When it comes to investing, one of the most popular and proven ways to gradually grow your wealth is to implement a passive investing strategy. This strategy is great for those who do not want to spend all their time monitoring their investments.

By implementing this strategy, investors can buy and hold their investments for the long term and focus on improving their earning power and savings rate.

One of the better ways to employ this passive investing strategy is to buy and hold a broadly diversified portfolio of companies across numerous industries, sectors, market capitalization sizes, and even countries.

You can do so by buying low-cost and well-diversified exchange-traded funds (ETFs) that will produce returns that track the market.

These ETFs also automatically reinvest all the dividends to take advantage of the power of compound interest:

However, this approach has some cons. These passive ETFs will never beat the market, even in a bear market, as their core holdings track the market by design. This means you will not get the market-beating returns skilled active stock pickers might get.

Intrigued?

Here are some of the best low-cost Ireland Domiciled ETFs for you to consider!

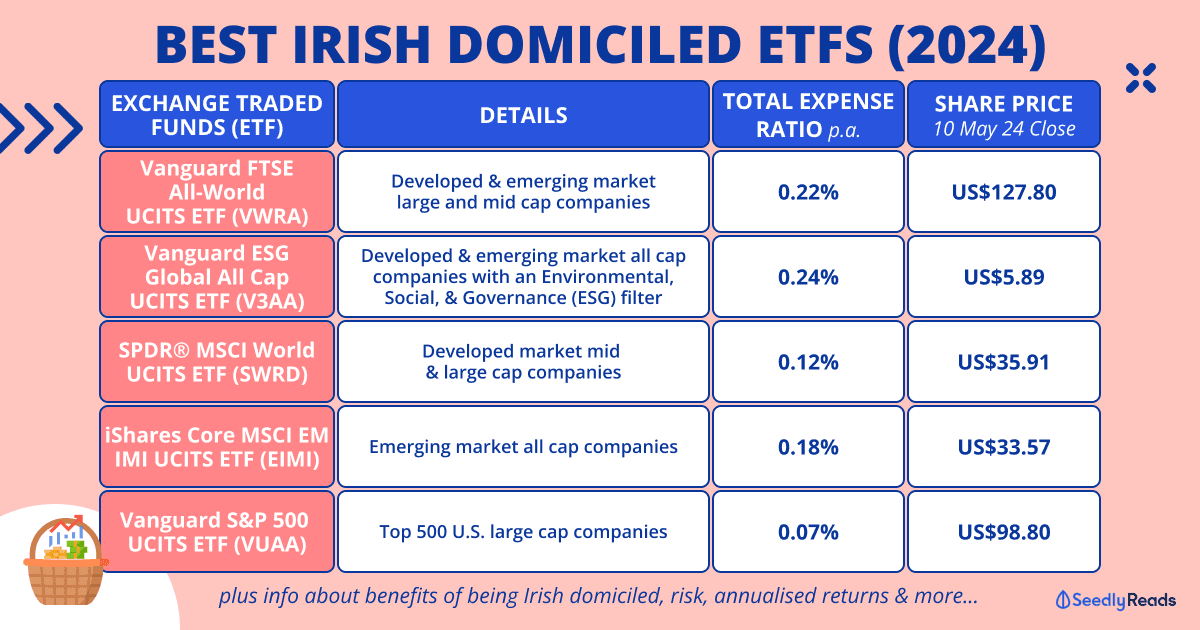

TL;DR: Best Irish Domiciled ETFs For Singaporeans to Buy and Hold

| ETF | Details | Total Expense Ratio (p.a.) | Share Price (As of 10 May 24 Close) |

|---|---|---|---|

| Vanguard FTSE All-World UCITS ETF (VWRA) | Developed and emerging market large and mid cap companies | 0.22% | US$127.80 |

| Vanguard ESG Global All Cap UCITS ETF (V3AA) | Developed and emerging market all cap companies with an Environmental, Social, & Governance (ESG) filter | 0.24% | US$5.89 |

| SPDR® MSCI World UCITS ETF (SWRD) | Developed market mid and large cap companies | 0.12% | US$35.91 |

| iShares Core MSCI EM IMI UCITS ETF (EIMI) | Emerging market all cap companies | 0.18% | US$33.57 |

| Vanguard S&P 500 UCITS ETF ACC (VUAA) | Top 500 U.S. large cap companies | 0.07% | US$98.80 |

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be or does not constitute financial advice, investment advice, trading advice or any other advice or recommendation offered or endorsed by Seedly or any other company. Investors should always do their due diligence before investing in any investment products or adopting any investment strategies.

Why Ireland Domiciled Exchange Traded Funds (ETFs)?

One of the main ways to keep costs down is to pay less on dividends.

Personally, I prefer Ireland-domiciled ETFs to U.S.-based ETFs because they reduce the withholding taxes you have to pay on the dividends received (30% vs 15%) and help you avoid estate duty/inheritance tax/death tax complications in the unfortunate event that the investor passes on.

You can read all about it here:

Note that these ETFs are listed on the London Stock Exchange (LSE) and domiciled in Ireland.

A Note About Total Assets Under Management for ETFs

When it comes to total assets under management, we believe that the AUM of the ETF should not be a primary consideration as:

- The ETF is a Wrapper: Although an investor may own a significant portion of the ETF, their actual share of the total market capitalization of the underlying securities is typically very minimal.

- Size Does Not Equal Liquidity: Liquidity in an ETF is determined by the securities in the underlying basket, not by the ETF’s assets under management (AUM). Thanks to the ETF’s open-ended structure, liquidity providers can readily offer bids and asks at the ETF’s fair value, making it easier for investors to manage large positions regardless of the fund’s size.

- Independent Trading Impact: Trading in ETFs occurs on the secondary market, which allows investors of all sizes to conduct their transactions without affecting others in the fund. This mechanism provides a layer of isolation for each investor’s activity.

- Risk of Fund Closure: If an ETF does not attract sufficient assets and the manager decides to shut it down, the primary risks for investors include market exposure, potential capital gains, and the need to reinvest funds. On the date of closure, the assets are liquidated, and the closing net asset value (NAV) is distributed to the remaining investors.

Rather, when considering an ETF investment, it’s important for investors to assess the fund’s investment objectives, risk characteristics, and liquidity to determine how it might fit into their overall investment strategy.

1. VWRA ETF: Vanguard FTSE All-World UCITS ETF ACC (USD)

First, we have the Vanguard FTSE All-World UCITS ETF (USD): VWRA, which was incepted on 23 July 2019 and is domiciled in Ireland and listed on the London Stock Exchange (LSE).

This ETF aims to physically track the performance of the FTSE All-World Index, which is market capitalization-weighted and includes large and mid-cap stocks from developed and emerging markets.

There are two main variants of the ETF you can pick from.

The accumulating variant VWRA automatically reinvests all the dividends to take advantage of the power of compound interest, while the distributing variant VWRD distributes the dividends that are paid out.

This ETF is actually a market capitalisation-weighted ETF. It comprises 3,665 large and mid-cap companies from developed and emerging countries, with a median market cap of US$111.4B.

VWRA Exposure: Top 10 Holdings, Sectors, Geography & More

Here is a breakdown of the exposure of the ETF.

VWRA Top 10 holdings:

- Microsoft Corp. 4.2%

- Apple Inc. 3.3%

- NVIDIA Corp. 2.9%

- Alphabet Inc. 2.2%

- Amazon.com Inc. 2.2%

- Meta Platforms Inc. 1.4%

- Berkshire Hathaway Inc. 1.0%

- Eli Lilly & Co. 0.9%

- Taiwan Semiconductor Manufacturing Co. Ltd. 0.8%

- JPMorgan Chase & Co. 0.8%

Top 10 approximately equals 19.7% of net assets Data as at 31 March 2024.

VWRA Sectors & Geography

The ETF is heavily weighted towards large-cap technology companies based in the United States.

More specifically, the portfolio’s market allocation is mainly comprised of developed countries like the U.S. (62.2%), Japan (6.3%), the U.K.(3.6%), and France (2.7%), with a small portion allocated to emerging markets like China (2.6%) and India (2.1%).

VWRA Share Price

The ETF is currently trading at a price of US$127.80 per share as of 10 May 2024 close.

VWRA Total Asset Value

As for fund size, VWRA is huge, as the ETF’s total assets amount to about US$24.77B.

VWRA Expense Ratio

The total expense ratio at 0.22% per annum (p.a.) is not too high either.

In other words, you will pay $22 in fees per $10,000 invested per year on top of the fees brokerages charge.

VWRA Returns (As of Close)

In terms of returns, the fund is also performing pretty well, according according to Google and alphacubator:

Since its inception in July 2019, VWRA has increased cumulatively by 59.61%, and annualised returns as follows:

| ANNUAL RETURN 1Y | ANNUAL RETURN 3Y | ANNUAL RETURN 5Y | ANNUAL RETURN 10Y | ANNUAL RETURN 20Y | ANNUAL RETURN | |

|---|---|---|---|---|---|---|

| Vanguard FTSE All-World UCITS ETF USD Accumulation | 23.97% | 9.24% | 11.05% | 11.05% | 11.05% | 11.05% |

This is a pretty great performance for a passive investing strategy. But do remember that past performance is not indicative of future returns. So please do further due diligence on these ETFs to determine if they can continue growing.

VWRA Tracking Error

However, according to Vanguard, this ETF has an annualised tracking error of:

- 1 year: 0.06%

- 3 years: 0.09%

compared to the FTSE All-World Index it tracks.

This ETF demonstrates a very low tracking error, which means you can expect it to deliver similar market returns as the benchmark it tracks.

VWRA Risk

Here’s a lowdown of how risky this ETF is according to justETF

Who is This ETF For?

This ETF is great for those who are looking for a cheap, globally diversified and passive investment vehicle that covers developed and emerging markets.

2. V3AA ETF: Vanguard ESG Global All Cap UCITS ETF ACC (USD)

Alternatively, if you want something different, consider the Vanguard ESG Global All Cap UCITS ETF (USD), which was incepted on 23 March 2021.

This ETF aims to physically track the performance of the FTSE Global All Cap Choice Index, with dividends being accumulated and reinvested into the ETF. The overarching index for this is the FTSE Global All Cap.

This index encompasses large, mid, and small-cap stocks across developed and emerging markets globally. The included stocks are selected and filtered based on Environmental, social, and governance (ESG) criteria:

V3AA Exposure: Top 10 Holdings, Sectors, Geography & More

Here is a breakdown of the exposure of the ETF:

The ETF is quite well diversified and not too focused on companies based in the United States. It also offers diversification across company sizes and ESG filtering.

V3AA Share Price

The ETF is currently trading at a price of US$5.89 per share as of 10 May 2024 close.

V3AA Total Asset Value

As for fund size, V3AA is small as the ETF’s total assets amount to about US$643M.

V3AA Expense Ratio

The total expense ratio is 0.24% per annum (p.a.), which is on the higher side.

In other words, you will pay $24 in fees per $10,000 invested annually on top of the fees brokerages charge.

V3AA Returns (As of Close)

In terms of returns, the fund is performing pretty okay, according according to Google and alphacubator:

Since its inception on 23 March 2021, V3AA has increased cumulatively by 14.87% for annualised growth rates as follows:

| ANNUAL RETURN 1Y | ANNUAL RETURN 3Y | ANNUAL RETURN 5Y | ANNUAL RETURN 10Y | ANNUAL RETURN 20Y | ANNUAL RETURN | |

|---|---|---|---|---|---|---|

| Vanguard ESG Global All Cap UCITS ETF (USD) Accumulating | 24.41% | 7.6% | 8.76% | 8.76% | 8.76% | 8.76% |

V3AA Tracking Error

However, according to Vanguard, this ETF has an annualised tracking error of 0.07% compared to the FTSE Global All Cap Choice Index it tracks.

This ETF demonstrates a very low tracking error, which means you can expect it to deliver similar market returns as the benchmark it tracks.

V3AA Risk

Here’s a lowdown of how risky this ETF is according to justETF

Who is This ETF For?

This ETF is great for those looking for a cheap, globally-diversified and passive investment vehicle that covers large, mid and small-cap companies with an ESG filter. Basically this ETF offers more diversification than VWRA.

3. SWRD ETF: SPDR® MSCI World UCITS ETF ACC (USD)

Alternatively, if you just want exposure to the developed markets, the SPDR® MSCI World UCITS ETF (USD): SWRD, which was incepted on 28 February 2019, might be for you.

SWRD is an accumulating Ireland-domiciled ETF that aims to physically track the performance of the MSCI Total World Index, a market capitalisation-weighted index made up of about 1,465 mid and large-cap companies across 23 developed market countries worldwide. The ETF replicates the performance of its corresponding index through a sampling method, where it purchases a selection of the index’s most significant constituents. Dividends within the ETF are accumulated and reinvested back into the fund.

SWRD Exposure: Top 10 Holdings, Sectors, Geography & More

Here is a breakdown of the exposure of the ETF:

SWRD differs from VWRA in that it is heavily weighted towards large-cap technology companies based in the United States but excludes companies from emerging market countries.

SWRD Share Price

The ETF is currently trading at a price of US$35.91 per share as of the 10 May 2024 close.

SWRD Total Asset Value

ETF’s total assets amount to about US$5.45B.

SWRD Expense Ratio (p.a.)

In terms of expense ratio, this ETF charges 0.12% p.a., almost half of VWRA’s total expense ratio.

SWRD Returns

In terms of returns, the fund is also performing pretty well, according according to Google and alphacubator:

Since its inception in February 2019, SWRD has increased cumulatively by 77.16% and annualised returns as follows:

| ANNUAL RETURN 1Y | ANNUAL RETURN 3Y | ANNUAL RETURN 5Y | ANNUAL RETURN 10Y | ANNUAL RETURN 20Y | ANNUAL RETURN | |

|---|---|---|---|---|---|---|

| SPDR MSCI World UCITS ETF | 23.44% | 6.51% | 12.17% | 11.9% | 11.9% | 11.9% |

SWRD Tracking Error

According to SPDR, SWRD has a low 3 year annualised tracking error of 0.09% compared to the MSCI World Index it tracks in the past year.

This ETF demonstrates a very low tracking error, which means you can expect it to deliver similar market returns as the benchmark it tracks.

SWRD Risk

According to justETFs, this is the risk you have to contend with:

Who is This ETF For?

This ETF is great for those who are looking for a cheap, globally-diversified and passive investment vehicle that covers only the developed markets.

Many also get it for the cheaper expense ratio and pair it with EIMI to gain exposure to both developed and emerging markets.

4. EIMI ETF: iShares Core MSCI EM IMI UCITS ETF ACC (USD)

Speaking of EIMI, you might want to look at the iShares Core MSCI EM IMI UCITS ETF (EIMI), which was incepted on 30 May 2014.

EIMI is an accumulating, Ireland-domiciled ETF that aims to physically track the performance of the MSCI Emerging Markets Investable Market Index, a market capitalisation-weighted index made up of about 2,800 large, mid, and small-cap emerging markets companies. Dividends within the ETF are accumulated and reinvested back into the fund.

EIMI Exposure: Top 10 Holdings, Sectors, Geography & More

Here is a breakdown of the exposure of the ETF:

EIMI is very different from VWRA and SWRD as it consists mainly of emerging market companies from China, Taiwan, South Korea, India, etc.

The ETF also grants entire market exposure, meaning you would not miss out on potential growth surprises from often-overlooked smaller companies.

EIMI Share Price

The ETF is currently trading at a price of US$33.57 per share as of 10 May 2024 close.

EIMI Total Asset Value

ETF’s total assets amount to about US$18.91B.

EIMI Expense Ratio (p.a.)

In terms of expense ratio, this ETF charges 0.18% p.a., which is close to VWRA’s total expense ratio.

EIMI Returns

The fund has not performed well, according to Google and alphacubator.

Since its inception on 30 May 2014, EIMI has increased cumulatively by 31.34% and annualised returns as follows:

| ANNUAL RETURN 1Y | ANNUAL RETURN 3Y | ANNUAL RETURN 5Y | ANNUAL RETURN 10Y | ANNUAL RETURN 20Y | ANNUAL RETURN | |

|---|---|---|---|---|---|---|

| iShares Core MSCI EIMI UCITS ETF USD (Acc) | 13.35% | -3.64% | 4.35% | 2.58% | 2.58% | 2.58% |

EIMI Tracking Returns

According to Trackinsight, EIMI has a low tracking error of 0.015% in the past year compared to the MSCI Emerging Markets Investable Market Index it tracks.

This ETF demonstrates a very low tracking error, which means you can expect it to deliver similar market returns as the benchmark it tracks.

EIMI Risk

Here is the risk of EIMI you have to contend with:

Who is This ETF For?

This ETF is great for those who are looking for a cheap, globally diversified and passive investment vehicle that covers only emerging markets.

Many buy a combination of SWRD and EIMI to get cheaper exposure to the world’s market than VWRA. But you will need to keep track of your trading fees to see if this makes sense for you.

Those who get the ETF are also bullish about Emerging Markets and view it as a hedge against the recent outperformance of the developed markets stocks.

Next up, we have the Vanguard S&P 500 UCITS ETF USD (USD): VUAA. If you were wondering why we chose VUAA over something like CSPX, it is mainly due to the price, as CSPX trades at US$545.17 while VUAA trades at US$97.76.

S&P 500 ETFs: CSPX vs VUAA

CSPX is a larger ETF with a higher per-unit price, which makes it less accessible for those with limited capital. Conversely, VUAA has a smaller per-unit price, making it more suitable for investors with smaller amounts of capital.

As mentioned above, the trading volume of the companies that make up the ETF, like Apple and Microsoft in the case of the S&P 500, influences the ETF’s liquidity more significantly.

For context, VUAA is an Ireland-domiciled ETF incepted on 14 May 2019:

The ETF aims to physically track the performance of the S&P 500 Index:

The market capitalisation-weighted index comprises about 500 large-cap and established U.S. companies. Dividends within the ETF are accumulated and reinvested back into the fund.

The ETF is also somewhat globally diversified as many of these companies are large multinational corporations with a presence worldwide.

VUAA Exposure: Top 10 Holdings, Sectors, Geography & More

Here’s a little more about VUAA’s exposure:

As you can see from the above, the S&P500 is almost completely U.S.-centric and consists of companies only located in the U.S.

The index is also quite tech-heavy, as eight out of 10 of the top ten holdings are tech companies.

VUAA Share Price

The ETF is currently trading at a price of US$98.80 per share as of 10 May 2024 close.

VUAA Total Asset Value

ETF’s total assets amount to about US$51.63B.

VUAA Total Expense Ratio (p.a.)

Regarding expense ratio, this ETF charges 0.07% p.a., which is the lowest on this list.

VUAA Returns

In terms of returns, the fund is also performing pretty well, according according to Google and alphacubator:

Since its inception on 14 May 2019, VUAA has increased cumulatively by 92.98% and annualised returns as follows:

| ANNUAL RETURN 1Y | ANNUAL RETURN 3Y | ANNUAL RETURN 5Y | ANNUAL RETURN 10Y | ANNUAL RETURN 20Y | ANNUAL RETURN | |

|---|---|---|---|---|---|---|

| Vanguard S&P 500 UCITS ETF USD Accumulation | 27.89% | 8.61% | 14.87% | 14.87% | 14.87% | 14.87% |

VUAA Tracking Error

According to Blackrock, VUAA has a low tracking error of 0.02% compared to the S&P 500 Index it tracks in the past three years.

This ETF demonstrates a very low tracking error, which means you can expect it to deliver similar market returns as the benchmark it tracks.

VUAA Risk

According to justETF, this is the risk you have to contend with when investing in VUAA:

Advertisement