Whether you’re looking for a place to park your U.S. dollar (USD) or take advantage of the better interest rates in the U.S., USD fixed deposits are a great way to grow your foreign currency.

But like all investment products that deal with foreign currency, certain risks are involved if you want the higher interest.

So here’s all you need to know about USD fixed deposits, including the best rates in town offered by local banks!

TL;DR: Best USD Fixed Deposit Rates Singapore (Oct 2023)

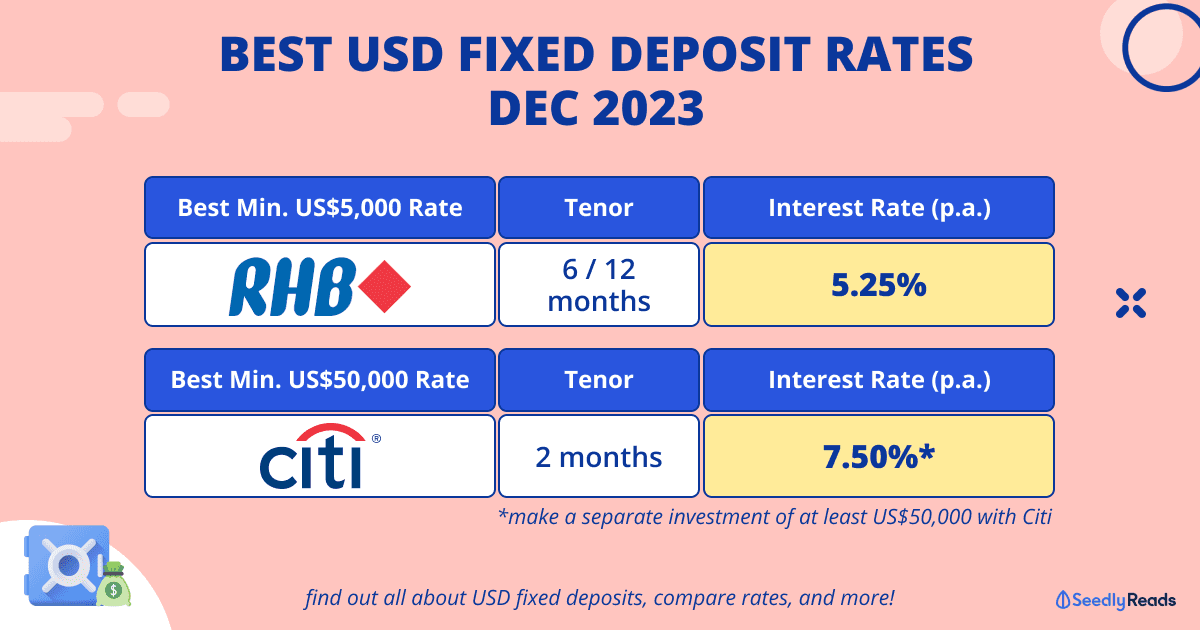

Your best options are:

- RHB Bank: 5.25% p.a. for six or 12 months with a minimum US$5,000 deposit

But based on interest rates alone, Citibank currently offers the highest at 7.5% p.a. for two months with a minimum US$50,000 deposit. However, to enjoy this high rate, you must make a separate investment of at least US$50,000 with Citi.

| Bank (Click to teleport) | Highest Interest Rate (p.a.) | Minimum Deposit | Available Tenors |

|---|---|---|---|

| Bank of East Asia | 4.90% (board rate) 5.03% (tier rate) | US$10,000 (board rate) US$100,000 (tier rate) | 1 week | 1 month | 2 months | 3 months | 6 months | 12 months |

| CIMB | 5.20% | US$10,000 | 1 month | 3 months | 6 months | 12 months |

| Citibank | 7.50% (With purchase of investments from Citi worth >$49,999) | US$50,000 | 2 months |

| DBS | 5.11% | S$5,000 equivalent | 1 month | 2 months | 3 months | 6 months | 12 months |

| Hong Leong Bank | 4.8776% | US$50,000 | 1 month | 3 months | 6 months | 12 months |

| HSBC | 3.95% | US$25,000 | 1 month | 3 months | 6 months | 12 months |

| ICBC | 4.85% | US$500 | 1 week | 1 month | 3 months | 6 months | 12 months |

| Maybank | 5.20% | US$10,000 | 1 month | 2 months | 3 months | 6 months |

| RHB | 5.25% | US$5,000 | 6 months | 12 months |

| Standard Chartered | 4.60% - 4.80% | US$5,000 | 1 week | 2 weeks | 1 month | 2 months | 3 months | 6 months | 12 months |

| State Bank of India | 5.00% | US$5,000 | 1 month | 2 months | 3 months | 6 months | 12 months | 18 months | 24 months |

| OCBC | 5.19% | US$5,000 | 1 month | 2 months | 3 months | 5 months | 6 months | 7 months | 8 months | 9 months | 12 months |

| UOB | 5.11% | US$5,000 (for 1-12 month tenor) US$25,000 (for 1-2 week tenor) | 1 week | 2 weeks | 1 month | 2 months | 3 months | 6 months | 12 months |

Jump to:

- What Are USD Fixed Deposits?

- Things to Consider Before Investing in USD Fixed Deposits

- Best USD Fixed Deposit Rates in Singapore

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product. Information is accurate as of 5 Dec 2023.

What Are USD Fixed Deposits?

USD Fixed Deposits are a type of foreign currency fixed deposit where the depositor places a sum of USD with the bank for a fixed period to earn guaranteed interest.

Like SGD fixed deposits, the money must stay in the account for a fixed period of time, or you will incur an early withdrawal fee.

This predetermined period of time (tenor) can range anywhere from one week to 24 months.

But why use USD fixed deposits over SGD fixed deposits?

Well, there are a number of possible reasons:

- Lock in a good exchange rate for future spending and grow that sum with USD fixed deposits (also known as hedging against foreign currency fluctuations)

- Parking USD for future U.S. market stock purchases

- Take advantage of the currently better interest rates in the U.S. compared to Singapore,

Things to Consider Before Investing in USD Fixed Deposits

However, there are some major considerations you’ll need to make.

First off, foreign currency fixed deposits are NOT insured by the Singapore Deposit Insurance Corporation (SDIC).

Secondly, you will be exposed to foreign currency risks if you ultimately spend in SGD or another non-USD currency. If the U.S. dollar weakens against the Singapore dollar, you might lose money, depending on the extent of the drop.

If you’re curious to know what other Seedly members have to say, check out this thread to get a better idea:

Due to the above reasons, USD fixed deposits are quite a bit riskier than SGD fixed deposits.

That said, we do get much higher interest. So, if you have a good reason and can set aside a sum of USD for a period of time, it can serve you well!

Here are all the current fixed deposit rates in Singapore.

Bank of East Asia USD Fixed Deposit Rates

Bank of East Asia FD Rates: Board Rates

| Bank of East Asia USD Fixed Deposit Board Rates | Rates (% p.a.) | |||||

|---|---|---|---|---|---|---|

| Minimum (Equivalent) Personal | 1 week | 1 month | 2 months | 3 months | 6 months | 12 months |

| US$10,000 | 4.43 | 4.48 | 4.57 | 4.90 | 4.82 | 4.65 |

Bank of East Asia FD Rates: Tier Rates

| Bank of East Asia USD Fixed Deposit Tier Rates | Rates (% p.a.) | |||||

|---|---|---|---|---|---|---|

| Minimum | 1 week | 1 month | 2 months | 3 months | 6 months | 12 months |

| US$100,000 | 4.56 | 4.61 | 4.70 | 5.03 | 4.95 | 4.78 |

For a fixed deposit amount of S$500,000 equivalent or over, please contact the Bank of East Asia for the applicable prevailing interest rate.

CIMB USD Fixed Deposit Rates

Promotional Rates

From 1 Nov 2023, CIMB Singapore is running a promotion offering the exclusive rates in the table below for online placements of a minimum of 10,000 units (i.e. US$10,000):

| CIMB USD Fixed Deposit Promotional Rates | Online Rates (% p.a.) | Validity | |||

|---|---|---|---|---|---|

| Minimum | 1 Month | 3 Months | 6 Months | 12 Months | Till further notice |

| US$10,000 | 5.05 | 5.10 | 5.20 | 4.90 | |

Board Rates

| Tenure (Month) | US$10,000 | US$50,000 | US$100,000 | US$250,000 |

|---|---|---|---|---|

| 1 | 4.29 | 4.29 | 4.34 | 4.34 |

| 3 | 4.65 | 4.65 | 4.70 | 4.70 |

| 6 | 4.65 | 4.65 | 4.70 | 4.70 |

| 12 | 4.60 | 4.60 | 4.65 | 4.65 |

Citibank USD Fixed Deposit Rates

Citibank USD FD Time Deposit Investment Bundle Promotion

| Citibank USD Fixed Deposit Rates | Rates (% p.a.) |

|---|---|

| Minimum amount | 2 months |

| US$50,000 | 7.50 |

*The maximum time deposit placement is the lower of the investment amount or US$2 Million.

Citibank USD Fixed Deposit T&Cs

The promotion entitles eligible customers to enjoy the USD 2-month promotional time deposit rate from 1 December 2023 to 31 December 2023 with a minimum separate investment purchase of US$50,000 equivalent.

You will need to place the promotional Time Deposit through a Relationship Manager. This promotion is not applicable for placement through Citibank Online or Citi Mobile App. The Investment purchase must also be made within the Promotion Period. The Time Deposit will be valued only upon the Investment settlement date. Time Deposit must be effected by 31 January 2024. Also, “Investment” refers to a Citi-distributed investment product with a minimum net sales charge of 1%.

DBS USD Fixed Deposit Rates

DBS USD FD Rates (Online)

| DBS USD Fixed Deposit Rates | Rates (% p.a.) | ||||

|---|---|---|---|---|---|

| Amount | 1 Months | 2 Months | 3 Months | 6 Months | 12 Months |

| < US$10,000 | 4.99 | 5.01 | 4.88 | 4.54 | 4.28 |

| < US$25,000 | 4.99 | 5.01 | 4.88 | 4.54 | 4.28 |

| < US$50,000 | 4.99 | 5.01 | 4.88 | 4.54 | 4.28 |

| < US$100,000 | 4.99 | 5.01 | 4.88 | 4.54 | 4.28 |

| < US$250,000 | 5.09 | 5.11 | 5.03 | 4.84 | 4.58 |

| <= US$500,000 | 5.09 | 5.11 | 5.03 | 4.84 | 4.58 |

Minimum amount of S$5,000 equivalent.

Hong Leong Bank USD Fixed Deposit Rates

Hong Leong Bank USD FD Rate: Board Rates

| Hong Leong Bank USD Fixed Deposit Rates | Rate (% p.a.) | |||

|---|---|---|---|---|

| Minimum amount | 1 Month | 3 Months | 6 Months | 12 Months |

| US$50,000 | 4.6738 | 4.8776 | 4.8266 | 4.6847 |

HSBC USD Fixed Deposit Rates

HSBC USD FD Rates: Board Rates

| HSBC USD Fixed Deposit Rates | Rates (% p.a.) | |||

|---|---|---|---|---|

| Placement Amount | 1 Month | 3 Month | 6 Month | 12 Month |

| US$25,000 to US$49,999 | 3.65 | 3.75 | 3.75 | 3.75 |

| US$50,000 to US$99,999 | 3.65 | 3.75 | 3.75 | 3.75 |

| US$100,000 to US$249,999 | 3.75 | 3.85 | 3.85 | 3.85 |

| US$250,000 to US$499,999 | 3.85 | 3.95 | 3.95 | 3.95 |

| US$500,000 to US$999,999 | 3.85 | 3.95 | 3.95 | 3.95 |

| US$1,000,000 and above | 3.85 | 3.95 | 3.95 | 3.95 |

ICBC USD Fixed Deposit Rates

ICBC USD FD Rates: Promotion Rates

| ICBC USD Fixed Deposit Promotional Rates | Online Rates (% p.a.) | |||||

|---|---|---|---|---|---|---|

| Minimum | 1 Week | 1 Month | 3 Months | 6 Months | 12 Months | 12 Months (via e-Banking) |

| US$500 | 0.01 | 4.30 | 4.85 | 4.85 | 4.80 | 4.85 |

*Deposit over the counter requires a minimum amount of US$20,000 while a deposit via E-banking requires a minimum amount of US$500.

ICBC USD FD Rates: Board Rates

| Amount (USD) | 1 Month | 3 Months | 6 Months | 12 Months |

|---|---|---|---|---|

| < US$100,000 (exclusive) | 4.20% | 4.75% | 4.75% | 4.70% |

| US$100,000 and above | 4.30% | 4.85% | 4.83% | 4.80% |

Maybank USD Fixed Deposit Rates

Maybank USD FD Rate: iSAVvy Foreign Currency Time Deposit

| Maybank iSAVvy USD Fixed Deposit Rates | Online Rates (% p.a.) | |||

|---|---|---|---|---|

| Minimum | 1 Month | 2 Months | 3 Months | 6 Months |

| US$10,000 | 4.85 | 5.00 | 5.05 | 5.20 |

Maybank USD FD Rate: Tier Rates

| Maybank USD Fixed Deposit Rates | Online Rates (% p.a.) | |||

|---|---|---|---|---|

| Minimum | 1 Month | 2 Months | 3 Months | 6 Months |

| US$10,000 | 4.65 | 4.80 | 4.85 | 5.00 |

| US$50,000 | 4.70 | 4.85 | 4.90 | 5.05 |

| US$100,000 | 4.85 | 5.00 | 5.05 | 5.20 |

RHB USD Fixed Deposit Rates

RHB USD FD Rates: Promo Rates

| Minimum Placement Amount | 6 Months (% p.a.) | 12 Months (% p.a.) |

|---|---|---|

| US$5,000 | 5.25 | 5.25 |

RHB USD FD Rates: Board Rates

| RHB USD Fixed Deposit Rates | Online Rates (% p.a.) | |||||||

|---|---|---|---|---|---|---|---|---|

| Amount | 1 Week | 1 Month | 2 Months | 3 Months | 6 Months | 9 Months | 12 Months | 24 Months |

| Up to US$99,999 | 0.01 | 4.36 | 4.45 | 4.54 | 4.59 | 4.54 | 4.44 | 4.44 |

| US$100,000 to US$499,999 | 0.02 | 4.37 | 4.46 | 4.56 | 4.61 | 4.56 | 4.46 | 4.46 |

| US$500,000 to US$999,999 | 0.03 | 4.38 | 4.48 | 4.58 | 4.63 | 4.58 | 4.48 | 4.48 |

| US$1,000,000 & above | 0.05 | 4.40 | 4.50 | 4.60 | 4.65 | 4.60 | 4.50 | 4.50 |

Minimum amount of US$5,000.

Standard Chartered USD Fixed Deposit Rates

SC USD Fixed D Rates: Promo Rates

| Minimum Placement | Tenor | Promotional Rate | Priority Banking Preferential Rate | Priority Private Banking Preferential Rate |

|---|---|---|---|---|

| US$25,000 | 8 months | 4.60% | 4.70% | 4.80% |

SC USD Fixed D Rates: Board Rates

| Standard Chartered USD Fixed Deposit Rates | Online Rates (% p.a.) | ||||||

|---|---|---|---|---|---|---|---|

| Amount | 1 Week | 2 Weeks | 1 Month | 2 Months | 3 Months | 6 Months | 12 Months |

| US$5,000 to US$24,999 | 3.93 | 3.93 | 3.8959 | 3.9406 | 3.9752 | 4.1409 | 4.0684 |

| US$25,000 to US$49,999 | 3.93 | 3.93 | 3.8959 | 3.9406 | 3.9752 | 4.1409 | 4.0684 |

| US$50,000 to US$99,999 | 3.93 | 3.93 | 3.8959 | 3.9406 | 3.9752 | 4.1409 | 4.0684 |

| US$100,000 to US$249,999 | 4.03 | 4.03 | 3.9959 | 4.0406 | 4.0752 | 4.2409 | 4.1684 |

| US$250,000 to US$499,999 | 4.13 | 4.13 | 4.0959 | 4.1406 | 4.1752 | 4.3409 | 4.2684 |

| US$500,000 and above | 4.18 | 4.18 | 4.1459 | 4.1906 | 4.2252 | 4.3409 | 4.3184 |

State Bank of India USD Fixed Deposit Rates

State Bank of India USD Fixed D Rates: Board Rates

| State Bank of India USD Fixed Deposit Rates | Online Rates (% p.a.) | |||||||

|---|---|---|---|---|---|---|---|---|

| Amount | 1 Week | 1 Month | 2 Months | 3 Months | 6 Months | 12 Months | 18 Months | 24 Months |

| US$5,000 to < US$1,000,000 | - | 3.50 | 3.50 | 4.75 | 5.00 | 5.00 | 3.25 | 3.00 |

OCBC USD Fixed Deposit Rates

OCBC USD Fixed D Rates: Board Rates

| OCBC USD Fixed Deposit Rates | Online Rates (% p.a.) | ||||||

|---|---|---|---|---|---|---|---|

| Amount | 1 Month | 2 Months | 3 Months | 6 Months | 8 Months | 9 Months | 12 Months |

| First US$49,999 | 4.99 | 4.82 | 4.80 | 4.55 | 4.69 | 4.71 | 4.34 |

| US$50,000 to US$99,999 | 5.09 | 4.92 | 4.88 | 4.55 | 4.72 | 4.74 | 4.34 |

| US$100,000 to US$249,999 | 5.09 | 4.92 | 4.90 | 4.85 | 4.83 | 4.85 | 4.64 |

| US$250,000 to US$499,999 | 5.19 | 5.02 | 5.00 | 4.85 | 4.86 | 4.88 | 4.64 |

| Above US$500,000 | 5.19 | 5.02 | 5.00 | 4.85 | 4.86 | 4.88 | 4.85 |

Minimum deposit of US$5,000.

UOB USD Fixed Deposit Rates

UOB Fixed D Rates: Board Rates

| UOB USD Fixed Deposit Rates | Online Rates (% p.a.) | ||||||

|---|---|---|---|---|---|---|---|

| Amount | 1 Week | 2 Weeks | 1 Month | 2 Months | 3 Months | 6 Months | 12 Months |

| First US$49,999 | 3.86 | 3.88 | 4.89 | 4.90 | 4.91 | 4.66 | 4.42 |

| US$50,000 to US$99,999 | 3.86 | 3.88 | 4.99 | 5.00 | 5.01 | 4.66 | 4.42 |

| US$100,000 to US$249,999 | 4.36 | 4.38 | 4.99 | 5.00 | 5.01 | 4.94 | 4.72 |

| US$250,000 to US$499,999 | 4.36 | 4.38 | 5.09 | 5.10 | 5.11 | 4.94 | 4.72 |

Minimum deposit of US$5,000 for one to 12-month tenor and US$25,000 for one to two-week tenor.

Related Articles

Advertisement