Back in my mid-20s, I remembered starting my two-hour commute to work one day and thinking, “Why the f@#$ am I doing this?” This was almost immediately followed by:

Sounds familiar?

If you’ve ever had that conversation with yourself as you’re being “chauffeured” to work in your Mercedes-Benz or Volvo stretch limo (read: public buses).

I feel you…

So let’s find out how much you theoretically need to earn before considering buying an air freshener for your brand-new car.

Disclaimer: the numbers and figures here are based on assumptions and estimations and are accurate as of 19 April 2023, so feel free to adjust them accordingly to reflect your situation better.

TL;DR: Can I Even Afford To Buy A Car?

- The cheapest new car on the market as of Feb 2022 is the Perodua Bezza 1.3 Premium X which is going for $123,999

- You need to cough up S$2,264.63 per month, on top of the S$29,400 downpayment, which you’ll need to make in cash.

- It’s not possible to responsibly afford a car on a monthly income of S$3,000…

- You need a gross monthly income of S$8,729 to comfortably afford the cheapest car on the market.

Why Are Cars So Expensive in Singapore?

Singapore is notorious for being one of the most expensive cities in the world. And it’s no surprise that the cost of owning a car is astronomical.

As a matter of fact, BudgetDirect has compared the prices of multiple car models in Singapore versus the prices of the same models in other countries.

See a massive difference?

Now let’s take a look at Singapore’s road infrastructure.

Singapore has more than ten times fewer kilometres (km) of roads compared to the other countries in the table above.

Although we have vastly fewer registered vehicles here, the number of cars per km of roads is a lot more than those of the other countries.

Therefore, to control the number of people who own cars in Singapore, we have implemented several measures:

These measures include additional fees and taxes (such as Certificate of Entitlement or Excise Duty) on top of the vehicle’s original price.

Now that you know why it’s expensive to own a car in Singapore, you must be wondering, how much do you need to pay monthly to own a car?

What Car Are We Looking At?

As Seedly is all about personal finance and fiscal responsibility, so buying an Aston Martin is antithetical to what Seedly is all about.

So for this exercise, we’re going to be really budget about this and pick the cheapest new car we can find on the market.

Besides, we just need something with four wheels that’ll bring us from point A to point B – without having to experience what it’s like being a sardine in a tin.

Here’s how we chose our car:

- It has to be a brand new passenger vehicle with an automatic transmission (Like the wife said, “I am NOT getting into a lorry in this dress.”)

- A car loan will be taken (If you’re going, “Need car loan meh?” Stop. Just stop reading this article now, you high-SES… Ahem. We digress.)

So what’s the cheapest new car we can find?

It’s the… Don’t hold your breath… Perodua Bezza 1.3 Premium X!

And she’s all yours for a mere S$$123,999 inclusive of Certificate Of Entitlement (price from sgCarMart and is correct as of 19 Apr 23).

Monthly Installment

As the Open Market Value (OMV) for the Perodua Bezza is $11,040 (less than $20,000), that means that the maximum car loan you can get is 70% of the car price, and you’ll only need to put down a 30% down payment.

FYI: Cars with OMV exceeding $20,000 will be entitled to a maximum loan value of 60% of the car price and a minimum 40% down payment. The key takeaway here? If you’re unsure whether you can afford that car, look at how much cash you can put down for the downpayment and work up from there.

Assuming you take the maximum loan tenure of 7 years (at 2.78% interest):

- Loan Amount (70%) = S$68,599

- Downpayment in Cash (30%) = S$29,400

Road Tax

Using SGCarMart’s Road Tax Calculator, the annual road tax for a Perodua Bezza is S$584.

Your monthly road tax = S$48.67

Car Insurance Premium

Car insurance is pretty much a given for anyone who owns a car.

Read more: Which Is The Best Car Insurance For Me?

For the sake of this theoretical calculation, we’re going to assume that this is your first car and that you are relatively young and inexperienced (younger than 27 years old and with less than 2 years of driving experience). Yeah… Insurance companies have high standards.

For your reference, this is the driver profile we submitted for a car insurance quote:

- 25-year-old, single male

- Working indoors

- 0% No-Claim Discount

- 2 years of driving experience

Without going into details like why women get quoted cheaper prices (yes, insurance companies generally consider the fairer sex as safer drivers), the excess, personal accident coverage, etc, the cheapest annual car insurance premium we can get is S$2,733.30.

Your monthly car insurance premium = S$227.78

FYI: It’ll definitely get cheaper as you get older, get married, and manage to maintain an accident and claim-free record, or when you know which credit cards to use for car insurance premiums. In any case, if anything happens, make sure you know what to do when you get into a car accident.

Petrol Cost

- Actual fuel consumption is probably closer to 17km/L given the start-stop traffic of driving in the city

- You live in the East but work in the West, so an average of 60km each day, for a grand total of 1,800km a month

- You keep your petrol costs low by referring to this Comparison of Petrol Prices religiously and manage to pay about S$2.74/L

Parking Cost

Contrary to what many people think, this is where it can get surprisingly expensive.

Here are some assumptions regarding your monthly parking arrangements:

- HDB season parking at S$110 per month

- Office season parking at S$110 per month (highly dependent on location)

- Shopping centre parking at S$80 ($2.50/hour for an average of 8 hours a week, or 32 hours a month)

- Parking coupon-type parking at S$24 (2 booklets at S$12 each)

Your monthly parking cost = S$324

ERP Cost

If you plan your routes carefully, you might be able to avoid ERP charges altogether.

But if you need to enter the CBD or get into town on a Saturday, it’ll probably cost you something like S$2 each time you cross a gantry. Assuming a conservative charge of S$10 a week.

Your monthly ERP cost = S$40

Car Servicing And Repair

Considering that you’re starting with a new car, we’ll assume that the first couple of years will only require regular servicing.

We called up a few workshops in Singapore and got an average cost of S$250 for every 10,000km interval.

Assuming that we’re doing 1,800km a month, that’s one servicing to be scheduled every 5 months or so.

A major servicing which entails tyre replacement and the works will cost about S$400.

And that happens probably once every 2 years.

Let’s also assume that because of your regular servicing and the fact that you’re not driving your Perodua Bezza like you’re in the Fast and Furious franchise, you’re not going to be hit with any major repair work.

We’re going to hazard a guess here and say that your monthly car servicing and repair cost = S$100 (to be safe)

How Much Do I Need To Spend Per Month On A Car?

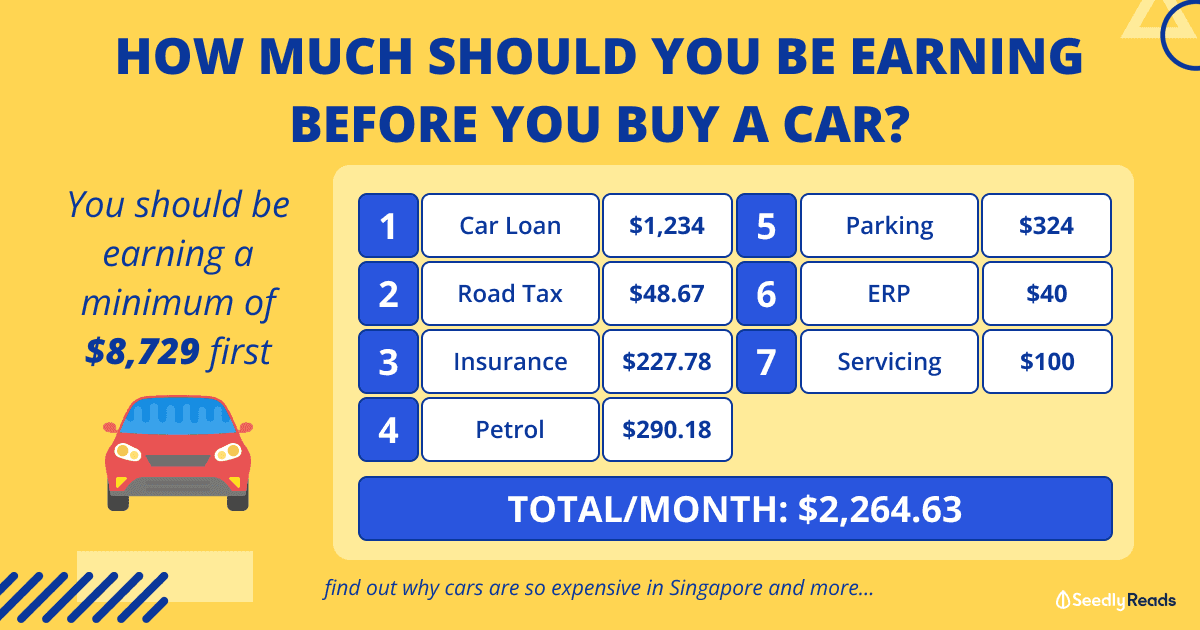

| Breakdown | Cost |

|---|---|

| Car Loan | S$1,234 |

| Road Tax | S$48.67 |

| Car Insurance | S$227.78 |

| Petrol | S$290.18 |

| Parking | S$324 |

| ERP | S$40 |

| Car Servicing | S$100 |

| Monthly Total | S$2,264.63 |

Of course, the figures here are all based on assumptions and agar-ations, so you’ll need to adjust your individual monthly costs accordingly.

Oh yeah, and don’t forget. This is on top of the S$29,400 downpayment, which you’ll finance in cold-hard cash.

How Much Do I Need To Earn Per Month Before I Can Afford A Car?

You might have seen your peers or know of people around you who earn a gross monthly income to the tune of S$3,000 but are cruising around in their rides. And deep down, you’re wondering, “Can meh? How they afford sia…”

Erm… They can’t.

And honestly, we don’t know how they’re doing it either.

Remember the 50% expenses, 30% wealth building, 20% savings rule where we pay ourselves first before spending anything? Let’s break it down:

- Gross monthly: S$3,000

- After CPF contribution (20%): S$3,000 – S$600 = S$2,400

- After 30% wealth building: $2,400 – S$720 = S$1,680

- After 20% savings: S$1,680 – S$480 = S$1,200

Even if we assume that you pour everything you have left of your “Expenditure” fund into your car (meaning you’re effectively surviving on air).

You’re still short of a whopping S$1,064.63 in order to own that Perodua Bezza!

Yeah… Your friends are over-leveraged.

Meaning they’re not saving enough or they’re not investing for their future.

So let’s be realistic about this and work backwards.

We’ll keep the “Expenditure” fund at 50% and give you at least S$1,500 for food, insurance, parents’ allowance, etc. so you can live like a well-adjusted human being. We’ll also need to add the S$2,264.63 monthly car payment, which brings our total “Expenditure” fund to S$3,764.63.

This means that your total monthly income, before CPF deduction, which caps out at $6,000 a month, should ideally be ~S$7,529 as S$1,200 of your salary goes to CPF.

Or a gross monthly income of ~S$8,729.

And if you’re looking to get your own place in the future, you’ll need to make sure that you do not commit your entire income to your car because you won’t have enough debt allowance to take up a mortgage loan… #justsaying

Related Articles

Advertisement