Best Renovation Loan in Singapore (2023): The First-Time Homeowner Guide

Whether you’re renovating your Build-to-Order (BTO), or your newly-bought resale flat, there is a chance that you’ll enter this mode.

Managing your personal finances can be a chore, but managing a couple’s finances is another level.

At a range of $26,700 – $89,600 for a four-room BTO flat, home renovation is, no doubt, one of the biggest expenditures in our lives.

Cash flow can be a b*** when you have other commitments (for example, your wedding).

This is where a home renovation loan becomes useful as it eases your finances, but of course, you have to pay back the interest incurred.

Without further ado, we’re here to guide you through the thought process of picking a home renovation loan!

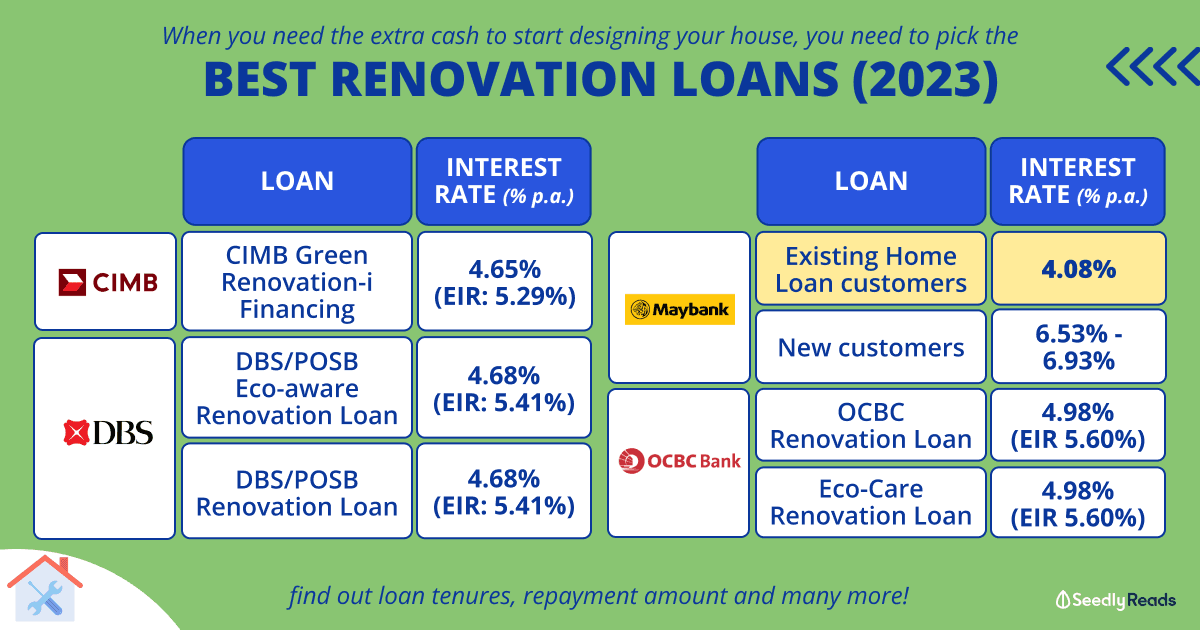

TL;DR: Best Renovation Loans in Singapore (2023)

Teleport here:

- How do renovation loans work in Singapore?

- How much renovation loan can I get in Singapore?

- Which bank is best for a renovation loan?

- Should you take a renovation loan?

Note: All rates are as of 8 July 2023 and may be subject to changes. Please check with the respective financial institutions for updated information.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised financial advice. Readers should always do their due diligence, consider their financial goals before committing to any financial product, and consult their financial advisor before making any decisions.

How Do Renovation Loans Work in Singapore?

As the name suggests, renovation loans are solely meant to finance your home renovations.

It differs from a home loan, which is used to finance your mortgage; you either take it up from a bank or the Housing Development Board (HDB).

Due to their special purpose, renovation loans are usually of lower effective interest rates than personal loans.

A renovation loan is usually quoted at a monthly rest rate, meaning that interest is calculated based on the loan’s outstanding balance.

In contrast, a personal loan is quoted at a flat rate, and the interest payments are calculated based on the original loan amount.

There are different packages and restrictions on what you can pay the renovation loan to pay for, and the money will also be disbursed to your interior designer or contractor directly.

A typical renovation loan tenure ranges from one to five years, and the maximum amount you can borrow is six times your annual salary or $30,000, whichever is lower.

If your loan must be disbursed in instalments or to several suppliers, banks may levy extra fees.

So, be sure to scrutinise the terms and conditions if there are processing, handling or admin fees charged on the loan amount.

Note: DBS charges a mandatory insurance fee of 1 per cent of the loan amount, which covers the balance of the loan in the event of death or total and permanent disability.

What Can Renovation Loans Be Used to Pay For?

While these loans have restrictions on what they can be used for, the list of usage is quite extensive and generally covers the major works required.

This list will vary across banks, but just a look through DBS’ loan, this is what it covers:

| Usage of Renovation Loans |

|---|

| Electrical and Wiring |

| Built-in Cabinets |

| Painting & Redecorating Works |

| Structural Alterations |

| External Works Within Compound of the House |

| Flooring and Tiling |

| Basic Bathroom Fittings |

How Much Money Do You Need For Renovation?

This is highly subjective and dependent on the aesthetic that you’re going for.

1) Buying To Sell

If you plan to sell the flat in a couple of years, you wouldn’t want to pour too much money into it.

But hey, you’ll still need to live in it in the meantime, so you’ll probably need to do some minor renovations.

Some of you might have considered opting in for HDB’s Optional Component Scheme (OCS).

Believe it or not, the OCS offers will differ between housing projects, costing anywhere from $5,000 and up.

For reference, the OCS for a 4-room HDB BTO (in a relatively mature estate) that was completed in 2017 costs $8,000 to $9,000 – depending on the types of fitting you choose.

According to HDB, this is what a 3-room, 4-room, 5-room, and 3Gen flats’ current OCS will include:

| OCS Optional Components | Specifications |

|---|---|

| Sanitary fittings and internal doors |

|

| Floor finishes |

|

Basically, it’s the bare minimum you need to make a house liveable because your flat will probably look like this when it’s brand new:

Unless you appreciate raw concrete floors and somehow don’t need a functioning shower and toilet…

Also, I’m not disparaging the quality of the finishes, but the ones I’ve seen for my project were not the best – in my opinion.

Another point to note is that you have to decide if you want to opt-in for OCS when selecting your flat.

And that’s a good three to five years before you actually see your place.

I’ve had many friends who opted for the OCS, only to change their minds after getting their keys and seeing the flat firsthand (Spoiler alert: they didn’t like what they got).

This means extra costs involved to overlay tiles on top of the existing OCS floors.

2) Buying Your Forever Home

Now, if you’re not planning to sell your place, you should try decorating it so you can live in it for life.

For reference, the renovation costs of four-room flats I know ranged from $41,000 to $66,000, excluding furniture.

You can definitely achieve a lot for lesser depending on what you prioritise.

Do yourself a favour and at least find a contractor or Interior Designer who you trust or who has good after-sales service – these qualities will naturally command a higher price.

How Much Renovation Loan Can You Get?

The maximum is $30,000 or 6 times your monthly salary, whichever is lower.

So if we’re looking at the $40,000, you’re actually $10k short.

You can probably loan that amount, too, but it’ll come with a much higher interest, and you also have to take note of your Total Debt Servicing Ratio.

Can You Use CPF to Repay Renovation Loan?

No. You are not allowed to use your Central Provident Fund (CPF) to repay your reno loan.

CPF is built for retirement purposes, so it cannot be used for home renovation.

You can, however, use your CPF account for investments.

Read more:

- The Ultimate List of Interior Designers To Avoid In Singapore

- Getting Your First Property In Singapore: We Answer 10 Commonly Asked Questions

- Renovation Shopping Hacks: Based On Real Community Reviews

Best Renovation Loans in Singapore (2023)

In order to ensure that you can repay the loan on time and avoid these fees, it would be wise to choose a loan package that suits your demands and budget.

Additionally, bank site checks might be carried out following the loan distribution to ensure the loan proceeds were used for the quoted renovation projects.

Based on a loan amount of $30,000 of tenure of five years, these are what you should be expecting:

| CIMB Green Renovation-i Financing Loan | DBS/POSB Renovation Loan | DBS/POSB Eco-aware Renovation Loan | Maybank Home Renovation Loan | OCBC Renovation Loan | OCBC Eco-Care Renovation Loan | |

|---|---|---|---|---|---|---|

| Interest Rate (% p.a.) | 4.65% (EIR 5.29%) | 4.68% (EIR 5.41%) | 4.68% (EIR 5.41%) | New For loan tenure 1 to 2 years: 6.93% For loan tenure 3 to 5 years: 6.53% Existing customers: 4.08% (min. 3 years tenure & loan quantum of $15,000) | 4.98% (EIR 5.60%) | 4.98% (EIR 5.60%) |

| Loan Tenure | 1 - 5 years | 1 - 5 years | 1 - 5 years | 1 - 5 years | 1 - 5 years | 1 - 5 years |

| Monthly Repayment | $562 | $564.49 | $561.75 | $587.41 | $567.24 | $565.86 |

| Processing/Admin/Handling Fee | 1% of approved loan | 1% of approved loan | 1% of approved loan | 0.75% of approved loan | 0.5% of approved loan | 0.5% of approved loan |

| Loan Amount | Up to $30,000 or 6 times monthly salary, whichever is lower | Up to $30,000 or 6 times monthly salary, whichever is lower | Up to $30,000 or 6 times monthly salary, whichever is lower | Up to $30,000 or 6 times monthly salary, whichever is lower | Up to $30,000 or 6 times monthly salary, whichever is lower | Up to $30,000 or 6 times monthly salary, whichever is lower |

| Minimum Annual Income | $24,000 | $24,000 | $24,000 | $30,000 | $24,000 | $24,000 |

| Note/Promotion | To qualify, you need to meet 5 of the Eco requirements: Check Eligibility | - | To qualify, you need to fulfil at least 6 out of the 10 Eco requirements: Check Eligibility | - | One-time S$88 bill rebate when you sign up for Senoko's LifeGreen24 plan | |

So… Should You Still Take A Home Reno Loan?

There are two schools of thought:

Take The Home Reno Loan

Take the loan if you believe that you can grow your money at a much faster rate than the interest charged.

Looking at the market rate now, loan interest usually ranges between 2.88% to 5.8%, with a tenure of one to five years.

This will depend on how confident you are at beating the prevailing rates when applying for a home renovation loan.

The fact that you would like to do up your house nicely is also a valid reason, albeit within a reasonable budget, of course.

Because technically, this would be more of a want than a need.

Start Saving Now

Most people I know have taken a reno loan because of cash flow reasons.

But, if you start planning early, you might be able to save enough, especially when you have started investing and your investment horizon is way longer.

Those who invest will point out that the amount spent on a renovation is a lot and could be put towards growing a portfolio, and that’s true.

Everyone’s investment risk is different, and you will need to evaluate if you might be better off getting a loan.

For example, your investment returns might be way more than the interest you need to repay for taking up the loan.

Nonetheless, nothing beats having peace of mind when it comes to paying for big-ticket items like these.

You should always use a credit card for big-ticket purchases to clock miles and rewards.

Building Your Dream Home

Whether you decide to take a home reno loan or not, have a talk with your partner and work out a ballpark figure for how much you’ll need for:

- BTO down payment (assuming that you take a bank loan unless you die, also sure take the HDB loan)

- Wedding (could just be a ROM)

- Your budget for home reno (you can even walk into an agency and ask for a quote to get a feel for how much you need; it’s free)

Because once you have a good gauge of all these related costs, you’ll have a better idea of how to save up for it or whether you really need a home reno loan.

Have more home renovation loan-related questions? Why not ask the Seedly community?

Advertisement