In Singapore, enthusiastic insurance agents camping at MRT stations are aplenty.

While many are keen to explain their wide array of insurance products that’ll suit your needs. Unfortunately, as consumers, these plans are oftentimes difficult to comprehend.

And relying solely on the 5-minute pitch of an insurance agent may not necessarily result in you obtaining the best plan.

While there are hundreds of different insurance products out in the market, personal accident plans are perhaps one of the most common and basic ones which most consumers would consider.

For those who’ve just started out researching on insurance and are looking for the best plan for your buck, here’s a guide on some of the best personal accident plans you can get.

Disclaimer: we’re neither sponsored nor are we giving advice, the opinions stated in this article are based on a simple comparison based on rudimentary criteria. Always seek professional advice or speak to your advisor for more information.

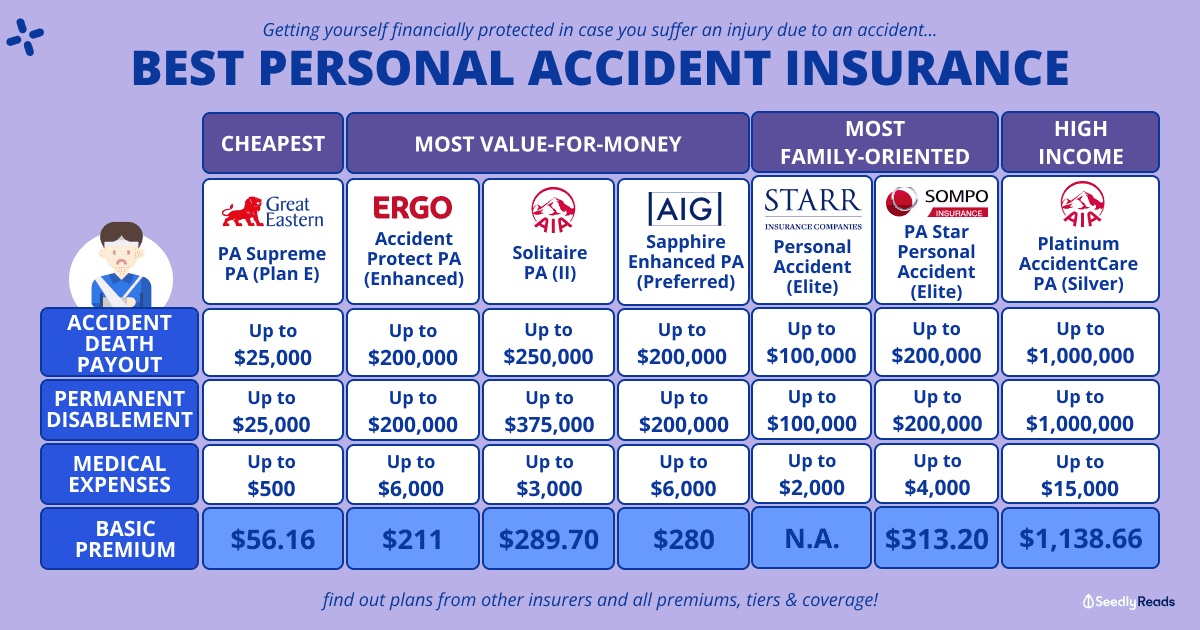

TL;DR: Which Is The Best Personal Accident (PA) Insurance For You?

Before we dive into the different plans, there’s a need to establish that the premiums and sum assured are based on the following profile:

- A professional working in a desk-bound job

- Does not travel overseas frequently for work

- Does not ride a motorcycle, and isn’t a frequent pillion rider

- Is a breadwinner of the family with dependants (e.g. children or elderly parents)

Why did we only choose white-collar as a base profile?

Because by 2030, two-thirds of Singaporeans will be in a white-collar job.

The other reason is also because the riskier your job is, chances are the premiums will go up too.

That said, we’re solely looking at basic coverage. If you want comprehensive coverage, you would need to be prepared to pay more.

Best Personal Accident Plans

- Cheapest Premium: Great Eastern PA Supreme Personal Accident (Plan E)

- Most Value For Money: ERGO AccidentProtect Individual Personal Accident (Enhanced), AIA Solitaire PA (II) Personal Accident, AIG Sapphire Enhanced Personal Accident (Preferred)

- Most Family-Oriented: Starr Insurance Personal Accident & Sompo PA Star Personal Accident (Elite)

- For High-Income individuals Who Travel Frequently: AIA Platinum AccidentCare Personal Accident (Silver)

What Is A Personal Accident Plan?

A personal accident plan is considered one of the three key insurance policies that you will need in your lifetime.

It is a general insurance that complements your Medical and Hospitalisation insurance, and it provides you with financial support in the event of an unfortunate accident.

Payouts come in three forms:

- On a reimbursement basis

- Based on medical expenses incurred, or

- Lump-sum payout (depending on the type of injuries sustained)

What’s Covered In A Personal Accident Plan?

In general, there are different types of coverages you can get from a personal accident plan.

The most common ones are:

Accidental Death Benefit

This is a key coverage under the personal accident scheme. It ensures that in the event of death during an accident, a payout will be given to the person’s dependants.

Permanent And Partial Disability

Another key coverage of the PA scheme. This ensures that in an event where the policyholder gets into an accident and becomes disabled, he or she will be given a form of compensation to tide them through.

Income Benefit

Usually applicable for employed policyholders at the time of injury who are unable to work due to the injury. The amount may differ from different policies.

Medical Expenses Coverage

Medical expenses reimbursements help alleviate your medical bills and are usually capped at a certain limit.

Daily Hospital Benefit

This is payable if you are hospitalised due to an accident. You can receive this even if you’re unemployed.

Note: This list is just a general overview of the usual coverage for personal accident insurance. Naturally, not all PA plans offer the same coverage.

Should You Get A Personal Accident Insurance Plan?

It is of course, optional for you to have a personal accident plan.

But it is definitely an added layer of protection – especially if you’re really accident-prone.

But really, you should consider getting a PA plan if you are:

- A sole breadwinner or have family members who are financially dependent on you

- Commuting regularly on motorcycles, bicycles, or electric scooters

- Participating in extreme sports

- Travelling often for work or leisure

- Working in a risky job

However, do keep in mind that your situation may affect the type of premiums you will pay for insurance.

Essentially, most insurance plans classify policyholders into these occupational class:

- Occupational Class 1: Professionals and persons engaged in executive, administrative or clerical duties such as accountant, lawyer, banker, doctor, teacher, nurse, secretary, etc.

- Occupational Class 2: Persons engaged in skilled or semi-skilled work and not exposed to hazardous conditions with some degree of risks, such as supervision of manual workers, totally administrative job in an industrial environment, professions of an outdoor nature, work involving overseas travel or work involving the occasional use of tools or machinery, such as foreman, grocer, hairdresser, salesman, tailor, surveyor, tourist guide, etc.

- Occupational Class 3: Persons engaged in occupations involving regular light to medium manual work with no substantial hazard which may increase the risk of sickness or accident. Examples are professions involving the use of tools or machinery, such as a carpenter, builder, painter, driver, technician, hawker, unarmed security guard, etc.

- Occupational Class 4: Persons in high-risk occupations involving heavy manual work including hot works. Examples are full-time national serviceman, fireman, policeman, armed security guard and woodworking machinist, etc.

For those working in blue-collared jobs, the insurance premiums you pay may be higher than the prices listed in this article, due to the different risk levels of your job.

For the majority of working adults in white-collared office jobs, it’s best to get a personal accident plan that has decent coverage and annual premiums that won’t break the bank.

Things To Look Out For When Buying A Personal Accident Plan

I’ve spoken to a few of my insurance agent friends to find out more about what you should look out for when purchasing a personal accident insurance plan.

Other than the cost of annual premiums, other key things you’ve to look out for include:

Accidental Death And Disability Amount

Accidental death, disability, and medical reimbursements are highlights of a personal accident insurance plan, and in an event of a major accident, these claims are most useful.

Make sure that you have enough coverage in these areas when looking for the right plan.

Medical Reimbursements Amount

Make sure you are clear on your accidental medical reimbursement amount, and whether claims should be made per injury, per body part, or per year.

How Is “Accident” Defined In The Policy? Are There Any Extensions For The Definition Of An Accident?

Check if your PA policy includes accidents beyond the standard coverage.

For example, coverages for food poisoning, insect bites, terrorism are good to have.

Check The Schedule For The Indemnities For Accidental Dismember And Disability Amount

In your insurance policy, look under: Product Summary >> Accidental Dismemberment Benefit >> Schedule of Indemnity List.

Take note of what is being covered in your insurance, as well as the percentage insured amount.

Traditional Chinese Medicine (TCM) And Chiropractor Claim Amounts

Check if your PA policy includes TCM and Chiropractor claims.

These are good to have, especially in cases of injuries where you have the option to seek alternative medical treatments.

For The Elderly

Check the maximum age of entry and the maximum renewable age.

It is better for you to choose one that has a renewable age of at least 85 years old, so that you will be protected for a much longer time.

Which Personal Accident Insurance Is Best For You?

The best personal accident plan is one that is catered to your customer profile. Here, I’ve picked out 6 of the best ones according to various profiles.

AIA

Most individuals would be familiar with AIA – one of the biggest insurance companies in Singapore and very likely, you know someone who works there.

The company has two Personal Accident plans: AIA Solitaire and AIA Platinum AccidentCare.

What I like most about the AIA Solitaire is that it’s the most value-for-money plan, especially Plan II.

AIA Solitaire PA Personal Accident

| Personal Accident Plans (Basic) | AIA Solitaire PA Personal Accident | AIA Solitaire PA (II) Personal Accident | AIA Solitaire PA (III) Personal Accident | AIA Solitaire PA (IV) Personal Accident |

| Annual Premium | $176.33 | $289.70 | $469.15 | $671.76 |

| Accidental Death | Up to $100,000 | Up to $250,000 | Up to $500,000 | Up to $750,000 |

| Accidental Permanent Total Disablement Benefit | Up to $150,000 | Up to $375,000 | Up to $750,000 | Up to $1,125,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

Up to $100,000 | Up to $250,000 | Up to $500,000 | Up to $750,000 |

| Accidental Dismemberment and Burns Benefit | Up to $100,000 | Up to $250,000 | Up to $500,000 | Up to $750,000 |

| Medical & Surgical Expenses | Up to $2,000 | Up to $3,000 | Up to $4,000 | Up to $5,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $500 | Up to $750 | Up to $1,000 | Up to $1,250 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Optional | |||

| Weekly Income Benefit | Optional | |||

| Hospitalisation Benefits | Optional | |||

| Dependant Cover Benefits | Optional | |||

| Bereavement Allowance / Grant | – | |||

| Special Features | – | |||

AIA Platinum AccidentCare Personal Accident

On the contrary, the AIA Platinum AccidentCare might just be the priciest insurance plan on this list. but there’s a catch – it covers up to $5,000,000!

Even in its simplest form, this plan covers Aviation Accident which pays on top of Accidental Death or Permanent Disability, and is seemingly designed for frequent travellers and high-profile individuals who travel often.

| Personal Accident Plans (Basic) | AIA Platinum AccidentCare Personal Accident (Silver) | AIA Platinum AccidentCare Personal Accident (Gold) | AIA Platinum AccidentCare Personal Accident (Diamond) |

| Annual Premium | Occupational class 1: $1,138.66

Occupational class 2: $1,415.77 |

Occupational class 1: $2,423.96

Occupational class 2: $3,007.36 |

Occupational class 1: $3,641.41

Occupational class 2: $4,501.14 |

| Accidental Death | Up to $1,000,000 | Up to $3,000,000 | Up to $5,000,000 |

| Accidental Permanent Total Disablement Benefit | |||

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | ||

| Burns Benefit | – | ||

| Medical & Surgical Expenses | Up to $15,000 | Up to $20,000 | Up to $25,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $3,000 | Up to $4,000 | Up to $5,000 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $5,000 | Up to $8,000 | Up to $10,000 |

| Weekly Income Benefit | Optional | ||

| Hospitalisation Benefits | Optional | ||

| Dependant Cover Benefits | Optional | ||

| Bereavement Allowance / Grant | – | ||

| Special Features | Aviation Accident Benefit (Pays on top of the Accidental Death, Accidental Dismemberment and Burns Benefit when you pass away while travelling as a fare-paying passenger on a flight): $1 mil, $3 mil & $5 mil |

||

Allianz

Getting into an accident is an unfortunate incident, and your recovery might be better when you choose the Allianz Personal Accident.

The one thing that stood out is its mobility aids and home modification benefits – up to $15,000. With potential life changes that may occur after a major accident, this might be what you need to make adjustments to your living environment.

| Personal Accident Plans (Basic) | Allianz Accident Protect Plus Personal Accident (Silver) | Allianz Accident Protect Plus Personal Accident (Gold) | Allianz Accident Protect Plus Personal Accident (Platinum) | Allianz Accident Protect Plus Personal Accident (Child) |

| Annual Premium | $179.76 | $333.84 | $731.88 | $64.20 |

| Accidental Death | Up to $50,000 | Up to $100,000 | Up to $300,000 | Up to $25,000 |

| Accidental Permanent Total Disablement Benefit | Up to $50,000 | Up to $100,000 | Up to $300,000 | Up to $25,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | |||

| Burns Benefit | – | |||

| Medical & Surgical Expenses | Up to $2,500 | Up to $5,000 | Up to $7,500 | Up to $2,500 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

– | |||

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $5,000 | Up to $10,000 | Up to $15,000 | Up to $5,000 |

| Weekly Income Benefit | Optional | |||

| Hospitalisation Benefits | Optional | |||

| Dependant Cover Benefits | Optional | |||

| Bereavement Allowance / Grant | Up to $2,500 | Up to $5,000 | Up to $7,500 | Up to $2,500 |

| Special Features | No Claim Bonus of 10% each year, up to a maximum of 30% | |||

AIG

The AIG Sapphire Enhanced Personal Accident is next-in-line for the most value-for-money title.

At $159, you can get similar coverage as the AIA Solitaire PA Plan (which is $179). If price is your main concern, this is probably an insurance to consider.

On top that, the plan provides Dependent Child’s Cover at 20% and 25%, which means that the financial protection extends to your child if something happens to you.

| Personal Accident Plans (Basic) | AIG Sapphire Enhanced Personal Accident (Standard) | AIG Sapphire Enhanced Personal Accident (Preferred) | AIG Sapphire Enhanced Personal Accident (Deluxe) | AIG Sapphire Enhanced Personal Accident (Prestige) |

| Annual Premium | $159 | $280 | $363 | $530 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | |||

| Burns Benefit | – | |||

| Medical & Surgical Expenses | Up to $2,000 | Up to $6,000 | Up to $8,000 | Up to $10,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

– | |||

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $4,000 | Up to $4,000 | Up to $4,000 | Up to $4,000 |

| Weekly Income Benefit | Optional | |||

| Hospitalisation Benefits | Up to $50 per day | Up to $100 per day | Up to $150 per day | Up to $250 per day |

| Dependant Cover Benefits | ||||

| Bereavement Allowance / Grant | – | |||

| Special Features | Dependent Child’s Cover: 20% for Standard & Preferred; 25% for Deluxe & Prestige | |||

China Taiping Insurance

China Taiping is the newest contender on this list and its premium is relatively higher compared to other insurers.

But there’s a catch — it has a 5 per cent No Claim Discount is given at each renewal up to 20 per cent when no claim is made. Besides this, the plan also extends to diseases such as SARS, Bird Flu (H5N1) & Dengue Fever.

| Personal Accident Plans (Basic) | China Taiping Personal Accident Safe (Economy) | China Taiping Personal Accident Safe (Executive) | China Taiping Personal Accident Safe (Platinum) | China Taiping Personal Accident Safe (Titanium) |

| Annual Premium | $173 | $283 | $433 | $543 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

Up to $200,000 | Up to $400,000 | Up to $600,000 | Up to $1,000,000 |

| Burns Benefit | – | |||

| Medical & Surgical Expenses | Up to $1,000 | Up to $2,000 | Up to $3,000 | Up to $5,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $500 | Up to $500 | Up to $500 | Up to $500 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $2,000 | Up to $2,000 | Up to $2,000 | Up to $2,000 |

| Weekly Income Benefit | – | |||

| Hospitalisation Benefits | Up to $100 per day | Up to $150 per day | Up to $200 per day | Up to $300 per day |

| Dependant Cover Benefits | Plans include benefits for insured, spouse, child, parent-in-law and maid | |||

| Bereavement Allowance / Grant | Up to $2,000 | Up to $2,000 | Up to $2,000 | Up to $2,000 |

| Special Features | Plans also cover: – SARS, Bird Flu (H5N1) & Dengue Fever – Emergency medical evacuation & repatriation: S$50,000 for individual Plan, $100,000 for Family Plan – Animal or insect bites – Repatriation of mortal remains – Child Care Benefit (upon death of insured/spouse) – 5% No Claim Discount is given at each renewal up to 20% when no claim is made – Education Fund for insured Child upon accident death of Insured or Spouse – S$20,000 Per Child – Receive S$10,000* in the event of death caused by COVID-19 |

|||

ERGO Insurance

ERGO Insurance is a subsidiary of ERGO Group AG, a major insurance group in Germany and Europe.

ERGO Insurance is a subsidiary of ERGO Group AG, a major insurance group in Germany and Europe.

At $221, the ERGO AccidentProtect Individual Personal Accident (Enhanced) is pretty much a policy has covers most categories.

| Personal Accident Plans (Basic) | ERGO AccidentProtect Individual Personal Accident (Basic) | ERGO AccidentProtect Individual Personal Accident (Enhanced) | ERGO AccidentProtect Individual Personal Accident (Standard) | ERGO AccidentProtect Individual Personal Accident (Deluxe) |

| Annual Premium | $127 | $221 | $301 | $574.00 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

Up to $200,000 | Up to $400,000 | Up to $600,000 | Up to $1,000,000 |

| Burns Benefit | – | |||

| Medical & Surgical Expenses | Up to $3,000 | Up to $6,000 | Up to $8,000 | Up to $10,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $500 | Up to $750 | Up to $750 | Up to $1,000 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $3,000 | Up to $4,000 | Up to $4,000 | Up to $5,000 |

| Weekly Income Benefit | Optional | |||

| Hospitalisation Benefits | Optional | |||

| Dependant Cover Benefits | – | |||

| Bereavement Allowance / Grant | – | |||

| Special Features | – | |||

FWD

Amongst all insurance plans, FWD Personal Accident Insurance is the one of the two insurers that provides personal liability coverage. This protects you financially if you’re responsible for damages or injuries to others.

Unlike the other insurers that offer recuperation benefits from traditional chinese medicine, this insurance plan provides physiotherapy expenses up to $5,000.

| Personal Accident Plans (Basic) | FWD Personal Accident | ||||

| Annual Premium | $121.12 | $228.79 | $363.37 | $740.19 | $1,345.80 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 | Up to $1,000,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 | Up to $1,000,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | ||||

| Burns Benefit | – | ||||

| Medical & Surgical Expenses | Up to $2,000 | Up to $4,000 | Up to $6,000 | Up to $10,000 | Up to $15,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $500 | Up to $600 | Up to $700 | Up to $1,000 | Up to $1,500 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Mobility aid: Up to $500

Home modifications: Up to $10,000 |

Mobility aid: Up to $1,000

Home modifications: Up to $15,000 |

Mobility aid: Up to $2,000

Home modifications: Up to $20,000 |

Mobility aid: Up to $3,000

Home modifications: Up to $30,000 |

Mobility aid: Up to $5,000

Home modifications: Up to $50,000 |

| Weekly Income Benefit | – | – | – | Up to $300 | Up to $500 |

| Hospitalisation Benefits | – | – | – | Up to $300 per day | Up to $500 per day |

| Dependant Cover Benefits | – | – | – | – | – |

| Bereavement Allowance / Grant | Up to $5,000 | Up to $5,000 | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | Physiotherapy expenses: Up to $1,000

Personal liability: Up to $100,000 Ticketed Event Cancellation: Up to $100 |

Physiotherapy expenses: Up to $1,500

Personal liability: Up to $200,000 Ticketed Event Cancellation: Up to $200 |

Physiotherapy expenses: Up to $2,000

Personal liability: Up to $300,000 Ticketed Event Cancellation: Up to $300 |

Physiotherapy expenses: Up to $3,000

Personal liability: Up to $400,000 Ticketed Event Cancellation: Up to $500 |

Physiotherapy expenses: Up to $5,000

Personal liability: Up to $500,000 Ticketed Event Cancellation: Up to $1,000 |

Great Eastern

Great Eastern needs no introduction.

As one of the biggest insurers in Singapore, Great Eastern has not one, but six types of Personal Accident plans!

It offers the Great Eastern PA Supreme Personal Accident (Plan E) which is the cheapest plan on this list, at $56.16. These plans are namely:

- Great Eastern AccidentCare Plus II Personal Accident

- Great Eastern Essential Protector Personal Accident

- Great Eastern Essential Protector Plus Personal Accident

- Great Eastern GREAT Protector Active Personal Accident

- Great Eastern PA Supreme Personal Accident

- Great Eastern Prestige PACare Personal Accident

For your benefit, I’ve shortlisted only those that cover medical expense reimbursements.

Great Eastern Essential Protector Plus Personal Accident

| Personal Accident Plans (Basic) | Great Eastern Essential Protector Plus Personal Accident (Plan A) | Great Eastern Essential Protector Plus Personal Accident (Plan B) | Great Eastern Essential Protector Plus Personal Accident (Plan C) |

| Annual Premium | $230.04 | $339.12 | $492.48 |

| Accidental Death | Up to $50,000 | Up to $100,000 | Up to $200,000 |

| Accidental Permanent Total Disablement Benefit | Up to $50,000 | Up to $100,000 | Up to $200,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | Up to $4,000 | Up to $6,000 | Up to $8,000 |

| Medical & Surgical Expenses | Up to $5,000 | Up to $10,000 | Up to $15,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

– | – | – |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $500 | Up to $1,000 | Up to $2,000 |

| Weekly Income Benefit | – | – | – |

| Hospitalisation Benefits | Up to $100 per day | Up to $150 per day | Up to $200 per day |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | – | – | – |

Great Eastern GREAT Protector Active Personal Accident

| Personal Accident Plans (Basic) | Great Eastern GREAT Protector Active Personal Accident (Basic) | Great Eastern GREAT Protector Active Personal Accident (Classic) | Great Eastern GREAT Protector Active Personal Accident (Elite) |

| Annual Premium | $323 | $524.86 | $857.94 |

| Accidental Death | Up to $200,000 | Up to $500,000 | Up to $1,000,000 |

| Accidental Permanent Total Disablement Benefit | Major: Up to $300,000 – $600,000

Other: Up to $5,000 – $100,000 |

Major: Up to $750,000* – $1,500,000

Other: Up to $12,500 – $250,000 |

Major: Up to $1,500,000* – $3,000,000

Other: Up to $25,000 – $500,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | Up to $3,000 | Up to$4,000 | Up to $5,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

– | – | – |

| Mobility Aids & Home Modification Benefit/Reimbursement | – | – | – |

| Weekly Income Benefit | – | – | – |

| Hospitalisation Benefits | – | – | – |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | For claim under Complementary Medicine Practitioner and/or Allied Health Professional: $1,000

For claim under Sickness (injury and/or condition due to bite, sting, attack or such similar incident by an insect or animal, food poisoning or Hand Foot and Mouth Disease (HFMD): $500 |

||

Great Eastern PA Supreme Personal Accident

| Personal Accident Plans (Basic) | Great Eastern PA Supreme Personal Accident (Plan A) | Great Eastern PA Supreme Personal Accident (Plan B) | Great Eastern PA Supreme Personal Accident (Plan C) | Great Eastern PA Supreme Personal Accident (Plan D) | Great Eastern PA Supreme Personal Accident (Plan E) |

| Annual Premium | $159.84 | $280.80 | $389.88 | $600.48 | $56.16 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 | Up to $25,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 | Up to $25,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – | – | – |

| Burns Benefit | – | – | – | – | – |

| Medical & Surgical Expenses | Up to $2,000 | Up to $4,000 | Up to $5,000 | Up to $7,000 | Up to $500 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $150 | Up to $150 | Up to $150 | Up to $150 | Up to $150 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $1,000 | Up to $1,000 | Up to $1,000 | Up to $1,000 | Up to $1,000 |

| Weekly Income Benefit | Up to $100 per day (max. 104 weeks) | Up to $200 per day (max. 104 weeks) | Up to $300 per day (max. 104 weeks) | Up to 500 per day (max. 104 weeks) | – |

| Hospitalisation Benefits | Up to $100 per day (max. 90 days) | Up to $200 per day (max. 90 days) | Up to $250 per day (max. 90 days) | Up to 300 per day (max. 90 days) | – |

| Dependant Cover Benefits | – | – | – | – | – |

| Bereavement Allowance / Grant | Up to $3,000 | Up to $3,000 | Up to $3,000 | Up to $3,000 | Up to $3,000 |

| Special Features | Personal belongings: Up to $200

Evacuation and repatriation: Up to $50,000 |

Personal belongings: Up to $300

Evacuation and repatriation: Up to $50,000 |

Personal belongings: Up to $400

Evacuation and repatriation: Up to $50,000 |

Personal belongings: Up to $500

Evacuation and repatriation: Up to $50,000 |

Evacuation and repatriation: Up to $25,000 |

Hong Leong Assurance

The Hong Leong Assurance Accident Protect360 is the only insurance on this list that offers coverage for your mobile and credit card outstanding bills.

This means that in the event of an accidental death or total permanent disability, this policy will pay for the mobile phone and credit card outstanding bills in a lump sum based on your last bill received.

| Personal Accident Plans (Basic) | Hong Leong Assurance Accident Protect360 (Premier) | Hong Leong Assurance Accident Protect360 (Platinum) | Hong Leong Assurance Accident Protect360 (Diamond) |

| Annual Premium | N.A. | N.A. | N.A. |

| Accidental Death | Up to $50,000 | Up to $100,000 | Up to $250,000 |

| Accidental Permanent Total Disablement Benefit | Up to $50,000 | Up to $100,000 | Up to $250,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | Up to $500 | Up to $750 | Up to $1,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $1,000 | Up to $1,000 | Up to $1,000 |

| Mobility Aids & Home Modification Benefit/Reimbursement | – | – | – |

| Monthly Income Benefit | Up to $250 (max. 5 months) | Up to $250 (max. 5 months) | Up to $500 (max. 2.5 months) |

| Hospitalisation Benefits | – | – | – |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | Mobile Phone and Credit Card Outstanding Bills: $1,000 | ||

HSBC

The HSBC Life SmartPA Protect+ Personal Accident Insurance (Platinum) is the priciest insurance plan on this list, at $1,716.8.

As you might already be aware that a high premium is often a result of higher coverage, and this is exactly the case for this plan.

It covers up to $1,000,000 for Accidental Death or Permanent Disability, and it’s one of the policies that offer burn benefits.

| Personal Accident Plans (Basic) | HSBC Life SmartPA Protect+ Personal Accident Insurance (Silver) | HSBC Life SmartPA Protect+ Personal Accident Insurance (Gold) | HSBC Life SmartPA Protect+ Personal Accident Insurance (Platinum) |

| Annual Premium | Up to $197.50 | Up to $436.70 | Up to $1,716.80 |

| Accidental Death | Up to $150,000 | Up to $350,000 | Up to $1,000,000 |

| Accidental Permanent Total Disablement Benefit | Up to $150,000 | Up to $350,000 | Up to $1,000,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | Up to $15,000 | Up to $35,000 | Up to $100,000 |

| Medical & Surgical Expenses | Up to $2,000 | Up to $5,000 | Up to $10,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $1,000 | Up to $2,000 | Up to $5,000 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $5,000 | Up to $10,000 | Up to $10,000 |

| Weekly Income Benefit | – | – | – |

| Hospitalisation Benefits | – | – | – |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | – | – | – |

HSBC Life Band Aid

With a relatively cheaper premium compared to HSBC Life SmartPA Protect+ Personal Accident Insurance, the coverage of this plan is not as extensive.

However, the HSBC Life Band Aid plan offers to pay three times the benefit of Accidental Death or Accidental Permanent Total Disablement Benefit if the insured is a passenger on a commercial airplane.

You don’t really see this benefit in other insurance plans and if you do travel often, this may be something up your alley.

| Personal Accident Plans (Basic) | HSBC Life Band Aid (Plan 1) | HSBC Life Band Aid (Plan 2) | HSBC Life Band Aid (Plan 3) |

| Annual Premium | Up to $101.52 | Up to $203.04 | Up to $507.60 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $500,000 |

| Accidental Permanent Total Disablement Benefit | Up to $150,000 | Up to $300,000 | Up to $750,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

Up to $200,000 | Up to $400,000 | Up to $1,000,000 |

| Burns Benefit | – | ||

| Medical & Surgical Expenses | – | ||

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

– | ||

| Mobility Aids & Home Modification Benefit/Reimbursement | – | ||

| Weekly Income Benefit | – | ||

| Hospitalisation Benefits | – | ||

| Dependant Cover Benefits | – | ||

| Bereavement Allowance / Grant | – | ||

| Special Features | Triple Indemnity Benefit if the insured is a passenger on commercial airplane: Up to $300,000 |

Triple Indemnity Benefit if the insured is a passenger on commercial airplane: Up to $600,000 |

Triple Indemnity Benefit if the insured is a passenger on commercial airplane: Up to $1,500,000 |

Income PA Guard

Income PA Guard is one of the insurers that strives to keep insurance premiums affordable while delivering adequate coverage.

A glean into what the plan covers, it is comparable to the likes of AIA Solitaire and AIG Sapphire Enhanced Personal Accident.

| Personal Accident Plans (Basic) | Income PA Guard (Plan 1) | Income PA Guard (Plan 2) | Income PA Guard (Plan 3) | Income PA Guard (Plan 4) |

| Annual Premium | $154.43 | $271.81 | $469.55 | $638.20 |

| Accidental Death | Up to $100,000 | Up to $250,000 | Up to $500,000 | Up to $750,000 |

| Accidental Permanent Total Disablement Benefit | Up to $150,000 | Up to $375,000 | Up to $750,000 | Up to $1,125,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

Up to $100,000 | Up to $250,000 | Up to $500,000 | Up to $750,000 |

| Burns Benefit | – | – | – | – |

| Medical & Surgical Expenses | Up to $2,000 | Up to $4,000 | Up to $5,000 | Up to $6,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $500 | Up to $750 | Up to $1,000 | Up to $1,250 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Optional | |||

| Weekly Income Benefit | Optional | |||

| Hospitalisation Benefits | Optional | |||

| Dependant Cover Benefits | Optional | |||

| Bereavement Allowance / Grant | Optional | |||

| Special Features | – | – | – | – |

India International Insurance

What sets India International Insurance Personal Accident plan apart is that the insurance plan provides coverage for common diseases hand foot mouth disease and dengue fever.

What sets India International Insurance Personal Accident plan apart is that the insurance plan provides coverage for common diseases hand foot mouth disease and dengue fever.

| Personal Accident Plans (Basic) | India International Insurance Personal Accident (Plan 1) | India International Insurance Personal Accident (Plan 2) | India International Insurance Personal Accident (Plan 3) | India International Insurance Personal Accident (Plan 4) |

| Annual Premium | N.A. | N.A. | N.A. | N.A. |

| Accidental Death | Up to $50,000 | Up to $100,000 | Up to $200,000 | Up to $300,000 |

| Accidental Permanent Total Disablement Benefit | Up to $50,000 | Up to $100,000 | Up to $200,000 | Up to $300,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – | – |

| Burns Benefit | – | – | – | – |

| Medical & Surgical Expenses | Up to $3,000 | Up to $5,000 | Up to $6,000 | Up to $8,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $600 | Up to $1,000 | Up to $1,200 | Up to $1,600 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $300 | Up to $500 | Up to $600 | Up to $800 |

| Weekly Income Benefit | – | – | – | – |

| Hospitalisation Benefits | – | – | – | – |

| Dependant Cover Benefits | – | – | – | – |

| Bereavement Allowance / Grant | Up to $3,000 | Up to $3,000 | Up to $3,000 | Up to $3,000 |

| Special Features | Medical Expenses incurred due to chikungunya, dengue haemorrhagic fever, hand foot mouth, pulmonary tuberculosis, zika: Up to $1,000 | Medical Expenses incurred due to chikungunya, dengue haemorrhagic fever, hand foot mouth, pulmonary tuberculosis, zika: Up to $2,000 | Medical Expenses incurred due to chikungunya, dengue haemorrhagic fever, hand foot mouth, pulmonary tuberculosis, zika: Up to $3,000 | Medical Expenses incurred due to chikungunya, dengue haemorrhagic fever, hand foot mouth, pulmonary tuberculosis, zika: Up to $5,000 |

MSIG Insurance

The MGIS ProtectionPlus is a plan you might not want to miss if your job poses some risks which may result in temporary total disablement, such as fracture of your limbs.

While the maximum duration is not stated, the insured will be getting $100 to $600 per week for a temporary total disablement, and the amount if halved for a temporary partial disablement.

| Personal Accident Plans (Basic) | MSIG ProtectionPlus Personal Accident (Silver) | MSIG ProtectionPlus Personal Accident (Gold) | MSIG ProtectionPlus Personal Accident (Platinum) |

| Annual Premium | $124.20 | $210.60 | $351 |

| Accidental Death | Up to $100,000 | Up to $150,000 | Up to $250,000 |

| Accidental Permanent Total Disablement Benefit | Up to $150,000 | Up to $225,000 | Up to $375,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit | – | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | Up to $1,000 | Up to $3,000 | Up to $5,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

|||

| Mobility Aids & Home Modification Benefit/Reimbursement | – | – | – |

| Weekly Income Benefit | – | – | – |

| Hospitalisation Benefits | Up to $50 per day (max. $2,500) |

Up to $100 per day (max. $5,000) |

Up to $200 per day (max. $10,000) |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | Up to $3,000 | Up to $5,000 | Up to $10,000 |

| Special Features | Temporary Total Disablement: Up to $100 per week

Temporary Partial Disablement: Up to $50 per week |

Temporary Total Disablement: Up to $300 per week

Temporary Partial Disablement: Up to $150 per week |

Temporary Total Disablement: Up to $600 per week

Temporary Partial Disablement: Up to $300 per week |

| Sign Up Now | Apply Now | Apply Now | Apply Now |

Prudential

Prudential PRUPersonal Accident is likely the only insurance on this list that pays three times the amount of accidental death and permanent disability if the occurs on a public transport.

It also covers minor everyday mishaps such as food poisoning, infectious diseases, animal and insect bites. Further to that, it also covers injuries sustained during National Service, reservist and adventurous activities like scuba diving.

| Personal Accident Plans (Basic) | Prudential PRUPersonal Accident (Plan A) | Prudential PRUPersonal Accident (Plan B) | Prudential PRUPersonal Accident (Plan C) | Prudential PRUPersonal Accident (Plan D) | Prudential PRUPersonal Accident (Plan E) | Prudential PRUPersonal Accident (Plan F) |

| Annual Premium | $176.64 | $272.53 | $383.56 | $472.38 | $676.27 | $898.32 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 | Up to $750,000 | Up to $1,000,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 | Up to $500,000 | Up to $750,000 | Up to $1,000,000 |

| Double Indemnity for Accidental Death or Permanent Disability from private transport and pedestrian accidents, building fires and accidents during school-time |

Up to $200,000 | Up to $400,000 | Up to $600,000 | Up to $1,000,000 | Up to $1,500,000 | Up to $2,000,000 |

| Burns Benefit | – | – | – | – | – | – |

| Medical & Surgical Expenses | Up to $2,000 | Up to $2,500 | Up to $3,000 | Up to $4,000 | Up to $5,000 | Up to $6,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $500 | Up to $500 | Up to $1,000 | Up to $1,000 | Up to $1,250 | Up to $1,250 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Optional | |||||

| Weekly Income Benefit | Optional | |||||

| Hospitalisation Benefits | Optional | |||||

| Dependant Cover Benefits | Optional | |||||

| Bereavement Allowance / Grant | Optional | |||||

| Special Features | Triple Indemnity Benefit for Public transport accidents: $300,000 |

Triple Indemnity Benefit for Public transport accidents: $600,000 |

Triple Indemnity Benefit for Public transport accidents: $900,000 |

Triple Indemnity Benefit for Public transport accidents: $1,500,000 |

Triple Indemnity Benefit for Public transport accidents: $2,250,000 |

Triple Indemnity Benefit for Public transport accidents: $3,000,000 |

Singlife

The Singlife Personal Accident plan is definitely a plan to consider especially for those who are exposed to higher risks at work, or have children.

While this article focuses on white-collar individuals, the plan actually provides child support and hospital allowance in ICU.

Similar to the FWD plan, the plan by Singlife also offers a coverage of personal liability.

| Personal Accident Plans (Basic) | Singlife Personal Accident (Lite) | Singlife Personal Accident (Standard) | Singlife Personal Accident (Plus) |

| Annual Premium | N.A. | N.A. | N.A. |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $300,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $300,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | Up to $3,000 | Up to $4,000 | Up to $5,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $50 per day (max. $500) | Up to $75 per day (max. $750) | Up to $100 per day (max. $1,000) |

| Mobility Aids & Home Modification Benefit/Reimbursement | – | – | – |

| Weekly Income Benefit | – | – | – |

| Hospitalisation Benefits | Up to $50 per day | Up to $100 per day | Up to $200 per day |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | Physiotherapy treatment for Accidental Injury: Up to $100

Hospital allowance in ICU as a result of accident (up to 30 days): Up to $100 per day Personal liability: Up to $100,000 Child support fund: Up to $5,000 Loan protector: Up to $10,000 |

Physiotherapy treatment for Accidental Injury: Up to $200

Hospital allowance in ICU as a result of accident (up to 30 days): Up to $200 per day Personal liability: Up to $200,000 Child support fund: Up to $10,000 Loan protector: Up to $20,000 |

Physiotherapy treatment for Accidental Injury: Up to $300

Hospital allowance in ICU as a result of accident (up to 30 days): Up to $400 per day Personal liability: Up to $300,000 Child support fund: Up to $15,000 Loan protector: Up to $30,000 |

Sompo Insurance

Sompo Insurance is a family-friendly plan and suitable for those who have elderly parents to care for.

On top of that, if you suffer an injury due to an accident and the total benefit payable to you is more than 50 per cent of the Original Sum Insured, you can receive a re-employment benefit upon proof of employment and income at the time of the accident.

| Personal Accident Plans (Basic) | Sompo PA Star Personal Accident (Deluxe) | Sompo PA Star Personal Accident (Elite) | Sompo PA Star Personal Accident (Elite Plus) |

| Annual Premium | $194.40 | $313.20 | $713.88 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $500,000 |

| Accidental Permanent Total Disablement Benefit | Up to $100,000 | Up to $200,000 | Up to $500,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | Up to $3,000 | Up to $4,000 | Up to $7,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

Up to $300 (max. $600) | Up to $600 (max. $1,200) | Up to $600 (max. $1,200) |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $3,000 | Up to $4,000 | Up to $4,000 |

| Weekly Income Benefit | Up to $100 per day | Up to $200 per day | Up to $400 per day |

| Hospitalisation Benefits | Up to $100 per day | Up to $150 per day | Up to $300 per day |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | Family/Parental Allowance (per month): Up to $2,000

Re-employment Benefit: Up to $1,000 |

Family/Parental Allowance (per month): Up to $3,000

Re-employment Benefit: Up to $2,000 |

Family/Parental Allowance (per month): Up to $3,000

Re-employment Benefit: Up to $2,000 |

Starr Insurance

The Starr Insurance Personal Accident plan provides utility expense reimbursement for the insured’s family.

| Personal Accident Plans (Basic) | Starr Insurance Personal Accident (Bronze) | Starr Insurance Personal Accident (Silver) | Starr Insurance Personal Accident (Gold) |

| Annual Premium | N.A. | N.A. | N.A. |

| Accidental Death | $100,000 | $200,000 | $300,000 |

| Accidental Permanent Total Disablement Benefit | $100,000 | $200,000 | $300,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | $2,000 | $4,000 | $6,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

– | – | – |

| Mobility Aids & Home Modification Benefit/Reimbursement | Mobility: $300

Home renovation: $500 |

Mobility: $500

Home renovation: $1,000 |

Mobility: $600

Home renovation: $3,000 |

| Weekly Income Benefit | $100 | $200 | $300 |

| Hospitalisation Benefits | $50 | $100 | $150 |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | – | – | – |

| Special Features | Family Assistance Pillar (Utility Expense Reimbursement): $50 | Family Assistance Pillar (Utility Expense Reimbursement): $100 | Family Assistance Pillar (Utility Expense Reimbursement): $150 |

Tiq

Similar to MGIS’ Personal Accident plan, Tiq’s Personal Accident covers temporary total disablement.

As part of its plan, there is a physiotherapy benefit that the insured can use during the recovery process.

| Personal Accident Plans (Basic) | Tiq Personal Accident (Enhanced Silver) | Tiq Personal Accident (Enhanced Gold) | Tiq Personal Accident (Enhanced Platinum) |

| Annual Premium | $248.09 | $403.17 | $702.30 |

| Accidental Death | Up to $125,000 | Up to $300,000 | Up to $500,000 |

| Accidental Permanent Total Disablement Benefit | Up to $125,000 | Up to $250,000 | Up to $500,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – |

| Burns Benefit | – | – | – |

| Medical & Surgical Expenses | Up to $500 | Up to $1,500 | Up to $2,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit | – | – | – |

| Mobility Aids & Home Modification Benefit/Reimbursement | Up to $1,000 | Up to $2,000 | Up to $3,000 |

| Weekly Income Benefit | – | – | – |

| Hospitalisation Benefits | Up to $50 per day (up to 180 days) |

Up to $100 per day (up to 180 days) |

Up to $200 per day (up to 180 days) |

| Dependant Cover Benefits | – | – | – |

| Bereavement Allowance / Grant | Up to $3,000 | Up to $3,000 | Up to $3,000 |

| Special Features | Temporary Total Disablement: Up to $50 per week (up to 104 weeks)

Physiotherapy: Up to $1,000 |

Temporary Total Disablement: Up to $100 per week (up to 104 weeks)

Physiotherapy: Up to $1,500 |

Temporary Total Disablement: Up to $200 per week (up to 104 weeks)

Physiotherapy: Up to $2,000 |

Tokio Marine

The Tokio Marine Protect Personal Accident Insurance Plan includes dental as part of its recuperation benefit and this will be useful to those require some form of tooth adjustments as a result of an incident.

| Personal Accident Plans (Basic) | Tokio Marine TM Protect Personal Accident (Plan A) | Tokio Marine TM Protect Personal Accident (Plan B) | Tokio Marine TM Protect Personal Accident (Plan C) | Tokio Marine TM Protect Personal Accident (Plan D) |

| Annual Premium | $198 | $285 | $535 | $1,020 |

| Accidental Death | Up to $100,000 | Up to $200,000 | Up to $500,000 | Up to $1,000,000 |

| Accidental Permanent Total Disablement Benefit | Up to $150,000 | Up to $300,000 | Up to $750,000 | Up to $1,000,000 |

| Double Indemnity for Accidental Death on Public Conveyance Benefit |

– | – | – | – |

| Burns Benefit | – | – | – | – |

| Medical & Surgical Expenses | Up to $2,500 | Up to $4,000 | Up to $7,500 | Up to $10,000 |

| Recuperation (Traditional Chinese Medicine/Chiropractic Reimbursement) Benefit |

TCM/Chiro: Up to $500

Dental: Up to $500 |

TCM/Chiro: Up to $750

Dental: Up to $750 |

TCM/Chiro: Up to $1,000

Dental: Up to $1,000 |

TCM/Chiro: Up to $1,500

Dental: Up to $1,500 |

| Mobility Aids & Home Modification Benefit/Reimbursement | Optional | |||

| Weekly Income Benefit | Optional | |||

| Hospitalisation Benefits | Optional | |||

| Dependant Cover Benefits | – | – | – | – |

| Bereavement Allowance / Grant | – | – | – | – |

| Special Features | Death Benefit: Up to $3,000 | Death Benefit: Up to $3,000 | Death Benefit: Up to $3,000 | Death Benefit: Up to $3,000 |

Related Articles:

- Insurance: How To Review & Why You Should

- Best Insurance Options for Those With Pre-existing Conditions

- Travel Insurance Claim Guide: From Baggage Loss, Trip Cancellations to COVID-19

- Best Cancer Insurance in Singapore: Keeping a Peace of Mind in Hard Times

- Best Travel Insurance in Singapore (2023): Travel With a Peace of Mind

Advertisement