Digital banks have sprung up in Singapore with the likes of GXS and Trust Bank, which offer no minimum balance and attractive interest rates that accrue daily.

Talk about compound interest!

But what exactly are digital banks? Should you open an account with one?

Read on to find out!

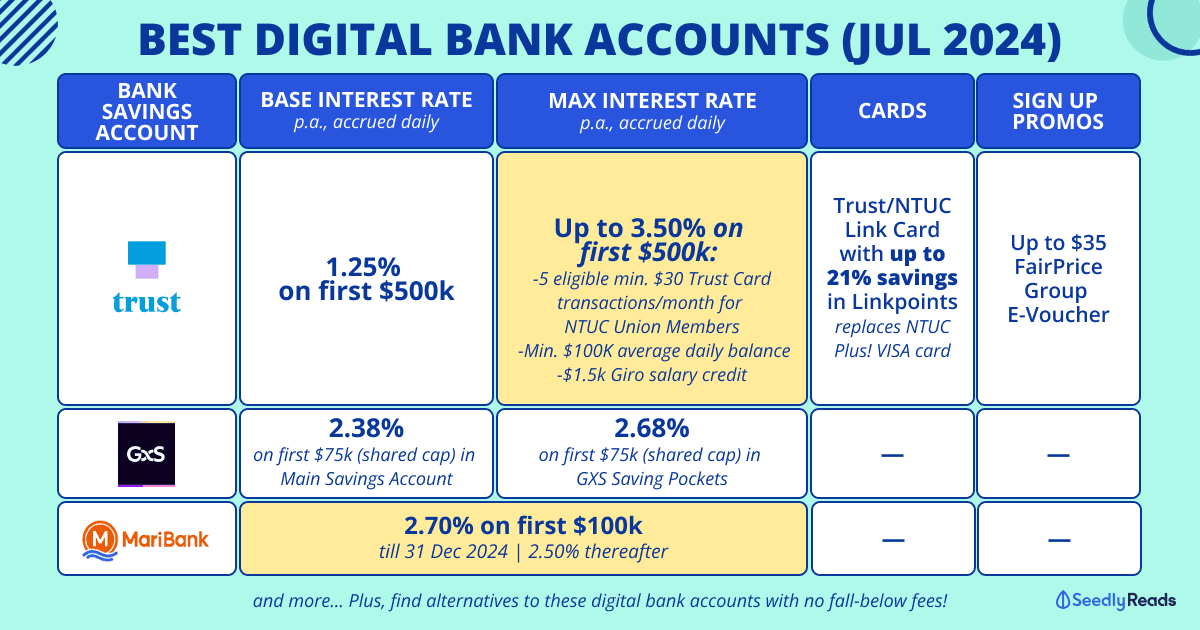

TL;DR: Best Digital Bank Accounts (2024)

| Account | Base interest rate (p.a., accrued daily) | Bonus interest (p.a., accrued daily) |

|---|---|---|

| GXS Savings Account | GXS Main Account: 2.38% for deposits up to $75k | GXS Saving Pockets (up to 8): Up to 2.68% Shared cap with Main account |

| Mari Savings Account | 2.70% till 31 Dec 2024 for deposits up to $100k 2.50% thereafter | — |

| Trust Bank Savings Account | 1.25% for deposits up to $500k 0.05% for deposits above $500k | Up to 3.50% (1) Min. $100k Balance Bonus (Maintain Min. $100k Average Daily Balance (ADB) for the month on first $500k: +0.50% (2) Spend Bonus on First $500k(Make 5 Qualifying Trust Card Transactions of Min. $30 Monthly): NTUC Union Member: +0.50% Non NTUC Union: +1.0% (3) Salary Credit Bonus on First $500k ($1.5k in a single transaction to Trust account through GIRO within the month): +0.75% |

Jump to:

- What is a digital bank?

- Trust Bank

- GXS Bank

- MariBank

- Should You Consider Opening an Account with a Digital Bank?

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised financial advice. Readers should always do their own due diligence and consider their financial goals before committing to any financial product. The article was updated on Wed (24 Jan 2024) to reflect the latest changes to Trust Bank’s cap increases.

What is a Digital Bank? Digital Banks vs Traditional Banks

You might be wondering…

What exactly is a digital bank? Don’t traditional banks like DBS already offer digital banking?

Simply put, digital banks offer the same banking services as traditional banks, except that they operate entirely online. This means there are no physical bank branches, and all your regular bank services will only be available through your smartphone or smart device.

Some services, such as GIRO and cashing in cheques, are unavailable.

On the bright side, digital banks offer perks such as the absence of pesky fees (fall-below fees or monthly fees). Moreover, they often offer attractive interest rates with little to no conditions (minimum salary crediting, for example).

Retail Vs. Wholesale Vs. Full Digital Bank Licenses

When we talk about digital banks, there are two classifications: digital full banks and digital wholesale banks.

For the uninitiated, digital full banks can take deposits from retail customers, while digital wholesale banks generally cater to SMEs and other non-retail segments.

In December 2020, the MAS issued two players a digital full bank license to the GXS Bank (by Grab & Singtel) and the MariBank (by Sea Group).

Singapore’s other digital banks – Anext Bank and Green Link Digital Bank – are wholesale banks that can serve micro, small and medium-sized enterprises and non-retail clients.

On the other hand, there is Trust Bank, another digital bank that operates exclusively online.

However, it possesses a full banking license, which allows it to operate similarly to conventional financial institutions. Two prominent entities, Standard Chartered Bank and FairPrice Group support it.

Are Digital Banks Safe?

Digital banks also have the same deposit protection as traditional banks as they are part of the Singapore Deposit Insurance Corporation’s (SDIC) Deposit Insurance (DI) Scheme.

All full banks and finance companies in Singapore are members of the DI Scheme, except those exempted by the MAS.

Under the DI Scheme, if any member bank or finance company fails, all of your insured deposits with that member are aggregated and insured up to $100,000 by the SDIC.

Your insured deposits are covered under the DI Scheme, so the SDIC will pay you the insured amounts in the event that a digital bank fails.

The digital banks in this article have met all relevant prudential requirements and licensing preconditions before MAS grants them their respective banking licences.

The applications were assessed based on the following:

- The value proposition of the business model, incorporating innovative use of technology to serve customer needs and reach under-served segments;

- Capacity to run a responsible and long-lasting digital banking business;

- Reviews of the business plans and assumptions underpinning their financial projections arising from the impact of COVID-19;

- Expected to establish that they will be profitable based on a five-year financial projection, according to criteria from MAS;

- Growth prospects and other contributions to Singapore’s financial centre.

In other words, your deposits are safe with digital banks as they are meant to be long-term businesses.

Read More:

- Best Savings Accounts Singapore: Which Bank Has The Best Interest Rate?

- Best Fixed Deposit Rates in Singapore: UOB, OCBC, DBS, Maybank & More

Trust Bank

First, let’s talk about Trust Bank, a digital bank backed by Standard Chartered and FairPrice Group.

Everything related to Trust Bank is managed in the “Trust App”, which can be downloaded from the Google Play Store and Apple App Store.

Trust Interest Rate 1 Jun 2024 Increase

This interest rate for the Trust account will be boosted by up to 3.50% from 1 June 2024 onwards.

Trust Bank Savings Account Interest Rates (2024)

| Trust Bank Savings Account | |

|---|---|

| Base interest rate (p.a., accrued daily) | 1 Jun 2024 Onwards: Up to 3.50% 1.25% for deposits up to $500k 0.05% for deposits above $500k |

| Bonus interest (p.a., accrued daily) | 1 Jun 2024 Onwards: Up to 3.50% (1) Min. $100k Balance Bonus (Maintain Min. $100k Average Daily Balance (ADB) for the month on first $500k: +0.50% (2) Spend Bonus on First $500k(Make 5 Qualifying Trust Card Transactions of Min. $30 Monthly): NTUC Union Member: +0.50% Non NTUC Union: +1.0% (3) Salary Credit Bonus on First $500k ($1.5k in a single transaction to Trust account through GIRO within the month): +0.75% |

The interest in your Trust Savings Account is accrued daily and credited at the end of the month.

Trust Bank Savings Account Key Information

Eligibility: Singapore citizen, Singapore permanent resident or foreigner; and 18 years old and above

Minimum initial deposit: None

Minimum monthly balance: None

Maximum deposit amount: N.A.

Ability to use FAST and Paynow: Yes

Ability to withdraw cash: Yes. From Trust / Standard Chartered Bank (SCB) ATMs located across the island and overseas ATMs with Visa enabled.

Trust Bank Cards

Trust Bank offers two cards: the Trust Link card (for everyone) and the NTUC Link card (exclusively for NTUC Union members).

The cards are VISA Signature cards that offer dual functionality as credit and debit cards. They come with no annual fees or foreign transaction fees.

Aside from that, the main selling point of these cards is that they are used to earn NTUC Linkpoints, which grants you up to 21% savings so long as you hit the required minimum spending.

Trust Bank Referral Promo ($10 + $10 FairPrice Group e-Voucher)

From now till 30 Sept 2024:

- Upon the referee’s successful sign-up using the referer’s referral code, both the referer and the referee will receive a $10 FairPrice Group e-Voucher each.

- Apply for a Trust Credit card user and make your first transaction within 90 days of opening to receive another $25 FairPrice Group E-voucher.

GXS Bank

Grab and Singtel founded GXS Bank as one of the first two digital banks to serve retail customers.

Recently, GXS has rolled out the GXS Debit Card, a welcome addition to its banking ecosystem.

GXS Savings Account Interest Rates

GXS Savings Account has a simple 2.38% p.a. base interest rate accrued daily on deposits up to $75,000.

But if you transfer your money into the GXS Saving Pockets, this interest is increased to 2.68% p.a.

GXS Savings Account Key Information

Eligibility: Singapore citizen, Singapore permanent resident, and 16 years old and above

Minimum initial deposit: None

Maximum deposit amount: $75,000

GXS Saving Pockets

In addition to the GXS Main Account, you can set money aside in eight pockets to help you get into the habit of saving.

These pockets are great as you can personalise them to help you visualise your goals better, all while earning 2.68% p.a. on each pocket. If you’re concerned about being locked in, don’t worry; you can instantly transfer money from one pocket to your main account, which you can then transfer out. An important thing to note is that the balance in your pockets shares the same up to $75,000 maximum balance cap with your GXS Main Account.

Pro tip: Keep all your money in your pockets for the extra interest and transfer it to your main account when you need to spend. It’s a slight hassle for an extra 0.3% p.a.

Open GXS Savings Account

Due to GXS’s popularity when it first opened, all GXS Savings Account slots are now full. Register via the GXS app for early access to new slots!

MariBank

![]()

Launched by Sea Group, Maribank is the latest digital bank to hit our shores. Like GXS with the Grab ecosystem, Maribank will greatly benefit those within the Shopee ecosystem.

Maribank Savings Account Interest Rates

Previously the Mari Savings Account interest was 2.88% p.a. on the first $100k till 30 June 2024.

But from 1 July 2024 onwards, the interest rate will be lowered to 2.70% p.a. on the first $100k till 31 December 2024.

Thereafter, the base interest rate would revert to 2.50% p.a..

The interest is accrued daily and calculated based on the previous day’s balance.

Maribank Savings Account Key Information

Eligibility: Singapore citizen, Singapore permanent resident, and 18 years old and above

Minimum initial deposit: None

Maximum deposit amount: $100,000

Ability to use FAST and Paynow: Yes

Mari Savings Account users may also opt to top up their ShopeePay balance.

Maribank Sign Up Promo

You can register for a MariBank account using a valid Singapore mobile number and open a savings account using Singpass Myinfo.

Should You Consider Opening an Account with a Digital Bank?

If you own a savings account with a traditional bank.

The first thing most of us would look at is the interest rates offered. Digital banks currently offer 2.38% to 3.50% p.a. But your options are limited because GXS Bank is not accepting new sign-ups, and you will have to jump through some hoops for Trust Bank. The best fuss-free offering is Maribank with its 2.70% p.a. on the first $100k.

For comparison, here are the realistic interest rates that banks are offering based on our criteria:

All digital banks offer pretty competitive interest rates compared to the realistic interest rates that Seedly has set out.

Alternatively, there is an option from Singlife as well.

Digital Banks vs Singlife Account

Digital banks currently offer 2.38% to 3.50% p.a. But your options are limited because GXS Bank is not accepting new sign-ups, and you will have to jump through some hoops for Trust Bank. The best fuss-free offering is Maribank with its 2.70% p.a. on the first $100k.

In comparison, the Singlife Account is a capital-guaranteed insurance savings plan with no lock-in or fees that offer 3.00% p.a. on the first $10,000 and 1.00% on the next $90,000:

Note: The Singlife Account insurance savings plan is protected under the Policy Owners’ Protection (PPF) Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). The PPF Scheme provides 100% protection for the guaranteed benefits of your life insurance policies, subject to caps where applicable. As the Singlife account is a universal life plan (as stated in the product summary), this puts it under the individual life and voluntary group life policies excluding annuities). According to SDIC, the amount insured (amount deposited) has a guaranteed surrender value at the point of failure that is capped at $100,000. There is also a cap of $500,000 for the aggregated guaranteed sum assured. The coverage is automatic, and no further action is needed from you. You can also check out the SDIC site or the Life Insurance Association (LIA) site for more information about the benefits and caps of the PPF scheme.

You can get 0.5% p.a. bonus interest on the Singlife account by making a net top-up of $800 each month too:

That being said, I personally believe that digital banks are great secondary savings accounts that you can take advantage of.

Why secondary?

Firstly, digital banks are completely online, which is a double-edged sword.

While you can enjoy lower or no fees for using their services, it also means that they are more susceptible to technological issues or cyber-attacks.

There are also other pros and cons that you need to take note of:

| Pros | Cons |

|---|---|

| Interest accrued daily (i.e. interest compounds faster than traditional banks that credits interest monthly) | No physical bank branches. |

| Little to no fees compared to traditional banks | Limited number of ATMs and CDMs. |

| No minimum monthly balance! | Services are maintained online and hence more susceptible to technological issues. |

| 24/7 helplines and support services | |

| More efficient and flexible than traditional banks due to use of technology |

After all, putting all your eggs into one basket is not a good idea.

If you do not own a savings account with a traditional bank

For those who are unbanked or unable to qualify for traditional savings accounts, digital banks are a life-saver as you can now enjoy the perks of banking to grow your savings, maximise your spending with credit cards (responsibly) and take advantage of other financial products!

If you are an NTUC Union member or shop at Fairprice frequently

For NTUC Union members who have been using the OCBC NTUC Plus! Visa Credit Card, applying for the NTUC Link Card is a no-brainer if you want to continue earning Linkpoints and saving when you shop at FairPrice Group (aka NTUC grocery stores and Cheers).

For non-union members who shop at Fairprice, applying for the Trust Link Card is a great option that can also help you save.

Related Articles

Advertisement