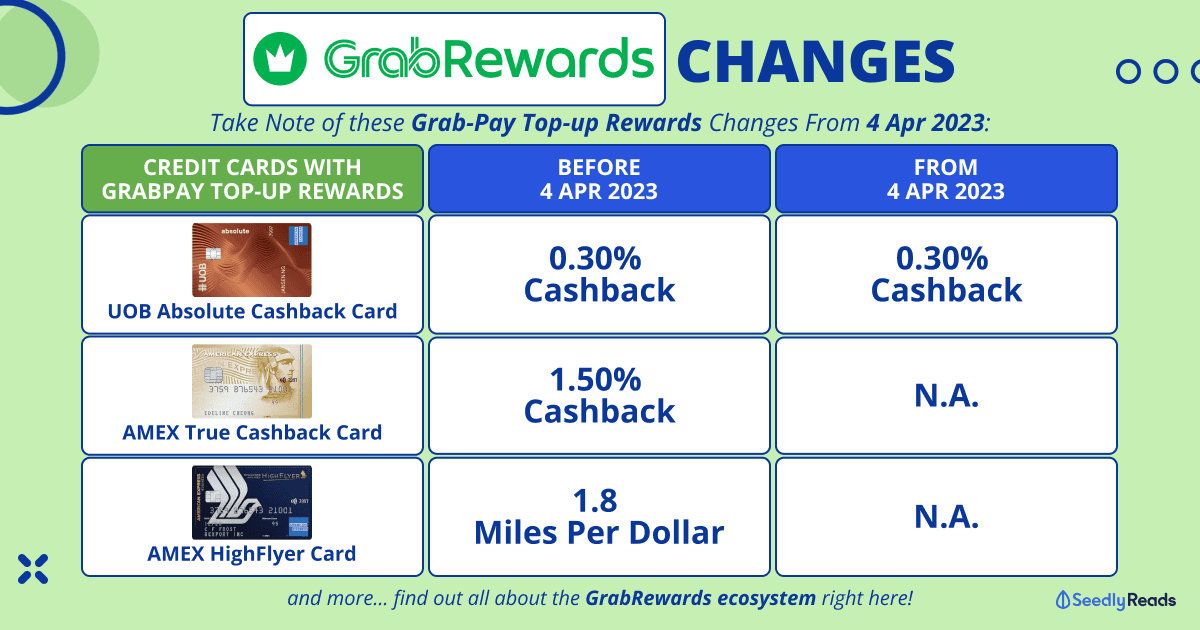

GrabRewards Grab Points Nerf: From 4 Apr 2023, AMEX Will Remove GrabPay Top-up Rewards for AMEX TCB & HighFlyer Cards

●

1 Mar 2023 Update: AMEX to Remove GrabPay Top-ups Rewards For AMEX True Cashback and AMEX HighFlyer Credit Card

If you are a GrabPay user, take note.

American Express (AMEX) will be nerfing the AMEX True Cashback and AMEX Singapore Airlines Business Credit Card (i.e. AMEX HighFlyer Card) from 4 April 2023 as follows:

RIP Grab Pay users…

Here’s what you need to know about the changes.

TL;DR: GrabRewards Grab Points — AMEX GrabPay Changes to AMEX True Cashback Grab Top Up and More

| Credit Cards Offering Rewards for GrabPay Top-Ups | Before 4 Apr 2023 | From 4 Apr 2023 |

|---|---|---|

| UOB Absolute Cashback Card | 0.30% Cashback | 0.30% Cashback |

| AMEX True Cashback Card | 1.50% Cashback | N.A. |

| American Express® Singapore Airlines Business Credit Card (AMEX HighFlyer Card) | 1.8 Miles Per Dollar | N.A. |

Click to Teleport

- Previous GrabRewards Changes

- What is GrabRewards?

- GrabRewards Change #1: 1.2% Back on GrabPay Wallet and PayLater by Grab Transactions

- GrabRewards Change #2: Stand a Chance To Win Up to 25,000 GrabRewards Points on Each Grabpay Wallet Transaction

- GrabRewards Change #3: Only 0.3% Back on GrabPay Card

- Should I Stick With GrabPay?

- Best Credit Card To Top Up GrabPay Wallets

Previous GrabRewards Changes

Sadly, that’s not the only change that happened to GrabRewards.

In August last year, Grab announced would stop awarding GrabRewards Points when you make transactions with your debit or credit cards on the Grab app:

Also announced Grab announced another round of changes to its GrabRewards system in October last year:

What is GrabRewards? Grab Points System Explained

Before we dive into the changes, here’s a little about GrabRewards.

Basically, it is Grab’s loyalty programme that rewards users for making everyday transactions with Grab.

Users can earn GrabRewards points across Grab services, including transport, delivery (food, parcel and grocery) and e-wallet payments across thousands of participating merchants.

GrabRewards Tiers

As a GrabRewards member, you can access certain perks based on your GrabRewards membership tier.

For context, you need to earn this amount of GrabRewards points to unlock each tier:

- Member: 0 points

- Silver: >300 points

- Gold: >1,200 points

- Platinum: >4,500 points.

The earn periods are broken into two parts: [1 January–30 June] and [1 July–31 December]. The total points earned (exclusions apply) before the end of each period [30 June or 31 December] will determine your tier for that period and the six months after.

For example, if you reach 4,500 points on 30 June 2022, you’ll become a Platinum member until 31 December 2022. If you have 3,000 points on 30 June 2022, you’ll be a Gold member until 31 December 2022.

Do GrabRewards Points Expire?

Also, as long as you complete one cashless Grab transaction a month, the validity of all your points extends by six months.

As you progress up the tiers, you will unlock more exclusive rewards and benefits – such as priority bookings for your Grab rides, prioritised customer support, preferential airport lounge dates and more.

How Do You Use GrabPay Points?

In addition, these points can be used to redeem vouchers from the GrabRewards catalogue; you can pay with points to offset your deliveries and in-store payments and take part in exciting season promos and lucky draws. Simply ope up your Grab app to check what you have look forward to.

With that in mind, let’s look at the changes.

GrabRewards Change #1: 1.2% Back on GrabPay Wallet and PayLater by Grab Transactions

The first change involves the GrabRewards points you earn using your GrabPay Wallet, GrabPay Card and PayLater by Grabtransactions.

From now till 13 October 2022, you can still get up to 2% back in GrabRewards points for every $1 spent;

But from 14 October 2022, you will only get up to 1.2% back in GrabRewards points for every $1 spent on:

- Online GrabPay Wallet transactions at Grab’s merchant partners and Grab services (e.g. rides and deliveries)

- PayLater by Grab transactions:

- Postpaid and instalments on Grab services (e.g. rides and deliveries)

- Online and in-store at Grab’s merchant partners.

How Much Are Grab Points Worth?

As these GrabRewards points are worth approximately $0.002 each, you can earn up to 1.2% back ($0.012/$1) on the Platinum tier.

How Many Grab Points Is $1?

Also, this means that 500 Grab points are worth about $1.

GrabRewards Change #2: Stand a Chance To Win Up to 25,000 GrabRewards Points on Each Grabpay Wallet Transaction

The following big change involves GrabPay Wallet transactions.

From now till 13 October 2022, you can still get up to 1.2% back in GrabRewards points for every $1 spent using your GrabPay Wallet at Grab’s in-store merchant partners.

However, from 14 October 2022, instead of that guaranteed 1.2% back per dollar spent, each in-store GrabPay Wallet transaction at Grab’s merchant partners will grant you a chance to win up to 25,000 GrabRewards points:

May the odds be ever in your favour.

GrabRewards Change #3: Only 0.3% Back on GrabPay Card

Last but not least, we have the change to GrabPay Mastercard transactions.

From now till 13 October 2022, you can still get up to 2% back for all eligible GrabPay Card transactions in multiple categories like dining and takeout, travel, streaming, online games, telco bills and more:

But from 14 October 2022, you will only receive 0.3% back in GrabRewards points for every $1 spent on GrabPay Card Food & Beverages (F&B) transactions with the following merchant category codes (MCC):

- 5811 – Caterers

- 5451- Dairy Product Stores

- 5814 – Fast Food Restaurants

- 5812 – Eating Places and Restaurants

- 5462 – Bakeries

- 5813 – Drinking Places (Alcoholic Beverages), Bars, Taverns, Cocktail lounges, Nightclubs and Discotheques

- 5441 – Candy, Nut and Confectionery Stores.

Should I Stick With GrabPay?

So you might think, should you still stick with GrabPay after these changes?

With Grab removing GrabRewards points from Debit/Credit cards in August and this upcoming October nerf, the company is trying to convince you to choose their ecosystem.

But frankly, the October changes have taken the shine off the GrabPay ecosystem as you now have to play a game of chance every time you pay using your GrabPay wallet in-store at Grab’s merchant partners instead of the guaranteed cashback.

The downgrade to the GrabPay Card, where you get only 0.3% back on F&B transactions alone, doesn’t help either.

The saving grace is that you’ll still get confirmed GrabRewards points if you use the GrabPay Wallet online with Grab’s merchant partners and Grab services or their Buy Now Pay Later (BNPL) service, PayLater by Grab.

There’s also some additional cashback to consider.

It turns out there are cards from American Express that offer you cashback or miles on GrabPay wallet top-ups without the fees.

Best Credit Card To Top Up GrabPay Wallets: AMEX True Cashback GrabPay and AMEX HighFlyer Cashback GrabPay Changes

But unfortunately that will be changing too.

From 4 April 2023, American Express will remove rewards for GrabPay top-ups for the AMEX True Cashback Card and AMEX Singapore Airlines Business Credit Card.

AMEX Grab Top Up: AMEX Top Up Grab Cashback After 4 April 2023

This means that from 4 April 2023, you can only get rewards from AMEX for GrabPay top-ups by using the UOB Absolute Cashback Card. But you’ll only get a paltry 0.30% cashback for doing so.

Here are the changes summed up in table form:

| Credit Cards Offering Rewards for GrabPay Top-Ups | Before 4 Apr 2023 | From 4 Apr 2023 |

|---|---|---|

| UOB Absolute Cashback Card | 0.30% Cashback | 0.30% Cashback |

| AMEX True Cashback Card | 1.50% Cashback | N.A. |

| American Express® Singapore Airlines Business Credit Card (AMEX HighFlyer Card) | 1.8 Miles Per Dollar | N.A. |

That’s okay, but I would like to point out that other cashback credit cards like the DBS Live Fresh Card, and the UOB EVOL Card offer anywhere from 5% – 8% cashback if you can hit the minimum spend of $600 a month.

Related Articles

Advertisement