Singapore Savings Bond (SSB) Sep 2024 Interest Rate Projections

Are you wondering whether you should invest in the current month’s Singapore Savings Bond (SSB) or wait for next month’s SSB for potentially higher interest rates?

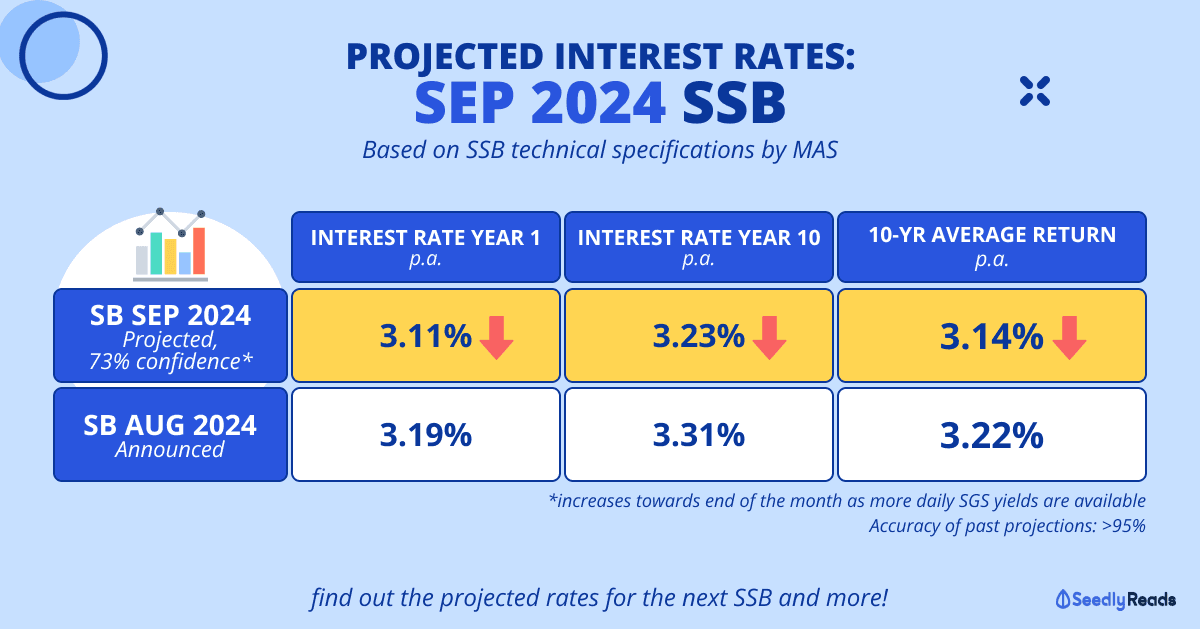

Thanks to SSB technical specifications by the Money Authority of Singapore (MAS) and some really complicated mathematics done by user “@hwckhs” from I Love SSB, we can actually predict with high accuracy what next month’s SSB interest rate will be!

TL;DR: Singapore Savings Bond 2024 August Interest Rate Projection Guide

Subscribe to the current issue (SBAUG24) of SSBs, as the next issue is very likely to have a lower interest rate! SSB (SBAUG24) will close for applications on Friday (26 July) at 9pm!

| Interest Rate Year 1 p.a. |

Interest Rate Year 10 p.a. |

10-Year Average Return p.a. |

|

| SBSEP2024 (Projected) |

3.11% | 3.23% | 3.14% |

| SBAUG2024 (Announced) |

3.19% | 3.31% | 3.22% |

Jump to:

- What Is Next Month’s SSB Interest Rate Projection?

- Is The SSB Interest Rate Projection Accurate?

- How Can I Use The Projections To My Advantage?

What Is Next Month’s Singapore Saving Bond Interest Rate Projection?

For the next SSB, the 10-year average return for the September 2024 SSB is projected to be 3.14% p.a., with interest rates from 3.11% p.a. (year 1) to 3.23% p.a. (year 10).

Singapore Savings Bond Yield

As of the time of writing, the confidence level is at 78%. This is because confidence increases towards the end of the month as more daily SGS yields become available.

The latest daily SGS yield is considered to be on 23 July 2024.

Disclaimer: These rates are projected by I Love SSB using SSB technical specifications given by MAS. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their due diligence and consider their financial goals before investing in any investment product. Note that the information is accurate as of 24 June 2024.

Is the Singapore SSB Rates Projection Accurate?

You might wonder, how do we get these figures, and are the projections even accurate?

As mentioned, SSB technical specifications by MAS allow us to make these projections. However, as the math is complicated for the average person to understand, we’ll trust the results instead.

I Love SSB has done past SSB interest rate projections, and so far, they have all seen an accuracy rate above 95%!

The website even backtested data from 2015 onwards to further prove that the results are fairly accurate.

Here are some past projections:

As you can tell, the 10-year average return is pretty much on the money, while the other numbers aren’t too far off either!

How Can I Use the Singapore Bonds Interest Rate Projections to My Advantage?

Now that we can project future SSB interest rates, here’s how you can use that information to your advantage!

For starters, if you have a sum of money that you want to invest in Singapore Savings Bonds but have yet to do so, you may wait for the following month if it has a higher projected interest.

On the other hand, if interest is projected to be lower in the following month, quickly subscribe to the current SSB issue!

For seasoned SSB investors with previous allotments, you may use these projections to start a bond ladder.

You’ll essentially redeem an earlier SSB issue and reinvest it into a high-yielding SSB for more interest.

Read More: How To Redeem Singapore Savings Bond (2024)

For those of us who want to see detailed calculations of how much more interest you would earn, here is a calculator by I Love SSB that you can use to see how much more interest you would earn:

Related Articles

Advertisement