We wrote about the median gross income in 2023, where the median monthly salary of a full-time worker stands at $5,197, including employer CPF.

While it is good to know where you stand regarding your salary, your household income is a better number to look at.

The resident-employed household income measures the combined incomes of all the people living under the same roof with at least one employed person.

It includes every form of income, such as salaries, employer’s CPF wage contributions, and investment returns.

TL;DR: Median Singaporean Household Income Has Risen to $10,869 in 2023

- Household income is the sum of the gross income of all household members.

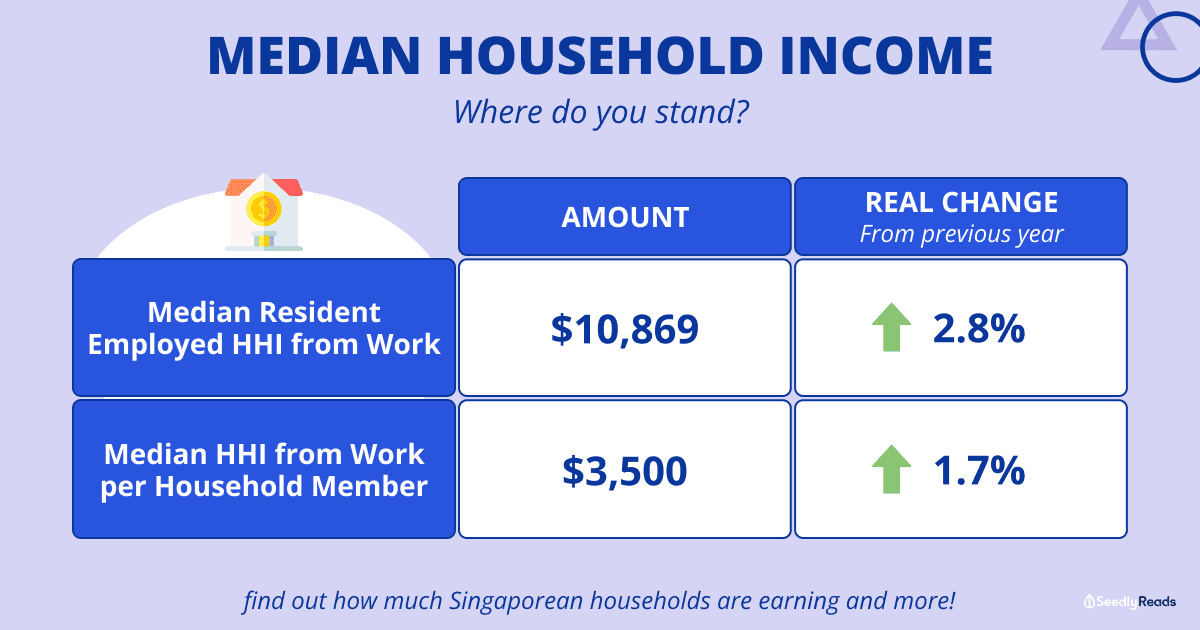

- For households with at least one working person, the median household income for resident-employed households has risen from $10,099 in 2022 to $10,869 in 2023.

- After adjusting for inflation, the median monthly household income from work rose 2.8 per cent in 2023.

- The median household income from work per household member rose from $3,287 in 2022 to $3,500 in 2023.

- After adjusting for inflation, the median monthly household income from work per household member rose 1.7 per cent in 2023.

We usually use the median for better representation since average income is often skewed by top earners.

Median Household Monthly Income

According to the Singapore Department of Statistics, the median household income for resident-employed households is $10,869 in 2023.

It increased from $10,099 in 2022, a 2.8 per cent increase after adjusting for inflation.

An important point to note is that we are talking about household income. This does not necessarily mean a husband and wife’s combined earnings. With Singapore’s ageing population and many working adults still living with their parents well into their 30s, many households also have working children, contributing to these statistics.

Median Household Monthly Income per Person

Examining the median household monthly income alone could be inaccurate since household sizes vary.

As such, another method is to look at the median household income per person.

Household monthly income per person is calculated by dividing the total gross household monthly income by the total number of family members living under one roof.

The median household income from work per household member rose from $3,287 in 2022 to $3,500 in 2023.

This refers to a growth of 1.7 per cent after adjusting for inflation.

Hence, if your household income per member is above $3,500, you are better off than 50% of the households in Singapore.

Average Monthly Household Income from Work Per Household Member Among Resident Employed Households by Deciles, 2023

Singstat noted that some resident employed households in the lowest 10% owned a car (16.0%), employed a domestic worker (14.7%), lived in private property (8.0%) or were with household reference persons aged 65 years andover (36.6%) in 2023. It is also important to recognise that not all households are consistently in the same decile group from one year to the next.

Census of Population 2020 Household Income

For those of us who want a more detailed view of household incomes, here is the latest data available based on the Census of Population 2020:

| Monthly Resident Employed Household Income from Work ($) | Percentage of Resident Employed Households |

|---|---|

| Below 1,000 | 2.27% |

| 1,000 - 1,999 | 5.93% |

| 2,000 - 2,999 | 5.83% |

| 3,000 - 3,999 | 6.23% |

| 4,000 - 4,999 | 5.94% |

| 5,000 - 5,999 | 6.18% |

| 6,000 - 6,999 | 5.77% |

| 7,000 - 7,999 | 5.56% |

| 8,000 - 8,999 | 5.28% |

| 9,000 - 9,999 | 5.02% |

| 10,000 - 10,999 | 4.63% |

| 11,000 - 11,999 | 4.13% |

| 12,000 - 12,999 | 3.69% |

| 13,000 - 13,999 | 3.45% |

| 14,000 - 14,999 | 2.99% |

| 15,000 - 17,499 | 6.46% |

| 17,500 - 19,999 | 4.63% |

| 20,000 & Over | 16.01% |

Source: Department of Statistics Singapore

What Does It Mean for You?

” It is what you do with your income that matters.”

Falling below the median for household income does not necessarily mean you are poor.

In fact, we know of more Singaporeans who are poor despite earning a higher income.

This is because, with an increased salary, people often start spending more due to lifestyle inflation.

It is, therefore, more essential to take a look at your savings rate instead.

Ideally, as our income increases, your savings rate should increase as well.

We should ultimately aim to have an increase in expenses lesser than the increase in income.

What Can You Do About It?

If you fall below the median household income, here are some ways to not let it get in your way:

- Get proper insurance coverage so that your financial safety net will be there to safeguard your own savings.

- Household income includes every form of income, including investment gains. One can look to increase his household income through investments.

- Simple things such as getting the best savings account for that extra interest rate can help you in the long run.

- Married couples can look to come out with a possible budgeting formula to help them save better for their household. Here’s one of the methods we wrote about which can help a couple save an extra S$120,000!

- Another life hack for Singaporeans would be using free course credits to upgrade your knowledge and skills, which could accelerate your earning power.

- Set your own personal finance goals and know what you’re working towards and what you’re working hard for.

And of course, don’t forget to get all the free deals on Seedly Rewards to maximise your savings… 😉

Related Articles

Advertisement