How to Invest: A Singaporean’s Guide To Investing for Beginners

Sudhan P

Sudhan P●

Personal finance involves managing your Income, Spending, Insurance, Savings, and Investments.

If you are reading this now, you are probably looking to invest to grow your money.

With the core inflation rate at 1.51% in Singapore on average, investing sounds more attractive than the meager 0.05% interest earned in your savings account.

Are You Ready to Invest?

You are if you check all these points!

- Have paid off high-interest debt

- Have enough insurance coverage

- Have spare cash (i.e after accounting for 6 months of emergency funds)

- Have an investing horizon of 5 years or more

- Ready to do your own due diligence and research

You may have stumbled upon some financial blogs online.

Or you may have read some of Seedly’s blog posts and feel inspired to start investing.

Regardless of how promising a certain investment may sound…

Always, ALWAYS do your own due diligence.

If that wasn’t clear enough, YOU NEED TO FULLY UNDERSTAND WHAT YOU ARE INVESTING IN.

Once you’ve done all the research, you are then ready to invest and get returns higher than the inflation rate (and even more)!

And you shouldn’t procrastinate and put off investing for another time (which may never come).

First Things First: How To Open A CDP Account & Choose A Brokerage?

Before we even talk about what to invest in.

You need a CDP and brokerage account for most of the investments that I’ll be talking about.

Learn what a CDP account is and how to open your own CDP account.

We’ll even help you to figure out which is the best online brokerage to use.

- CDP vs Custodian Account? Which Should I Use and Why?

- Ultimate Cheatsheet: Cheapest Stock Trading/ Brokerage House In Singapore

- Cheapest Online Brokerages in Singapore Compared: IBKR vs moomoo vs Tiger Brokers vs uSmart

- How to Use a Broker: A Step-by-Step Guide to Investing Terms Explained for Dummies

- Real User Reviews On Online Brokerage

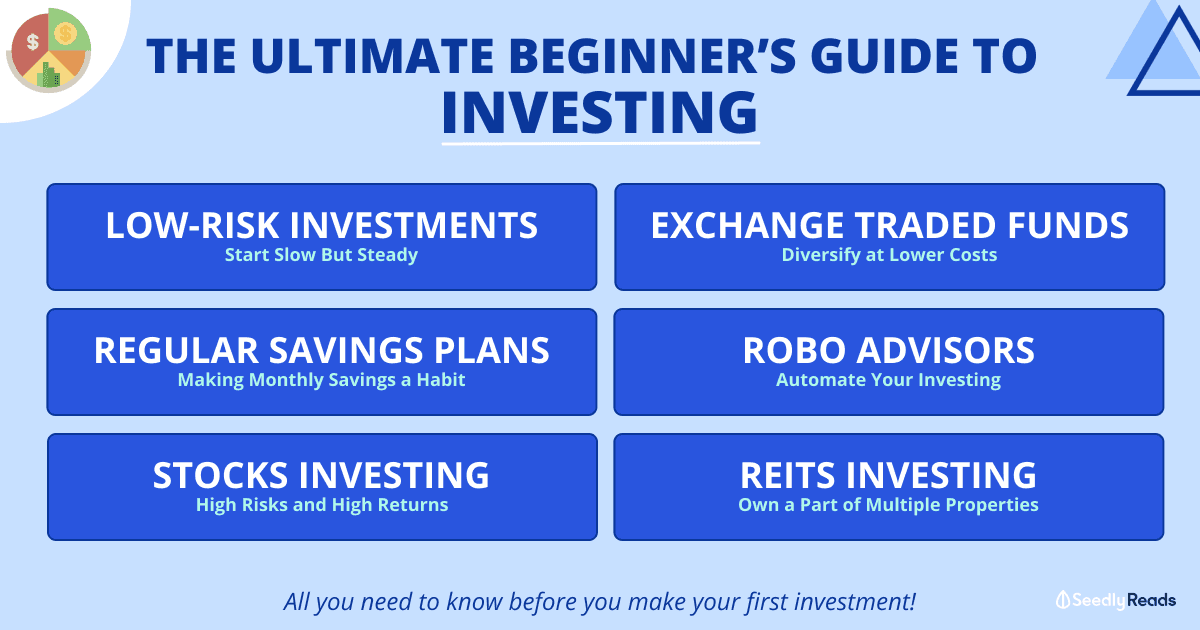

TL;DR: A Singaporean’s Guide To Investing for Beginners

Click on me to go to the relevant section!

Guide to Low-Risk Investments

For: Low risk; Individuals who are risk-averse and want high liquidity.

If you want virtually risk-free investments backed by the Singapore government:

- Guide to Singapore Savings Bond (SSB) and How to Buy – decade-long bond with flexible redemption and decent interest

- Guide to Treasury Bills (T-Bills) and How to Buy – six-month or one-year treasury bills with typically higher interest than SSB but less liquidity

- Guide to Singapore Government Securities (SGS) Bonds and How to Buy – bonds with varying tenors

Here are other low-risk investments that you can consider:

Guide to Exchange Traded Funds

For: Medium risk; Individuals who want to diversify at lower costs.

An Exchange Traded Fund (ETF) usually tracks an index or a pool of many companies.

Investing in an ETF gives you a small stake in many different companies and is more cost-effective than investing in 30 different companies individually.

- A Beginner’s Guide On How To Invest in ETFs in Singapore

- ETFs in Singapore (SGX): What Investors Should Know

- How To Choose The Right Exchange Traded Fund (ETF) To Invest In?

- STI ETF: A Simple Way To Invest In Singapore’s Top 30 Companies

- Best U.S. ETFs

- A Dummies Guide To Investing In Ireland-Domiciled S&P 500 ETFs

- Popular ETFs Listed in Hong Kong

- The Ultimate Compilation of Exchange-Traded Funds (ETFs)

Guide to Regular Savings Plan

For: Medium risk; Individuals who want to cultivate the habit of investing monthly.

A regular savings plan or regular shares savings plan (RSSP) is an investment plan that allows you to invest a small and fixed amount of money (as low as S$50) into a particular investment product on a monthly basis.

- Working Adults: Easiest Ways To Invest A Monthly Sum For Beginners

- Which Regular Shares Savings (RSS) Plan Is The Cheapest? DBS vs OCBC vs PhillipCapital

Guide to Robo Advisors

For: Medium risk; Individuals who want to cultivate the habit of investing monthly.

Robo advisors are digital platforms that provide investment services with little to no human supervision. They usually invest in instruments like ETFs, unit trusts (or mutual funds), and bonds.

They will help to build and manage your investment portfolio based on your risk profile and investment goals in a low-cost and passive manner.

- A Dummy’s Guide to Investing in Robo Advisors

- Best Robo Advisors Comparison Guide: Stashaway vs Syfe vs Endowus & More

- Best Digital Wealth Management Services: SaxoWealthCare vs Endowus vs MoneyOwl

- Robo-Advisor vs Financial Advisor: Which Is Better?

- Robo Advisors Singapore: 6 Reasons Why You Should Invest With Robos And 3 Reasons Why You Should Not

- Robo Advisors Returns Revealed: StashAway, Endowus, Syfe, Kristal.AI and More!

Guide to Stocks Investing

For: High Risk; Individuals who are risk-seeking and want more than just to beat inflation.

Common Myth: “High Risk, High Returns”?

Truth: High Risks ≠ High Returns.

Higher risks can POTENTIALLY give you higher returns, but know that it is not always an equal sign. The potential for upside returns is also the potential for downside returns.

Be prepared that your capital can turn to zero if the company goes bust. But of course, if it goes well, your initial capital can also grow to a lot more.

What Are Stocks?

Stocks (also known as shares or equities) are a type of investment available on the stock market that gives you part ownership of a listed company.

To know about the various jargon used in the stock market, here’s a “What Is” compilation just for you.

On that page, you can know what the various terms such as “dividend yield”, “P/E ratio” and “market capitalisation” mean.

Different Categories of Investing

There are three main types of stocks: value stocks, growth stocks, and dividend stocks? What do they mean and which is suitable for you?

- Dividend Stocks vs Growth Stocks vs Value Stocks: Which Is the Best Investment Strategy for You?

- New to Investing? Here Are The Best Investing Strategies You Need to Learn Before Investing

Once you have learnt the basic terms of investing and the different categories of investors out there, you would want to look into the language of business, which is accounting.

You now need to know how to analyse financial statements to pick stocks.

How To Read Financial Statements

The first step to understanding a stock? Learning how to read their financial statements. Here is a walk-through of the 3 financial statements, simplified with explanations using a fictitious company, Seedly Chicken Rice!

Reading Company Annual Reports

A company’s annual report is like a student’s report card.

It has information about the company, such as its business profile, the management team, and its financial statements.

Investors need to know how to read an annual report to make informed decisions about the company they have part-ownership in.

How to Make the Most out of Annual General Meetings

Companies hold their annual general meetings (AGMs) once every financial year. Attending AGMs is one of the ways for shareholders to evaluate the management of a company, an important aspect when it comes to stock-picking.

How To Read Financial Ratios

The “What Is” compilation comes in handy for you here again to understand the various financial ratios.

- Profit Margin, Dividend Yield & ROE, ROA, ROIC

- P/B, P/E ratios & Quick Ratio, D/E Ratio, Interest Coverage Ratio

- Value Investing: 5 Things To Look Out For In A Company

Picking the Best Stocks

Now that you know the basics, let’s learn how to pick individual stocks for your portfolio.

The following guides will help you to pick the best stocks listed on the stock market:

- The Ultimate Beginner’s Guide to Picking Your First Stock

- Here’s How You Can Pick Great Stocks Just Like Warren Buffett

- Economic Moats Explained: What to Look out for When Investing in Companies

- Here’s How to Pick Strong Dividend Companies That Can Survive Recessions

- Investing Cheat Sheet: How To Pick the Best Technology Stocks To Invest In

- Want to Discover Great Stocks? Here Are 7 of the Best Free Stock Screeners to Try in 2020

For those who want to be introduced to some of the companies available in the Singapore stock market, you can start off with the Straits Times Index (STI).

The STI is home to 30 of the largest and most liquid companies in Singapore, such as CapitaLand, DBS, and Singapore Airlines.

Here’s an introduction to each of the index stocks in just 60 seconds!

We also have in-depth analyses and guides on non-STI and overseas stocks as well:

- The Ultimate Singaporean Guide To Investing In FAANG Stocks (Facebook, Amazon, Apple, Netflix, and Google)

- A Singaporean Guide to Buying US Stocks With the Cheapest Brokerages

If you are thirsty for more investing knowledge, you can check out these 10 investing books!

Guide to Real Estate Investment Trusts (REITs)

For: High Risk; Individuals who are risk-seeking and want to receive good distribution yields.

REITs basically pool money from investors to invest in a portfolio of income-generating real estate assets.

Here’s everything you need to know about REITs and choosing the best ones:

- Working Adults: Guide to REITs Investing in Singapore

- Understanding REITs Better: What Makes Up a Typical REIT Structure?

- REIT Jargon 101: Commonly-Used Terms That REIT Investors Must Know

- Cheat Sheet: How to Pick the Best Singapore REITs to Invest In

- REIT ETFs: The Ultimate Singaporean Guide to Investing in ‘Em

- Seedly REITs Tool: A FREE One-Stop Resource to Help You Invest in REITs

Guide to Alternative Investments, Including Cryptocurrencies

Some of these investments (such as P2P lending and cryptocurrencies) can be very risky. So do bear that in mind before investing in them.

- P2P Lending Platforms Comparison

- A Singaporean’s Guide: How To Invest In Gold

- Guide to Commodity Investing

- Are Luxury Branded Watches a Good Investment?

When it comes to cryptocurrencies, MAS strongly discourages investing in cryptocurrencies and has deemed that they are not suitable investments for the public.

But for those of you who are still keen, here are some helpful guides:

- Cryptocurrencies: Here’s Everything You Need To Know

- A Beginner’s Guide: How to Buy Bitcoin And Other Cryptocurrencies in Singapore

- Crypto Cold Wallet Guide: Here’s How To Store Your Cryptocurrency Safely

Strengthening the Investor Mindset

Investing is all about the long-term.

You should be disciplined and stay the course during market volatility, which is a norm when it comes to investing.

Most importantly, you need to have a sound investment strategy. Here are some useful articles to help you out:

- How Much Investment Risk Should You Take as You Grow Older?

- Practical Tips on Investing During the Stock Market Volatility

- Here’s How to Invest Well over the Long-Term (Includes Views from Warren Buffett)

- 3 Warren Buffett Quotes To Keep Us Sane During the Current Stock Market Crash

- How to 6X an Investment Portfolio: Lessons From How Temasek Invests

- $12,000 Dividend Per Year: Here’s How Much You Need To Invest!

- Budget 2023 Singapore Summary

Have Burning Questions Surrounding Investments?

Why not check out our community on Seedly and participate in the lively discussion about all things money!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the companies mentioned.

Read More

Advertisement