There are many things that come along with adulthood.

One of which is receiving way more letters than you ever did.

Amidst all the bills, there’s one letter that I’d look forward to receiving the start of the year.

It used to look a little like this.

I would glance at the iconic pie chart gleefully, noting how much interest my CPF account has earned me for the past year.

As someone who is used to receiving my interest monthly from my savings accounts, I was curious to find out how the interest rates of my CPF accounts are compounded.

Especially as someone who voluntarily tops up my CPF accounts to tap on that compounding magic.

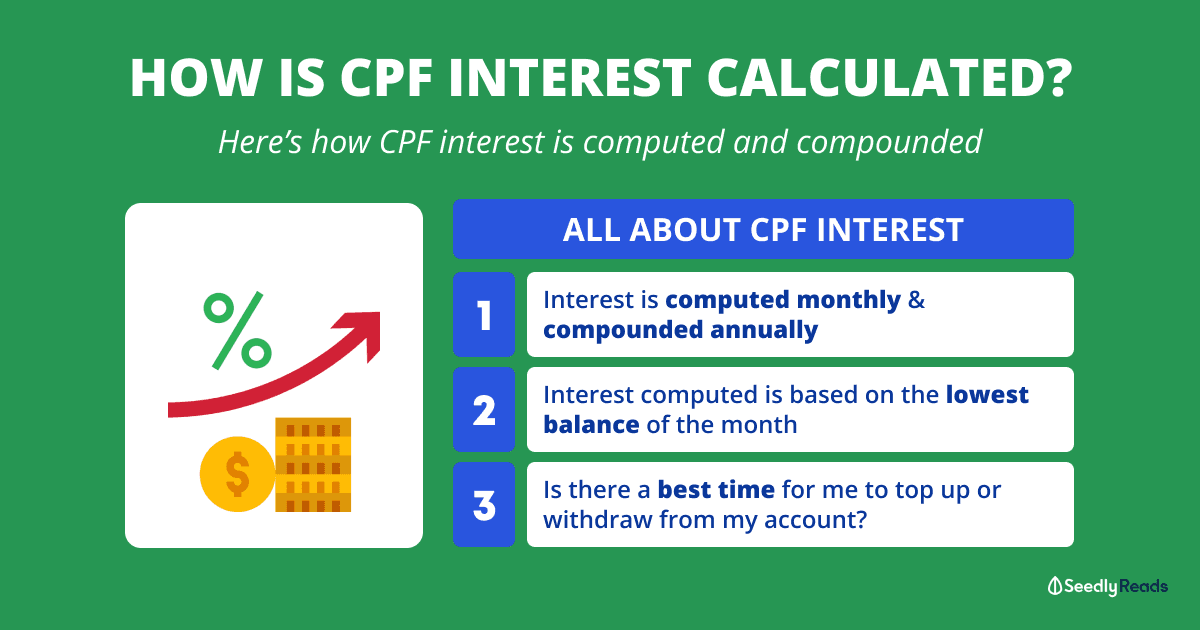

Wondering how your CPF interest is compounded?

Here’s what you need to know!

TL;DR: How Is My CPF Interest Rate Compounded and Credited into My Account?

Here’s a quick summary of how our CPF interest works in our accounts – It is computed monthly and compounded annually.

It is then credited into the accounts by 1 Jan in the following year.

Okay whoa, slow down. What EXACTLY does that mean?

Now, let’s break it down.

(Okay kidding, not this break it down. But you know what I mean.)

What Are CPF Interest Rates?

As a quick recap, here are the latest CPF interest rates.

| Ordinary Account (From 1 Jan - 31 Mar 2022) | Special and MediSave Accounts (From 1 Jan - 31 Mar 2022) | Retirement Account (From 1 Jan - 31 Dec 2022) | |

|---|---|---|---|

| Interest Rate Floor | 2.5% p.a. | 4% p.a. | 4% p.a. |

CPF reviews the interest rates every quarter, and there is a science behind how the interest rates are determined as well.

How Is CPF Interest Calculated?

For our bank accounts, we usually receive our interest monthly.

This means that the interest will typically be credited into the account by the end of the month or the start of the following month, depending on the bank.

This also means the interest is compounded monthly.

However, this is not the case for our CPF interest.

For our CPF accounts, our interest rates are compounded yearly.

This means that the CPF interest rates are paid once a year (i.e. 1 Jan).

To illustrate the difference, here’s how yearly compounding and monthly compounding works.

Let’s assume that Mr Calmond has $50,000, and places it somewhere that earns 2.5% interest.

Here’s the difference between yearly compounding and monthly compounding.

| Month | Balance | Interest | Balance | Interest |

|---|---|---|---|---|

| Yearly Compounding | Monthly Compounding | |||

| Jan | $50,000 | $104.16 | $50,000 | $104.16 |

| Feb | $50,000 | $104.16 | $50,104.17 | $104.38 |

| Mar | $50,000 | $104.16 | $50,208.55 | $104.60 |

| Apr | $50,000 | $104.16 | $50,313.15 | $104.82 |

| May | $50,000 | $104.16 | $50,417.97 | $105.04 |

| June | $50,000 | $104.16 | $50,523.01 | $105.26 |

| Jul | $50,000 | $104.16 | $50,628.27 | $105.48 |

| Aug | $50,000 | $104.16 | $50,733.75 | $105.70 |

| Sep | $50,000 | $104.16 | $50,839.45 | $105.92 |

| Oct | $50,000 | $104.16 | $50,945.37 | $106.14 |

| Nov | $50,000 | $104.16 | $51,051.51 | $106.36 |

| Dec | $50,000 | $104.16 | $51,157.87 | $106.58 |

| Total Interest Earned | $1,250 | $1,264.45 | ||

| Total Amount (After 1 Year) | $51,250 | $51,264 | ||

How Is CPF Interest Computed Every Month?

CPF also states that the CPF interest is computed monthly.

However, instead of using the average balance of the month, CPF calculates the interest rate based on the lowest balance of the month.

This means that any withdrawal or deductions made in the middle of the month will not earn interest in that given month.

Similarly, any contributions and refunds received that month will only start earning interest next month.

For illustration purposes, let’s assume that Mr Calmond still has $50,000 in his CPF Ordinary Account (OA).

He receives $100,000 in his CPF OA from selling his beloved HDB flat on 2 October.

(Figurative stack of cash since it’s going to be in his CPF OA instead.)

Even though he has $150,000 in his CPF OA, the interest rate computed for October will be based on $50,000.

This is because this refund will only start earning interest next month.

However, if he decides to invest this $100,000 via the CPF Investment Scheme on 15 November, the interest rate computed for November will be based on $50,000 as well.

This is because any withdrawal or deductions made will not earn interest in that given month.

Is There a Best Time for Me To Contribute or Withdraw From My CPF Account?

Based on how CPF interest is being computed, if you’re looking to time your contributions or withdrawals…

This means that if you do have to make any contributions, the most ‘ideal’ period is at the end of the month (for it to earn interest at the start of the following month).

(Pssst… Don’t do it literally on the last day of the month though, as some time might be required to process this contribution.)

And if you do have any withdrawals, the most ‘ideal’ period is at the start of the month (since the lowest amount will be used to calculate the interest for the month).

When Will My Top-ups Earn Interest in the CPF Account Under the Retirement Sum Topping-up Scheme?

Under the Retirement Sum Topping-up Scheme (RSTU), we can build up retirement savings by topping up our own or our loved ones’ CPF accounts.

This can be done by topping up using cash or CPF savings, and to the CPF Special Account (SA) or Retirement Account (RA) for ages 55 years and above.

As we’ve seen previously, the CPF interest computation is affected by the transactions in the account.

Similar to what’s mentioned above, any contributions (including cash top-ups) that are received will start earning interest in the following month.

For CPF transfers, if the giver received the CPF contributions and transferred them, the recipient will earn the interest next month.

The giver will not be earning any interest on the money that has been transferred.

Should You Still Top Up Your CPF Account?

We all know the advantages and disadvantages of topping up our CPF accounts.

By topping up our CPF, we can:

- lower income tax

- enjoy relatively high risk-free interest rates

- complement our retirement portfolio

- use it to fund for our child’s education

However, at the same time, topping up our CPF would mean:

- only withdrawing it at 55 or 65 years old onwards

- cashflow is affected

As always, everyone’s financial situation and circumstances are different, and only you will be able to determine whether voluntary top-ups and contributions are the best for you.

But now that we know how the interest rates are computed, we can make smart choices around such decisions. 😉

If you have any burning questions on CPF, you know where to ask them!

Advertisement