How Can the Workfare Income Supplement (WIS) Scheme Help Me Build My CPF Savings?

●

The Government has rolled out several initiatives in a bid to keep its citizens afloat during this economic crisis.

We’ve seen four different budgets rolled out in a span of a few months last year (Unity Budget 2020, Resilience Budget 2020, Solidarity Budget 2020, Fortitude Budget 2020), and also an added support of $8 billion to continue supporting workers and jobs when the pandemic was at its worst.

During the speech made by DPM Heng, he also mentioned that more workers will be eligible for the Workfare Special Payment, which was previously only available for those on the Workfare Income Supplement (WIS) Scheme.

With my friend recently getting a letter notifying her of this payout, I decided to take a look at what this scheme was about, and how it could help us Singaporeans.

What is the Workfare Income Supplement (WIS) Scheme?

Workfare was introduced mainly to help Singaporean workers with earnings at the bottom 20% percentile, with some support for those slightly above this range.

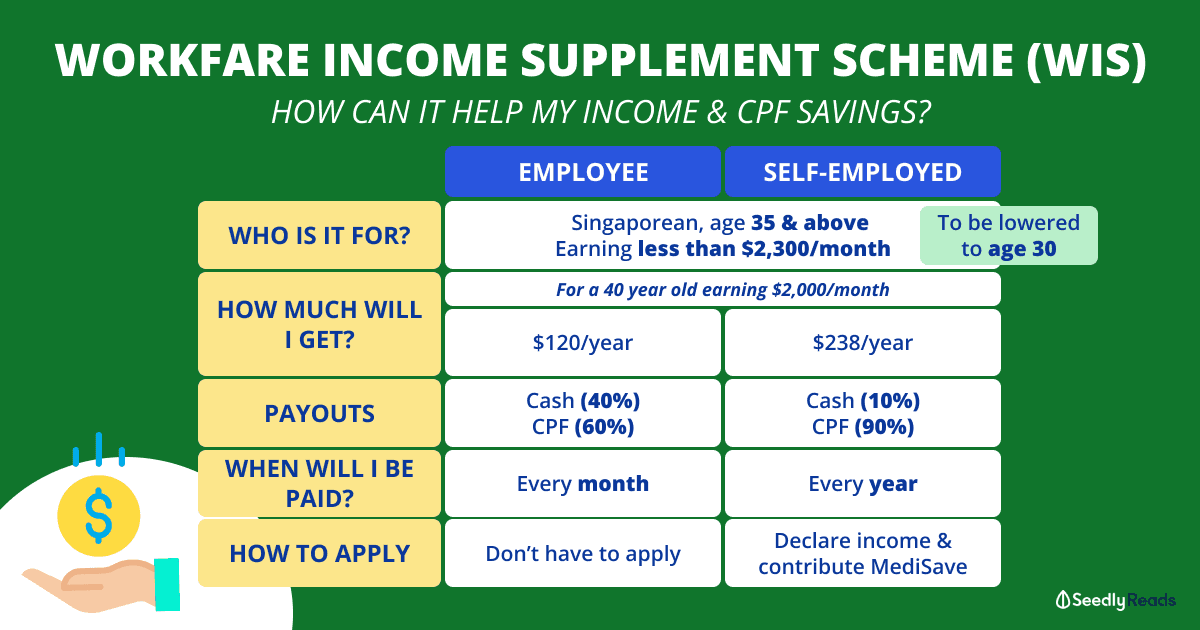

The Workfare Income Supplement (WIS) scheme was implemented to help eligible individuals in building up their income and CPF savings.

It offers payouts in forms of cash and Medisave top-ups to help in them growing their savings for retirement, housing and healthcare needs.

How Do I Qualify?

With effect from 1 Jan 2020, the eligibility criteria for the WIS Scheme have been widened to accommodate more workers.

During the recent National Day Rally, Prime Minister Lee Hsien Loong also mentioned that the qualifying age will be lowered from 35 to 30 years old to help younger low-wage workers.

As an Employee / Self-Employed Individual

If you’re an employee or self-employed, you must be:

- A Singapore Citizen

- 35 years old or above on 31 December of the work year (to be lowered to 30 years old)

- Earn an average monthly income of not more than $2,300 for the month worked (raised from $2,000); and

- Declared your net trade income and made MediSave contributions

(Net trade income refers to the gross trade income minus all allowable business expenses, capital allowances and trade losses)

Do note that the calculations are based on the average gross monthly income for the past 12 months.

To receive WIS by 30 April each year, the income has to be declared (along with MediSave contributions) by the last Friday of March.

Also, all persons with disabilities would qualify for WIS.

I Cannot Qualify If I:

- Live in a property with an annual value of more than $13,000 (assessed as at 31 December of the preceding year);

- Own two or more properties; or

- If married:

- Me and my spouse together own two or more properties; or

- the assessable income of my spouse for the preceding Year of Assessment exceeds $70,000

How Much Will I Get?

As an Employee

You’ll receive the payout as 40% in cash and 60% in CPF.

Cash will be deposited into your bank or sent as a cheque if you do not have a bank account.

(Payment of cheque will take 2 weeks longer than bank crediting)

The maximum annual WIS you can get as an employee:

| Age | Maximum Annual WIS |

|---|---|

| 35* – 44 | $1,700 |

| 45 – 54 | $2,500 |

| 55 – 59 | $3,300 |

| ≥ 60 | $4,000 |

* Includes persons with disabilities who are below 35

The annual WIS would vary depending on your income, and can be calculated with this nifty calculator.

As a Self-Employed Individual

You’ll receive the payout as 10% in cash and 90% in CPF.

Similarly, cash will be deposited into your bank or sent as a cheque if you do not have a bank account.

(Payment of cheque will take 2 weeks longer than bank crediting)

The maximum annual WIS you can get as a self-employed individual:

| Age | Maximum Annual WIS |

|---|---|

| 35* – 44 | $1,133 |

| 45 – 54 | $1,667 |

| 55 – 59 | $2,200 |

| ≥ 60 | $2,667 |

The actual WIS amount to be received can be calculated with this calculator.

When Will I Be Paid?

As an employee, you will receive WIS every month.

The payment dates are as follows:

| If you worked in | You will receive the WIS payout in |

|---|---|

| Jan | End Mar |

| Feb | End Apr |

| Mar | End May |

| Apr | End Jun |

| Month x | End of month (x + 2) |

As a self-employed individual, you will receive WIS once a year for work done in the preceding year.

If you declare your income and make MediSave contribution by last Friday of March, you will receive your WIS payment in end-April.

How Do I Apply for WIS?

As an Employee

You do not have to apply as you’ll be automatically enrolled in the system if you’re eligible.

Your WIS eligibility will be assessed based on your employer’s contributions.

If you’re earning more than $50 per month, it is mandatory for the employer to contribute to the employee’s CPF.

This includes the employee working on a permanent, part-time, contract or casual basis.

As a Self-Employed Individual

You have to declare your income to:

- IRAS if you have been issued an income tax return package; or

- CPFB at any Singapore Post branch if you have not been issued the income tax return package

You also have to make required MediSave contributions, which can be calculated with the WIS calculator.

How Much Do I Have To Contribute To MediSave?

Self-employed and not sure how much you need to top up to MediSave?

Besides using the calculator, the Workfare portal allows a convenient way to check the amount required.

Simply login into the portal with your Singpass and check on the WIS Medisave Amount to Top-up.

How Is This Related To the Workfare Skills Support (WSS) Scheme?

Eligible individuals will also be able to join the Workfare Skills Support (WSS) Scheme, which is complementary to the WIS Scheme.

The WSS Scheme is to encourage Singaporeans to go for training in order to stay relevant and remain employable.

This is applicable to both employees and self-employed individuals.

There will be training allowance ($6/hour) given if WSS qualifying courses are attended, up to a cap of 180 hours per year.

Will I Receive WIS Payouts If I’m Unemployed?

As this scheme is to encourage Singaporeans to enter or stay in the workforce, you will not receive any WIS payouts if you’re unemployed.

There are currently other schemes that are available to assist if you’re out of a job!

Workfare Income Supplement (WIS) Scheme To Support Needy Singaporeans

COVID-19 has shown the importance of social safety nets and support, where the low-wage workers are the most vulnerable in times of economic crises.

The Workfare Income Supplement Scheme is one of the ways the Government is looking to help provide material support for Singaporeans who need it.

A timely reminder to be financially prudent in an event of a rainy day, and to look into our retirement planning.

If you’re looking for ways to trim your lifestyle spending, hop on to our SeedlyCommunity to gather the best tips!

Advertisement