Your OCBC NTUC Plus! Cards Are Being Phased Out. Here’s What To Do!

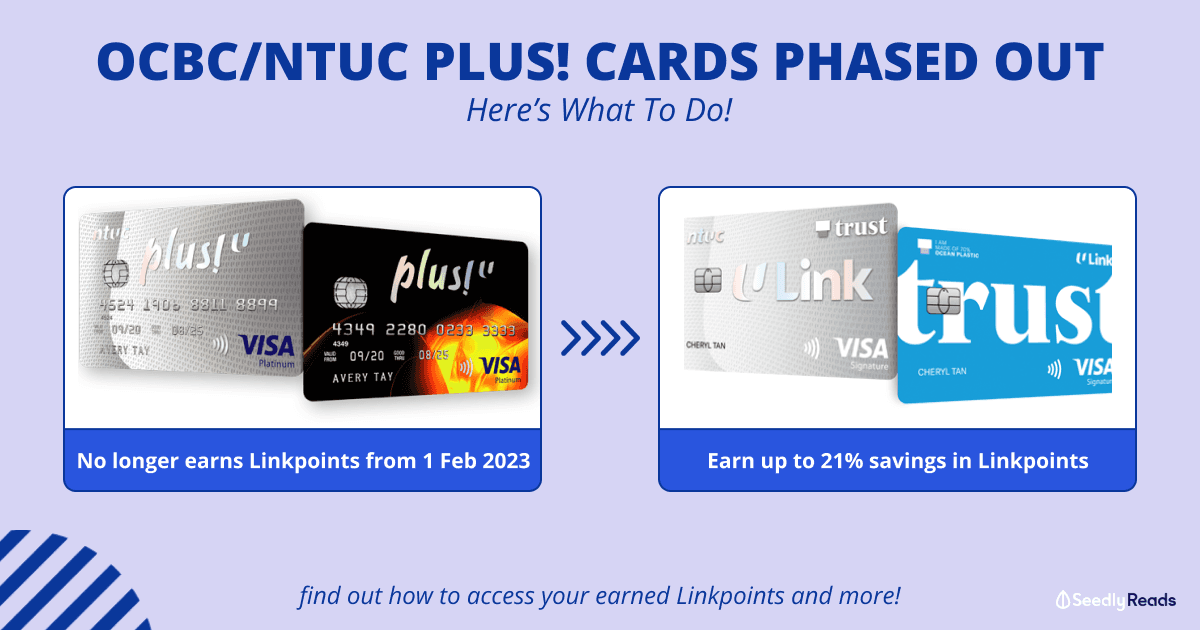

Come 1st February 2023, your OCBC/NTUC Plus! credit and debit cards will no longer be able to earn Linkpoints.

Specifically, these cards:

OCBC will be shutting down the Plus! programme according to their website:

Thank you for supporting the NTUC/OCBC Plus! partnership. The co-branded NTUC & OCBC PLUS! Credit and Debit Cards, NTUC-OCBC Starter account and PLUS! savings account will be phased out. These products will cease to function on 1 February 2023.

Huh? Then where did my hard-earned Linkpoints disappear to? How can I earn Linkpoints now?

Fret not!

Here’s all you need to know about the new cards that are essentially the replacement for the OCBC/NTUC Plus! cards, how to continue earning Linkpoints, and more!

TL;DR: OCBC NTUC Plus! Cards Phased Out. Here’s What To Do!

The NTUC/OCBC Plus! programme will cease on 1st Feb 2023 and you will no longer be able to earn and redeem Linkpoints with OCBC/NTUC Plus! cards.

Here’s what you need to do if you want to continue earning and redeeming Linkpoints:

- Update payment details if you are an NTUC Union Member and cancel your cards

- Choose from one of three options:

OCBC/NTUC Plus! Cards Cancellation and Linkpoints

Still holding on to your OCBC/NTUC Plus! cards? It would be wise to cancel them before 31st January. You may also receive a replacement OCBC 365 credit card, however, do note that this card will not be able to earn Linkpoints.

If you are an NTUC Union member who has set recurring payments on your card, you may wish to update your payment details via the MyNTUC app (Memberships & Cards > View Membership Info > Set Recurring Payment Mode).

Don’t worry as cancelling your Plus! cards will not forfeit your earned Linkpoints.

Your Linkpoints will still be under your Link Rewards membership and you can continue to earn/redeem them in the following ways:

Link Rewards via Fairprice App

For the more digital savvy, you may choose to download the Fairprice App (Android/iOS) to continue earning and redeeming Linkpoints.

All you have to do is download the app, sign up, tap on ‘Account’, ‘Link membership’ and then follow the instructions.

Earning and redeeming Linkpoints at FairPrice, Unity, and selected Kopitiam outlets can be done entirely via the FairPrice app.

However, for all other Link partners, you will need a physical Link Rewards card for now.

Link Rewards Cards

Not so keen on using an app? No worries, you can opt for what is formerly known as the Plus! and NTUC Plus! card.

Still confused? The black Link card is a card for everyone while the silver NTUC card is exclusive to NTUC Union members.

Of course, NTUC Union members earn Linkpoints at an accelerated rate than the general public does with the black Link card.

Do note that these cards are solely rewards cards; you cannot pay with them!

You can request a card here or call the Customer Service Hotline at 6380 5858.

Trust Credit and Debit cards

The third option is to sign up for an account with Trust Bank and use one of their two credit/debit cards:

Do note that these are dual-functionality cards where you can choose between credit or debit within the Trust app.

The silver NTUC Link Cards are exclusively for NTUC Union members whereas the blue Trust Link Cards are for everyone else.

These cards offer the best earn rates on Linkpoints, up to 21% savings at Fairprice, Unity and Cheers.

If you have the old OCBC/NTUC Plus! credit and debit cards and want similar benefits here’s what you need to do.

For NTUC Plus! Visa credit or debit cardholders, the silver NTUC Link card will essentially be your replacement card.

As for OCBC Plus! Visa credit or debit cardholders, the blue Trust Link cards will essentially be the replacement card.

However, you will have to go through the signup process with Trust Bank.

According to a report by the Straits Times, however, some users have failed to sign up with Trust Bank as they no longer draw a regular income to qualify for the new credit cards. So if your retiree parents no longer draw a regular income, you may have to settle for the debit card options instead.

Afterthoughts

I’m personally not too ecstatic about these new cards by Trust Bank. While they do provide a higher savings rate than the previous OCBC NTUC cards, there are just far too many hoops to jump through.

NTUC Link Credit Card Benefits – Up to 21% Savings*

- 2.5% base rate

- Earn unlimited savings of 0.5% on FPG groceries^ and 0.22% on all other eligible spend^^. Exclusive for FairPrice members only! Earn additional 2% on FPG groceries^, capped at 12,000 Linkpoints a year.

- 8.5% monthly bonus

- Earn 8.5% on FPG spend^^^ when you meet a monthly minimum eligible spend of S$350 outside of FPG, capped at 5,500 Linkpoints.

- 8.0% quarterly bonus

- Earn 8% on FPG spend^^^ when you meet your monthly minimum eligible spend for 3 consecutive months, capped at 7,500 Linkpoints.

- 2.0% FairPrice annual member bonus^^^^

- Earn 2% once a year on FPG groceries^, capped at 12,000 Linkpoints.

*Up to 21% savings is a promotional offer and may be revised to 14% after Feb 28, 2023.

Just taking a look at the above example, you would basically have to concentrate most of your credit card spend on one card to get the full benefits while making sure that you meet all the criteria.

Thus, it’s probably a better idea to stick to your miles or cashback credit cards and opt for the Link Rewards Card which has no membership fee or the NTUC card if you are an NTUC Union member.

Then again, this is my personal opinion! It’s better to make your own decision after you’ve checked out all your available options.

Related articles

Advertisement