Singapore’s three listed banks — DBS Group Holdings Ltd (SGX: D05), Oversea-Chinese Banking Corporation Limited (SGX: O39) and United Overseas Bank Ltd (SGX: U11) — have garnered plenty of interest among investors.

Since December 2020, when compared to Singapore’s stock market barometer, the Straits Times Index (STI), the banks’ shares have done pretty well.

For instance, shares in DBS have risen around 23% versus the STI’s decline of some 2%. DBS is currently the best-performing bank over the past year.

Increased optimism about Singapore’s economy mending with the vaccine roll-outs could have helped to lift investor sentiment.

In fact, Singapore’s Ministry of Trade and Industry projected our country’s gross domestic product (GDP) growth for 2021 to be around 7%, compared to a contraction of 5.4% in 2020.

However, the Singapore stock market has taken a breather over the past few days as news emerged that the new COVID-19 variant Omicron may be of concern.

With the banks’ share prices falling of late, investors who have the long term in mind could be wondering:

“Is there value in the banks at their latest stock prices?”

To help investors answer that question, let’s compare the historical price-to-book (PB) ratios, price-to-earnings (PE) ratios, and dividend yields of the three banks with their latest valuations.

Bank #1: DBS

First, let’s look at the biggest bank of ’em all, DBS.

The table below is a snapshot of DBS’ valuation from 2016 to 2020:

Here’s a quick analysis of DBS’ past valuation:

- DBS past dividend yield (excluding special dividends): Ranged from 3.9% to 4.8%, with an average of 4.4%

- DBS past PE ratio: Was between 9.3x and 12.3x, translating to an average ratio of 11.2x

- DBS past PB ratio: Fluctuated from 0.9x to 1.5x, giving an average of 1.2x

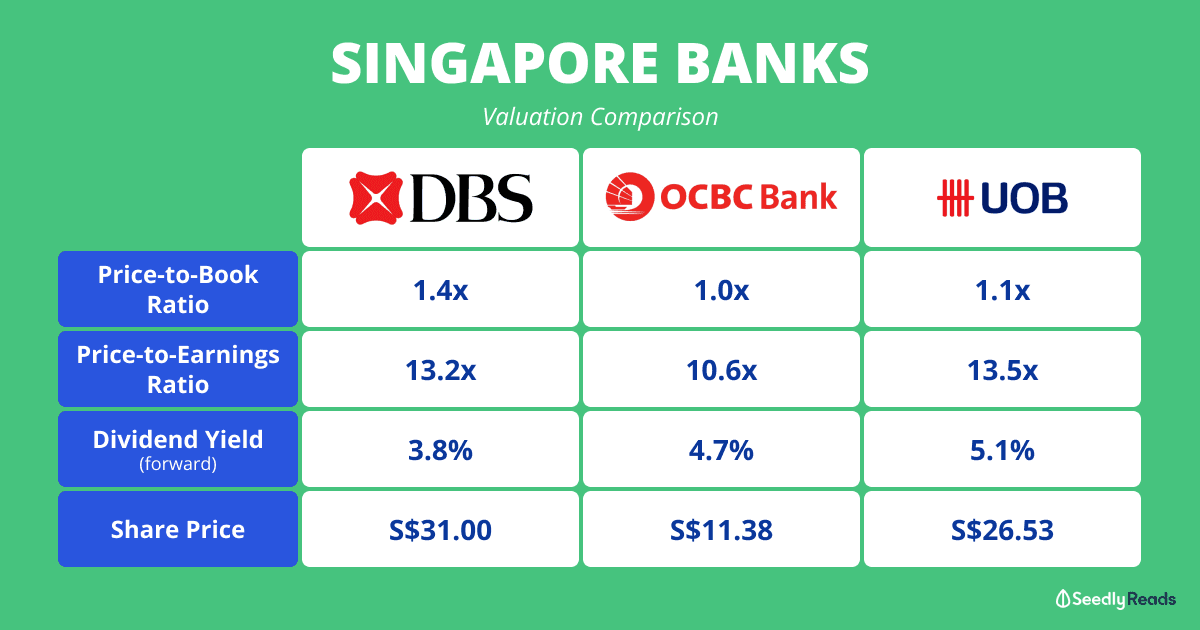

DBS is currently trading a share price of S$31.00 on 29 November. This translates to the following valuations:

- DBS dividend yield (forward): 3.8%

- DBS PE ratio: 13.2x

- DBS PB ratio: 1.4x

In July last year, the Monetary Authority of Singapore (MAS) called on local banks to cap their total dividends per share for 2020 at 60% of 2019’s dividends.

However, at the end of last month, Singapore’s central bank announced that the dividend restrictions on banks will not be extended.

Following the full lifting of regulatory restrictions, DBS increased its 2021 second quarter and third quarter interim dividends to S$0.33 per share each, up from S$0.18 per share a year ago.

DBS is the only bank to pay a quarterly dividend.

For the fourth quarter of 2021, DBS is expected to pay S$0.33 per share.

Using this, DBS’ forward dividend yield becomes 3.8% (using a projected 2021 total dividend of S$1.17 per share).

Compared to history, DBS looks expensive using all three valuation metrics.

Bank #2: OCBC

Next up, let’s look at OCBC’s valuation from 2016 to 2020:

Here’s a quick look at OCBC’s past valuation:

- OCBC past dividend yield: Ranged from 3.3% to 4.8%, with an average of 3.9%

- OCBC past PE ratio: Was between 9.7x and 11.8x, translating to an average ratio of 10.9x

- OCBC past PB (or price-to-NAV) ratio: Fluctuated from 0.8x to 1.3x, giving an average of 1.1x

At OCBC’s share price of S$11.38 on 29 November, the latest valuations are:

- OCBC dividend yield (forward): 4.7%

- OCBC PE ratio: 10.6x

- OCBC PB ratio: 1.0x

OCBC declared a 2021 interim dividend of S$0.25 per share, up from S$0.159 per share declared a year ago.

Assuming OCBC pays a final dividend of S$0.28 per share for the 2021 fourth-quarter (similar to the final dividend in 2019’s fourth quarter), OCBC’s dividend yield comes up to 4.7%.

OCBC seems undervalued in terms of its dividend yield, PE ratio and PB ratio.

Bank #3: UOB

Last but not the least, let’s explore UOB’s valuation from 2016 to 2020:

Here’s a quick analysis of UOB’s past valuation:

- UOB past dividend yield (including special dividends): Ranged from 3.6% to 5.0%, with an average of 4.2%

- UOB past PE ratio: Was between 10.0x and 12.7x, translating to an average ratio of 11.2x

- UOB past PB ratio: Fluctuated from 0.9x to 1.3x, giving an average of 1.1x

UOB shares are changing hands at S$26.53 each on 29 November. This translates to the following valuations:

- UOB dividend yield (forward): 5.1%

- UOB PE ratio: 13.5x

- UOB PB ratio: 1.1x

UOB declared a 2021 interim dividend of S$0.60 per share, up from S$0.39 per share declared a year ago.

Assuming UOB pays a final ordinary dividend of S$0.55 per share and a special dividend of S$0.20 per share for the 2021 fourth-quarter (similar to 2019’s final quarter), UOB’s forward dividend yield comes to 5.1%.

UOB has a dividend yield that’s better than average.

However, the bank’s PE ratio is higher than average while its PB ratio is on par with the mean.

Putting It All Together

Income investors would especially love the banks after the lifting of dividend restrictions by the MAS in July this year.

DBS OCBC UOB

Interim dividend per share for 2019 S$0.30 S$0.25 S$0.55

Interim dividend per share for 2020 S$0.18 S$0.159 S$0.39

Interim dividend per share for 2021 S$0.33 S$0.25 S$0.60

UOB is offering the best dividend yield of 5.1% based on its declared 2021 interim dividend of S$0.60 per share and a projected total final dividend of S$0.75 per share.

OCBC comes next in line at 4.7%, followed by DBS at 3.8%.

It’s also worth noting that the banks’ dividend yields are above Singapore’s long-term average inflation rate of around 2%.

In terms of PE and PB ratios, the banks generally seem to be either fairly valued or overvalued.

The recent Omicron variant is something to watch out for as we look ahead.

A resurgence of virus cases could see us scaling back on our re-opening plans, causing the banks’ share prices to fall further.

Investors who are considering investing in Singapore banks for the long run must be able to stomach this volatility.

What’s Your Take on Singapore Banks?

Check out the community at Seedly and participate in the lively discussion regarding banking stocks and more!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer doesn’t own shares in any companies mentioned.

Advertisement