Cheapest Online Brokerages in Singapore 2024 Comparison: IBKR vs moomoo vs Tiger Brokers vs uSmart vs CMC Invest

●

When it comes to investing, I think most of us are in it to maximise our profits, regardless of the amount invested or the time frame we have for investing. These profits come in the form of portfolio returns after fees, so it would make sense to keep your fees as low as possible so you can keep significantly more of your portfolio’s return.

Sure, there’s a case for having your portfolio managed professionally with the right financial advisor or Robo-advisor worth the fees.

But for most of us who are embarking on the do-it-yourself (DIY) path to investing, finding the brokerage with the lowest fees for our needs should be near the top of our list of priorities.

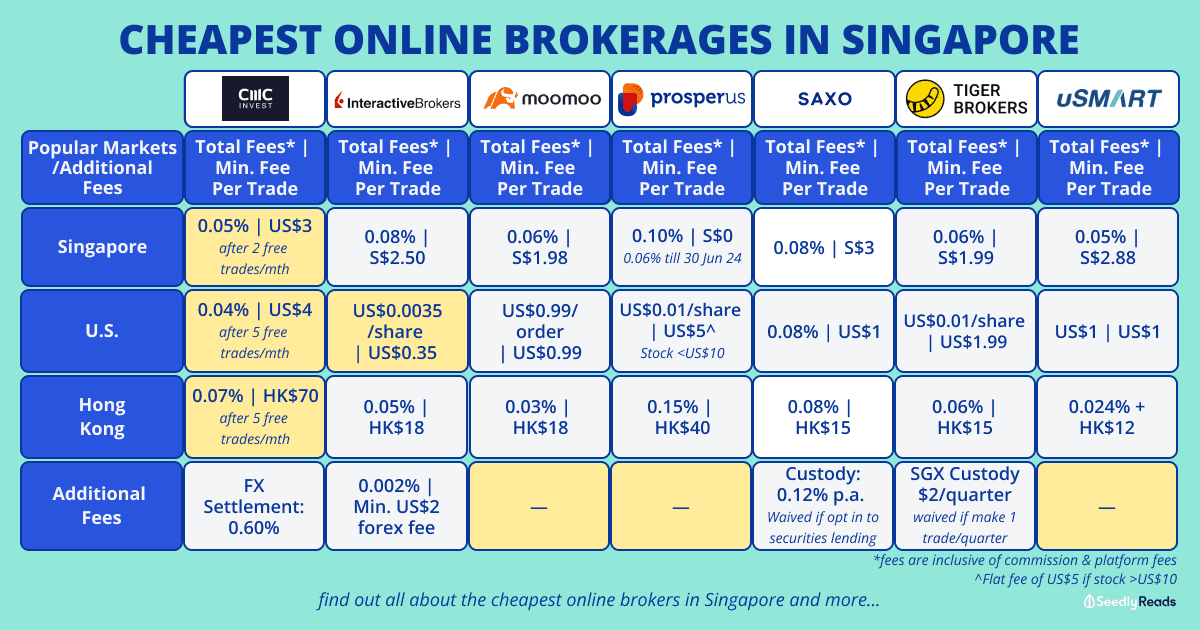

With that in mind, here is a comparison of the cheapest online brokerages in Singapore.

TL;DR: Best Online Brokerages in Singapore (2024)

| Markets | Singapore | U.S. | Hong Kong | U.K. | Australian Stocks | China (A Shares) | Additional Fees |

|---|---|---|---|---|---|---|---|

| CMC Invest Gold Fees | Min. Commission Per Trade | 0.05% | S$3 after 2 free trades/month | 0.04% | US$4 after 5 free trades/month | 0.07% | HK$70 after 5 free trades/month | 0.06% | £6 after 5 free trades/month | — | — | FX Settlement Fee: 0.60% |

| IBKR (Tiered) Fees^ | Min. Commission Per Trade Apply Now | 0.08% | S$2.50 (Including GST) | US$0.0035/share | US$0.35 | 0.05% | HK$18 | 0.05% | £1 | 0.08% | AU$5 | — | Currency Conversion Fee: 0.002% | US$2 per trade (E.g. converting from SGD to USD) If broker client account commissions do not exceed total required commission, a monthly US$1 inactivity fee will be applied to accounts having a Net Liquidation Value of less than US$1,000 on a prorated basis No fee will be charged if aggregate broker client account commission exceeds total required commission (US$1 multiplied by the number of broker client accounts) |

| moomoo Singapore Fees | Min Commission Per Trade Apply Now | 0.06% | S$1.98 (Commission + Platform fees) Commission: 0.03% Transaction amount, min. S$0.99/order + waived for 1 year after opening account Platform Fees: 0.03% Transaction amount, min. S$0.99 / order | US$0.99/order (Commission + Platform fees) Commission: US$0 (applicable to clients of moomoo SG on US stock trading only) Platform Fees: US$0.99/order (applicable to clients of moomoo SG on US stock trading only) Fractional Shares: Trade Size <1 Share, Commission waived, Platform Fees at 0.99% * Transaction amount, capped at $0.99 / Order. Trade Size ≥1 Shares, Commission and Platform Fees are charged based on the Standard US stock trading fees | 0.03% | HK$18 (Commission + Platform fees) Commission: 0.03%* of the investment amount or HK$3 which ever is higher Platform Fees: HK$15 / Order | — | — | 0.03% | CN¥18 (Commission + Platform fees) Commission: 0.03%* of the investment amount min. CN¥3/order Platform Fees: CN¥15/order | — |

| PropsperUs Rookie Fees | Min. Commission Per Trade | 0.06% | $0 (Till 30 June 2024) | Stock Price Stock Price >US$10: US$5/trade | 0.15% | min. HK$40 | 0.10% | £7 | 0.10% | AU$8 | 0.15% | CN¥40 | — |

| Saxo Classic Fees | Min. Commission Per Trade | 0.08% | S$3 | 0.08% | US$1 | 0.08% | HK$15 | 0.08% | £3 | 0.08% | AU$3 | 0.08% | CN15 | Custody Fee: 0.12% p.a. (waived if opted into securities lending) FX Conversion Spreads: 0.25% |

| Tiger Brokers Fees | Min. Commission Per Trade Apply Now | 0.06% | S$1.99 (Commission + Platform fees) Commission: 0.03% * Transaction amount, min. S$0.99/order + waived for 365 days after opening account Platform Fees: 0.03% * Transaction amount, min. S$1 / order | US$0.01/share | US$1.99 (Commission + Platform fees) Commission: US$0.005/share, min. US$0.99/order + waived for 180 days after account opening Platform Fees: US$0.005 / share, min. US$1 / order Charges for Fractional Shares Trading: Trade <1 share — Commission waived & Platform Fee is 1% of Trade Value, capped at US$1 Trade ≥1 share — Commission and Platform Fee are charged based on the Standard US Stocks & ETFs trading fees | 0.06% | HK$15 (Commission + Platform fees) Commission: 0.03%* Transaction amount, min. HK$7/order + waived for 365 days after opening account Platform Fees: 0.03%* Transaction amount, HK$8/order | — | 0.10% | AU$8 (Commission + Platform fees) Commission: 0.03%* Transaction amount, min. AU$2 / order Platform Fees: 0.07%* Transaction amount, AU$6 / order | 0.06% | CN¥15 (Commission + Platform fees) Commission: 0.03%* Transaction amount, min. CN¥7 / order + waived for 365 days after opening account Platform Fees: 0.03%* Transaction amount, min. CN¥8 / order | SGX Custody Fees: $2 for accounts with no trading transactions in the quarter |

| uSmart Trader Fees | Min. Commission Per Trade | 0.05% | S$2.88 (Commission + Platform fees) Commission: 0.02% of Transaction Amount Min. S$1 per Order Platform Fees: 0.03% of Transaction Amount Min. S$1.88 per Order | US$1 (Commission + Platform fees) Commission: $0 Platform Fees Stock price ≥ 40 USD: US$1 /Order (Fixed) Stock price<40 USD: US$0.005 / share Min. US$1 Per Order Max 0.50% of Transaction Amount | 0.024% + HK$12 (Commission + Platform fees) Commission: 0.024% of transaction amount Platform Fees: HK$12 | — | — | — | — |

^Tiered pricing. Interactive Brokers Singapore offers tiered pricing to lower rates even more with more volume. In cases where an exchange provides a rebate, the company will pass some or all of the savings directly back to you.Note: Goods and services tax (currently 9% as determined by the Inland Revenue Authority of Singapore), where applicable, will be separately applied to eligible services.

Broker Comparison Singapore: Click to Teleport

- Safety

- Pricing (Fees)

- Promos

- Trading Options and Features

- UI/UX and Customer Service

- Closing Thoughts

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before embarking on any investments or purchasing any investment products. Information is accurate as of 26 April 2024.

Online Brokerages Singapore Comparison Criteria

For starters, here is how we selected the brokerages for this comparison:

- Charges less ≤S$5 minimum fee per trade for the major stock markets that Singaporeans trade in (i.e. Singapore, U.S.)

- This has to be the standard fee charged and not the promotional price for long-term sustainability.

- Supports at least three major countries’ stock markets for a variety

- MAS regulated.

This narrows it down to six brokerages:

- CMC Invest (Singapore)

- Interactive Brokers (Singapore)

- Moomoo (Singapore)

- ProsperUs (Singapore)

- Saxo (Singapore)

- Tiger Brokers (Singapore)

- uSmart (Singapore)

Sorry, Syfe Trade, TD Ameritrade, Webull, and others.

As such, we will be comparing these brokerages based on six main factors:

- Safety

- Pricing & Markets Available

- Promotions

- Trading Options and Features

- UI/UX and Customer Service

Online Brokerages Account Singapore Safety

Arguably, this should be the number one factor when considering a brokerage.

After all, low fees are inconsequential if something happens to your investments.

Is CMC Invest Singapore Safe?

CMC Invest is the newest kid on the block, with their product set to be fully operational soon. You may be familiar with CMC Markets, the company behind CMC Invest, which was founded by Peter Cruddas back in 1989.

Fast forward to 2023, CMC Markets came up with CMC Invest, an initiative that forms part of a three-year strategic plan to expand the Group’s successful Invest platform, which endeavors to make trading accessible to all.

CMC Markets Singapore Invest Pte. Ltd. (trading name “CMC Invest”) is authorised and regulated by the Monetary Authority of Singapore (MAS) to deal in listed securities, ETFs, and exchange-traded-derivatives contracts.

The company also has a physical office at 9 Raffles Place, Republic Plaza Tower I, #30-02, Singapore 048619.

Is Interactive Brokers Singapore Safe?

Regarding safety, Interactive Brokers Singapore Pte. Ltd. (IBKR SG) is the most established brokerage on this list.

![]()

The Singapore branch of Interactive Brokers is part of Interactive Brokers Limited Liability Company (IBKR LLC): an American multinational brokerage firm that conducts its broker/dealer business in over 135 market destinations worldwide.

FYI: IBKR LLC and its affiliates are owned by the Ineractive Brokers Group LLC.

IBKR Singapore Security

IBKR LLC was actually established 44 years ago and currently has about US$10.6 billion in consolidated equity capital.

In terms of regulation, IB LLC is regulated by the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) the Commodity Futures Trading Commission (CFTC) and the regulations of other securities exchanges where IB LLC is a member.

In addition to the above-mentioned safeguards, Interactive Brokers has sent a clarification about the investor protections you enjoy in your Interactive Brokers Singapore account:

If you hold securities or commodities on non-Singaporean markets, those positions are held in clearinghouses, depositories or banks in those markets. For instance, US stocks are held with the US Depository Trust and Clearing Corporation and European stocks are generally held with Euronext, Euroclear and other Western European clearinghouses. Your fully paid for non-Singaporean securities are custodied through our US affiliate, Interactive Brokers LLC, and benefit from US SIPC coverage.

Interactive Brokers Singapore Pte Ltd custodies certain of your securities positions with its US affiliate, Interactive Brokers LLC (“IBLLC”), which is licensed by the US Securities & Exchange Commission and a member of the US Securities Investor Protection Corporation (“SIPC’). To the extent that your securities (or cash balances, to the extent they are acting as margin in support of a short stock or option position carried by IBLLC) are custodied at IBLLC, they are protected by SIPC for a maximum coverage of US$500,000 (with a cash sublimit of US$250,000) and under Interactive Brokers LLC’s excess SIPC policy with certain underwriters at Lloyd’s of London 1 for up to an additional US$30 million (with a cash sublimit of $900,000) subject to an aggregate limit of US$150 million. Futures and options on futures are not covered. This coverage provides protection against failure of a broker-dealer, not against loss of market value of securities. In the unlikely event it should ever become necessary to assert a claim in a SIPC insolvency proceeding as a result of a failure of IBLLC, Interactive Brokers Singapore Pte Ltd will make the claim on your behalf. This applies to positions held by Interactive Brokers Singapore Pte Ltd at IBLLC on behalf of its customers and does not apply to any accounts that customers at Interactive Brokers Singapore Pte Ltd open with IBLLC.

Cash in USD, EUR or other non-local currencies (anything other than SGD or CNH), are held in leading global banks outside of Singapore, including Standard Chartered, Barclays and JP Morgan Chase. SGD and CNH cash is held in Singapore banks.

So you can be sure that your money is kept safe and diversified.

Is moomoo Singapore Safe?

Next up, we have moomoo Singapore, which was started in 2018 by Moomoo Financial Pte. Ltd, a wholly-owned subsidiary of Futu Holdings Ltd.

For context, Futu Holdings was established in Hong Kong back in 2011.

The company is listed on the NASDAQ (NASDAQ: FUTU) and is backed by Chinese internet giant Tencent Holdings (SEHK: 700), renowned U.S. venture capitalist firm Sequoia Capital and Matrix Partners.

According to moomoo SG, previously known as Futu SG:

Securities products and services available via moomoo are offered by wholly-owned subsidiaries of Futu Holdings Ltd., including but not limited to Moomoo Financial Inc. and Moomoo Financial Singapore Pte. Ltd.

Moomoo Financial Inc. is also a broker-dealer regulated by the SEC, FINRA and CFTC

But for the Singapore entity Moomoo Financial Singapore Pte. Ltd., the brokerage is regulated by MAS as Moomoo Financial Singapore Pte. Ltd. and is a capital markets services licence holder (Licence No. CMS101000).

In addition to the above-mentioned safeguards, moomoo SG states that moomoo SG customers are covered by SIPC insurance for up to US$500,000 for their U.S. securities.

The company also has a physical office at 1 Raffles Quay (North Tower) #39-02, Singapore 048583.

Is PropserUs Safe?

ProsperUs emerged in 2019 as a response to Carol Fong, the Group CEO of CGS-CIMB, recognizing the need for the company to proactively innovate in the face of potential disruption.

With a historical legacy of over 40 years, CGS-CIMB, originally GK-Goh Securities since its inception in 1979, has evolved into a prominent regional financial services provider.

In light of the growing influence of FinTechs, Fong aimed to redefine CGS-CIMB’s business approach to resonate with the evolving preferences of the new generation of investors.

Formally introduced in November 2020, ProsperUs draws its name from deliberate wordplay, encapsulating the essence of fostering prosperity together. This aligns with our investment philosophy of establishing enduring and sustainable wealth, epitomized by the popular millennial acronym FIRE, standing for “Financial Independence, Retire Early.”

ProsperUs, which falls under CGS-CIMB Securities (Singapore) Pte. Ltd. is regulated by MAS, with a Capital Markets Services License to operate a legal brokerage business dealing in in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-The-Counter Derivatives Contracts and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading.

The company also has a physical office at 50 Raffles Place, #01-01, Singapore, Singapore, 048623.

Is Saxo Safe?

Saxo (Singapore) is the Singapore subsidiary of the Saxo Bank, a Danish investment bank specialising in online trading and investing. The bank was established in Copenhagen, Denmark, in 1992. By 1998, the bank pioneered one of Europe’s inaugural online trading platforms, furnishing both seasoned tools and uncomplicated entry to worldwide financial markets for aspiring investors.

Presently, the bank stands as a well-capitalized Danish (EU) bank boasting robust capital ratios, holding an investment-grade rating from S&P and earning the designation of a Systemically Important Financial Institution (SIFI). The banks is also trusted by over one million clients worldwide and manages a portfolio exceeding US$100 billion in client assets; Saxo has evolved into an internationally acclaimed investment firm catering to investors and traders with a serious commitment to their financial pursuits. Our clientele benefits from regulated and dependable access to a vast array of over 70,000 financial instruments through our industry-leading platforms.

While maintaining its headquarters in Denmark, the bank has expanded its global footprint, employing individuals from more than 72 nationalities across offices in 15 countries.

Saxo Captial Markets Pte. Ltd. (trading name “Saxo”) is authorised and regulated by the MAS with a Capital Markets and Services license to deal in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-The-Counter Derivatives Contracts and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading and is an Exempt Financial Advisor.

The company also has a physical office at 88 Market Street CapitaSpring #31-01. Singapore 048948.

SAXO Promotion

SAXO is running a promotion for new clients from now till 2 June!

The reward? $200 Takashimaya Shopping Vouchers (Current stackable promo remains)!

Is Tiger Brokers Singapore Safe?

Next, we have Tiger Brokers (Singapore).

The company was founded back in Jun 2014 and is backed by Interactive Brokers Group Inc (IBKR), Xiaomi Inc, the ZhenFund, and Wall Street investment guru Jim Rogers.

The company is steadily growing as it was recently listed on the NASDAQ exchange in March 2019 with the ticker symbol (NASDAQ: TIGR).

Tiger Brokers and subsidiaries hold 21 licenses/registrations in the USA, New Zealand, Australia, Hong Kong and Singapore.

It’s subsidiary Tiger Brokers (Singapore) Pte. Ltd (TBSL) runs the Tiger Trade platform in Singapore. You will be glad to know that the company is regulated by MAS, a capital markets services licensee (Reg. No. 201810449W), and is authorised to operate in Singapore.

As such, Tiger Brokers complies with section 104 of the Securities and Futures Act (“SFA”), where ‘Clients’ funds and investments are kept by a segregated bank account and custodian to ensure it does not commingle with other accounts.

Also, according to Tiger’s customer agreement:

All money, approved securities or other property received by TBSPL from you or from any other Person, including but not limited to, any Clearing house, on your behalf, shall be held by TBSPL as trustee or custodian, segregated from its assets and paid into a segregated bank account or a segregated debt securities account (collectively “Client’s Accounts), and all such monies, approved debt securities or other property so held may be commingled with other client’s funds and shall not form part of TBSPL’s assets for the purposes of insolvency or winding-up.

As such, your investments are held by different banks and prime brokers as custodians for the respective market products and asset classes:

- US Markets: Transactions are cleared by Trade Up Securities, Inc., and shares are held in custody by Depository Trust Company (“DTCC”).

- Hong Kong Markets: Transactions are cleared by Interactive Brokers (“IBKJR”) and custodised by Central Clearing and Settlement System (“CCASS”).

- Singapore Markets: Transactions are cleared by TBSPL, and shares are held in custody by the Central Depository in accordance with SGX Rules

- Mutual Funds and Unit Trusts: Assets are custodised by IFAST Financial Pte Ltd and AllFund, Singapore Branch.

Is uSmart Singapore Safe?

Last but not least, we have uSmart SG.

uSmart group was founded back in December 2018 and backed by the Chow Tai Fook group, one of the largest conglomerates based in Hong Kong.

It has headquarters not only in Singapore but in Hong Kong, China and New Zealand as well.

uSmart SG is regulated by MAS as uSMART Securities (Singapore) Pte. Ltd., and holds a capital markets services license.

According to uSmart, the Client’s moneys will be held by USPL on the client’s behalf in a trust account, either:

- With a bank that holds a licence under section 7 or 79 of the Banking Act 1970 of Singapore

- A merchant bank that holds a merchant bank licence or is treated as having been granted a merchant bank licence under the Banking Act 1970 of Singapore;

- A finance company licensed under the Finance Companies Act 1967 of Singapore; or

- A custodian outside Singapore which is licensed, registered or authorised to conduct banking business in the country or territory where the account is maintained.

- uSmart SG Custodians

- Singapore: iFAST Financial Pte. Ltd.

- Hong Kong: uSMART Securities Limited

- US: uSMART Securities Limited.

However, uSmart users should take note that:

The Client’s moneys and assets will be deposited into a trust account or custody account and commingled with the other clients of USPL. The Client’s assets will be deposited into a custody account and commingled with the other clients of USPL.

This means that there will be some additional risks compared to segregated accounts.

You can tell that these are not some fly-by-night brokerages as they are heavily regulated.

But, if I were to rank them, Interactive Brokers would be the safest, followed closely by Tiger Brokers, moomoo and uSmart.

Now, let’s move on to the pricing comparison of the more popular markets that Singaporeans trade in.

Brokerage Fees Comparison: What Is the Cheapest Stock Broker in Singapore?

We will compare the basic tier of these brokerages in terms of pricing.

| Markets | Singapore | U.S. | Hong Kong | U.K. | Australian Stocks | China (A Shares) | Additional Fees |

|---|---|---|---|---|---|---|---|

| CMC Invest Gold Fees | Min. Commission Per Trade | 0.05% | S$3 after 2 free trades/month | 0.04% | US$4 after 5 free trades/month | 0.07% | HK$70 after 5 free trades/month | 0.06% | £6 after 5 free trades/month | — | — | FX Settlement Fee: 0.60% |

| IBKR (Tiered) Fees^ | Min. Commission Per Trade Apply Now | 0.08% | S$2.50 (Including GST) | US$0.0035/share | US$0.35 | 0.05% | HK$18 | 0.05% | £1 | 0.08% | AU$5 | — | Currency Conversion Fee: 0.002% | US$2 per trade (E.g. converting from SGD to USD) If broker client account commissions do not exceed total required commission, a monthly US$1 inactivity fee will be applied to accounts having a Net Liquidation Value of less than US$1,000 on a prorated basis No fee will be charged if aggregate broker client account commission exceeds total required commission (US$1 multiplied by the number of broker client accounts) |

| moomoo Singapore Fees | Min Commission Per Trade Apply Now | 0.06% | S$1.98 (Commission + Platform fees) Commission: 0.03% Transaction amount, min. S$0.99/order + waived for 1 year after opening account Platform Fees: 0.03% Transaction amount, min. S$0.99 / order | US$0.99/order (Commission + Platform fees) Commission: US$0 (applicable to clients of moomoo SG on US stock trading only) Platform Fees: US$0.99/order (applicable to clients of moomoo SG on US stock trading only) Fractional Shares: Trade Size <1 Share, Commission waived, Platform Fees at 0.99% * Transaction amount, capped at $0.99 / Order. Trade Size ≥1 Shares, Commission and Platform Fees are charged based on the Standard US stock trading fees | 0.03% | HK$18 (Commission + Platform fees) Commission: 0.03%* of the investment amount or HK$3 which ever is higher Platform Fees: HK$15 / Order | — | — | 0.03% | CN¥18 (Commission + Platform fees) Commission: 0.03%* of the investment amount min. CN¥3/order Platform Fees: CN¥15/order | — |

| PropsperUs Rookie Fees | Min. Commission Per Trade | 0.06% | $0 (Till 30 June 2024) | Stock Price Stock Price >US$10: US$5/trade | 0.15% | min. HK$40 | 0.10% | £7 | 0.10% | AU$8 | 0.15% | CN¥40 | — |

| Saxo Classic Fees | Min. Commission Per Trade | 0.08% | S$3 | 0.08% | US$1 | 0.08% | HK$15 | 0.08% | £3 | 0.08% | AU$3 | 0.08% | CN15 | Custody Fee: 0.12% p.a. (waived if opted into securities lending) FX Conversion Spreads: 0.25% |

| Tiger Brokers Fees | Min. Commission Per Trade Apply Now | 0.06% | S$1.99 (Commission + Platform fees) Commission: 0.03% * Transaction amount, min. S$0.99/order + waived for 365 days after opening account Platform Fees: 0.03% * Transaction amount, min. S$1 / order | US$0.01/share | US$1.99 (Commission + Platform fees) Commission: US$0.005/share, min. US$0.99/order + waived for 180 days after account opening Platform Fees: US$0.005 / share, min. US$1 / order Charges for Fractional Shares Trading: Trade <1 share — Commission waived & Platform Fee is 1% of Trade Value, capped at US$1 Trade ≥1 share — Commission and Platform Fee are charged based on the Standard US Stocks & ETFs trading fees | 0.06% | HK$15 (Commission + Platform fees) Commission: 0.03%* Transaction amount, min. HK$7/order + waived for 365 days after opening account Platform Fees: 0.03%* Transaction amount, HK$8/order | — | 0.10% | AU$8 (Commission + Platform fees) Commission: 0.03%* Transaction amount, min. AU$2 / order Platform Fees: 0.07%* Transaction amount, AU$6 / order | 0.06% | CN¥15 (Commission + Platform fees) Commission: 0.03%* Transaction amount, min. CN¥7 / order + waived for 365 days after opening account Platform Fees: 0.03%* Transaction amount, min. CN¥8 / order | SGX Custody Fees: $2 for accounts with no trading transactions in the quarter |

| uSmart Trader Fees | Min. Commission Per Trade | 0.05% | S$2.88 (Commission + Platform fees) Commission: 0.02% of Transaction Amount Min. S$1 per Order Platform Fees: 0.03% of Transaction Amount Min. S$1.88 per Order | US$1 (Commission + Platform fees) Commission: $0 Platform Fees Stock price ≥ 40 USD: US$1 /Order (Fixed) Stock price<40 USD: US$0.005 / share Min. US$1 Per Order Max 0.50% of Transaction Amount | 0.024% + HK$12 (Commission + Platform fees) Commission: 0.024% of transaction amount Platform Fees: HK$12 | — | — | — | — |

^Lowest tier (Tier 1) Interactive Brokers offers tiered pricing to lower rates even more. In cases where an exchange provides a rebate, the company will pass some or all of the savings directly back to you.

*Inclusive of GST.

However, with IBKR SG’s fixed tier, these exchange and regulatory fees are included in your commission fees.

Additional Exchange Fees

In addition, you will need to pay additional exchange and regulatory fees as seen below.

SGX Exchange Fees

- Trading Fee: 0.0075% * of the transaction amount

- Clearing Fee” 0.0325% * of the transaction amount.

US Exchange Fees

- SEC Fees (sells only) US$0.000008 * Transaction amount, min US$0.01

- Settlement Fees US$0.003 / Share, max 1% * Transaction amount

- Trading Activity Fees (TAF, sells only) US$0.000145 / Share, min. US$0.01 / Trade, max US$7.27

- ADR Custodian Fees US$0.01~US$0.05.

Hong Kong Exchange Fees

- Trading Fee 0.00565%*transaction amount, minimum HK$0.01

- Settlement Fees 0.002%* transaction amount, minimum HK$2, maximum HK$100

- SFC Transaction Levy 0.0027%* transaction amount, minimum HK$0.01

- FRC Transaction Levy 0.00015%*transaction amount

- Stamp Duty 0.10%* trasanction amount, rounded up to the nearest dollar. For example, HK$2.01 will be rounded up to HK$3.00.

China A-Shares Fees

- Handling Fees 0.00341% * Transaction amount

- Securities Management Fees 0.002% * Transaction amount

- CSDC Transfer Fees 0.001% * Transaction amount

- HKSCC Transfer Fees 0.002% * Transaction amount

- Stamp Duty 0.05% * Transaction amount SAT

- Portfolio Fees Holding stock value * 0.008% / 365 (calculated by day, charged by month)

- Dividend Tax 10% * Dividend and bonuses (deducted by SAT at the time of dividend distribution).

The Singapore government will levy the prevailing Goods and Services Tax (GST) at a rate of 8% on these fees as well.

Promotions For New Users

Now let’s talk bout the new user promos.

Although this should not be the main reason why you choose a brokerage, this is important nonetheless.

CMC Invest Sign-Up Promo

Get up to one FREE Tesla Inc share when you fund and trade your new CMC Invest account:

- 1x Nike Share: Fund $1,000 and make 6 trades by 30 June 2024

- 1x Tesla Inc share (capped at 2,000): Fund a net deposit of S$10,000 and make at least 3 trades of S$3,000 ≤ 90 days from account opening

T&Cs apply.

Free upgrade to Invest Tier

- Free for 12 months for both new and existing clients.

- Lower fx settlement rate of 0.20%, versus 0.60% for the free ‘Gold’ tier and even 0.40% for ‘Diamond’ tier which costs S$128/month

- More free trades per month in SG, US, UK, HK & CA, 45 on ‘Invest’ versus 22 on ‘Gold’

Interactive Brokers Singapore Sign-Up Promo

Interactive Brokers actually has a referral program.

For new users that are invited by existing Interactive Brokers Singapore customers, you will get to enjoy these rewards:

- Referrer Reward: US$200 for each referred client when the referred client opens an individual, joint, trust or retirement account, funds and maintains a balance of at least US$10,000 for one year.

- Referred Reward (New User): New users will receive $1 in IBKR shares for every $100 of value (cash or other assets) added to their account for up to US$1,000 worth of IBKR shares.

Do note that the average balance must be maintained for at least one year for the shares to vest and be accessible.

T&Cs apply.

moomoo Singapore Sign-Up Promo

Get up to S$660 in rewards and up to 5.8%^ p.a. guaranteed returns when you park your cash with Moomoo Cash Plus for up to 30 days. Valid till 3 January 2024. T&Cs apply.

ProsperUs Sign-Up Promo

Get up to S$88 in cash credits when you open an account with ProsperUs and deposit S$10,000 (S$88 cash credits) or S$3,000 ($38 cash credits) for 60 days. T&Cs apply.

Saxo Sign-Up Promo

Terms and Conditions apply

Get up to USD 888 worth of rewards and an 8%* p.a. interest bonus

- Promotion is valid for new Tiger Brokers customers only

- Open a Tiger Brokers account and complete additional actions to be eligible for rewards

- The promotion is valid until 22 November 2023

- Terms and Conditions apply

uSmart Sign-Up Promo

Up till 31 December 2023, new users who open a uSmart account and complete tasks will receive the following:

| Task | Reward |

|---|---|

| Complete your first deposit (any amount) during the promotion period | USD 2 cash voucher |

| Complete at least one US stock option trade (buy/sell/short selling) during the promotion period | USD 2 cash voucher |

| Complete at least one US Fractional shares trade (buy/sell)during the promotion period | USD 2 cash voucher |

| Complete at least one trade with any SMART Order during the promotion period | USD 2 cash voucher |

| Upgrade to an Intel account during the promotion period and keep it for one month | USD 2 cash voucher |

| Complete at least one trade with any SMART Plan during the promotion period | USD 2 cash voucher |

| Join a live broadcast during the promotion period | USD 2 cash voucher |

T&Cs apply.

Trading Options And Features

CMC Invest

As it is still rather new, CMC Invest only offers the following for now:

- Stocks

- ETFs

However, they are looking to add Options and Wealth Management soon!

Interactive Brokers

Undoubtedly, Interactive Brokers is the brokerage with the most trading options as you can trade:

- Stocks (long or short)

- ETFs

- REITs

- Penny Stocks

- Mutual Funds

- Options

- Futures and Futures Options

- Currencies

- Bonds

As for data and features, users will receive free delayed market data for the available exchanges by default.

As the cherry on top, IBKR also allows for fractional shares trading!

moomoo

With moomoo, you can trade the following investment products on the platform:

- Singapore Market: Stocks, ETFs, REITs, Structured Warrants and DLCs

- US Market: Stocks, ETFs, Futures, ADRs and Options

- HK Market: Stocks, ETFs, REITs, Futures, Warrants and Callable bull/bear contracts (CBBCs)

In addition, you get access to free level 2 market data and fractional shares trading!

PropserUs

With ProsperUS, you can trade the following investment products on the platform:

- Stocks

- Bonds

- Exchange-Traded Funds (ETFs)

- Mutual Funds

- Contract For Difference (CFD)

- Forex (FX)

- Futures

- Options.

Saxo

Saxo provides you with the opportunity to trade a diverse range of financial instruments, including stocks, ETFs, bonds, mutual funds, futures, CFDs, forex, commodities, forex options, and listed options.

More specifically, you get access to a selection of more than 23,500 stocks and over 7,000 ETFs across various markets such as Singapore, the US, Hong Kong, and 50 other global markets.

Tiger Brokers

As for Tiger Brokers, you can trade the following investment products on the platform:

-

US/HK/SG/CN/AU stocks (long or short)

-

US stock options and HK Warrants/CBBCs

-

US stock ETFs / SG stock ETFs and REITs

-

Index/metal/treasury/energy futures & more

You also get access to access to multiple trading features such as real-time stock quotes, one-click trading, profit and loss analysis, stock options trading, in-depth analytics, screeners and candlestick charts.

Not to mention that Tiger Brokers also allows for fractional shares trading!

uSmart

With uSmart, you can trade these investment products:

- US/HK/SG stocks

- US stock options and HK Warrants/CBBCs

While uSmart lacks variety and does not offer free real-time stock quotes, it does have a leg up over Tiger Brokers and Moomoo (at the moment) thanks to its fractional shares trading feature.

Moreover, uSmart stands out with its educational features, making learning easier for beginner investors.

UI/UX and Customer Service: Which Online Brokerage Is Best for Beginners Singapore?

In terms of these brokerages, you can check out our real user reviews of these brokerages that discuss the user experience and their customer service experience:

As a bonus, we have many experienced users on Seedly who can answer any queries you might have when comparing online brokerages:

Best Online Brokerages Singapore: Which Brokerage Is Best in Singapore?

Which Online Brokerage Is Best? The Case for Interactive Brokers And CMC Invest

I would choose Interactive Brokers simply because of its low costs, especially after it removed monthly maintenance fees.

The wide range of access to markets is a plus point, too, especially for those who are looking to access the Ireland domiciled ETFs on the London Stock Exchange.

On the other hand, CMC Invest is a strong competitor with its free trades and $0 on platform fees. But do be aware of the 0.60% FX settlement fee.

Is moomoo or Tiger Better? What About uSmart?

If you are choosing between Tiger Brokers and moomoo, you might want to go with moomoo if you are cost-conscious.

For example, if you were trading a US share, you would be charged a minimum of US$0.99 on moomoo per trade and US$1.99 on Tiger per trade after adding up the commission fees and platform fees.

But regardless, isn’t it great that we have these affordable options?

Related Articles

- Ultimate Digital Multi-Currency Accounts Comparison: Revolut vs Instarem vs Wise vs Wirex vs YouTrip

- $12,000 Dividend Per Year: Here’s How Much You Need To Invest

- Step-By-Step Guide: Opening A CDP And Stock Trading / Brokerage Account In Singapore

- How to Invest: A Singaporean’s Guide To Investing for Beginners

Advertisement