What Should I Do With My First Pay Cheque?

So, you’ve graduated.

Suddenly, you’re no longer getting an allowance…

In a blink of an eye, you’ve got your first job and it’s finally time to receive your first paycheque.

You take a look at your bank account.

See a huge jump in your bank balance.

And wonder, “Hmm… What should I do with my first pay cheque?”

Before you go off and start spending it.

We highly recommend that you use this very simple guide to understanding the 50-30-20 Allocation Rule.

What kind of accounts you should set up, and what should you do as a fiscally responsible adult.

Welcome to adulthood!

Always Remember to Pay Yourself First…

You might be wondering, what the hell does this even mean?

I am already being paid what…

Well, not exactly.

Think of yourself as a mini-business that needs to stay financially healthy.

Your monthly salary is an inflow of funds that only happens once a month.

And just like any business with a good operating model, you’ll need to have:

- Spending monies (Expenses Account) for daily operations

- Monies to capitalise on opportunities and grow your business (Wealth Account)

- Cash reserves (Savings Account) for emergencies

Notice that all of these accounts are kept separate from each other?

Your Savings and Wealth Accounts are effectively used to “pay yourself” and help you grow your ‘business’ (wealth for retirement).

By segmenting your money into different accounts for different purposes, this is a simple yet effective way to manage your money.

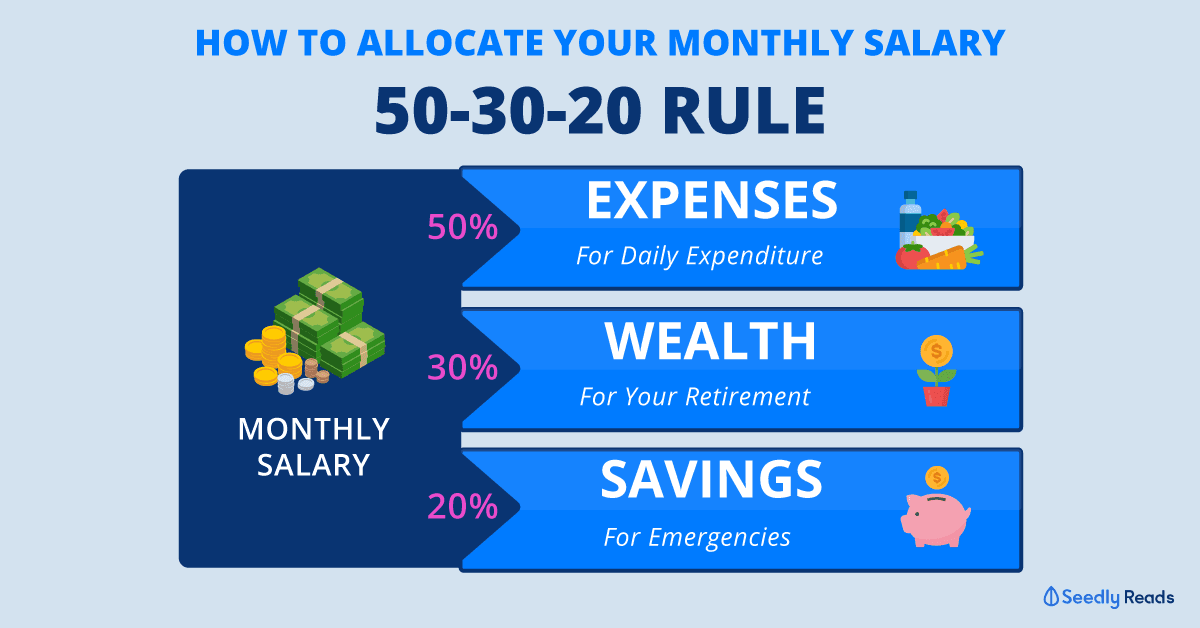

Allocating Your Salary According to the 50-30-20 Rule

So how do you allocate your money?

All you have to do is follow the 50-30-20 Rule and set up automated processes to credit the different amounts of money into different accounts.

On your payday, your entire salary will be credited into your Savings Account:

- One day after your payday, 50% of your salary should be credited to your Expenses Account

- Another 30% of your salary will be credited to a Wealth Account which will, for example, prompt an automated Regular Shares Savings (RSS) Plan to make an investment for you

- The 20% of your salary left in your Savings Account will go towards building an emergency fund

In just three simple steps which you can automate, you are pretty much set for your monthly cash flow management.

Amazing isn’t it?

Note: the 50-30-20 allocation is only a guide, you can always adjust the percentage of allocation according to your needs and requirements

Letting Your Money Compound and Grow

To give you a better idea of how the 50-30-20 Rule helps in ‘paying yourself’, let’s see how much you can grow your money.

Here’re some assumptions for this exercise:

- Monthly take-home salary: $2,000 (with no increment and no bonuses factored in)

- Expenses Account: $1,000

- Wealth Account: $600

- Savings Account: $400

- Savings Account starting balance: $0

- Savings Account interest: 1.8%

- Expenses Account over the years: remains the same

- Wealth Account returns: 6.3% (based on the 3-year Dollar Cost Average Returns on the STI ETF) with minimum fees

Here’s what your respective accounts will look like:

And here’s the breakdown:

- Savings Account: $9,782

- Wealth Account: $15,380

Within a span of twenty-plus months, you would have amassed A TOTAL OF $25,162!

Note: this is a calculation based on the STI ETF, depending on your risk appetite and knowledge there are other instruments out there to consider as well

A Closer Look at the Numbers Behind Your Salary Allocation

So how did I arrive at the grand total of $25,162?

Here’s how…

It’s not really accurate because it excludes the 13th-month Annual Workfare Supplement (AWS) and additional year-end bonuses which most companies (if not all) would add to your monthly take-home salary.

But if you start with a really solid foundation at a company that recognises your value, your salary will definitely increase at a much higher rate than the above-illustrated example.

Plus if you increase the percentage that you allocate to your Savings and Wealth accounts, you can also take advantage of compound interest to grow your money even faster!

Growing Your Savings Account

Want to grow your Savings Account faster?

You can do so through a high-interest savings account!

To make it easier for you, we’ve created the Seedly Savings Account Calculator which you can use for FREE!

All you have to do is fill up some basic information like your:

- bank balance

- monthly salary credited

- monthly credit card spend

And the calculator will tell you which savings account gives you the highest interest rate!

If you’re still unsure, you can also read Real User Reviews left by our Seedly community to find out if it’s really the best savings account for you!

Find the Best Savings Account for Me

Take Control of Your Finances by Budgeting

As shown above, it’s really simple to adopt the 50-30-20 Rule.

In fact, you can do all of this with a single bank account.

You just need to set up automated instructions to separate your money into the three recommended ‘accounts’.

If possible, challenge yourself by allocating as much as you can towards your Savings and Wealth Accounts.

Your Expenses Account should be comfortable but also a tad challenging to push yourself constantly to make smarter spending choices.

Start with 50-30-20, and see if you can push yourself to 40-30-30.

Or even 20-40-40!

Related Articles

Advertisement