Government Payout: How Much Do I Get From the Government (GSTV & AP) in 2023 and Beyond?

●

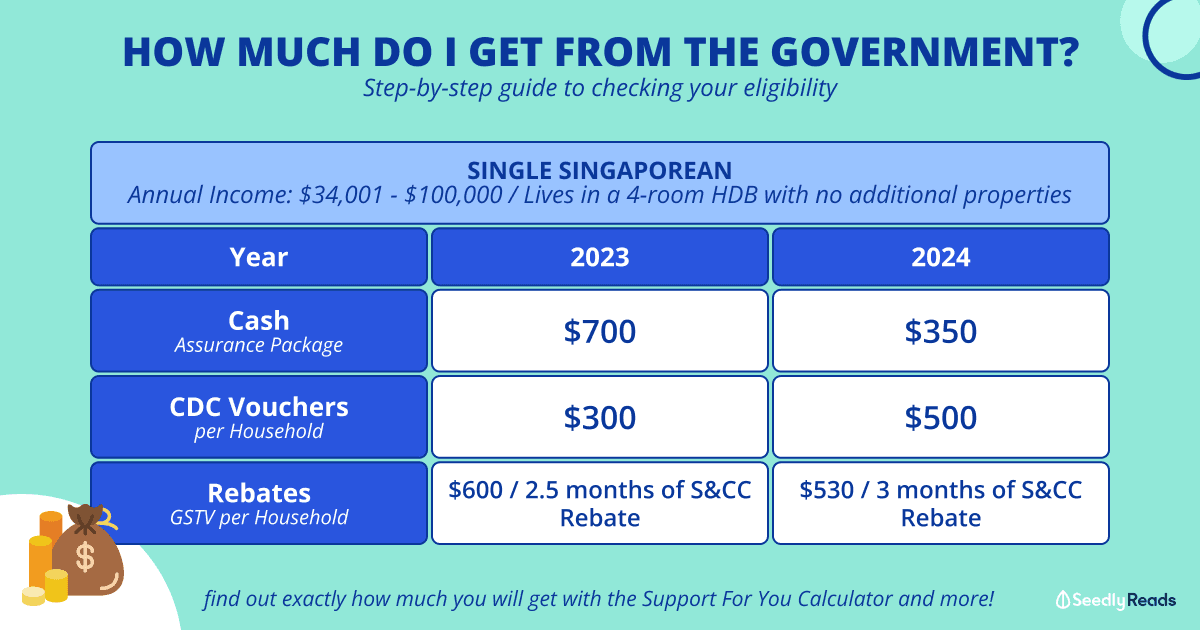

By now, you would have heard of Budget 2023, along with the overwhelming slew of measures over the years to help Singaporeans cope with the rising cost of living in Singapore.

But if you feel a bit overwhelmed by the sheer number of schemes, fret not!

We got you.

Here’s a simple step-by-step guide to determine exactly what you will be getting in 2023 and beyond, ignoring all the other schemes that don’t apply to you!

TL;DR: How to Check Your Government Payout in 2023 and Beyond Using the Support for You Calculator

Jump to:

- Support Go Where: Support for You Calculator to Check Your GST Voucher & Assurance Package Eligibility

- How to Check Your Assessable Income

- How to Check The Annual Value of Your Property

- Support for You Calculator Step-by-Step Guide

Support Go Where: Support for You Calculator to Check Your GST Voucher & Assurance Package Eligibility

For the uninitiated, SupportGoWhere is a one-stop portal for individuals and families in Singapore to find support schemes and services by LifeSG and GovTech.

Part of their efforts includes this helpful and aptly named Support For You Calculator.

To make full use of this calculator, you will need to first find your assessable income (AI) and the annual value (AV) of your home.

Check Assessable Income (AI) for GST Voucher, Assurance Package and Other Government Benefits

According to the Inland Revenue Authority of Singapore, ‘Your AI includes all forms of income from trade, business, profession or vocation, employment, and taxable rental income.’

Your AI can be found on your tax bill (or Notice of Assessment) that you receive each year if you are required to pay taxes. You may visit iras.gov.sg [login to myTax Portal using your Singpass > Notices/Letters > Individual, select Year of Assessment (YA) 2021/2022] to view your Notice of Assessment.

For this year’s payouts, you will need to input your YA2021/2022 AI as listed on the Goods and Service Tax (GST) Voucher website:

Check Annual Value of Property Singapore (2023)

As for the Annual Value of your property, you may refer to the latest data from IRAS to get an estimation:

| Property Category | Median AV of Property in 2021 |

| HDB Flats | |

| 1- or 2-room | $5,340 |

| 3-room | $8,220 |

| 4-room | $10,140 |

| 5-room | $10,980 |

| Executive and Others | $11,340 |

| Private Property | |

| Non-landed (including Executive Condominiums) | $23,400 |

| Landed | $37,200 |

But for a more accurate reading, you can simply check it for free using the View Property Portfolio tool on IRAS’ site. If you do not own the property, you will need to get the homeowner to check it for you.

With that out of the way, here is the guide.

Support for You Calculator Step-by-Step Guide

1. Input Age and Assessable Income

For this guide, I have come up with the example of a small family consisting of two parents and one child living in a 4-room flat which is the only property they own:

- Father aged 61 in 2023 with AI of $21,000

- Mother aged 58 in 2023 with AI of $25,000

- Daughter aged 30 in 2023 with AI of $50,000.

I will start things off with the daughter, adding her age and AI:

2. Input Property Information

Next up, her property information:

3. Add Other Household Members (Optional)

This step is optional, but for this example, I’ll be adding the Dad and the Mom’s information:

- Father aged 61 in 2023 with AI of $21,000

- Mother aged 58 in 2023 with AI of $25,000.

4. Click ‘Show Estimated Benefits’

Next up, press the ‘Show estimated benefits’ button, and voila: here’s your estimate of the Government benefits you and your household can get for 2023 and beyond!

Read More Budget 2023 Coverage

- Complete GST Voucher 2023 + Assurance Package 2023 Guide: A Government Payout 2023 Summary

- More Baby Bonus & Paternity Leaves: Did Budget 2023 Address Young Parents’ Concerns?

- HDB BTO Balloting System: Does It Need To Be Revamped?

- Benefits For New Parents (2023 & Beyond): Baby Bonus, CDA Grants, 4 Weeks Paternity Leave & More

- The Ultimate HDB Grants Guide: CPF Housing Grants for BTO, Resale & SBF Flats

Advertisement