As investors, I would think that at a basic level, all of us would want to maximise our investment returns.

But, there are a few things in our way.

For one, we cannot avoid risk when it comes to investing.

In addition to this risk, there’s another thing that can chip away at our profits — the cost of trading. This can include anything from fees to commissions which can all add up over the years.

So you might be asking, can you actually put your money away and keep your expenses low?

We got you!

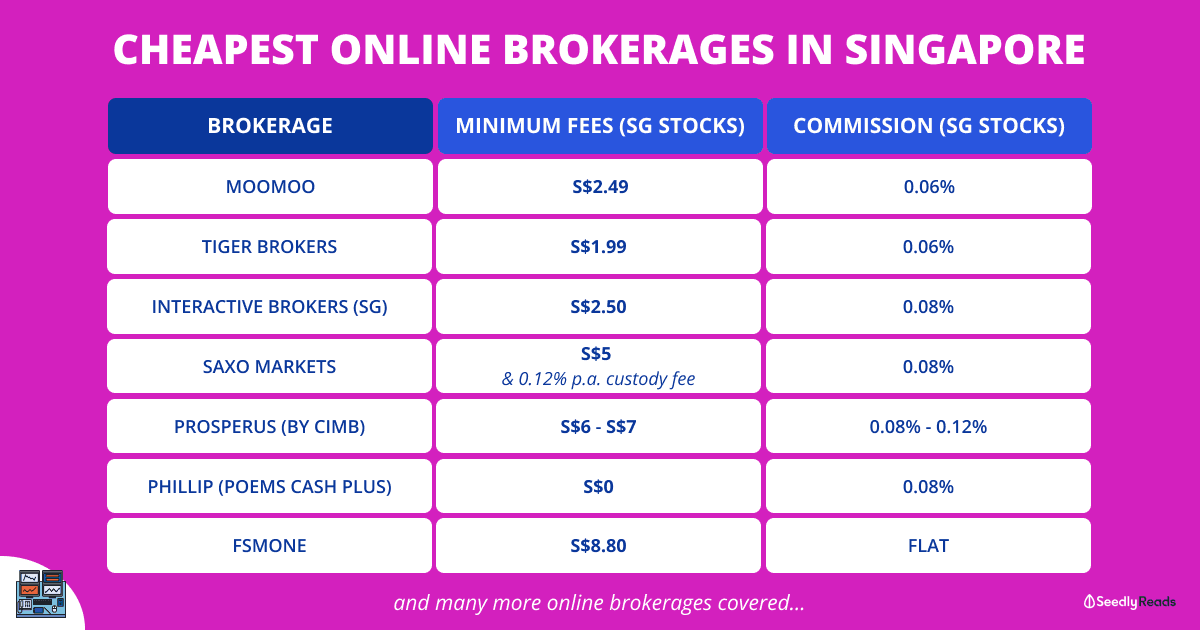

TL;DR: Singapore Brokerage Comparison —Cheapest Brokerages in Singapore 2021

If you are wondering which brokerage firm is the best in Singapore on top of just brokerage fees and charges, the real user reviews on the various brokerages will be able to provide you with excellent insight.

All You Need To Know About Stock Brokerage Accounts in Singapore

- Brokerage accounts that hold your shares as a custodian, generally charge lower fees than if you own the stock under your CDP account.

- Investors should determine if they are willing to bear the risk of a custodian brokerage account.

- For a seasoned investor, the special features of the online brokerage platforms will be something you should look at.

CDP vs Custodian Accounts

While a CDP account allows you to you hold all purchased stocks under your name, a custodian account means your purchased stocks are held by the respective investment firms.

You won’t be able to use more than the amount you’ve placed in your account.

We’ve fleshed out the pros and cons of both account types in greater detail here.

*If you’re looking to trade just stock CFDs, though, neither a CDP account nor custodian account is required.

Stock Brokerage Accounts in Singapore Fee Comparison (SG Stocks)

For this Singapore specific comparison, we will be looking at the popular brokerage accounts in Singapore that let you trade on the SGX.

If you would like to buy US stocks, check out our comprehensive guide to the cheapest brokers to buy US shares.

For this comparison, we are splitting up the online offerings from the brokerages into three main categories:

- Stock brokerage fees for Online Accounts (Cash Accounts)

- Stock brokerage fees for Pre-Funded Accounts/Cash Upfront Trading Accounts

- Stock brokerage fees for Broker-Assisted Trading Accounts

Online Brokerage Accounts in Singapore: Cash Accounts Fee Comparison (SG Stocks)

Most of the online stock brokerages in Singapore offer cash accounts that let you purchase a stock without putting up cash beforehand or trade on a ‘contra’ basis.

But, you will still have to pay on T+2, where T is the transaction date and 2 refers to the number of days.

This account provides you flexibility for short term trading as you do not need to put up a cash deposit. However, you pay for this flexibility as commissions are generally higher.

For context, these cash accounts that we are comparing allow you to trade online or on mobile.

| Cash Accounts | Minimum Commission Fee (SGD) | Trading Fee ≤$50k | Trading Fee $50k-$100k | Trading Fee >$100k | Custodian or CDP Account? | Extra Fees |

|---|---|---|---|---|---|---|

| CGS-CIMB iTrade | $25 | 0.275% | 0.22% | 0.18% | CDP | - |

| DBS Vickers Securities | $25 | 0.28% | 0.22% | 0.18% | ||

| KGI Securities / KGI Connex | $25 | 0.275% | 0.22% | 0.18% | ||

| Lim & Tan Securities | $25 | 0.28% | 0.22% | 0.18% | ||

| Maybank Kim Eng Securities | $25 | 0.275% | 0.22% | 0.18% | ||

| OCBC Securities iOCBC | $25 | 0.275% | 0.22% | 0.18% | $15 CDP Quarterly Sub-account Maintenance Fee $2 monthly Foreign Shares Custody Fee |

|

| Phillip Securities (POEMS) | $25 | 0.28% | 0.22% | 0.18% | ||

| UOB Kay Hian | $25 | 0.275% | 0.22% | 0.18% | $15 CDP Quarterly Sub-account Maintenance Fee |

Base on the above comparison, we can see that the rates are rather close to each other for these cash accounts that let you hold your shares via a CDP account.

Fees

Across the board, the minimum fees are $25 with a trading fee of:

- 0.275-0.28% (<$50k)

- 0.22% ($50k-$100k)

- 0.18% (>$100k).

Real User Reviews On Brokerages (Cash Account)

Online Brokerage Accounts in Singapore: Cash Upfront Trading Accounts Fee Comparison (SG Stocks)

In Singapore, there have been a growing number of banks and stock brokerages offering up pre-funded accounts with more competitive rates.

These pre-funded accounts, or cash upfront trading (CUT) accounts offer these rates with one major requirement.

CUT accounts require that you have to deposit money into your account before you can purchase stocks. Your buying power is also limited to how much you deposit into your trading account. However, this also means that you get to enjoy lower commissions.

If you can live with this inconvenience, I would think that this is worth the savings.

To illustrate, let’s compare CGS-CIMB Securities cash account with their basic 0.275% trading fee and their CGS-CIMB iTrade CUT account with their basic 0.18% trading fee.

If you invested S$10,000, you would have saved S$9.50. This amount will also scale up the more your invest.

For context, these cash upfront accounts that we are comparing allow you to trade online or on mobile.

| Pre-funded/ Cash Upfront Accounts | Minimum Commission Fee (SGD) | Trading Fee ≤$50,000 | Trading Fee $50,001 - $100,000 | Trading Fee >$100,000 | Custodian or CDP Account? | Extra Fees |

|---|---|---|---|---|---|---|

| DBS Vickers Cash Upfront* | $10 | 0.12% | CDP | N/A | ||

| FSMOne | $8.80 (Flat) | - | CDP + Custodian (CDP account linked for sell orders only) | 0% (No charges for Stocks & ETFs) | ||

| CGS-CIMB iTrade | $18 | 0.18% | Custodian | N/A | ||

| HSBC Online Securities | $25 | 0.25% (HSBC personal banking) | 0.18% (HSBC Premier) | 0.15% (HSBC Jade) | N/A | |

| Interactive Brokers Singapore | $2.50 | 0.08% | N/A (Inactivity fee removed as of 1 July 2021) |

|||

| KGI Connex (Pre-funded) | $25 | 0.18% | N/A | |||

| Lim & Tan Securities: Cash Collateralised Trading | $18 | 0.18% | N/A | |||

| moomooo (by Futu Holdings) | $2.50 ($0.99 commission fee + $1.50 platform fee) | 0.06% (0.03% commission fee + 0.03% platform fee) | N/A | |||

| Maybank Kim Eng Trade (Pre-funded) | $10 | 0.12% | N/A | |||

| OCBC Securities: Equities Plus Account | $18 | 0.18% | Quarterly sub-account fee (waived for >$250k AUM) $2 + GST (a/c without holdings) $15 + GST (a/c with holdings) $2 foreign shares custody fee |

|||

| Phillip Securities: POEMS Cash Plus | $0 | 0.08% | Account maintenance fees ($0 - $249,999 AUM): S$15 per quarter (waived if there is at least 1 trade per quarter for the Account) Account maintenance fees (>S$250,000 AUM): Waived |

|||

| ProsperUs (By CIMB) | $6 - $7 | 0.12% (min. $7) | 0.10% (min. S$6) | 0.08% (min. S$6) | - | |

| Saxo Capital Markets | $5 | 0.08% | 0.12% p.a. custody fee | |||

| Standard Chartered: Online Trading | $10 | 0.20% | 0.18% (>S$200,000 AUM) | N/A | ||

| Tiger Brokers: Tiger Trade | $1.99 ($0.99 commission fee + $1 platform fee) | 0.06% (0.03% commission fee + 0.03% platform fee) | N/A | |||

| UOB Kay Hian: UTRADE Plus | $18 | 0.18% | Quarterly sub-account fee SGD2 + GST (a/c without holdings) or SGD15 + GST (a/c with holdings) |

|||

*DBS Vickers Cash Upfront is only applicable to buy trades. For sell trades, the commission to sell is S$25.

Effectively, POEMS is the most affordable brokerage if your investment amount is S$334 and below, as they only charge 0.08% with NO minimum fee per trade. Note that POEMS charge a quarterly maintenance fee of S$15. But, this fee will be waived as long as you make one trade per quarter.

But, if your investment amount is above S$334, you are better off with Tiger Brokers.

If you would like to own your stocks in your CDP account, your only option is DBS Vickers cash upfront with its S$10 minimum fee and 0.08% trading fee.

However, take note that you can only use it to conduct buy trades with this account. If you want to conduct sell trades, you will be charged a commission of S$25.

One way to get around this would be to buy stocks on your DBS Vickers cash upfront account and sell it with your FSMOne account, which has a lower S$10 minimum fee and 0.08% trading fee.

Real User Reviews On Brokerages (Cash Upfront)

Broker Assisted Brokerage Accounts in Singapore Fees Comparison (SG Stocks)

Clearly, online brokerage accounts offer better rates than offline broker-assisted accounts.

However, if you are not comfortable with a do-it-yourself approach to trading and want help from a human over the phone — broker-assisted accounts are the way to go.

For investors who use a broker for their trading, the comparison is as per below:

| Brokerages (Broker Assisted) | Minimum Fees | Trading Fees (based on contract amount) (S$) | Custodian or CDP Account? | ||

|---|---|---|---|---|---|

| <$50K | $50K to $100K | >$100K | CDP | ||

| CGS-CIMB Securities | $40 | 0.50% | 0.40% | 0.25% | |

| DBS Vickers | $40 | 0.375% | 0.30% | 0.23% | |

| KGI Securities | $40 | 0.50% | 0.40% | 0.25% | |

| Lim & Tan Securities | $40 | 0.50% | 0.40% | 0.25% | |

| Maybank Kim Eng | $40 | 0.50% | 0.40% | 0.25% | |

| Phillips Securities (POEMS) | $40 | 0.50% | 0.40% | 0.25% | |

| OCBC Securities | $40 | 0.50% | 0.40% | 0.25% | |

| RHB Securities | $40 | 0.50% | 0.40% | 0.25% | |

| Citibank | $50 | 0.50% | 0.50% | 0.40% | Custodian |

DBS Vickers offers the lowest broker-assist fees if you really need this service.

Real User Reviews On Brokerages (Broker-Assisted)

Other Considerations

Also, if you are wondering which brokerage firm is the best in Singapore, you can check out our real user reviews on the various brokerages.

These reviews will provide you with excellent insight to help you choose which brokerage is best for you.

We urge you to pick wisely and test out several brokerages before choosing one to use as your primary brokerage account.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the companies mentioned.

Related Articles

- How to Invest: A Singaporean’s Guide To Investing for Beginners

- How To Buy Bitcoin and Other Cryptocurrencies in Singapore: A Beginner’s Guide

- Digital Core REIT IPO: Another Data Centre REIT to Be Listed Here on 6 Dec

- What Is the UOB APAC Green REIT ETF? A New Way To Invest in Environmentally-friendly REITs

- Best Robo Advisors Comparison Guide: Autowealth vs Endowus vs Stashaway vs Syfe & More

- CSOP iEdge S-REIT Leaders Index ETF: What Investors Should Know About This New REIT ETF

- Tiger Brokers Review: Is This Tiger King of Brokerages in Singapore?

- Undervalued Stocks in Singapore: 7 Best Blue Chip Stocks To Consider

- Low Cost Online Brokerage Comparison and Review: Moomoo vs Tiger Brokers vs Interactive Brokers

- Budget 2023 Singapore Summary

- Best Travel Insurance in Singapore (2023): Find The Best One For Your Needs

Advertisement