 | 0.12% | None stated for US equities |

| Basic Trading Accounts | |||

| CGS-CIMB Securities | 20.00 (US$20 or 0.30% of trade, whichever is greater) | 0.30% | S$2 + GST per counter/month (capped at S$150/quarter) |

| HSBC Securities Trading | 10.80 | 0.15% + GST | No custodian fee |

| KGI Securities | 20.00 | 0.30% | None stated |

| Lim & Tan Securities | 20.00 | 0.30% | S$2 + GST per counter/month (capped at S$150/quarter) + GST or 0.0025% pa of market value of shares whichever is applicable Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

| Maybank Kim Eng Securities | 20.00 | 0.30% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

| OCBC Securities (Basic Trading Account) | 20.00 | 0.30% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

| Phillip Securities (Cash Management) | 20.00 | 0.30% | Waiver condition is 2 trades per month or 6 trades per quarter or minimum SGD132 brokerage per quarter. Otherwise. SGD2.00 per counter per month (subject to max SGD150.00 per quarter) subjected to prevailing GST is chargeable. |

| UOB Kay Hian | 20.00 | 0.30% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

| DBS Vickers | 27.00 | 0.18% | S$2 + GST per counter/month (capped at S$150/quarter) Custody Fee Waiver: At least 2 Trades per month or 6 trades per quarter |

(Note: Custodian fees are waived if certain conditions are met. Typically, the fees will be waived if you trade at least two times per account per month or at least six times per account per quarter.)

*An annual custody fee applies for accounts with Stocks, ETFs/ETCs or Bond positions. The custody fee will be calculated daily using the end-of-day values and charged on a monthly basis. Singapore Residents and Singapore Incorporated Entities are not charged a custody fee for accessing SGX stocks and ETFs.

For this category, Syfe Trade is the cheapest option as new users get free trades for the first three months and two free trades a month and $1.49 trades for the third trade onwards thereafter. The brokerage also offers fractional trading that allows investors to buy into the world’s biggest companies starting with as little as US$1, regardless of the share price.

Not to mention that you can own a portfolio of stocks or ETFs for a fraction of the usual cost. Pretty cool, right?

US Brokerages and Overseas Brokers and Types of Fees

Brokerage Minimum Fees (US$) Per Order Trading Commissions Additional Notes

Firstrade 0.00 Flat US$25 per withdrawal

Interactive Brokers

(Tiered Account)0.35

(Base tier: US$300,000 in monthly shares volume)US$0.0035/share, up to a maximum of 1% of trade value N/A

(Inactivity fee removed as of 1 July 2021)

Moomoo

(Powered by Futu)0.99

[Commission fee (0.00) + platform fee (0.99)]Flat US$0 platform fee till 12 Apr 2023 for existing clients, and US$0 platform fee for one year after account opening for new clients, US$0.99 thereafter

TD Ameritrade 0.00 Flat US$25 per withdrawal [Outgoing domestic (U.S.) or international withdrawals]

Tiger Brokers

Apply Now1.99

[Commission fee (0.99) + platform fee (1.00)]US$0.010/share

[Commission fee (0.005) + platform fee (0.005)], up to a maximum of 1% of trade valueRefer a friend to get lifetime commission free trades

uSmart 1.50

[Commission fee (0.50) + platform fee (1.00)]US$0.008/share

[Commission fee (0.003) + platform fee (0.005)], up to a maximum of 1% of trade valueN/A

Webull

Apply Now0.00 Flat N/A

On top of brokerage and custodian fees involved, investors will need to take note of other fees such as Securities and Exchange Commission (SEC) fees and dividend handling charges (if any).

(Note: Firstrade is not regulated by the Monetary Authority of Singapore (MAS). We have added it here to provide a comprehensive comparison for readers. We would recommend investors trade through MAS-regulated brokers only.)

As for the overseas brokerages, I would look at TD Ameritrade because you can’t beat free. But note the hefty US$25 (S$33.80) withdrawal fee.

Otherwise, your next best option would be Interactive Brokers Singapore’s tiered account with its low fees of US$0.0035 per share (min. US$0.35) and one free withdrawal every month (S$15 per withdrawal thereafter).

The best part? You can buy fractional shares on Interactive Brokers as well!

For those who want to have an in-depth brokerage comparison between Interactive Brokers (tiered account), Moomoo, and Tiger Brokers, here’s something for you:

Pro tip: Don’t be fooled by cheaper commissions, as brokerages also earn money from you via FX spread, as seen here:

Buy US Stocks in Singapore Tax

Yes, there are taxes involved when investing in U.S. shares as a Singaporean.

Investors need to take note of withholding tax for dividends, currency conversion fees, and U.S. estate tax.

How to Find the Best US Stocks to Buy Now

Researching U.S. stocks to buy is made easy with stock screeners.

StocksCafe, Investing.com, MSN Money and Yahoo Finance provide screening of US-listed stocks.

From there, you can understand more about the companies by analysing their economic moats and financial statements, among other criteria.

Forex Risks

Unless you’re retiring in a country that uses the U.S. dollar, there are also forex risks that should be taken into consideration. If you’re curious to know what other Seedly members have to say, check out this thread to get a better idea.

Related Articles

- Cheapest Online Brokerages to Invest in US Stocks/ETFs – IBKR vs Syfe Trade vs Moomoo & More

- AI Is The Next Big Thing. Here Are Some Of The Companies That Will Benefit From The AI Boom

- Cheapest Online Brokerages in Singapore 2023 Comparison: IBKR vs moomoo vs Tiger Brokers vs uSmart

- Budget 2023 Singapore Summary

Advertisement