Working Adults: Easiest Ways To Invest A Monthly Sum For Beginners

A good habit to cultivate

Chances are if you are reading this article, it would mean that you are keen to grow your money in over an extended period on a regular schedule. Before we bring you through this simple 5-minute guide, let us answer 3 key questions.

Full disclaimer: We are not paid or sponsored to write this. So you can trust that this is a simple strategy we advocate for beginners who are ready.

Read Also: When Should I Begin Investing?

Read This Community Member’s investment Story:

“Always remember that this is a long game (10-20 years)”

Why Should I Invest?

Why Should I Invest?

- You aim to beat inflation, currently at around 1.9% a year.

- Thus, you can either put it in your savings account and lose in value over time

- Or you can start with something easy and develop the right mindset – passive and long investment horizon

Why Should I Start Now?

- In a good market or bad market, retail investors (like you and I) should start

- There are a ton of day-traders who buy and sell positions from daily but the mindset should be set on a long-term for retail investors

- Long-term Investors believe in the term: “TIME IN MARKET” where over a longer horizon, the products should grow along with the market hence beating inflation

Why Should I Invest Monthly?

- This is following the strategy of Dollar Cost Averaging where you simply put in a standard amount (eg $100 on a regular schedule)

- In a long investment horizon, the investment value will pay off and you end up buying more units

- Your returns may not be as good as an investor who waits for the perfect timing (highly subjective though) to buy, but it definitely beats letting your money sit in the bank

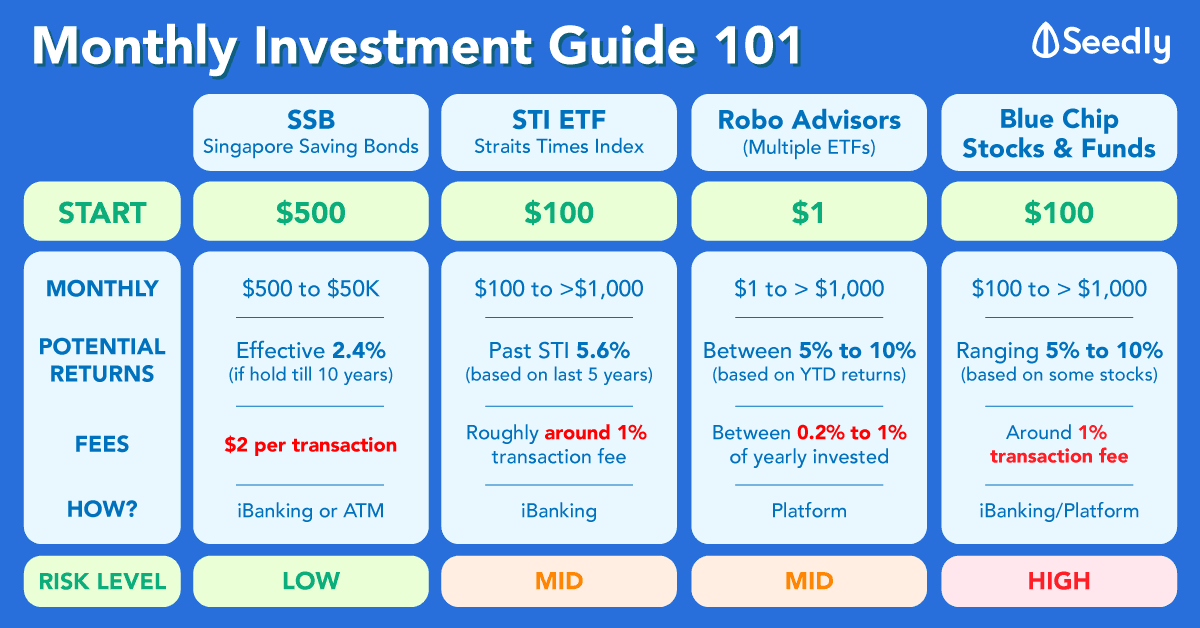

TL;DR: The monthly-investment products

Let us share with you these products which are extremely easy to start with minimum cash commitment. You can read more about these products in detail below.

Low Risk – Singapore Savings Bonds

This is where essentially, every month you get a chance to invest in the future of the Singapore government by loaning them some money.

A simple product to understand where you get a paid sum at the end of X number of years you lend them for. It is also useful because you can redeem this product anytime you need it, but of course, you get less interest.

| Singapore Savings Bonds | |

|---|---|

| Minimum amount to start | $500 |

| Monthly contribution | Between $500 to $50k |

| Returns | Effective 2.4% (if hold until 10 years) |

| Fees | $2 per transaction |

How to buy?

- Step 1: Have a Bank account with either DBS/POSB, OCBC or UOB and a CDP (central depository) securities account (Free to set up)

- Step 2: Apply through ATM or iBanking, the money that you invest will be deducted from your linked bank account

- Step 3: Towards the end of the month, you will get the allocation of the SSB allocated and you receive it in the following month

- Step 4: Receive your first interest payment 6 months after you get issued your SSB allocation

Further Reading: Guide to Investing in Singapore Savings Bond (SSB) – Interest Rates and How to Buy

Mid Risk – Index Investing (STI ETF)

This method is typically recommended to low commitment investing and a relatively passive way to approach longer term horizon.

In Singapore, the common way to do it is via the STI ETF (Straits Times Index, Exchange Traded Fund) where you are betting on an index fund which tracks the top 30 companies in Singapore like DBS, OCBC, Singtel, etc. (from a mix of verticals)

| STI ETF Regular Savings Plan | |

|---|---|

| Minimum amount to start | $100 |

| Monthly contribution | Between $100 to >$1000 |

| Returns | Past STI 5.6% (based on last 5 years) |

| Fees | Roughly around 1% transaction fee |

How to buy?

- Step 1: Have a Bank account with either DBS/POSB, OCBC, Maybank or POEMS

- Step 2: Apply through iBanking, the money that you invest will be deducted from your linked bank account

- Step 3: Towards the 15th of month, you will automatically buy the STI ETF based on your preference amount

- Step 4: Receive a monthly updated report on your investments and dividends quarterly

Further Reading: You can view a more detailed comparison and further information on which to buy.

Mid Risk – Index Investing (Global ETF)

This is very similar to the above method. But for investors who would aim to diversify globally (so you don’t just invest in SGX listed companies), you can choose to invest in Robo-Advisors, which has recently taken off here in Singapore.

This is very similar to the above method. But for investors who would aim to diversify globally (so you don’t just invest in SGX listed companies), you can choose to invest in Robo-Advisors, which has recently taken off here in Singapore.

For example, if you invest in Smartly, it will buy indexes like the S&P 500 (the top 506 companies in the US) and Asian (excluding Japan) indexes. The screenshot above would be the example of Smartly and the various asset classes they will buy and hold on your behalf.

In Singapore, there are 3 players who have recently launched, you can find out more about a comparison here or common questions asked about them.

| Robo-Advisor Regular Investment Plan | |

|---|---|

| Minimum amount to start | $1 (Stashaway), $50 (Smartly) and $3000 (Autowealth) |

| Monthly contribution | Between $100 to >$1000 |

| Returns | Between 5% to 10% (based on YTD returns) |

| Fees | Between 0.2% to 0.8% |

How to buy?

- Step 1: Head over to their product pages here: StashAway, Autowealth or Smartly

- Step 2: Apply for an account and you will be guided through a process to prove your identity (passport or IC) and a risk assessment profiling

- Step 3: Transfer the starting amount based on your projected goals to their bank account

- Step 4: Set up automated GIRO Standing Instruction to their account and confirm it on the platform monthly

- Step 5: You can log in to the accounts to track the progress of your investments and payouts accordingly

Further Reading: StashAway vs AutoWealth vs Smartly

Read User Reviews on Robo-Advisors

High Risk – Funds, Blue-Chip Stocks

This is where you can consider investing in active mutual funds or individual blue-chip stocks. In a nutshell, blue-chip stocks are companies which are the biggest in the Singapore market with some of the strongest fundamentals.

A few platforms like your banks, FundSuperMart (FSM), POEMS and OCBC actually allow you to do this on a monthly basis. However, there is a certain level of discretion that you asana investor will need to take when choosing which fund or stock to buy on a monthly basis.

Hence, we do not recommend this for normal beginner retail investors unless you have attended some form of course or have done a ton of research on these companies or funds.

| Funds, Blue Chip Stocks Regular Investment Plan | |

|---|---|

| Minimum amount to start | $100 |

| Monthly contribution | Between $100 to >$1000 |

| Returns | Between 5% to 10% (based on various stocks) |

| Fees | Roughly around 1% transaction feeFor Funds +(2-3%) extra management fees |

How to buy?

- Step 1: Have a Bank account with either DBS/POSB, OCBC, UOB or FSM/POEMS and a CDP (central depository) securities account (Free to set up)

- Step 2: Apply through iBanking, the money that you invest will be deducted from your linked bank account

- Step 3: Towards the mid of month, you will automatically buy the Stock counter or fund selected based on your preference amount

- Step 4: Receive a monthly updated report on your investments and dividends quarterly

Further Reading: What Should I Know Before Making My First Investment?

Read User Reviews on Online Brokerages

Conclusion – Start investing monthly

If you have reached the end of this article, you should be well-equipped to know the different options available.

At least start with the SSB to get a feel of what a Brokerage is, and also what a CDP securities account to learn the ropes!

If you have any questions, please feel free to post it on our Seedly QnA where fellow beginner and advanced investors can help advise you accordingly. Cheers!

Advertisement