GREAT220: Great Eastern's Short Term Endowment Plan 2019

Great Eastern has yet AGAIN x2 release another short-term endowment plan – Great Eastern GREAT220. (Because they also had one in 2018)

This time with proper information provided on their website, let’s see what’s so great about GREAT220.

Disclaimer: We are not sponsored. All opinions are our own, we just want to help you!

If this is your first time hearing of GREAT220, here’s a mini recap: Great Eastern celebrated their 110th birthday last year and released the SAME short-term endowment plan in commemoration.

Although your Financial Advisor will probably say that the endowment plan this time is different.

They aren’t wrong, it is 3 years this time instead of 5 years from GREAT 270. But seriously, how many of these short-term endowment plans would they like to release in a year?

An Ever-Growing List of GREAT220’s Predecessors

| Plans | When? | Duration | Features |

|---|---|---|---|

| GREAT 205 | Sept 2017 | 3 years | 2.05% p.a. |

| GREAT 205 | Mar 2018 | 3 years | 2.05% p.a. |

| GREAT 270 | May 2018 | 5 years | 2.70% p.a. |

| GREAT 220 | Aug 2018 | 3 years | 2.20% p.a. |

| GREAT 220 | May 2019 | 3 years | 2.20% p.a. |

Note: Only GREAT220 is available from 7 May 2019, the rest are no longer available.

Soon enough, they will be able to match Singapore Savings Bonds‘ (SSBs) rate of issuance. However, it is still debatable if their risk level is comparable to SSBs since the latter is government-backed.

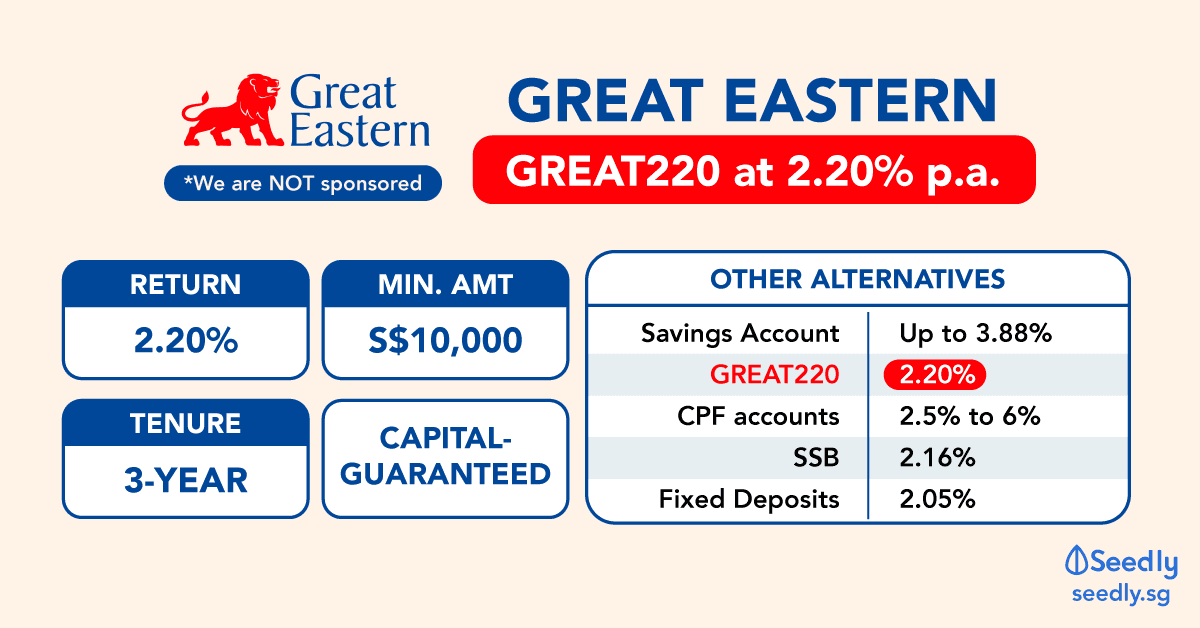

GREAT220’s Benefits At A Glance

- GREAT220 is open for a short period of time depending on their available tranche

- 3-year single premium – consumers will invest a lump sum (one-time premium payment) into the policy which lasts for 3 years

- Pays out a guaranteed interest of 2.20% every year

- Minimum investment of $10K (under 65 years old) – which is not a small amount

It is to be confirmed if you can use the Supplementary Retirement Scheme (SRS).

Here’s A Quick Comparison of GREAT220’s Returns

GREAT220 is a short-term endowment plan that offers moderate returns as illustrated above.

If you have been following Seedly closely, we have listed other investment products with varying risks. Here’s a look at the pros and cons of GREAT220:

Pros of GREAT220

- Capital guaranteed if held till maturity

- You get back 106.6% of your principal sum in total (If you choose to withdraw your interest earn every year)

- Relatively low risk given that they are products of a reputable insurance company

- Breakeven after 2 years (with interest earned)

Cons of GREAT220

- A large sum of money required – minimum S$10,000

- There are early-termination charges – you may lose money if you choose to withdraw your savings from Great Eastern early (before the third year)

GREAT220 In Comparison To Singapore Savings Bonds (SSBs)

A quick look into this month’s SSB at 1.88% p.a. for the third year and it is apparent to everyone that it offers lower interest than GREAT220.

But SSBs are government-backed.

Note: Figures are accurate as at 9 May 2019

Recommended Read: When Should You Choose Fixed Deposits over Singapore Savings Bonds (SSB)?

When should you choose SSBs over Great Eastern’s GREAT220?

- If you require liquidity in less than 3 years, SSBs would suit you better as there is no termination fee for withdrawing early

- If you feel that S$10,000 is a huge amount to park aside for 3 years; the minimum amount for SSBs is S$500

Where Else Can You Put S$10,000 Apart From GREAT220?

If you are not a fan of the huge initial cash outlay or if you are looking for low-risk alternatives to invest your money in, here are some other alternatives, that may or may not have the same return, for you to consider:

| Other Alternatives to GREAT220 | Return over 3 years |

|---|---|

| Singapore Savings Bond (as of May 2019) | 1.88% p.a. |

| Voluntary cash top-up to CPF OA/SA | OA: 2.5% to 3.5% p.a. SA/MA: 4% to 5% p.a. |

| CIMB Fast Saver | 1% p.a. |

| High-Interest Savings Accounts | Up to 3.88% p.a. |

| Other Investment Options | - |

There are no one-size-fits-all financial products, so remember to continuously do your research and find out how each product is able to suit your financial portfolio.

Watch Out For The “Consumer Mentality”

It’s important for us, as consumers, to approach a financial product objectively. This would ensure that we do not fall prey to purchasing something that we don’t need just because they’ve used gimmicky words like:

“Limited Time Only” or “While Stocks Last” ?

Do not feel pressured, or give in to FOMO (Fear Of Missing Out) and take up these policies, just because.

I mean, the rate of release of these short-term endowment plans – not just Great Eastern – is probably more regular than the times my dog tries to run out of the house when the gates are left unattended (read: A LOT).

In fact, AIA also released one called AIA Smart G3, in commemoration of their 100th anniversary in early 2019.

So even if you missed this, we might just see another or an even better one next time!

In short, DON’T buy into something just because you think you will be losing out if you don’t. There are plenty of other financial products around.

Just like every financial product and financial planning, there is no one-size-fits-all solution to your personal finance journey. However, with careful research and continuous learning, you will be able to better plan your finances.

And as always, read all terms and conditions for any policies or investment instruments. Approach a professional (like your trusted financial advisor) to review your portfolio, and clarify clauses and questions which you might have missed out, before making any decision!

Advertisement