The streaming video giant delighted investors in January when it announced in its 2020 fourth-quarter earnings update that after years of burning cash, it is finally close to being self-sustainable.

Subscription video on demand (SVOD) as a business had previously been a highly contested topic among investors.

Although there is no denying that there is product-market fit, Netflix has burnt through billions in cash to build original content each year, raising questions about the unit economics of the business model.

But cash-burn may soon be a thing of the pass for the undisputed king of SVOD.

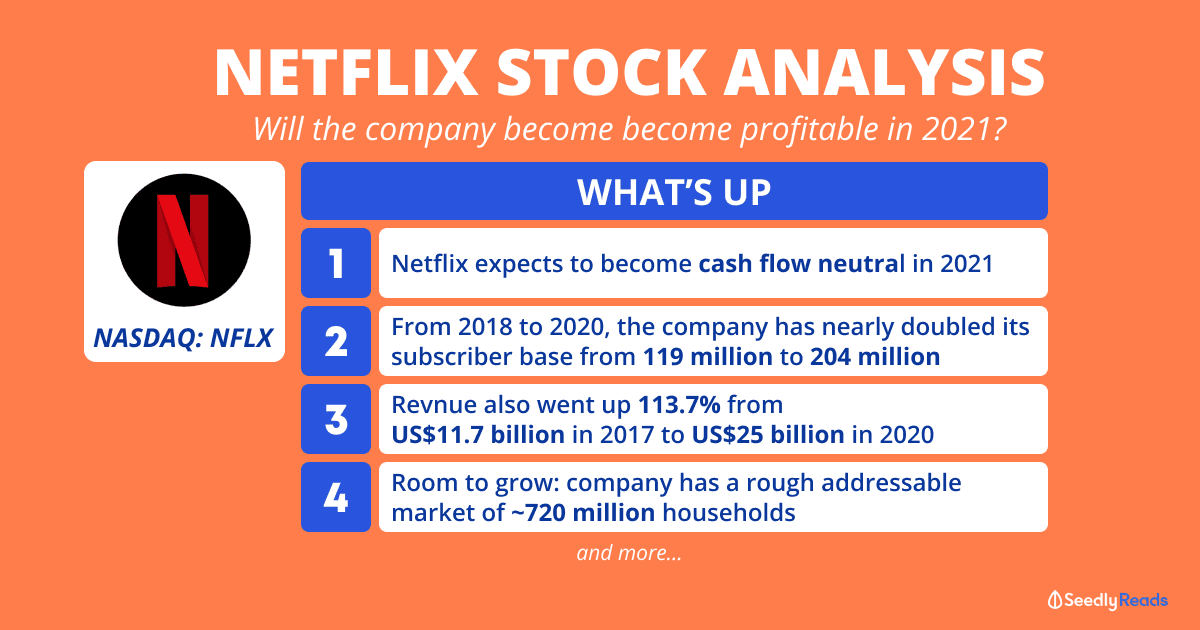

For 2021, Netflix said that it anticipates free cash flow to be around break-even. It is so confident in its ability to be self-sustaining that it plans on repaying some of its bonds and even toyed with the idea of returning cash to shareholders through share buybacks.

Unsurprisingly, Netflix’s optimism was met with enthusiasm from stock market participants. On the day after the announcement of its fourth-quarter results, Netflix’s share price spiked by more than 10%.

So, What’s Driving Netflix’s Change in Fortunes?

The short answer is scale and operating leverage.

From the start of 2018 to the end of 2020, Netflix’s paid memberships have risen from about 119 million to 204 million.

In addition, price hikes have made each member more valuable to Netflix. Its average monthly revenue per member has grown from US$9.88 to US$11.02.

Consequently, Netflix’s revenue has increased by 113.7% from US$11.7 billion in 2017 to US$25 billion in 2020.

At sufficient scale, Netflix can fund its original content production entirely from the cash earned from subscriptions.

In early 2020, I wrote an article titled What Investors Don’t Get About Netflix titled. In it, I explained:

“To improve its free cash flow metric, Netflix needs to spend much less as a percentage of its revenue. And I think its entirely possible that this scenario will play out sooner rather than later. The math is simple.

There is a fixed cost to producing content but the value of the content scales as the user count grows.

For instance, the content that Netflix is producing today can reach its 167 million global subscribers. But as the number of subscribers grows, the content it is producing will reach a larger subscriber base. Put another way, the fixed amount spent on each movie or series will be spread out across a much larger revenue base as user count grows.

Over time, the amount of cash spent on content will take up a much lower percentage of revenue and, in turn, free cash flow should eventually be positive.”

This scenario seems to be playing out exactly as I wrote. Netflix, now with its 204 million members paying monthly subscriptions, can start to internally fund its content production each year.

And It Is Likely to Get Better From Here…

With Netflix hitting this breakeven milestone in its business, the company will likely start to exhibit extremely strong unit economics moving forward.

Put another way, from 2022 onwards, we are likely to see a high free cash flow margin generated from each net member addition.

How much can Netflix potentially earn?

Well, looking at the market opportunity, I believe the company’s annual free cash flow could be in the tens of billions.

With around 1.6 billion television households worldwide and an estimated 45% of those having broadband internet access, Netflix has an addressable market of roughly 720 million households.

If we assume that Netflix manages to penetrate just 50% of that market, it will have 360 million members – or around 155 million more than it reported for the fourth quarter of 2020.

Let’s also assume that Netflix has factored in 20 million new members in 2021, which will bring its free cash flow number to break even.

To be conservative, let’s also say the contribution margin of every subsequent member added is 90%.

Using average revenue per user of US$11, we can calculate that by the time Netflix hits 360 million subscribers, it could potentially be generating US$16 billion* in free cash flow annually. That’s a hefty sum – bear in mind too that I did not even factor in any price hikes.

* Calculated by using 224 million as the breakeven number of members. The equation is (360 million-224 million)*US$11*12*0.9.

Ending Thoughts…

Netflix has long been a highly debated company among investors.

Although it is normal for a young technology company to be burning money, Netflix is far from a young tech startup. Its streaming service has been around for more than a decade and yet it has been lighting up cash for years, raising doubts about the sustainability and unit economics of its business.

But the early criticism from outsiders is starting to look misplaced.

Despite the competition from Disney Plus and other content-giants, Netflix is still the top dog when it comes to SVOD. Steady member growth and low churn speak to that. It’s early (and steady) investments in producing original content are starting to reap the rewards, driving new memberships and increasing the value of its service to existing members.

Netflix’s co-CEO and co-founder, Reed Hasting, perhaps knew it all along. In Netflix’s 2017 fourth-quarter letter to shareholders, a time when it was still burning billions of dollars each year, the company wrote:

“We are increasing operating margins and expect that in the future, a combination of rising operating profits and slowing growth in original content spend will turn our business FCF positive.”

Netflix is one of the modern era’s great examples of how long-term investing pays off. The company was willing to endure years of cash burn and even tapped into the high-interest debt market to fund its growth. But these investments will likely more than pay off in the years to come.

To me, Netflix is a poster child of the benefits of long-term investing, and a shining example for any serious long-term investor to learn from.

The Good Investors

This article first appeared on The Good Investors on 10 February 2021 and is part of a content syndication agreement between The Good Investors and Seedly.

The Good Investors is the personal investing blog of two simple guys, Chong Ser Jing and Jeremy Chia, who are passionate about educating Singaporeans about stock market investing.

If you have any questions about stock investing, why not head over to the Seedly to discuss them with like-minded individuals?

Disclaimer: The information provided by Seedly serves as an educational piece and does not constitute an offer or solicitation to buy or sell any investment product(s). It does not take into account the specific investment objectives, financial situation or particular needs of any person. Readers should always do their own due diligence and consider their financial goals before investing in any investment product(s).