Water Price & Electricity Price Hike: Here’s How Much More You Need to Save in 2024 & 2025

“钱不够用的“, which translates to ‘There’s never enough money’.

If you recall, there was a video clip of a lady who burst out laughing when she was asked if she had enough for retirement. It’s not hard to understand why she laughed though.

Now, we’ve just received a slew of announcements indicating that utility prices, and let’s not forget, the Goods and Services Tax (GST) will also increase to 9% starting in 2024.

Are you confused, angry, or even anxious?

I completely understand, and I share those sentiments with you.

As we continue to navigate each day while these changes loom on the horizon, it’s essential to consider how we can better prepare for what’s to come in 2024 and 2025 as we enter the last quarter of 2023. The last thing any of us want is to find ourselves scrambling for money.

So, how much more do you need to prepare for utilities in the next two years? Let’s find out.

TL;DR: How Has Singapore’s Cost of Utilities Changed Over The Years?

Click here to jump:

- How much do you need for water in 2024 and 2025?

- How would your electricity bill change in Q4 2023?

- What else can you do besides saving more?

Water Prices in Singapore And How Much You Need

If you don’t know by now, water prices are set to increase by $0.50 or 18.2% in the next two years. This is the first water price increment since the last hike in 2017.

The increment will be conducted in two phases – 20 cents per cubic metre from 1 April 2024, and another 30 cents per cubic metre from 1 April 2025, bringing a total increase of 50 cents per cubic metre increase.

As a result of these changes, residents of one- and two-room HDB flats will experience an average monthly increase of $4 in their water bills, while other HDB households can anticipate an average rise ranging between $6 and $9 per month. Private apartment households will also see their average monthly water bills increase by $7.

Now, let’s shift our focus to businesses in Singapore.

Approximately three-quarters of them will witness a monthly increase of less than $25 in their water bills. Additionally, three out of four hawkers will experience an approximate $15 increase in their utility bills each month.

But before we delve further into the impact of these price increases, it’s important to understand what water prices were like before 2023.

What Were The Water Prices Before 2023?

Water prices have always been tiered based on household usage, water conservation tax, and waterborne fees.

- The Water Tariff covers the costs incurred in various stages of the water production process

- The Water Conservation Tax (WCT) is levied as a percentage of the water tariff to encourage water conservation

- The Waterborne Tax (WBT) is a tax contribution that goes towards meeting the cost of treating used water and maintaining the used water network. It is charged based on the volume of water usage.

Currently, there are distinct pricing structures for water usage, with separate charges for those using less than or equal to 40m3 and those exceeding this threshold. Let’s zoom in on the disparities in the pricing mechanisms over the years:

| Before 1970s | 2000 | 2017 (Phase 1) |

2018 (Phase 2) |

2024 (Phase 1) |

2025 (Phase 2) |

|

| Tariff | First 20m3: $0.56/m3 | 0 – 40m3 :$1.17/m3 | 0 – 40m3 :$1.19/m3 | 0 – 40m3 :$1.21/m3 | 0 – 40m3: $1.29/m3 | 0 – 40m3: $1.43/m3 |

| 20 to 40m3: $0.80/m3 | ||||||

| > 40m3: $1.17/m3 | > 40m3: $1.40/m3 | > 40m3: $1.46/m3 | > 40m3: $1.52/m3 | > 40m3: $1.63/m3 | > 40m3: $1.81/m3 | |

| Water Conservation Tax |

First 20m3: – | 0 – 40m3: $0.35 (30% of $1.17) | 0 – 40m3: $0.42 (35% of $1.19) | 0 – 40m3: $0.61 (35% of $1.21) | 0 – 40m3: $0.65 (50% of $1.29) | 0 – 40m3: $0.72 (50% of $1.43) |

| > 20m3: $0.12 (15% of $0.80) | > 40m3: $0.63 (45% of $1.40) | > 40m3: $0.73 (50% of $1.46) | > 40m3: $0.92 (65% of $1.52) | > 40m3: $1.06 (65% of $1.63) | > 40m3: $1.18 (65% of $1.81) | |

| Waterborne Tax |

$0.10

|

$0.28 | 0 – 40m3: $0.78 | 0 – 40m3: $0.92 | 0 – 40m3: $1 | 0 – 40m3: $1.09 |

| > 40m3: $1.02 | > 40m3: $1.18 | > 40m3: $1.25 | > 40m3: $1.40 |

Do note that the higher rate is applied only to the amount of water used above the 40m3 threshold per month.

This means that if a household uses 51m3 per month, for the first 40m3 it will be $2.74 x 40 = $109.60, and for the next 11 cubic meters, it will be $3.69 x 11 = $150.19. Your water bill will be $259.79.

That being said, the government has planned to provide GST Vouchers (GSTV) for Utilities, specifically GSTV U-Save Rebates, at $20 per quarter ($80 per year) in both 2024 and 2025.

However, it’s important to note that to qualify for these rebates, the 950,000 Singaporean households must meet the following criteria:

- Households must have at least one Singaporean as the owner, occupier, or tenant of the HDB flat

- Household members cannot own more than one property.

Now, let’s delve into how these rebates can help ease the financial burden. How much do you still need to allocate from your budget?

Average Cost Per Household Per Year Less Government Support

According to the PUB, Singapore’s National Water Agency, a person uses an average of 0.15m3 or 150 litres a day, and based on the national average alone, most households will use less than 40m3 per month.

So, this should be how much you would be spending on water from 2023 to 2025, inclusive of GST:

| Period | Current | 2024 | 2025 | |

|---|---|---|---|---|

| Water usage per month | Average Water Consumption | ≤ 40 cubic metre | ≤ 40 cubic metre | ≤ 40 cubic metre |

| Price per cubic metre | $2.74 | $2.94 | $3.24 | |

| 1-room HDB | 8 | $24 | $25 | $28 |

| 2-room HDB | 10 | $28 | $31 | $34 |

| 3-room HDB | 12 | $36 | $39 | $43 |

| 4-room HDB | 15 | $46 | $50 | $55 |

| HDB 5-Room | 17 | $50 | $54 | $59 |

| HDB Executive | 19 | $55 | $60 | $66 |

| Apartment | 14 | $41 | $44 | $49 |

| Terrace | 26 | $76 | $82 | $90 |

| Semi-Detached | 31 | $92 | $99 | $109 |

| Bungalow | 49 | $146 | $158 | $174 |

| Estimated water bill per year before government subsidy | ||||

| Period | Current | 2024 | 2025 | |

| Water usage per month | Average Water Consumption | ≤ 40 cubic metre | ≤ 40 cubic metre | ≤ 40 cubic metre |

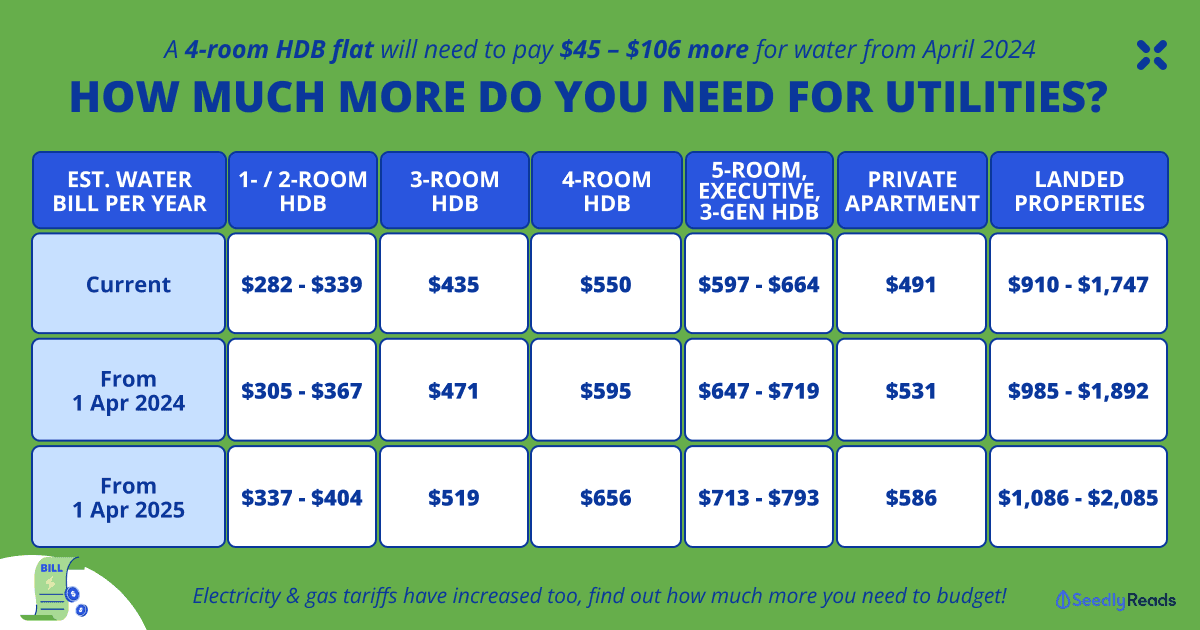

| 1-room HDB | 8 | $282 | $305 | $337 |

| 2-room HDB | 10 | $339 | $367 | $404 |

| 3-room HDB | 12 | $435 | $471 | $519 |

| 4-room HDB | 15 | $550 | $595 | $656 |

| HDB 5-Room | 17 | $597 | $647 | $713 |

| HDB Executive | 19 | $664 | $719 | $793 |

| Apartment | 14 | $491 | $531 | $586 |

| Terrace | 26 | $910 | $985 | $1,086 |

| Semi-Detached | 31 | $1,098 | $1,190 | $1,311 |

| Bungalow | 49 | $1,747 | $1,892 | $2,085 |

| Note: All costs are inclusive of GST. U-Save rebates are disbursed every quarter and HDB owners who own more than one (private) property will not be eligible for the GSTV U-Save Rebates. The last U-Save rebates disbursement in 2023 will be Oct 2023, at a range of $55 to $95. | ||||

If you stay in a 4-room HDB flat, you will need to pay approximately $45 – $106 more for your water bill.

Of course, the change in water prices will only take effect in April 2024 and April 2025. The estimated costs provided reflect what you can expect for a 12-month period from April 2024 to April 2025, and it assumes that there will be no further price changes in the subsequent years.

Electricity & Gas Tariffs in Singapore

Between Oct 1 and Dec 31 (Q4 2023), the electricity tariff for households will increase from 27.74 cents per kWh to 28.70 cents per kWh, excluding GST. This is an increment of 0.98 cents per kWh.

When GST is factored in, the total rate for the quarter will be 31 cents per kWh.

But what’s the reason behind this increase?

It’s not hard to guess — it’s due to higher fuel and energy costs.

In essence, the electricity tariff comprised of four components:

- Network Costs (paid to SP PowerAssets): This covers the cost of transporting electricity through the power grid

- Market Support Services Fee (paid to SP Services): This recovers costs associated with billing, meter reading, data management, retail market systems, and market development initiatives

- Market Administration and Power System Operation Fees (paid to the Energy Market Company and Power System Operator respectively): These fees recover the costs of operating the power system and wholesale electricity market

- Power Generation Cost (paid to power generation companies): This mainly covers the costs of operating power stations, including manpower, maintenance, and capital expenses.

The primary contributor to the rise in energy costs during the previous quarter:

Average Cost Per Household Per Month

For those unfamiliar, aside from using SP Group for household electricity, you have the option to engage an electricity retailer in the Open Electricity Market. This means you can switch to an electricity retailer and potentially save money on your electricity bill.

Most of these contracts are available for 6 months, 12 months, or 24 months, with fixed prices.

If you had already made the switch, kudos to you, as it was more cost-effective to do so when electricity prices were lower in Q2 2023.

And for those considering switching now, many retailers like Geneco offer a rate of 28.98 cents/kWh (inclusive of GST) for a 12-month contract, which is lower than SP Group’s 31 cents/kWh.

But before making a commitment, make sure you research the pros and cons of switching and read reviews:

Now, according to SP Group, families living in four-room HDB flats can expect their average monthly electricity bills to increase by $3.57 before GST.

All in all, we should expect the following changes in bills:

| Type of Premise | Average monthly consumption per person (kWh) | Average Monthly Bill | New Average Monthly Bill |

| 1-room HDB | 144.78 | $40.16 | $41.55 |

| 2-room HDB | 190.31 | $52.79 | $54.62 |

| 3-room HDB | 272.03 | $75.46 | $78.07 |

| 4-room HDB | 371.31 | $103 | $106.57 |

| HDB 5-Room | 433.95 | $120.38 | $124.54 |

| HDB Executive | 537.24 | $149.03 | $154.19 |

| Apartment | 513.86 | $142.54 | $147.48 |

| Terrace | 865.93 | $240.21 | $248.52 |

| Semi-Detached | 1,133.60 | $314.46 | $325.34 |

| Bungalow | 2,219.13 | $651.59 | $636.89 |

Source: SP Group

Meanwhile, the gas tariff for households will also rise by 0.51 cents per kWh before GST, going from 21.91 cents per kWh to 22.42 cents per kWh for the period from Oct 1 to Dec 31, 2023. With the 8% GST included, it will be 24.21 cents per kWh.

Read more:

What Can You Do Besides Saving More?

There’s only so much you can do by putting away your savings, and, you won’t want to compromise too much of your current lifestyle if it’s great.

Firstly, you’ve got to be sure you have enough for emergencies. Put away at least 12 months of your income just in case you can’t work.

Optimise Your Spending Using a Credit Card For Utilities

Needless to say, you should try to optimise your spending on utilities with a credit card that allows you to earn cashback or rebates.

Check out our guide to the best credit card for utilities:

Start Investing, Start Small If You Need

And lastly, to grow your savings, it’s good to start investing when you can. You don’t have to dump a huge sum or make high-risk investments.

For starters, you can consider shorter, lower-risk, government-backed investments such as the Singapore Savings Bonds, Fixed Deposits, and Treasury Bills.

If not, there are cash management accounts by brokerages and robo-advisors too.

Related Articles:

- Singapore Savings Bonds Interest Rate Guide: How Is the Interest Rate for the Singapore Savings Bond (SSB) Determined?

- Should You Use Your CPF Funds to Buy T-Bills or Fixed Deposits?

- The Ultimate Expat Guide to Understanding Investments in Singapore

- Low-Risk Investments in Singapore to Grow Your Money

- The Seedly Money Framework: The Complete Guide to Winning Your Finances in 2023 & Beyond

Advertisement