As Singaporeans, we would likely be familiar with Temasek, a state-owned investment company.

The firm is known for its strong track record of success. Since its inception in 1974, it has grown its global portfolio at a rate of about 14% per annum from S$354 million in 1974 to S$389 billion for the financial year ending 31 March 2024.

Temasek invests locally and internationally in diverse sectors, such as financial services, telecommunications, technology, healthcare, and consumer goods. The firm’s investments supplement Singapore’s annual Budget through the Net Investment Returns Contribution (NIRC) framework. For context, Temasek is one of three entities that are part of the Net Investment Returns (NIR) framework, the other two being GIC and the Monetary Authority of Singapore.

Through the NIR, the Singapore Government is able to spend up to 50% of the expected long-term real returns generated from the net assets managed by investment entities to support Singaporeans, with the NIRC estimated to be S$23.5 billion in Financial Year (FY) 2023 or about 20% of Singapore’s budget.

As such, Singaporeans need to understand how Temasek is doing. That said, let’s examine the firm’s portfolio performance in 2024.

TL;DR: Temasek’s Portfolio Performance in 2024 (FY2023-24)

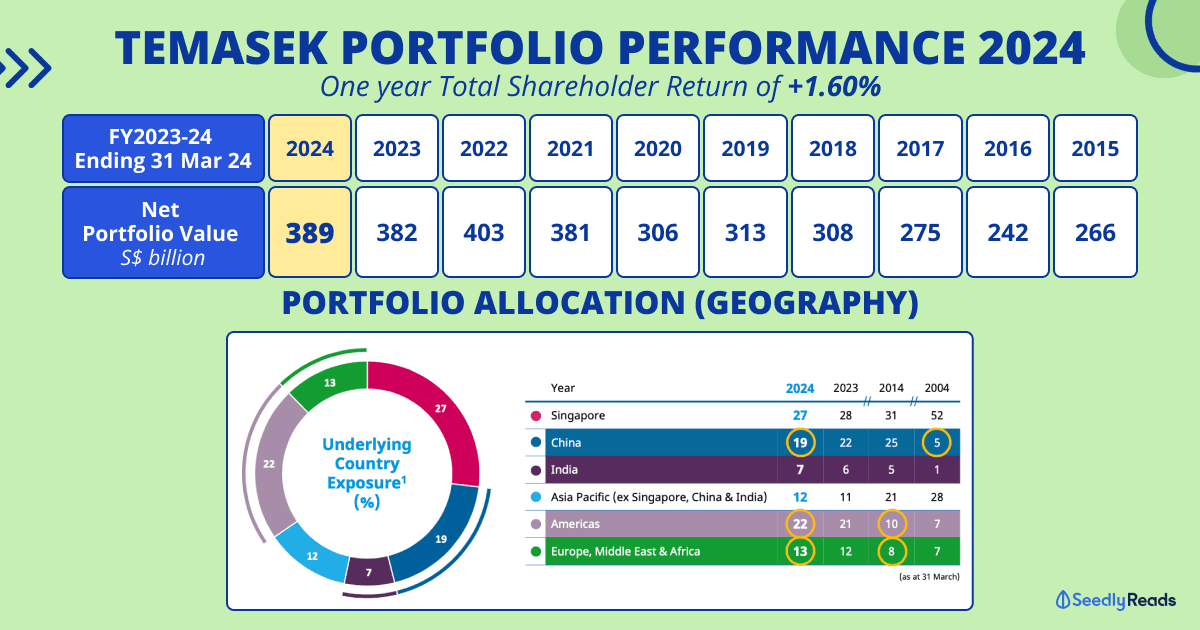

Temasek announced that it closed the financial year ended 31 March 2024 (FY2023-24) with a Net Portfolio Value (NPV) of S$389 billion. This is an increase of S$7 billion when compared to Temasek’s portfolio in FY2022-23. Temasek’s Mark-to-Market Net Portfolio Value, which includes a S$31 billion mark-to-market uplift from unlisted assets, reached S$420 billion, an increase of S$9 billion from the previous year.

Additionally, the firm had a one-year Total Shareholder Return (TSR) of +1.60%. with the 20-year TSR remaining steady at 7%, while the 10-year TSR was 6%.

Click to Teleport:

Temasek’s Portfolio Performance in 2024 (FY2023-24)

First, let’s look at how Temasek’s portfolio has performed.

Temasek’s Net Portfolio Value of S$389 Billion for the Year 2024 (FY2023-24)

Temasek announced that it closed the financial year ended 31 March 2024 (FY2023-24) with a Net Portfolio Value (NPV) of S$389 billion. This is an increase of S$9 billion when compared to the firm’s portfolio in FY2022-23:

Temasek’s Mark to Market Net Portfolio Value of S$420 Billion for the Year 2024 (FY2023-24)

Temasek has begun reporting its unlisted portfolio on a Mark to Market (MTM) basis with Ms Png Chin Yee, Chief Financial Officer, Temasek explaining that:

“The share of unlisted assets in our portfolio has grown from 20% in 2004 to 52% today. Over the decade, our unlisted assets have generated returns of 9% per annum, outperforming our overall portfolio and adding to the resilience of our long-term returns. While we have reported our unlisted portfolio on a book value less impairment basis, moving forward, reporting ourportfolio value on a mark to market basis would be more in line with our peers.”

FYI: According to Investopedia, Mark to market (MTM) is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities. MTM aims to provide a realistic appraisal of an institution’s or company’s current financial situation based on current market conditions. In trading and investing, certain securities, such as futures and mutual funds, are also marked to market to show the current market value of these investments.

Adjusting the valuation of the firm’s unlisted portfolio to reflect current market prices would result in a value increase of S$31 billion, bringing Temasek’s MTM Net Present Value (NPV) to S$420 billion, a S$9 billion rise from the previous year’s MTM NPV. This growth was primarily driven by the firm’s investment returns in the US and India, partially offset by the poor performance of China’s capital markets.

Temasek’s unlisted portfolio has consistently expanded, growing from 20% in 2004 to 52% as of March 31, 2024. Given this increased exposure, valuing the firm’s unlisted assets at market value aligns more closely with industry standards. Therefore, the firm has adopted this market practice in our reporting this year and has presented the MTM NPV for FY22 and FY23 on the same basis for consistency:

Temasek’s Investments/Divestments and Returns Over the Years

It has also invested S$328 billion during the decade, including S$26 billion in investments, S$33 billion in divestments and S$7 billion in net divestments this year:

Temasek maintained a cautious but steady investment pace amidst global economic uncertainties. The firm invested S$26 billion into opportunities in sectors such as technology, financial services, sustainability, consumer, and healthcare, aligning with the four structural trends of Digitisation, Sustainable Living, Future of Consumption, and Longer Lifespans. Excluding Singapore, the US remained the leading destination for Temasek’s capital, followed by India and Europe. Additionally, the firm increased its investment activities in Japan.

Temasek divested S$33 billion for the year, with approximately S$10 billion resulting from the redemption of capital by Singapore Airlines and Pavilion Energy for their mandatory convertible bonds and preferential shares, respectively. Overall, Temasek had a net divestment of S$7 billion, compared to a net investment of S$4 billion the previous year.

Temasek’s Long Term Returns

Temasek had a One-year Total Shareholder Return (TSR) of +1.60% to shareholder as its NPV went up from S$382 billion to S$389 billion:

For more context on this performance:

- The TSR since 1974 was an annualised return of 14%.

- The 20-year return to shareholder stood at 7%.

- The 10-year return to shareholder stood at 6%.

In the long term, performance in the long term has still remained steady:

What Does Temasek’s Portfolio Look Like in the Year 2024?

If you are wondering how we can learn to invest like Temasek, let’s examine the firm’s portfolio allocation to understand how it diversifies its investments.

Temasek’s stable longer-term returns have continued to be supported by the active reshaping of its portfolio, which spans various geographies, asset classes, and focus sectors. Since establishing its first offices in Asia in 2004, Temasek has benefited from its exposure to China during the first decade. In the following decade, it opened offices in New York and London, significantly increasing its exposure to the Americas, Europe, the Middle East, and Africa (EMEA), from 18% in 2014 to 35% in 2024. Temasek’s performance over the decade was enhanced by higher returns from the US and India, though it was impacted by China’s market performance over the last three years. Overall, its portfolio exposure remains primarily anchored in Asia.

Temasek Portfolio Allocation by Geography

Geographically, Temasek allocated more of its portfolio to Singapore and China by 1% and 3%, respectively. The firm also increased exposure to India, Asia Pacific (ex Singapore, China & India), the Americas, Europe, the Middle East & Africa by 1% across the board.

There are also changes to the portfolio in terms of sector allocation.

Here’s how Temasek’s portfolio allocation has changed over the years:

Please note that Temasek is not a sovereign wealth fund or a fund. It is a state-owned investment company and a provider of catalytic capital.

If you are keen to find out how Temasek’s portfolio did in FY 2022-23, we have attached our year 2023 coverage below.

Recap: Temasek’s Portfolio Performance 2023 (FY2022-2023)

Temasek announced that it closed the financial year ended 31 March 2023 with a Net Portfolio Value (NPV) of S$382 billion. This is a decrease of S$21 billion when compared to Temasek’s portfolio in the year 2022.

Here are some takeaways from this announcement in the year 2023.

Temasek’s Portfolio Value of S$382 Billion for the Year 2023

Temasek ended the year with a net portfolio value (NPV) of S$382 billion. This is a decrease from the net portfolio value of S$403 billion in the year 2022.

It has also invested S$326 billion during the decade, including S$31 billion worth of investments and S$27 billion worth of divestments this year.

Temasek had a One-year Total Shareholder Return (TSR) of -5.07% to shareholder.

For more context on this performance,

- The Total Shareholder Return since the year 1974, was an annualised return of 14%.

- The 20-year return to shareholder stood at 9%.

- The 10-year return to shareholder stood at 6%.

Do note that TSR takes into account all dividends distributed to the shareholder, less any capital injections.

What Does Temasek’s Portfolio Look Like in the Year 2023?

In case you are wondering how we can learn to invest like Temasek, let us take a look at Temasek’s portfolio to understand what did Temasek invest in and what are some of the changes they have made.

Geographically, Temasek increased their investment in Singapore by 1% while reducing their portfolio allocation in Asia (ex Singapore and China) by 1%.

There are also changes to the portfolio, in terms of sector allocation.

Here’s a comparison of the sector allocation of Temasek’s portfolio in the year 2020, 2021, 2022, and 2023.

| Temasek's Portfolio by Sector | 2020 | 2021 | 2022 | 2023 | Difference between 2022 and 2023 |

|---|---|---|---|---|---|

| Financial Services | 23 | 24 | 23 | 21 | Decrease by 2% |

| Telecommunications, Media and Technology | 21 | 21 | 18 | 17 | Decrease by 1% |

| Transportation and Industrials | 18 | 19 | 22 | 23 | Increase by 1% |

| Consumer and Real Estate | 17 | 14 | 15 | 16 | Increase by 1% |

| Life Sciences and Agri-Food | 8 | 10 | 9 | 9 | No change |

| Multi-Sector Funds | 8 | 8 | 8 | 8 | No change |

| Others (including credit) | 5 | 4 | 5 | 6 | Increase by 1% |

Read More

Advertisement