Getting your HDB for the first time can be quite an experience. From applying for your unit to getting your house keys, there seems to be an endless amount of information to read up on.

To top it off, an HDB flat is one of the big-ticket purchases for many, and everyone is trying to make a more informed decision to save some bucks:

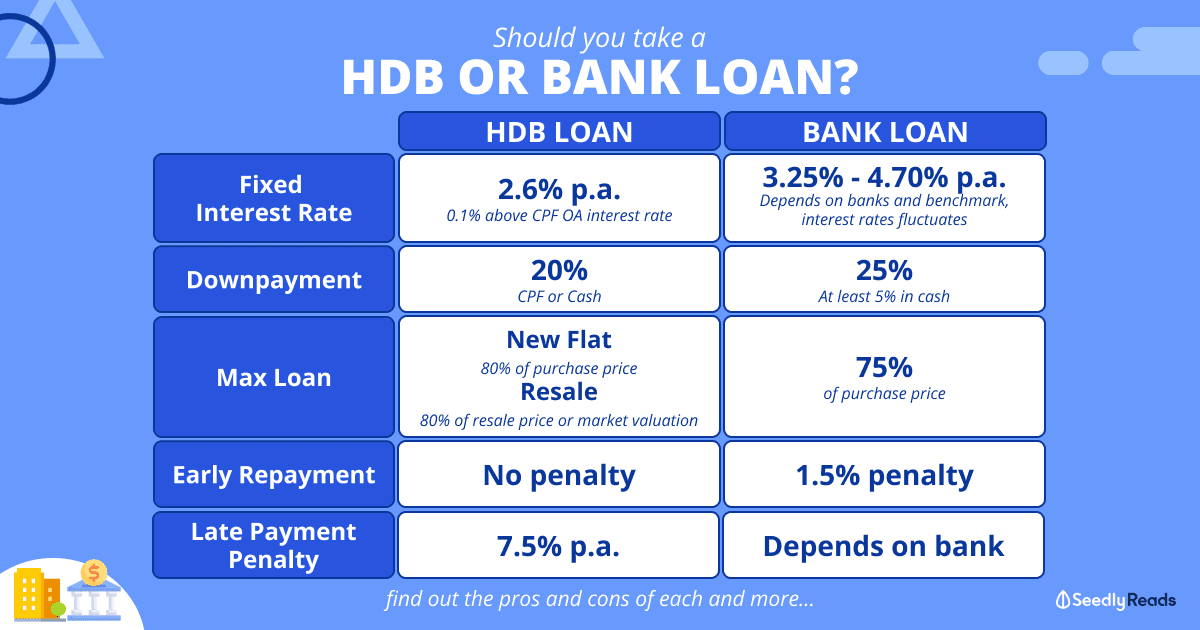

To save you from all the hassle, we’ve summarised all the differences between a Bank Loan and an HDB Loan!

TL;DR: HDB Loan vs Bank Loan – Which Is Better?

HDB Loan | Bank Loan |

|

|---|---|---|

| Interest Rate | Currently 2.6% (0.1% above the CPF Ordinary Account interest rate) | Currently 3.25% - 4.70% (Depends on the bank and benchmark, interest rates fluctuates) |

| Downpayment | 20% in CPF or Cash | At least 5% in cash+ 20% in cash or using CPF OA savings |

| Maximum Loan | New flats: 80% of the purchase price Resale flats: 80% of the resale price or market valuation, whichever is lower | 75% of the purchase price |

| Minimum Loan | None | Usually $100,000 |

| Late Payment Penalty | Currently 7.5% per annum | Depends on individual banks. Usually less lenient than HDB. |

| Eligibility | Income + citizenship requirements | No restrictions, although a bad credit score might hinder your application |

To Be Eligible For HDB Loan

- At least one buyer for the HDB is a Singapore Citizen

- Have not taken two or more housing loans from HDB previously

- Average gross monthly household income is less than $14,000

- Average gross monthly household income is less than $21,000 for extended families

- Average gross monthly household income is less than $7,000 for singles buying a 5-room or smaller resale flat or a 2-room new flat in a non-mature estate

- From mid-2024, HDB flats will be classified as Standard, Plus and Prime flats. Singles will get to have more options. For more info, refer to this article

- Must not own or have disposed of any private residential property in the past 30 months before the date of application for an HDB Loan Eligibility letter

- Maximum one market/hawker stall or commercial/industrial property ownership

* For HDB Loan Eligibility (HLE) applications and flat applications received before 11 September 2019, the income ceilings are $12,000 for families, $18,000 for extended families, and $6,000 for singles. From 9 May 2023, HDB flat buyers will need to obtain an HDB Flat Eligibility (HFE) Letter, which has replaced the HLE letter.

To Be Eligible For Bank Loan

Usually, a good credit score works.

Key Differences Between HDB Loans and Bank Loans

HDB Loans Allow You to Pay Downpayment With Your CPF Money

The downside of an HDB loan is that a minimum 20% downpayment is required. The upside is that you can use your CPF savings in your Ordinary Account to pay that downpayment.

When taking up a bank loan, a 25% downpayment is required. Of which 5% needs to be in cash.

HDB Loans Have Higher Interest Rates Than Bank Loans

HDB loans have a higher interest rate of 2.6%.

The interest rate for HDB loans seldom changes since it is pegged to the interest rate of the CPF Ordinary Account. Banks peg their interest rate to SORA rates which fluctuate frequently.

If you are not a fan of the fluctuation or the uncertainty, an HDB loan is the simpler option to go for.

No Repayment Penalties If You Go for HDB Loans

A good part about taking up an HDB loan is that there is no penalty for paying back the loan early.

This is different when it comes to taking up a Bank loan for your property because the bank ultimately depends on the interest rate to make money! Paying early can result in a prepayment penalty from the bank.

HDB Loans Are More Forgiving

What happens if you fail on your loan repayment for your property?

HDB tends to be more forgiving when it comes to the late repayment of your loan. This is definitely not the case when it comes to the banks where the repercussions of not paying your loan is higher.

Bank vs HDB Loan: Interest Rate, Loan Amount And Other Various Factors

To better illustrate the differences, we decided to test out the calculators that are found on the HDB and various banks’ websites.

For illustration purposes, we assume:

- Cost of new HDB BTO: $300,000

- Age of couple: 28 years old for both

- Repayment period: 25 years

Taking an HDB loan

- Able to loan up to 85 per cent of the cost, at $255,000

- CPF Ordinary Account’s interest rate is fixed at 2.5 per cent for the longest time (Note: you don’t have to wipe out your CPF Ordinary Account!)

- The interest rate of an HDB loan is 0.1 per cent above the CPF Ordinary Account’s interest rate, as of now, the interest rate of an HDB loan is at 2.6 per cent

With the help of the DBS Repayment Calculator, it worked out to be a repayment of $1,157 per month for a 25-year loan.

The loan repayment amount will be $347,057.

This brings the total cost of your HDB flat to $392,057.

Taking A 3-year Fixed Home Loan With DBS

- Able to take a 20-year loan up to 75 per cent of the cost, at $225,000.

- DBS Home Loan’s interest rate is set as (3M SORA + 1% p.a.), and for the first 3 years, it is fixed at 3.75 per cent p.a.

- 3M SORA refers to the 3-Month Compounded Singapore Overnight Rate Average (SORA) that is published on the MAS website. The 3M SORA is 3.6944 per cent per annum (as of 9 Sep 2022).

- We are assuming that the 3M SORA remains constant throughout the loan repayment period.

With this, and rounding up the interest rate thereafter to 4.7 per cent, it works out to a monthly repayment of ~$1,448 per month.

The loan repayment amount will be $347,487.

This brings the total cost of your HDB flat to $422,487.

Total Cost of HDB Loan vs. Bank Loan

Bank loans are more expensive at the time of writing partly due to the US back-to-back interest rate hikes in response to inflation, and this is especially so in 2022 and early 2023.

You may rejoice if you’re trying to invest in fixed deposits, but if you’re looking to borrow, you will definitely feel the pinch.

For more context, this is the US Fed Rate Hikes in 2022 and 2023:

| Date | Targeted Fed Funds Rate | % Change |

|---|---|---|

| 26 Jan 2022 | 0% - 0.25% | +0.25% |

| 16 Mar 2022 | 0.25% - 0.50% | +0.50% |

| 4 May 2022 | 0.75% - 1.00% | +0.75% |

| 15 Jun 2022 | 1.50% - 1.75% | +0.75% |

| 27 Jul 2022 | 2.25% - 2.50% | +0.75% |

| 21 Sep 2022 | 3.00% - 3.25% | +0.75% |

| 2 Nov 2022 | 3.75% - 4.00% | +0.50% |

| 14 Dec 2022 | 4.25% - 4.50% | +0.25% |

| 1 Feb 2023 | 4.50% - 4.75%, | +0.25% |

| 23 Mar 2023 | 4.75% to 5.00% | +0.25% |

| 3 May 2023 | 5.00% to 5.25% | +0.25% |

| 14 Jun 2023 | 5.00% to 5.25% | — |

| Upcoming FOMC meetings | ||

| 25/26 Jul 2023 | 5.25% to 5.50% | +0.25% |

| 19/20 Sep 2023 | — | — |

| 31 Oct/1 Nov 2023 | — | — |

| 12/13 Dec 2023 | — | — |

But whatever that goes up must come down. If you notice, the increase was at 0.25 per cent in 2023 instead of the aggressive increment in 2022.

Could this be a sign that it will dip in the next few announcements?

That said, you might also want to consider refinancing to save you some costs:

Read more: Fed Interest Rate Hikes (June 2023): What Are The Implications For Singapore?

What Is the SORA Interest Rate Benchmark And Why Is It Important?

Currently, most banks are using the SORA interest rate benchmark for their home loans. Amidst rising interest rates, the SORA interest rate has also gone up over the past few months.

Mortgage Repayment Calculator

If you suddenly strike 4D or win the first prize in Toto and make a partial repayment towards the mortgage of your home, you’ll probably want to find out what your remaining mortgage repayment looks like.

All you need are the following details:

- Loan Amount

- Interest rate

- Loan term

Simply plug that into a tool like the DBS Repayment Calculator to calculate the details of your home loan repayment.

What Can Homeowners Do to Refinance?

If you’re a homeowner on a bank loan right now, we know that you might be caught up in this heat.

It’s possibly time to refinance and consider the following:

- Refinance to a fixed-rate loan package instead of a floating one

- Making partial or full repayments in case interest rates rise significantly, using either cash or CPF funds

- To mitigate risk, you might want to consider splitting or refinancing your loans into separate fixed or variable loans, effectively spreading risk across two different portfolios.

- If you’re currently using a SIBOR-linked home loan package, it may be prudent to explore transitioning to a SORA-pegged package. Moreover, banks may potentially withdraw SIBOR-based packages soon as it will no longer be quoted from 2024, which could compel clients to migrate to other available packages and potentially increase their exposure to risk.

Lastly, it’s important to keep in mind that opting for a home loan package solely based on the lowest initial mortgage interest rate may not always be the wisest decision.

While low promotional rates may appear enticing, it’s crucial to assess the full financial implications over the entire duration of the package. The interest rates might experience a significant spike once the promotional period ends, or there could be additional fees and less favourable terms and conditions to consider.

Therefore, it’s prudent to conduct a comprehensive evaluation of the overall costs throughout the package’s lifespan before making a choice.

The Seedly Community’s Take On HDB vs. Bank Loans

Seedly is really blessed and fortunate that we have a helpful Seedly community where members are not selfish with their knowledge!

We conducted a poll on the types of loans our members use for their HDB.

Here’s just a sample of some of the most useful feedback which we collected:

- Rais Bin Mahmud:

HDB loan for convenience and not having to worry in future, due to the uncertainty and possibility of fluctuations in bank loans. - Amy Wang:

Legal fees for HDB Loans are lower too. On top of that, you can choose to end your loan anytime if you wish to (for bank loans it depends on individual banks). - Christopher How:

An interesting point to note will be that future fluctuations are negated because you can refinance to another bank that offers a lower rate. In my case, I switched from OCBC to POSB for a better rate. The only worry comes when your loan is less than 100k. Banks don’t do refinancing for loans below 100k. - Jay Tee:

In my opinion, an HDB loan is always better. If you’re going for BTO, it’s 5% to secure the flat. This is followed by another 5% payment when it comes to collecting the keys.

On the other hand, for Banks, it is usually a 10% payment followed by another 10% when collecting keys. If you reinvest the 10% down payment that you save from taking an HDB loan, you can cover the additional interest rate of HDB loans (especially if you plan to sell your BTO flat within 10 years or so?)

Also, go for the longest HDB loan – this allows you to have more cash on hand to invest and puts you in a better position even if you’re unsure whether you will sell your flat in 10 years. You can always renegotiate for a shorter loan term in future if you do decide to pay off your HDB. - Timothy Tan:

I would take an HDB loan (since a down payment of 10% can be paid with CPF) and after 6 months of payment, I will refinance with other banks for lower interest rates.

Still unsure or need more perspectives? Why not ask your questions on our Seedly Q&A?

If you’re shy, you can even ask anonymously.

Don’t say we bojio!

Related Articles

- Budget 2023 Singapore Summary

- How Will The New HDB Classification (Standard, Prime and Plus) Affect You?

- Ultimate Guide to CPF Interest Rates: Latest Rates, Calculation Methodology & Additional CPF Interest Explained

- Best Home Insurance Singapore (2023) Guide: Lessons Learnt When My Wife Tried to Set Me On Fire

- Singapore Savings Bonds Interest Rate Guide: How Is the Interest Rate for the Singapore Savings Bond (SSB) Determined?

Advertisement