Income Gro Capital Ease: 3-Year Insurance Savings Plan With 3.55% p.a. Guaranteed Returns at Maturity

●

Are you someone who’s looking for a place to hold your savings for the short term?

You might want to consider this:

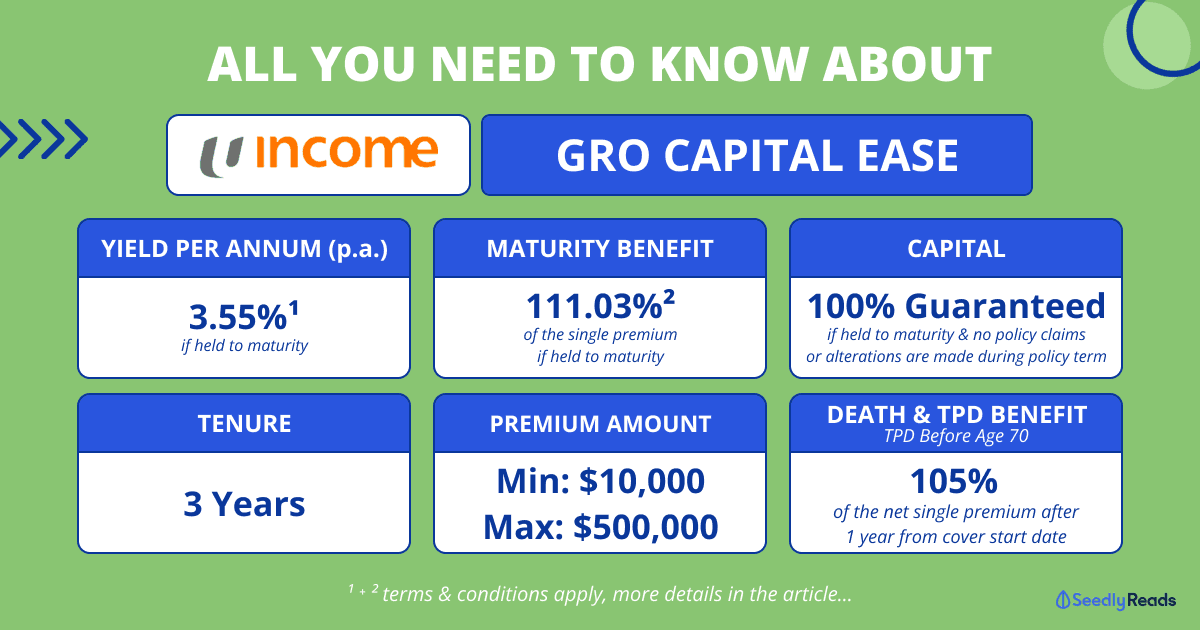

Income is launching Gro Capital Ease: a 3-year single premium insurance savings plan that provides a guaranteed yield of 3.55% p.a.¹ at maturity.

Here’s all you need to know!

TL;DR: Is Income’s Gro Capital Ease Insurance Savings Plan Worth It?

This is a non-participating single-premium insurance savings plan that provides guaranteed returns at maturity and protection at the same time.

Here’s a breakdown of Gro Capital Ease, which launched yesterday, 13 June 2023:

| Details | Income’s Gro Capital Ease |

|---|---|

| Policy Term | 3 Years |

| Guaranteed Yield at Maturity (3-Year Policy Term) | 3.55% p.a.¹ |

| Guaranteed Maturity Benefit (3-Year Policy Term) | 111.03%² of the single premium |

| Capital Guaranteed | 100% guaranteed if held to maturity, and no policy claims or alterations are made during the policy term. |

| Single Premium | One lump sum - Can be purchased online with a minimum single premium of $10,000 - Can also be purchased with a minimum single premium of $20,000 through a financial advisor representative - Maximum single premium limit of $500,000 per insured |

| Payment Options | Payment by Cash, PayNow QR, eGIRO or Supplementary Retirement Scheme (SRS) funds |

| Death and Total and Permanent Disability (TPD before age 70) Benefit | Within one year from the cover start date: Net single premium³ After one year from the cover start date: 105% of net single premium³ |

| Issuance | Guaranteed acceptance regardless of health condition |

| Entry Age | Insured: 10 – 80 Policyholder: 16 & above Online application: 18 & above |

| Policy Protection | Up to specified limits by the Singapore Deposit Insurance Corporation (SDIC) |

¹The guaranteed yield at maturity of 3.55% p.a. will be paid out at the end of the 3-year policy term, provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

²The guaranteed maturity benefit of 111.03% (rounded to the nearest 2 decimal places) of the single premium is based on the guaranteed yield at maturity of 3.55% p.a.

³Net single premium means the single premium amount which is shown in the schedule or the reduced single premium amount (if a part of this policy has been cashed in earlier).

3.55% p.a. Guaranteed Yield At Maturity

At a guaranteed yield of 3.55%, the guaranteed maturity benefit is 111.03%. If you pay for a single premium of $100,000, you’ll receive a total guaranteed maturity benefit of $111,033 or a return of $11,033 (rounded to the nearest dollar) after 3 years.

Death Benefit and Total and Permanent Disability Benefit

This plan also covers total and permanent disability (TPD) before age 70 and death during the policy term.

| Time the Insured Event Happens | Benefit |

| Within one year from the cover start date | The net single premium³ |

| After one year from the cover start date | 105% of the net single premium³ |

Payment Methods Available

- Cash, PayNow QR, eGIRO: Min. $10,000

- Supplementary Retirement Scheme (SRS) funds: Min. $20,000

Click to Teleport

- What is an Insurance Savings Plan?

- All You Need to Know About Income’s Gro Capital Ease Insurance Savings Plan

- How Gro Capital Ease Can Grow Your Savings

- Should I Buy Gro Capital Ease?

What is an Insurance Savings Plan?

An insurance savings plan is a life insurance policy that can be used to meet specific savings goals, such as buying a property or paying for your child’s tertiary education.

For such plans, you usually either pay regularly or make a lump sum payment (aka “single premium”).

The Gro Capital Ease plan is a good example of a single-premium insurance savings plan.

All You Need to Know About Income’s Gro Capital Ease Insurance Savings Plan

1. No Medical Underwriting Required

You’ll be glad to know that no medical underwriting is required for Income’s Gro Capital Ease.

But note that this plan is purchased on a first-come, first-served basis as only a limited tranche is available.

2. Guaranteed Capital At Maturity

Gro Capital Ease is a single premium, non-participating, 3-year insurance savings plan that offers a guaranteed yield at maturity of 3.55% p.a.¹ that will be paid out at the end of the 3-year policy term.

This will provide you with a guaranteed maturity benefit of 111.03%² (rounded to the nearest 2 decimal places) of the single premium, based on the guaranteed yield at maturity of 3.55% p.a.¹.

Here’s how this works.

Let’s assume that you’ve paid a single premium of $100,000; you’ll receive a total guaranteed maturity benefit of $111,033¹ or a return of $11,033 (rounded to the nearest dollar) after 3 years.

3. Death Benefit and Total and Permanent Disability Benefit

This plan also covers total and permanent disability (TPD) before age 70 and death during the policy term.

| Time the Insured Event Happens | Benefit |

| Within one year from the cover start date | The net single premium³ |

| After one year from the cover start date | 105% of the net single premium³ |

4. Minimum And Maximum Premium Limit For Income Gro Capital Ease

If you’re interested in applying, the steps are really simple!

You can apply for this plan online and make payments easily via PayNow, SRS, and eGIRO.

The minimum single premium for online purchases starts at $10,000.

If you prefer applying through a financial advisor representative, you can choose to use either cash or your SRS funds to buy this plan.

Application through a financial advisor representative requires a minimum sum of $20,000.

Is There a Difference Between Using Cash to Pay for the Income Gro Capital Ease Premium Versus Using My SRS Funds?

If you’re thinking of doing a lump sum top-up of $20,000 for payment via SRS, you might want to note that the maximum yearly contribution limit for SRS is $15,300 for Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs) and $35,700 for foreigners.

As such, please ensure that there is sufficient balance in your SRS account before proceeding with this.

Each insured’s maximum single premium limit for this tranche is $500,000.

5. Eligibility of Income Gro Capital Ease

Both foreigners and locals are welcome to apply this plan.

The entry age for this plan is:

| Minimum | Maximum | |

| Insured | 10 | 80 |

| Policyholder | 16* | N.A. |

*Individuals who take up the policy on their own from 10 to 15 years old (age last birthday) will require parental/legal guardian’s consent. Parents cannot take up policies on the lives of their children who are 18 years old (age last birthday) and above.

If you are making an online purchase, the plan is available to all Singaporeans or PRs aged 18 – 80 years old with a valid NRIC number.

How Gro Capital Ease Can Grow Your Savings

We probably do not all have $100,000 at the ready.

However, the minimum single premium of $10,000 (via online purchase) makes it somewhat accessible for one to get started.

Who Is This Plan Suitable For?

If you have been looking for somewhere to place your savings and do not need to use this money within the next 3 years, this insurance savings plan can be considered.

If you needed that sum of money within the next three years, this would not be the ideal option as you could incur a loss in the event you terminate your policy before the end of the 3-year period.

Also, do note that this plan is available on a limited tranche and is on a first-come, first-served basis.

Despite that, please do sufficient homework and read the terms and conditions carefully before diving into it.

Please don’t get it just because you feel the FOMO (fear of missing out).

Notes:

¹The guaranteed yield at maturity of 3.55% p.a. will be paid out at the end of the 3-year policy term, provided that the insured survives at the end of the policy term, with no policy alterations or claims made during the entire policy term.

²The guaranteed maturity benefit of 111.03% (rounded to the nearest 2 decimal places) of the single premium is based on the guaranteed yield at maturity of 3.55% p.a.

³Net single premium means the single premium amount which is shown in the schedule or the reduced single premium amount (if a part of this policy has been cashed in earlier).

Disclaimer: All opinions expressed in this article are of Seedly and not of Income Insurance Limited (“Income”). Income is not responsible nor liable to any party in any manner whatsoever for such opinions, and Seedly is solely responsible for any opinion and the accuracy and completeness of any information and intellectual property used in this article. The information contained in this article pertaining to any insurance product or plan is provided and meant for general information only and does not constitute an offer, recommendation, solicitation or advice by Income or Seedly to buy or sell any product(s), plan(s) or investment product(s). It is not and should not be relied on as financial advice and has no regard for any person’s investment and financial needs. If you are unsure whether this product or plan is suitable for you, you should seek personalised financial advice from a qualified insurance advisor. Otherwise, you may end up buying a product or plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. Precise terms, conditions and exclusions of the product are found in the policy contract.

For customised advice to suit your specific needs, consult an Income insurance advisor.

Protected up to specified limits by SDIC (applicable for Income products that fall under the Policy Owners’ Protection Scheme).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as of 14 June 2023.

Related Articles

Advertisement