Planning to buy a condo in 2024? Apart from choosing a unit based on your preferences, you’ll need to consider all the finance-related aspects of owning a condo.

It’s not just as simple as just your downpayment + loan repayments.

So here’s all you need to know about financing a condo plus our recommended income needed to comfortably own one!

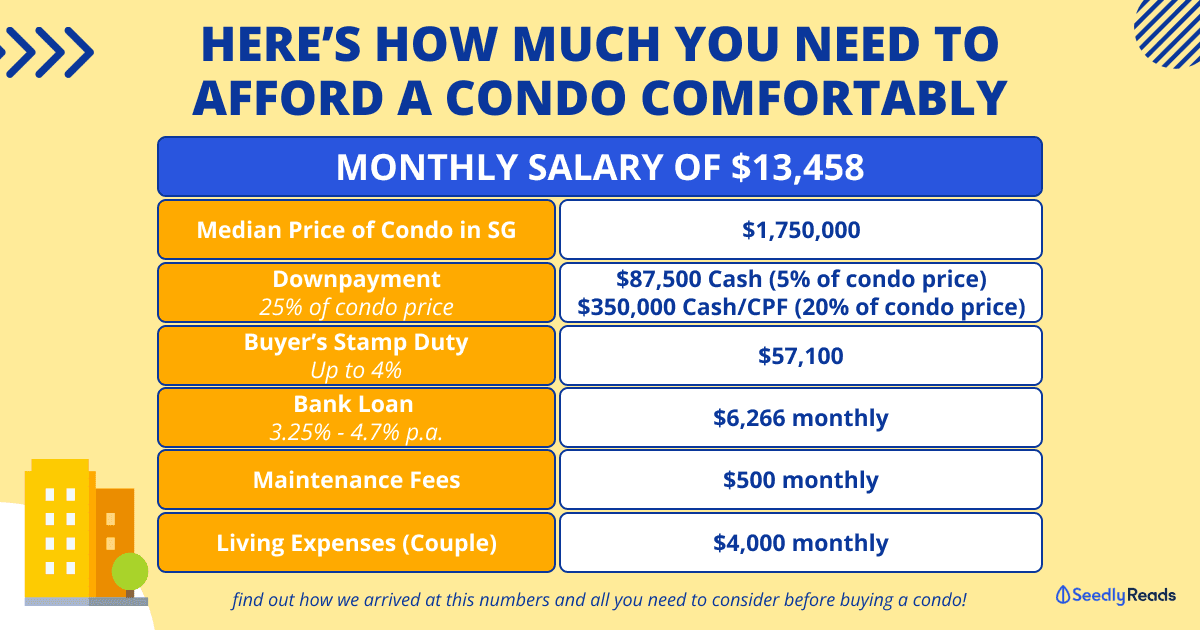

TL;DR: How Much You Need to Earn to Buy A Condo in Singapore (2024)

In This Article

- Median and Average Price of a Condo in Singapore

- How Much Do You Need to Buy a Condo?

- Other Factors To Consider

Median and Average Price of a Condo in Singapore

Before we start getting into prices, it’s important to know that prices will vary based on a multitude of factors. You can’t expect a 1-bedroom condo in Orchard to cost the same as a 1-bedroom in Punggol. That’s why our property market is segmented into three main regions and further segmented into districts followed by projects.

These regions are:

- Core Central Region (CCR)

- Rest of Central Region (RCR)

- Outside Central Region (OCR)

Properties that sit within the CCR are particularly pricey, given these cover Districts 1, 2, 6, 9, 10 and 11 – plus Sentosa and the Downtown Core.

They’re also typically located closer to the MRT and Singapore’s best schools (perfect for kiasu to-be parents!).

How much is a condo in Singapore?

While data is pretty transparent when it comes to the property price index and average/median prices based on market regions or districts, there isn’t very up-to-date information on the overall median price of a condo. So here’s the latest that we could find dated October 2023:

| Amount | |

|---|---|

| Average Price | $1,988,920 |

| Median Price | $1,688,000 |

| Average Price/Sq. Foot | $1,970.99 |

| Average Size (Sq. Foot) | 1,009.09 |

| Average Price/Sq. Metre | $21,215 |

| Average Size (Sq. Metre) | 93.74 |

Source: smartwealth.sg

According to 99.co’s data, the average price of a new 2-bedroom condo in Q4 2023 is as follows:

| New 2-Bedroom Condo | Average Price |

|---|---|

| CCR | $4,080,000 |

| RCR | $2,570,000 |

| OCR | $2,150,000 |

From what I can tell, the “average condo” is most likely a 2 or 3-bedroom condo. You can also see that the average prices are skewing higher.

Since Q3 2024, property prices have increased by 2.8% in Q4 2023. So we’ll round up the median price of condos in Singapore to about $1,750,000 for ease of calculation and a further increase in prices.

You might be wondering why we don’t use the average price of a condo instead. Well, the average can be skewed by sky-high transactions, so the median is a better gauge for condo prices in Singapore.

Disclaimer: Do note that all these figures are ballpark figures. While I try to be as accurate as possible with my research and data, it’s difficult to accommodate everyone. There are too many factors that determine the market value of a property, which is why I went with median prices. All I’m suggesting is that if your (combined) salary is close to the value mentioned, you could be considering a condo as your next property purchase.

How Much Do You Need to Buy a Condo?

You’d like to pay off your condo over 30 years – which is the maximum period allowed to enjoy the full 75% Loan-to-value (LTV) limit.

Aside from downpayment, you’ll also need to pay Buyer’s Stamp Duty (BSD) which cannot be paid by your housing loan. Based on the IRAS calculator, we will be paying an additional $57,100.

Let’s assume a Singaporean couple that has combined monthly expenses of about $4,000.

If you’re wondering how I arrived at this number, I’ve taken data from a cost of living study in 2021 that suggests that the average household member in Singapore needs about $1,600 a month. Multiple that by two and round it up due to inflation and we arrive at $4,000. I’ve also referenced multiple forums such as Reddit and our own Seedly community to determine what would be the average monthly expense.

Not to forget, you will also need to factor in condo maintenance fees which range from around $300 – $700 per month. We will use $500 in maintenance fees in this case.

| Downpayment | Upfront: | $87,500 (5% of total cost) |

| Cash or CPF: | $350,000 (20% of total cost) |

|

| Buyer's Stamp Duty | Cost: | $57,100 |

| Bank Loan | Total Cost: | $1,312,500 (75% of total cost) over 30 years |

| Monthly Repayment: | Around $6,266* (assuming interest rates of 4%) | |

| Maintenance fees | Monthly: | $500 |

| Living expenses (couple) | Monthly: | $4,000 |

| Total Needed | Monthly Salary (after CPF): | $10,766 |

| Monthly Salary (before CPF): | $13,458 (rounded up) |

After all those calculations we arrive at an income of $13,458 to comfortably afford a condo in Singapore before CPF.

This number is also built on the assumption that:

- You don’t funnel a portion of your salary into investments/loans (you really should!)

- You have sufficient savings to fund the 25% downpayment + Buyer’s Stamp Duty

- The interest for your bank loan remains at 3.25~4.70% (it’s greatly dependent on the bank’s fluctuating rates after the fifth year mark)

- The cost of your home insurance policy remains the same – which it won’t.

Insurance companies typically charge a higher premium if you upgrade from an HDB to a condo.

And let’s not forget inflation rates, which the Monetary Authority of Singapore (MAS) tracks by way of the Consumer Price Index, or CPI.

In 2023, Singapore’s CPI rose 4.8% year-on-year.

CPI factors in everything from education and housing to healthcare, so it’s safe to say your monthly expenditure will inevitably go up.

Other Factors To Consider

Do You Meet The Total Debt Servicing Ratio (TDSR)?

TDSR essentially enforces a limit on your debt repayments by pegging it to 60% of your monthly income.

Debt repayments include:

- Personal loans

- Car loans

- Outstanding home loans

So if your take-home is S$8,000 monthly (after the CPF deduction) but your loans come up to S$5,600 — that’d already be 70% of your monthly income.

Your application for a condo would likely be rejected.

Alternatively, you could be asked to place a higher downpayment on your freehold condo.

Loans: Taking A Bank Home Loan

Goodbye, HDB loans and grants.

Unless you’re some kinda Lee Ka-shing, paying off your condo will mean taking a bank loan — which you’ll only get if you’ve a good credit score.

On that, though, bank home loans can only cover 75% of the cost of your property.

That means you’d need to be able to comfortably cover the remaining 25%, further split into the following ratios:

- 5% upfront (in cash)

- 20% (cash or CPF)

Then come bank interest rates, which are really enough to put me off even considering a freehold property.

At present, interest rates for bank loans are around 3.25% to 4.7% annually.

Rates typically go up significantly after the fourth year, though, so be sure to give yourself leeway in case of revised interest rates from your bank.

If you’ve other property loans outstanding, then tough luck – because your bank will only loan you 50% of the cost of your condo.

TL;DR: You’ll need a good credit score to get a bank loan.

Related articles

Advertisement