We will be covering the Fortitude Budget Live. Refresh this page periodically to stay up to date!

Where are we right now?

- Globally, over 5 million people are infected and 340,000 lives lost

- COVID-19 has disrupted the global economy and we are looking at an unemployment rate that is the highest since the Great Depression

- IMF has predicted that Asia will see zero growth in the year 2020 — this is the worst performance in 60 years

Status on COVID-19 Coronavirus

- There is still the possibility of asymptomatic transmission of the virus

- There is also a chance of the virus evolving

- We have little idea how soon the vaccine will be ready

- Global efforts to control the pandemic is uncoordinated and uneven

What about Singapore?

As a small, open economy, our economic outlook depends heavily on the state of the global economy.

- Singapore’s GDP is expected to shrink due to COVID-19 impact

- Singapore will reopen her economy safely and in three phases guided by public health considerations

TL;DR: The $33 Billion Fortitude Budget

President Halimah Yacob given her in-principle support for the government to draw on past reserves for the support package.

This is the second time Singapore is tapping into her past reserves for her COVID-19 response.

The main focus of the budget is to:

- Protect livelihoods by supporting and helping businesses to adapt and transform

- Support households and community

There will be a bigger contingent sum, the Contingencies Fund (worth $13billion) that is set aside to react swiftly to public health or contingency measures.

Protect Livelihoods by Supporting Businesses

To do this well, businesses need to adapt and transform.

Workers need to adapt and reskill quickly.

Support for businesses will come in 3 fronts:

- Cashflow

- Cost

- Credit

Supporting Businesses: Cashflow

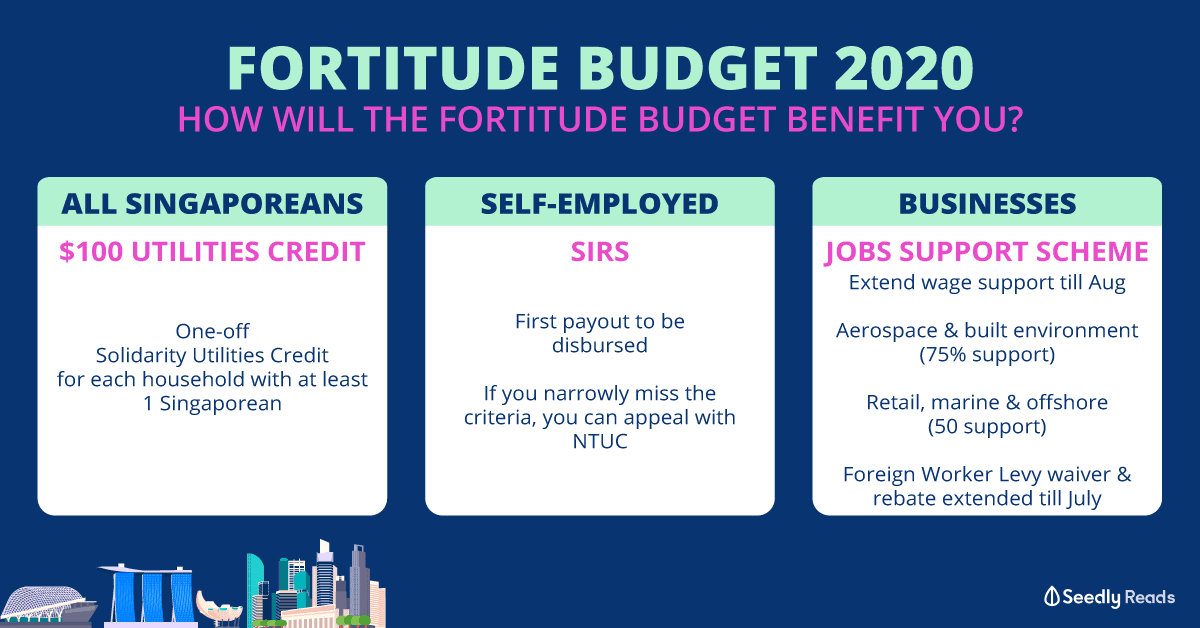

There will be enhancements made to the current Jobs Support Scheme (JSS) payout.

For all eligible firms, there will an additional 1 month of JSS payout.

The wage support scheme will be effectively extended until August 2020.

- This will be computed based on wages paid in August 2020

- The payout will be disbursed in October 2020

For firms that are not allowed to re-open, there will be a 75% wage support until August 2020 or whenever these firms are allowed to re-open (depending on whichever is earlier)

- Gyms and fitness centres are one such example

For companies that are severely affected, there will be an increase in wage support for firms in the following sectors

- 75% for aerospace and built environment

- 50% for retail, marine and offshore sectors

Note: these eligible companies will receive back payment for JSS support, and the first payout will be disbursed in July 2020

Supporting Businesses: Cost

Foreign worker levy waiver and rebate will now be extended too.

- There will be a levy waiver of 100% in June and 50% in July 2020

- And a rebate of $750 in June and $375 in July 2020

CPF contribution rates for SENIOR workers will also be deferred from 1 January 2021 to 1 January 2022.

About $2 billion will be used to offset rental costs of SME tenants.

There will be a new bill to mandate contributions by landlord towards rental waivers to SME tenants that were badly affected.

- This is unprecedented as the Government has decided to intervene in formal contracts to ensure that they are for a common good

- Overall, SMEs will benefit from 4 months worth of rental relief

For commercial tenants and hawkers, there will be 2 more months of rental waver, for a total of 4 and 5 months respectively.

For industrial office and agricultural tenants, there will be 1 month of rental waiver, for a total of 2 months in total.

Supporting Businesses: Credit

To bridge the financing gap, promising startups will receive fundings to sustain:

- There will be $285 million to catalyse and crowd in

- There will be another $285 million or more to match private investments

- SG united Trainee scheme for graduates

Helping Businesses to Transform

While we expect most businesses to resume in July 2020, certain sectors will have difficulty doing so.

The aviation and tourism sectors are such examples.

Companies are encouraged to undergo transformation early, to ensure that they can be adaptable in such difficult times.

Digital Transformation for Businesses

With the advent of COVID-19, digital solutions have now become more important.

$500 million will be used to support businesses in their digital transformation efforts.

- There will be a bonus of $300 per month over 5 months if a business chooses to take up e-payment as a form of digital transformation

- Digital Resilience Bonus: Up to $5,000 to help businesses take their next step towards digitalisation (eg. PayNow Corporate, e-invoicing, e-commerce solutions in the F&B and retail sectors)

Schools and Institutes of Higher Learning

More will be done while leveraging on Artificial Intelligence (AI) and new technologies to build new platforms for home-based learning.

There will also be a National Innovation Challenge launched to support partnerships.

Supporting Singaporeans to Adapt

An adaptable and skilled workforce is essential to power our future.

While the Government cannot save all jobs, it will protect ALL workers.

SGUnited Jobs and Skills Package

This will create close to 100,000 opportunities in jobs, traineeships, and skills training opportunities.

The public sector will take the lead and create 15,000 jobs in public sectors such as early childhood, healthcare, and long-term care — services which are essential to the nation in the long-run.

Government agencies will also work with businesses to create another 25,000 jobs.

Existing capacities in career conversion programmes will also be expanded.

Traineeships

In total, 25,000 traineeship positions will be created in 2020.

With more than 1,000 host companies projected to provide such opportunities to allow Singaporeans to gain relevant industry experience.

There will be 21,000 more SGUnited Traineeship opportunities introduced for local first-time job seekers — these will be offered from 1 June 2020.

The introduction of the SGUnited Mid-career Traineeships Scheme will provide 4,000 traineeships opportunities for unemployed mid-career job seekers.

A new SGUnited Skills Programme will also be set up to provide support for about 30,000 job seekers.

- This programme will be almost fully subsidised with SkillsFuture credits, and there will be

- A training allowance of $1,200 per month (starting July 2020) so that you can focus on your training

Hire Locals Today!

There will be a hiring incentive for employers to hire local workers who have undergone eligible traineeships and upskilling training programmes

- Eligible workers age 40 and above: 40% monthly salary over 6 months, capped at $12,000

- Eligible workers under 40: 20% monthly salary over 6 months, capped at $6,000

Helping Singaporeans Cope with COVID-19

The Temporary Relief Fund that was put in place earlier, provided help for 450,000 people in April.

The Government will now put in another $800 million set aside for COVID-19 Support Grant.

Self-Employed Person Income Relief Scheme (SIRS)

Self-Employed persons eligible for SIRS will receive their first payout of $3,000 this week.

- For those who missed the criteria slightly, you can appeal with NTUC

- For successful applicants, you can expect a reply from NTUC within a month of application

Care and Support Package in Previous Budgets

In previous Budgets, there has been a direct injection of aid for households such as:

- Solidarity Payment of $600 in cash

- GST Voucher Cash payout will also be dispatched in August 2020

Since we are spending more time at home due to Circuit Breaker:

- There will be a one-off $100 Solidarity Utilities Credit for each household with at least 1 Singaporean

Digital Inclusion for Singaporeans

- For students from lower incomes families, MOE will accelerate the timeline for secondary school students to own digital learning device for online learning

- IMDA will launch Seniors Go Digital Movement to help the older generation adopt digital channels

- The Government will launch the Digital Ambassadors movement to help seniors acquire digital skills

Enhance Matching for Donations

The government will partner with the Tote Board to enhance matching for donations.

- Charities can apply for dollar-for-dollar matching on eligible donations raise in FY2020

- $100 million top-ups to Enhanced Fund Raising Programme

- $18 million top-up to Invictus fund

Overall, Singaporeans are looking at the biggest budget provisioned to date, increasing our Overall Budget Deficit for FY2020 to $74.3 billion.

Advertisement