Definitive U.S. Stock Investing Taxes and Fees Guide for Singaporean Investors

●

When it comes to investing and creating a diversified investment portfolio, it is hard to avoid the United States and American companies.

After all, the U.S. is home to the New York Stock Exchange and the NASDAQ, two of the largest stock exchanges in the world by market capitalisation (market cap).

In addition, some of the most innovative and exciting growth companies in the world like Facebook, Amazon, Alphabet, Netflix and Google (FAANG) are listed in the U.S.

Not to mention the popular Exchange Traded Funds (ETFs) like the many S&P 500 ETFs that track the S&P 500 index.

These stocks and ETFs give you geographic exposure and of course pretty attractive returns as well.

However, as Singapore-based investors, we are considered Non-Resident Aliens (NRA) by the U.S.

As such, there are several tax pitfalls we need to be aware of and reduce our exposure to, as these taxes as these fees can destroy your returns.

TL;DR: Definitive Guide to Taxes and Fees For Non-Resident Investors Investing in The U.S.

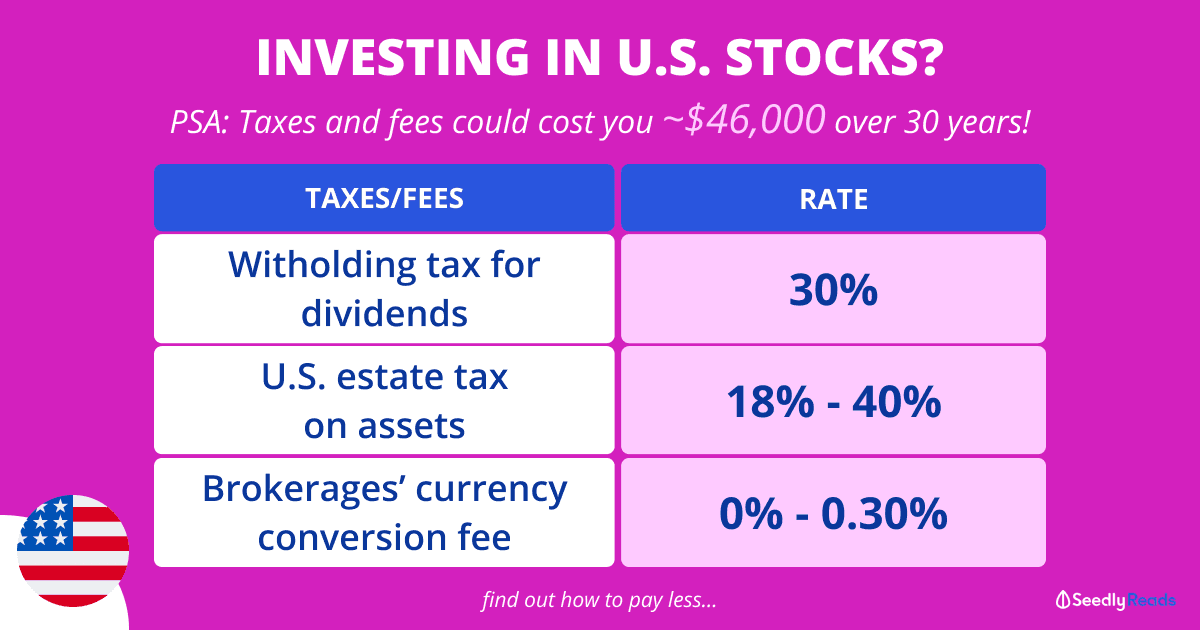

On top of brokerage fees and the expense ratio fee, these are the following taxes and costs you should be aware of when investing in U.S. companies.

If you are an NRA investor, these are the taxes you are liable for:

| Tax/Fee | Rate |

|---|---|

| Withholding tax for dividends | 30% |

| US Estate tax | 18%-40% |

| Broker's currency conversion fee | 0% -0.30% |

These taxes and costs apply to assets like:

- Stocks

- Bonds

- ETFs

- Mutual funds

- Cash in US-based brokerages

These are the taxes you are not liable for:

- Capital gains taxes (as these assets are not linked to income with a trade or business in the U.S.).*

- Majority of interest taxes (with the exception of those that involve starting an American trade or business)

- Foreign sourced income tax as Singapore does not currently tax this.

*If you spend more than 183 days in the U.S, you will owe taxes on net U.S. source capital gains.

In addition, you will need to be aware of the foreign currency risk and currency conversion fees as well.

This guide will be essential reading for any investors looking to invest in the U.S. regardless of whether you buy individual U.S. stocks, invest in U.S. unit trusts and ETFs

We will also be providing solutions to reduce the amount of tax you will have to pay as well.

Do note that taxation is a complex and convoluted subject. A country’s tax codes change regularly and updated legislation governments can have a substantial impact on tax structuring. If in doubt, please clarify with a tax consultant and/or your broker.

Are You a Non-Resident Alien (NRA)?

To determine how much tax you are liable for on your U.S. investments or assets, here is a simple test to do.

If you are not one of the below:

- U.S. Citizen

- Green Card Holder

- Lived in the US for 183 days within a three year time period*

You are considered a Non-Resident Alien (NRA) by the U.S. government and will be taxed accordingly.

The applies to all NRAs even if you do not live in the U.S. and own American investments or assets, you will be taxed.

As an NRA investor, you will need to fill in a W-8BEN form when you open a brokerage account to purchase accounts.

P.S. check out our guide to the cheapest stock trading and brokerage houses in Singapore.

Withholding Tax For Dividends When Investing in The U.S.

Singaporeans investing in the American market are taxed 30% on our dividends as the U.S does not have a tax treaty with Singapore.

For example, if the company declares a dividend that amounts to $100 to you, you will essentially only receive $70. However, we are exempt from capital gains (profits when the share price of our shares increase).

How to Pay Less Withholding Tax Dividends

One way to go around this is to invest in Ireland domiciled ETFs which benefit from the dual taxation treaty between the U.S. and Ireland.

This means that your dividends will only be taxed 15%. And while this is not perfect, it certainly is more pocket-friendly than 30%.

Where it is Domiciled Matters

Generally, Ireland domiciled ETFs are listed on the London Stock Exchange (LSE) but not all U.S. ETFs listed on the LSE are domiciled in Ireland.

The first thing investors should check when selecting an ETF is where the fund is domiciled.

This vital piece of information is clearly spelt out in the ETF factsheet, but can also be found on websites like the Financial Times.

Take note that even if you buy ETFs that are accumulating/capitalising, their dividends will still be taxed 15% before they are reinvested.

FYI: Accumulating ETFs automatically reinvest your dividend income back into the fund at no extra expense whereas Distributing ETFs payout dividends back to the investor regularly.

The one downside to this is that these Ireland-Domiciled ETFs typically have higher expense ratios and are less liquid with a worse bid-ask spread compared to U.S. domiciled ETFs.

To illustrate this, we will assume you invested in an accumulating Ireland domiciled ETF with a dividend yield of 4% per annum (p.a.).

If you buy a U.S. domiciled ETF, you will be paying 1.2% in fees.

On the other hand, If you buy an accumulating Ireland domiciled ETF, you will be saving 0.6% in dividend income that is reinvested.

Take this example, that you put $500 a month into a brokerage account for 30 years, depositing a total of $180,000 over that time and earning an average annual 5% return including dividend yield.

Over three decades, the investor would have $409,429 in their account but would have lost $46,233 due to the 0.6% in fees!

Unfortunately, only ETFs are domiciled in Ireland. If you invest in the other asset classes like stocks and bonds, you are still liable for the full 30% withholding tax for dividends.

US Estate Tax

In addition, there is also the U.S. Estate Tax.

In the unfortunate event if you pass away while holding on to stocks, bonds, ETFs, funds, cash in a US-based brokerage the U.S. government will apply an estate tax from 18 to 40% for assets worth more than US$60,000.

To avoid this, you can purchase ETFs domiciled in Ireland, as these ETFs are insulated from the estate tax.

In addition, U.S. treasury bonds, U.S. government agency securities and certain U.S. corporate bonds and U.S. commercial paper are exempt from this tax rate as well.

However, assets like stocks, bonds, funds, real estate or cash in a US-based brokerage are subject to this tax rate.

There are certain ways around this like starting a foreign trust. But you will need professional help to set this up correctly.

Do consult your tax consultant for further advice.

Foreign Currency Risk and Conversion Fees When Investing in The U.S.

Since these ETFs are denominated in a currency outside Singapore dollars (SGD), we need to be aware of the risk of foreign currency fluctuations, during transactions.

Let’s say you invest in a U.S. company and its stock price goes up. In theory, you will be directly profiting from these capital gains.

But, you will have to factor in foreign currency risk which are the losses you may incur due to currency fluctuations.

When the US Dollar (USD) Depreciates Against The Singapore Dollar (SGD)

For example, let’s say the exchange rate between the USD and SGD was 1:1 (each USD is worth one SGD) when you buy a stock.

At this exchange rate, the amount of profit you get is the same in either denomination.

But, let’s say the USD were to depreciate against the SGD, and the exchange rate becomes 1:0.9.

Your profits will be reduced if you were to sell a US stock and convert it back to SGD, as US$1 is now worth only S$0.90.

When the US Dollar (USD) Appreciates Against The Singapore Dollar (SGD)

On the flip side, if the USD were to appreciate against the SGD and the exchange rate becomes 0.9:1.

Your profits will be increased if you were to sell a US stock and convert it back to SGD, as US$1 is now worth ~S$1.10.

Brokerages Currency Conversion Fees

On top of this, some brokerages like Saxo also charge currency conversion fees.

When you top up SGD to your brokerage account and buy U.S. stocks denominated in USD, Saxo will charge a currency conversion fee.

Let’s say you want to buy U.S. stocks.

You can consider creating a USD sub-account with Saxo and do an account transfer from your SGD sub-account to convert SGD into USD.

This will cost you just 0.30% per transaction.

Alternatively, brokerages like Interactive Brokers charge a 0.002% fee with a minimum amount of US$2 for each transaction.

Whereas brokerages like moomoo and Tiger currently do not charge a fee for currency conversion.

Not to mention that some brokerages will charge for the forex spread, which is the difference between the bid and ask price when converting currency.

Avoid Dividend Stocks When Investing in The U.S.

At the end of the day, it really does not make much sense to invest in U.S. domiciled ETFs.

As seen with the illustrated example the 15% withholding tax difference saw a loss of $46,924 to fees.

Instead, you should be picking an Ireland domiciled ETF whenever possible.

However, if you are looking to pick stocks, I would avoid dividend-paying stocks as the 30% withholding tax really puts a dampener on the returns for dividends.

Not to mention the 18% to 40% estate tax on U.S. assets for NRAs which applies to both stocks and ETFs.

Advertisement