11 Best Credit Cards for Utility Bills In Singapore 2022

●

Hooray, we’re slowly moving towards a post-pandemic world now!

People are starting to travel and everything seems back to normal.

But…as we gleefully enjoy life once again, we’re also facing a possible recession and ongoing inflation.

The first thing that hits us should be…our bills.

If you’re not aware, the electricity tariff for Q2 2022 (1 April – 30 June 2022) has increased from 25.44 cents to 27.94 cents per kilowatt-hour (kWh)!

This is a 9.9% increase from Q1 2022 (1 Jan to 31 March 2022), and the fifth quarter in a row, the electricity tariff has increased.

This amounts to 29.90 cents per kWh if you factor in the prevailing 7% Goods and Services Tax (GST).

As of March 2022, an average utility bill for a 4-room HDB household is $104.29 (without gas) and $119.78 (with gas).

With our increase in electricity and water consumption, it has become even more important to find ways to shave a few more dollars off our bills.

The Singapore Power (SP) group is the main provider of basic utilities for Singaporeans, covering electricity, water, gas, and refuse removal.

Since the introduction of the Open Electricity Market (OEM), consumers have been able to explore different electricity retailers and choose plans that suit their needs.

This allows their electricity bills to also become more price competitive.

With the OEM in place, electricity retailers now have two ways to bill you:

- Via SP group (you will receive one bill, covering all utilities)

- Direct billing (you will receive two bills, one from the electricity retailer, and another from SP group for water, gas & refuse removal)

Now, after having the option of switching electricity retailers, would there be any other ways we could save even more money?

We’ve compiled a list of credit cards so that you can use them for utilities to earn cashback or rebates!

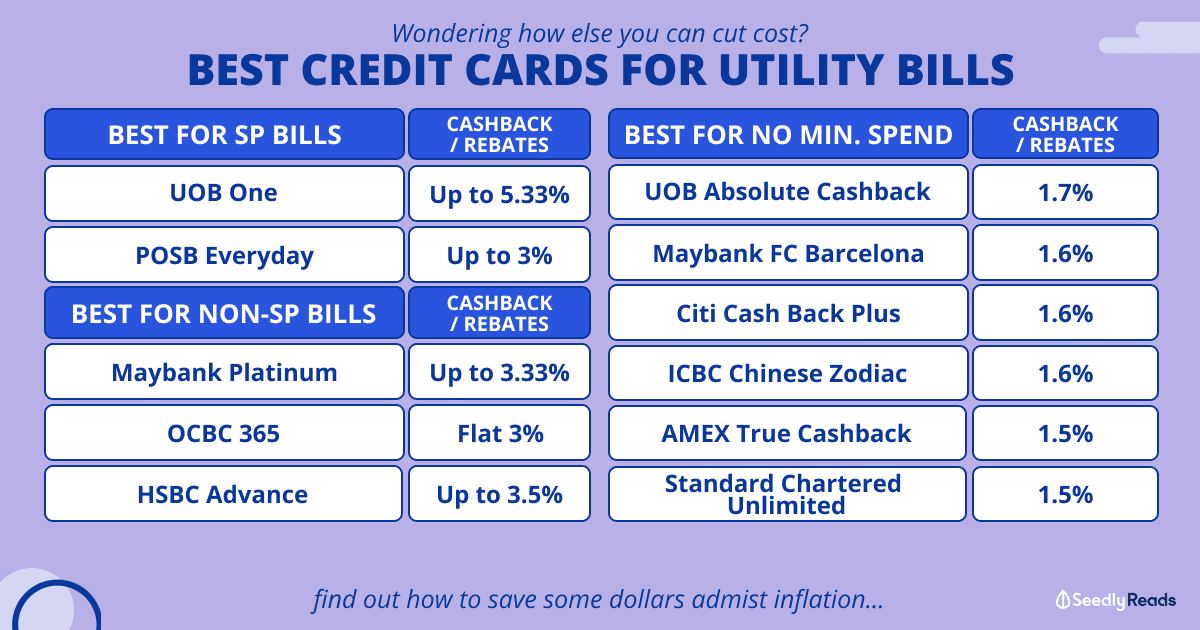

TL;DR: Best Credit Cards for Utilities in Singapore (2022) & How To Pay My Utility Bills

We will be looking at credit cards that offer the best cashback or rebates.

| Best for SP bills | Cashback/Rebate | Cashback/Rebate Cap | Minimum Spend |

|---|---|---|---|

| UOB One Card | Up to 5.33% | $50, $100 and $300 each quarter for spending of $500, $1,000 or $2,000 per month respectively The additional cashback of 1% for meeting the $2,000 minimum spend will be capped at $100 per month. | $2,000 per month for 5.33% $500 or $1000 per month for 4.33% |

| POSB Everyday Card | Up to 3%: SP Group & Tuas Power Up to 3%: Geneco, Sembcorp Power, Union Power Up to 2%: Keppel Electric, Senoko Energy | Cash rebate is capped at maximum POSB Daily$3 per calendar month for electricity bills and a maximum of POSB Daily$2 per calendar month for telco bills | No minimum spend |

| Best for non-SP bills | Cashback/Rebate | Cashback/Rebate Cap | Minimum Spend |

| Maybank Platinum Visa Card | Up to 3.33% | $100 per month | $300 per month |

| OCBC 365 Card | 3% | $80 per month | $800 per month |

| HSBC Advance Cashback Card | Non-members: 1.5% (2.5% if spending is more than $2,000) Advance Members: 2.5% (3.5% if spending is more than $2,000) | $125 per month | $2,000 |

| Credit Cards With No Minimum Spend | Cashback/Rebate | Cashback/Rebate Cap | |

| UOB Absolute Cashback Card | 1.7% | No cap | |

| Maybank FC Barcelona Visa Signature Card | 1.6% | No cap | |

| Citi Cash Back Plus Card | 1.6% | No cap | |

| ICBC Chinese Zodiac Card | 1.6% | No cap | |

| American Express True Cashback Card | 1.5% (3% on up to $5,000 spend in first 6 months) | No cap | |

| Standard Chartered Unlimited Cashback | 1.5% | No cap | |

Click here to jump:

- Best cards for SP bills

- Best cards for non-SP bills

- Cashback credit cards with no minimum spend for utilities

- How to pay my utility bills

- Cashback credit cards for other purposes

Disclaimer: The various credit cards all have their respective terms and conditions. So please read through them before deciding which credit card to get! Note that information is accurate as of 23 May 2022 and that promotions are subject to change without prior notice.

Best for SP bills

1. UOB One Card

The card which offers the highest cashback would be UOB One Card.

A highly popular card due to its quarterly cashback, the UOB One card offers an attractive rate of up to 4.33% rebate on Singapore Power (SP) utility bills if one were to qualify for the quarterly cash rebates.

As the UOB One Card offers quarterly rebates based on how much you spend, to get the maximum 5% cashback, there is a minimum spending of S$2,000.

For utility bills, there is an additional 1% rebate, which is equivalent to 5.33%.

Otherwise, if you spend S$500 or S$1,000 every month in one quarter, you get S$50 and S$100 rebates respectively, which translates to up to 4.33%.

This is definitely the BEST CARD out there if you’re paying for SP bills.

Note: This cash rebate is excluded from payments made via AXS.

Promotion: Ongoing partnerships with Shopee, supermarkets, Grab etc.

2. POSB Everyday Card

Next up is the POSB Everyday Card.

Next up is the POSB Everyday Card.

It offers up to 3% of cash rebates for SP utilities with no minimum spend.

Other companies eligible for the 3% rebates include Geneco, Sembcorp Power, Union Power and Tuas Power.

For Kepple Electricity and Senoko Energy, cash rebates are up to 2% with no minimum spend.

To top it off, it also offers 3% rebates for telecommunications, but comes with a minimum spend of S$800 per month.

If your monthly spending is more than S$800, this card would be suitable for you.

Note: The minimal spend requirement excludes payments made via AXS, SAM online bill payments, all other bill payments via internet banking, and all fees charged by POSB.

Promotion: Until 30 June 2022, get S$150 cashback for a new application.

Best for Non-SP retailers

1. Maybank Platinum Visa Card

For people who are using other electricity retailers other than SP, a great card to consider would be the Maybank Platinum Visa Card.

With just a minimum spend of S$300 (for both local spending and foreign currency spending), the Maybank Platinum Visa card is a good choice for the payment of utilities.

Perfect for low spenders.

For spending of S$300 per month in a quarter, the maximum quarterly cashback would be S$30, which translates to 3.33%.

Not too shabby at all.

The cashback cap for this card is S$100, which means the most you should spend with your card to maximise its cashback would be S$1,000 per month.

Promotion: The first 4,500 approved applicants with minimum spending of S$300 via a Maybank credit card or CreditAble, for their first two consecutive months, will get a Samsonite Harts 68/25 Spinner worth S$550.

Every subsequent eligible applicant will receive a S$100 cash credit.

2. OCBC 365 Card

Both the OCBC 365 Card offers a cashback rate of 3%, with a minimum spend of S$800 per month.

A pretty good cashback rate with a decently achievable minimum spend.

The OCBC 365 card has a cashback cap of S$80 per month.

Promotion: Valid till 30 June 2022, earn up to S$480 cashback when you charge your Foreign Currency spend to your OCBC 365 Credit Card.

The top 10 highest Qualifying Foreign Currency Spend will also receive a Marshall Acton II Bluetooth Speaker (worth S$469).

3. HSBC Advance Cashback Card

The HSBC Advance Cashback Card offers 1.5% cashback with no minimum spend.

However, something to note for this card is the different cashback rates available, depending on 2 factors:

| Monthly Spending | HSBC Advance Banking customers | Non-members |

| S$2,000 and below | 2.5% cashback on all purchases | 1.5% cashback on all purchases |

| Above S$2,000 | 3.5% cashback on all purchases | 2.5% cashback on all purchases |

This means that if you’re an HSBC Advance Banking customer who spends more than S$2000 monthly, this is a great card to consider as it offers 3.5% cashback for all purchases.

For anyone who is using a non-SP electricity retailer and is an HSBC Advance Banking customer who spends more than S$2,000 a month, this would be the best card to use for your electricity bills.

It is understandably not the easiest criteria to meet and more suitable for big spenders.

If that’s the case, consider the Maybank Platinum Visa card (mentioned above) instead.

Promotion (either or):

- Receive S$200 cashback for a new HSBC cardholder

- Receive S$50 cashback for an existing HSBC cardholder

Only those who have not cancelled any HSBC card last 12 months and have not revoked their consent to receive marketing or promotional materials are eligible.

Best Credit Cards With No Minimum Spend

1. American Express True Cashback Card

The American Express True Cashback Card offers a typical cashback rate of 1.5%, with no minimum spend required.

However, for the first 6 months, 3% cashback can be enjoyed on up to S$5,000 spent, giving this card a slight upper hand as compared to the rest of the cashback cards.

Promotion: Valid till 30 June 2022, receive S$80 CapitaVouchers when you spend S$250 in the first month of Card approval.

2. Citi Cash Back+ card

The Citi Cash Back+ card offers attractive cashback rates, at 1.6% with no minimum spend, across all categories.

This is higher than the market average of 1.5% for cashback.

The cashback is also unlimited too.

An unlimited cashback credit card gives cashback rewards on all purchases, with no caps on the amount you can earn.

Since different credit cards usually have different cashback rates for specific categories, if you’re someone who enjoys a fuss-free approach of having a minimal number of cards, this card would be great for your wallet.

There is also an SMS service provided so that you can redeem your accumulated cashback instantly.

Promotion: Valid till 30 June 2022, receive a welcome gift of up to S$240 cashback (6% bonus cashback) for spending S$4,000 in the first 2 months.

3. ICBC Chinese Zodiac Card

Another card to look out for is the ICBC Chinese Zodiac Credit Card.

Similar to the Citi Cash Back+ card, the ICBC Chinese Zodiac Credit Card also offers 1.6% cashback with no minimum spend, and also comes with unlimited cashback.

Currently, this card offers Free Worldwide VIP Lounge Access, a joint offer between ICBC and Dragonpass. Do check out its terms and conditions for more details.

Promotion: Not available.

3. Maybank FC Barcelona Visa Signature Card

The Maybank FC Barcelona Visa Signature Card also offers similar attractive cashback, also giving 1.6% cashback with no minimum spend, and also has an unlimited cashback cap.

This card seems perfect for FC Barcelona fans, with a chance to win a trip for two to catch FC Barcelona LIVE every football season, as well as perks like discounts on merchandise from the FC’s official stores.

Promotion: Get a Samsonite Harts 68/25 Spinner worth S$550 for any new Maybank credit card or CreditAble by spending a minimum of S$300 for each of the first two months.

5. Standard Chartered Unlimited Cashback

The Standard Chartered Unlimited card is another unlimited cashback card.

It is fuss-free as it offers 1.5% cashback on all purchases, regardless of category.

This makes it an excellent go-to card to keep in your wallet, especially if you don’t have a favorite spending category.

Your cashback earned will also be automatically used to offset the following statement cycle month’s billed amount.

Promotion: Valid till 30 June 2022, when you spend S$200, you can receive up to S$220 cashback and 3 months of Disney+ subscription

4. UOB Absolute Card

UOB Absolute Cashback Card is a card that offers a 1.7% cashback on all categories including insurance, school fees, healthcare, utilities and rental payments.

There are no cashback caps or spend exclusions.

As an additional benefit, cardholders get to enjoy the exclusive American Express Card privileges.

Promotion: Valid till 31 July 2022, with the first S$3,000 spent you can enjoy 5% cashback (equivalent to S$150).

How To Pay The Bills And Check My Bills Online

If you’ve opted for SP Services and just starting to pay the bills, you will need to set up your utility account with SP Services.

Similarly, if you’re buying electricity from an OEM retailer, you will need to set up an e-Services account.

This account enables you to view and download your electricity usage.

But, before jumping on to a new electricity retailer, you should note that there might be hidden fees and terms and conditions.

Read more: Hidden Fees And T&Cs To Take Note When Choosing An Electricity Retailer

Apart from Utilities, What Other Cashback Credit Cards Are There?

Of course, apart from utilities, we also have to make other expenses such as groceries and household items.

That’s why it is good to identify your primary purposes and needs for card usage before deciding which card to get.

So… What’s Your Go-to Credit Card For Utilities?

Do remember to do your due diligence as different cards would come with different terms and conditions.

Also, make sure that you pay your fees on time!

Share your thoughts with us by creating a free Seedly account and fire away within the Seedly Community today!

Create Your Free Seedly Account Today!

Once you’ve chosen your preferred card, make sure you check out product reviews of retailers too!

Related Articles

- Open Electricity Market Price Comparison: Cheapest Plans in Singapore (Apr 2022)

- Hidden Fees And T&Cs To Take Note When Choosing An Electricity Retailer

- Latest Singapore Inflation Rate & What You Can Do About It

- Latest Petrol Price Singapore (May 2022)

- The Ultimate Singaporean’s Guide to Surviving a Recession

- Best Home Insurance: Lessons Learnt When My Wife Tried to Set Me On Fire

- Best Credit Cards in Singapore

Advertisement