Are You Self-Employed? Don't Miss Out On Your Income Tax or CPF Contribution!

In Singapore, we have 0.2 million freelancers as of 2017, and they don’t usually use the term ‘freelancer’ but instead ‘self-employed’.

So if you fall into any of the jobs below, THIS ONE IS FOR YOU

- Tutors

- Insurance Agents

- Property Agents

- Private Hire Drivers

- Photographers or Videographers

- Social Media Influencers

- Designers

(This list is not exhaustive)

Forgive me for generalising, we try to be as comprehensive as possible to guide self-employed persons with their personal finance. Tweak the characteristics and make judgements if the following is still the best option for you.

Read also: Behind the Scenes: Sales – Insurance Industry. Is this for me?

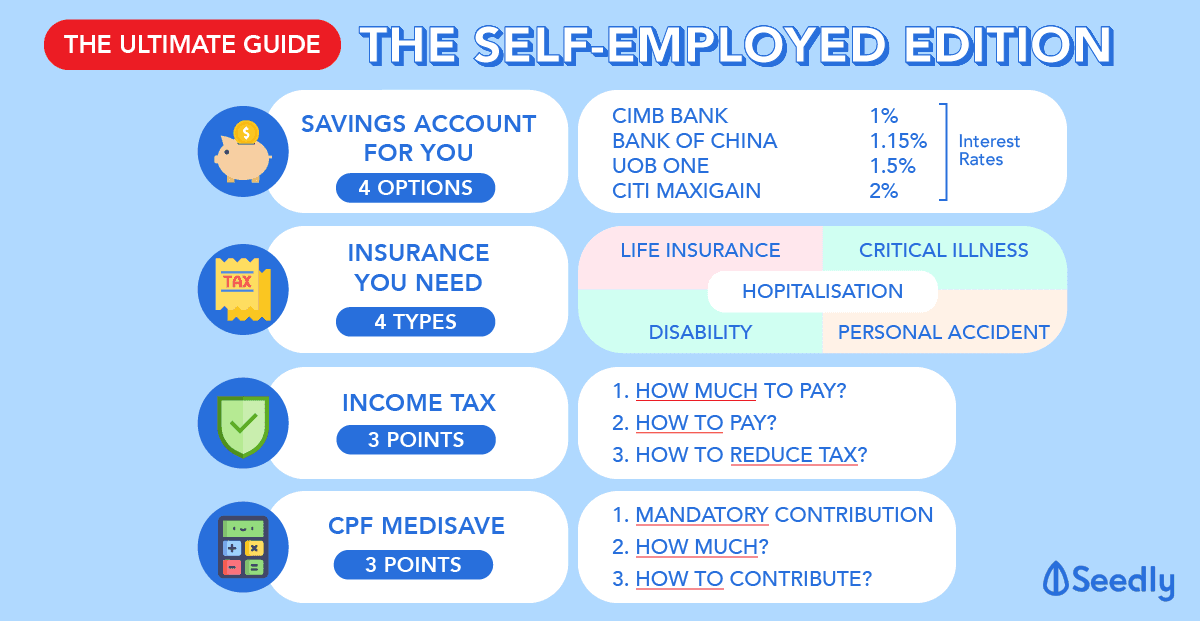

Here we will go through everything personal finance for the Self-Employed:

- Savings Account

- Insurance

- Income Tax

- CPF Contributions

Disclaimer: This post is not sponsored, all opinions are our own and any links out of Seedly are not affiliate links. ?

1. Savings Account for the Self-Employed

“I get paid via bank transfer/cheque, how?”

Because as a freelancer you often face:

- An irregular stream of income

- Being unable to credit your income via GIRO into your bank with the transaction reference codes of “SAL” or “PAY”

“Which savings account would be good for me?”

There are two types of savings account for you:

- Savings account with no condition

- Savings account with conditions that do not include salary crediting

Best Savings Account With No Condition – CIMB Bank

Based on our research, CIMB Bank offers the highest interest on your savings with absolutely NO CONDITION. So if you are still holding onto your POSBkids or first ever savings account, you are losing out so much in interest!

| CIMB FastSaver | |

|---|---|

| First S$50,000 | 1% |

| Above S$50,000 | 0.60% |

Best High-Interest Yielding Savings Account

After looking at the best savings account available, there are a few banks that offer a higher interest (more than 1%) without salary crediting, such as:

| Banks | Conditions | Interest Rate |

|---|---|---|

| Bank of China | • Card spend of at least S$500 and • 3 bills of at least S$30 | 1.15% |

| UOB ONE | • Card spend of at least S$500 | 1.5% |

| Citi MaxiGain Savings | • S$10,000 lump sum on account opening • Increase your account balance at the end of each month • For more details, click here. | 2% |

2. Insurance for the Self-Employed

Since you don’t have medical benefits from your company, insurance is essential to protect you and your source of income. Your needs will differ from a salaried staff.

A quick summary from the list of insurance a working adult needs:

| Insurance | Level of Importance | Why should you get it? |

|---|---|---|

| Health Insurance | High | • To protect your savings from the expensive healthcare |

| Life Insurance | High | • If you have dependants (parents, siblings, children etc.) that relies on you and your income for a living. |

| Critical Illness | Mid | • If anything, you would not be able to work, thus, this is for you and your family to cope by while you recover from with your illness. |

| Disability | Mid | • To still provide a source of income to your family/dependants through your recovery. |

| Personal Accident | Mid | • If your job requires you to move around a lot • To compensate you to seek aid for your injury • To compensate for the days you are unable to work due to your injury |

Now that we have found ways for you to maximise your income or savings. We will be talking about the expenses we hoped it would never reach us.

3. IRAS: Income Tax for the Self-Employed

Don’t forget to pay your taxes!

When will you be required to pay income tax?

- Once your income exceeds S$20,000 in a year

How can I reduce my income tax?

- Reduce your income tax by declaring your business expenses

- Reduce your income tax by topping up your CPF

Just to name a few. For more details on income tax and how to reduce them with tax reliefs here.

How to Pay Your Income Tax?

- GIRO

Online Application (Instant) / GIRO Form (3 weeks processing time) - iBanking

- AXS / SAM station

- DBS PayLah!

If you are unable to pay your tax in one lump sum, IRAS allows you to stagger your income tax payable over a stretch of 12 months, with no interest. This applies to everyone as well.

More ways available here. The community had also shared with us what the best way is to make your income tax payment.

4. CPF Contributions to your Medisave as a Self-Employed Person

It is easy to forget that you have to make contributions as a self-employed person. But don’t worry if you forget, the government will remind you. ?

When will you be required to contribute to Medisave?

- Earned more than S$6,000 in your annual Net Trade Income (NTI)

*NTI – gross trade income minus all allowable business expenses

How much do you have to contribute to Medisave?

- 4% ++ of your NTI

*Depending on your age and NTI - Use this calculator that CPF made to calculate your contribution.

For example, in 2017,

- If you earned S$30,000

- Aged 28

- Your Medisave contribution payable would be S$2,400

How do you contribute to your CPF Medisave?

There are 3 ways:

- e-Cashier at the CPF website;

- AXS / SAM stations;

- 12 monthly GIRO instalments.

GIRO allows you to stagger your CPF payment throughout the next 12 months, just by filling up the GIRO form.

LASTLY, MANAGE YOUR EXPENSES!

Why should you manage your expenses?

- Your income isn’t regular

- High income tax payable when you have more months with higher income than the remaining months

- With so much money on hand, it is always easy to spend it away.

The golden rule to allocate your salary goes by percentage, so it does apply for you as a self-employed working adult.

- 50% expenses

- 30% investment

- 20% savings

Just a golden rule for you to gauge with, do make some tweaks to cater to your current needs. Use an expense tracker if you need to!

Advertisement