Ultimate Integrated Shield Plan Comparison (2023): Are You on the Best Plan?

If you’ve been to the doctor lately, you might have felt a pinch in your pocket.

That’s because healthcare costs have increased quite significantly over the past few years.

When you know the true cost of healthcare in Singapore, you will know that MediShield Life coverage may not be enough when we’re seeing a rising ageing population here.

You might need an Integrated Shield Plan (IPs), which is an add-on to your MediShield Life coverage for hospitalisation expenses, and having it would enhance your MediShield Life coverage by a bit or even a whole lot (depending on which plan you go for).

But before we go into a detailed comparison of the different IP plans out there, here’s all you need to know about medical costs without IPs:

TL;DR: Which Integrated Shield Plan Is The Best?

Very quickly, these are what you need to know:

- Integrated Shield Plan adds to your coverage on your existing MediShield Life

- You should cover yourself with an Integrated Shield Plan if you wish to stay in a Private Hospital or Public Hospital Class A/B1 Wards

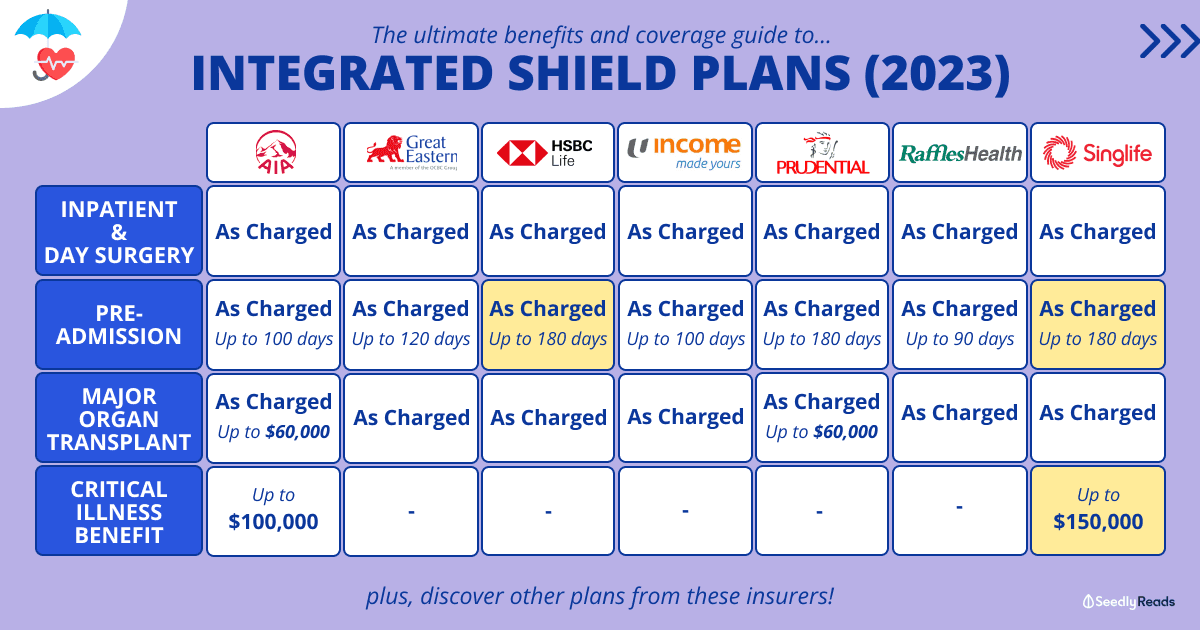

- AIA and Singlife offer coverage for selected Critical Illnesses

- Income is the only insurer that offers coverage for prosthesis

- ‘As Charged’ ensures that policyholders are reimbursed based on the medical expenses they incur, subject to policy limits, deductibles, and co-insurance, providing transparency and flexibility in reimbursement.

Click here to jump:

- What is an Integrated Shield Plan?

- Comparison of IP benefits and coverage

- What are deductibles and co-insurance?

- Should you get an Integrated Shield Plan?

Need Help Finding the Best Plan For You And Your Dependents?

We know, we know.

That’s A LOT to digest.

And if you still can’t make a decision, why not have someone do it for you?

Fill out this simple form, and we’ll get an independent financial expert to help you with your inquiry!

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

What Is an Integrated Shield Plan?

Integrated Shield Plan consists of 2 parts:

- Part 1: MediShield Life by Central Provident Fund Board (CPF)

- Part 2: Additional Private Insurance Coverage by private insurance companies to cover A/B1-type wards in public and private hospitals

An IP essentially provides these benefits:

- Coverage for pre and post hospitalisation

- Choice of private specialist doctors and hospitals

- Higher annual claim limits

- Coverage at private hospitals or A or B1 wards in public hospitals

IP also offers riders that can cover the cost of deductibles (a fixed amount you must pay before your insurance kicks in) and co-insurance (the percentage you must pay before insurance kicks in), allowing them to be minimised to 5 per cent with a co-pay rider.

And if you’re wondering how you should go about making claims from your IP, your insurance agent would act on your behalf for claims disbursement for the MediShield Life component of your IP.

MediShield Life

- MediShield Life covers all Singapore Citizens and Permanent Residents

- Covers you for Life

- It even covers your pre-existing condition, even if your additional Private (Part 2) Insurance coverage does not cover it.

Read More: Singaporean’s Ultimate Guide: What You Need To Know About Medisave?

If you have an Integrated Shield Plan, it means you already have MediShield Life. The Integrated Shield Plan is an optional add-on to your MediShield Life, so you are not making double payments.

Integrated Shield Plan Benefits & Comparisons

There are seven IP providers in the market right now, and their coverages range from:

- Private Hospitals: Standard room and below

- Public Hospitals: Class A ward and below

- Public Hospitals: Class B1 ward and below

- Public Hospitals: Class B2/C ward

How Can You Check if You Have an Integrated Shield Plan?

These are the steps you can take to check:

- Go to cpf.gov.sg‘s Healthcare dashboard

- Log on to My CPF Online Services

(You will need your SingPass) - See the “Health Insurance” section. If you do have an Integrated Shield Plan, it should look like this:

Integrated Shield Plan Standard Plans

Do note that there are typically three tiers of IP plans, but there is also a Standard Plan that’s targeted at Ward Class B1 in public hospitals.

Not to be confused with the tiering, these Standard Plans are plans that provide very basic coverage on top of your MediShield Life coverage, and the benefits are identical across all IP insurers.

There’s a catch, though. You will not be able to add a rider nor get covered for pre- and post-hospitalisation benefits such as psychiatric treatments and pregnancy complications.

For the latest set of benefits, you can refer to MOH’s website: www.moh.gov.sg

Best Integrated Shield Plans for Private & Public/Restructured Hospitals

1. Inpatient and Day Surgery

| Insurer | • Daily room & board • Daily ICU • Surgical Benefits: Procedures • Inpatient Hospice Palliative Care Service | Community Hospital Benefit |

|---|---|---|

| AIA HealthShield Gold Max Plan A & B | *As Charged | *As Charged |

| AIA HealthShield Gold Max Plan B Lite | Normal ward: Up to $2,250/day ICU Ward: Up to $6,850/day | Normal ward: Up to $760/day ICU Ward: Up to $960/day |

| Great Eastern Supreme Health P Plus & A Plus | *As Charged | *As Charged |

| Great Eastern Supreme Health B Plus | *As Charged | Normal ward: Up to $760/day ICU Ward: Up to $960/day |

| HSBC Life Shield Plan A & Plan B | *As Charged | Covered up to 45 days per hospitalisation |

| HSBC Life Shield Plan C | Normal ward: Up to $2,250/day ICU: Up to $6,850/day | Normal ward: Up to $760/day ICU Ward: Up to $960/day |

| Income's Enhanced IncomeShield (Preferred & Advantage Plans) | *As Charged | *As Charged |

| Income's Enhanced IncomeShield (Basic Plan) | *As Charged | *As Charged |

| Prudential's PRUShield Premier Plan 1, 2 & 3 | *As Charged | *As Charged |

| Prudential's PRUShield Plus 1 & 2 | *As Charged | *As Charged |

| Raffles Shield Private | *As Charged | Private, Class A, Class B1, Class B2+ / B / C: Covered 100% |

| Raffles Shield Plan A | *As Charged | Class A, Class B1, Class B2+ / B / C: 100% Private: 60% |

| Raffles Shield Plan B | ||

| Singlife Shield Plan 1, 2, 3 | *As Charged | *As Charged (Up To 365 Days) |

*As charged is highest coverage. Overall, the ‘as charged’ feature ensures that policyholders are reimbursed based on the actual medical expenses they incur, subject to policy limits, deductibles, and co-insurance, providing transparency and flexibility in reimbursement. Do note that benefit computation is also subjected to pro-ration factor.

2. Pre and Post-Hospitalisation Benefits

The number of days here indicates the maximum number of days before (after) the day of admission to (discharge from) the hospital.

Example: If it states 180 days coverage for pre-hospitalisation, it means that from the day of your admission to the hospital, count 6 months backward; any medical checkup, consultation etc. will be covered.

| Insurer | Pre-hospitalisation | Post-hospitalisation |

|---|---|---|

| AIA Plan A | As Charged (Up to 100 days) 13 months (Panel Providers) | As Charged (Up to 100 days) 13 months (Panel Providers) |

| AIA Plan B | As charged (Up to 180 days) | As charged (Up to 180 days) |

| AIA Plan B Lite | As Charged (Up to 100 days) 13 months (Panel Providers) | As charged (Up to 100 days) |

| Great Eastern (P Plus, A Plus & B Plus) | As Charged (up to 120 days) | As charged (i) within 180 days (ii) within 365 days - in a Restructured Hospital or prescribed by a Specialist Doctor who is a Panel Provider, that had ordered the Planned Hospitalisation |

| HSBC Life Shield Plan A & B | *As Charged (Up to 180 days) | *As Charged (Up to 365 days) |

| HSBC Life Shield Plan C | N.A. | N.A. |

| Income's Enhance IncomeShield (Preferred) | As charged (Up to 100 days if treated by non-panel) (Up to 180 days if treated by panel) | As charged (Up to 100 days if treated by non-panel) (Up to 365 days if treated by panel) |

| Income's Enhance IncomeShield (Advantage) | As Charged (Up to 100 days) | As Charged (Up to 100 days) |

| Income's Enhance IncomeShield (Basic) | As Charged (Up to 100 days) | As Charged (Up to 100 days) |

| Prudential PRUShield Premier & Plus Plans | * As Charged (Up to 180 days) | *As Charged (Up to 365 days) |

| Raffles Health Private & Plan A | As Charged (Up to 180 days by Panel or Singapore restructured Hospitals, 90 days otherwise) | As Charged (Up to 365 days by Panel or Singapore restructured Hospitals, 180 days otherwise) |

| Raffles Health Plan B | As Charged (Up to 90 Days) | As Charged (Up to 90 Days) |

| Singlife | * As Charged (Up to 180 days) | *As Charged (Up to 365 days) |

*Note: We will not be considering the benefits provided by each insurer for using their Panel of Providers.

3. Outpatient Treatment and Major Organ Transplant

All insurers cover outpatient treatments and major organ transplants ‘as charged’, outpatient treatments such as kidney dialysis and cancer treatment like radiotherapy, chemotherapy etc.

| INSURER | OUTPATIENT TREATMENT | MAJOR ORGAN TRANSPLANT |

|---|---|---|

| AIA Plan A, B & B Lite | As Charged | Plan A: Up to $60,000 per transplant Plan B: Up to $40,000 per transplant Plan B Lite: Up to $20,000 per transplant |

| Great Eastern GREAT SupremeHealth (P Plus, A Plus, B Plus) | As Charged for: -Erythropoietin -Immunosuppressants for organ transplant: -Kidney Dialysis Treatment -Radiotherapy for cancer -Long-term Parenteral Nutrition Outpatient Cancer Drug Treatment on the Cancer Drug List: 5x of MediShield Life limit per month Outpatient Cancer Drug Services: 5x of MediShield Life limit per Period of Insurance | As Charged |

| HSBC Life Shield Plan A & B | As Charged Outpatient Cancer Drug Treatment on the Cancer Drug List: 5x of MediShield Life limit per month Outpatient Cancer Drug Services: 5x of MediShield Life limit per Period of Insurance | As Charged Outpatient Cancer drugs treatments: 3x of MediShield Life limit Outpatient Cancer drugs services: 2x of MediShield Life limit |

| HSBC Life Shield Plan C | As Charged | As Charged |

| Income's Enhance IncomeShield (Preferred, Advantage, Basic) | As Charged | As Charged |

| Prudential's PRUShield Premier Plan 1, 2 & 3 | As charged Outpatient Cancer Drug Treatment on the Cancer Drug List: 5x of MediShield Life limit per month Outpatient Cancer Drug Services: 5x of MediShield Life limit per Period of Insurance | Up to $60,000/year |

| Prudential's PRUShield Plus Plan 1 & 2 | Up to $40,000/year | |

| Raffles Shield Private, A & B Plans | As charged Outpatient Cancer Drug Treatment on the Cancer Drug List: 4x of MediShield Life limit per month Outpatient Cancer Drug Services: 4x of MediShield Life limit per Period of Insurance | As Charged |

| Singlife | As Charged Outpatient Cancer Drug Treatment on the Cancer Drug List: 5x of MediShield Life limit per month Outpatient Cancer Drug Services: 5x of MediShield Life limit per Period of Insurance Outpatient Cancer Drug Treatment not on CDL list: Up to $30,000/year | As Charged |

4. Critical Illness (CI) and Prosthesis Benefit

Only 2 out of 6 provided additional benefits for critical illnesses and 1 out of 6 for prosthesis benefits.

| INSURER | CRITICAL ILLNESS | PROSTHESIS |

|---|---|---|

| AIA | Up to $100,000 policy year limit (for 30 CIs) | - |

| Great Eastern | - | - |

| HSBC | - | - |

| Income | - | As Charged Preferred Plan: Up to $10,000 Advantage & Basic: Up to $6,000 |

| Prudential | - | - |

| Raffles Health | - | - |

| Singlife | Up to $150,000 policy year limit (for 5 CIs) | - |

Critical Illness benefit is provided above the policy year and overall lifetime limits.5. Emergency Overseas Medical Treatment

In any case, where you require urgent medical treatment while you are travelling, your Integrated Shield Plans will still cover your medical expenses but usually at a limit like so:

| INSURER | EMERGENCY OVERSEAS TREATMENT |

|---|---|

| Income | As Charged Preferred: Limited to Private Hospitals charges Advantage: Limited to Restructured Hospitals, Class A ward charges Basic: Limited to Restructured Hospitals, Class B1 ward charges |

| AIA | As Charged |

| Great Eastern | As Charged P Plus: Limited to Private Hospitals charges A Plus: Limited to Restructured Hospitals, Class A ward charges B Plus: Limited to Restructured Hospitals, Class B1 ward charges |

| Prudential | As Charged (whichever is lower, overseas charges or Singapore Private Hospital's charges) |

| Singlife | As Charged |

| HSBC | As Charged, pegged to Singapore Private Hospital's charges |

| Raffles Health | As Charged Private: Limit to panel charges and subject to pro-ration factor Shield A: Limit to Singapore restructured hospital ward A Shield B: Limit to Singapore restructured hospital ward B1 |

6. Policy Year Limit

This limit is the maximum amount you can claim for hospitalisation expenses.

| INSURER | POLICY YEAR LIMIT |

|---|---|

| AIA | Plan A: Up to $2,000,000 if treated by panel, if not up to $1,000,000 Plan B: Up to $1,000,000 Plan B Lite: Up to $300,000 |

| Great Eastern | P Plus: Up to $1,500,000 A Plus: Up to $1,000,000 B Plus: Up to $500,000 |

| HSBC | Plan A: Up to $2,500,000 if treated by panel, if not up to $1,000,000 Plan B: Up to $500,000 Plan B Lite: Up to $200,000 |

| Income | Preferred: Up to $1,500,000 Advantage: Up to $500,000 Plan B Lite: Up to $200,000 |

| Prudential | Premier: Up to $1,200,000 Plus: Up to $600,000 |

| Raffles Health | Private: Up to $1,500,000 if treated by panel, if not up to $600,000 Plan B: Up to $600,000 Plan B Lite: Up to $300,000 |

| Singlife | With pre-authorisation: Up to $2,000,000 Without pre-authorisation: Up to $1,000,000 |

Deductibles & Co-Insurance

Integrated Shield Plans work a little like Car Insurance, where it requires you to pay an excess first before the insurer comes in to take over the rest of the payments. It is very similar to making a “downpayment”.

Similarly, for Integrated Shield Plan, you are required to pay a sum of money first, called deductibles and co-insurance, before the insurer covers the rest of your hospital bill.

Deductibles

All 6 insurers have the same deductible of $3,500 if you were admitted to a Private Hospital.

You are required to pay the first $3,500 of the bill before the insurer steps in.

Co-insurance

This comes in after the deduction of $3,500 from your bill.

For all 6 insurers, you are required to pay the next 10% of the bill before the insurer steps in.

Integrated Shield Plan Riders

You are able to cover about ~80% of the deductibles and co-insurance if you add on riders for yourself at an additional cost.

Premiums of Various Integrated Shield Plans

The premiums you need to fork out for Integrated Shield Plans vary.

Policy premiums also increase every few years from 20 years old onwards.

In short, your premiums get more expensive as you get older.

Thankfully, the premiums are payable by CPF Medisave Account up to the Medisave withdrawal limit.

Further Reading: Claims Processing Duration

How long would it take to get your claims processed if you were with any insurers?

| Insurer | Median Claims Processing Duration (Days) | 75th Percentile Claims Processing Duration (days) |

|---|---|---|

| AIA | 0 (same day) | 1 |

| Singlife | 0 (same day) | 1 |

| HSBC Life | 1 | 1 |

| Great Eastern | 0 (same day) | 1 |

| Income | 0 (same day) | 1 |

| Prudential | 0 (same day) | 1 |

| Raffles Health (New) | 2 | As RHI was approved to provide IPs from 16 July 2018 onwards, the number of claims processed by RHI is currently insufficient for analysis. |

Commonly Asked Questions or FAQs

I have Company Insurance. Do I still need this?

It depends.

- Integrated Shield Plan covers you for a lifetime.

- Your company insurance covers you for as long as you stay with the company. Unless your company offers Portable Medical Insurance.

If you are required to claim and have no Integrated Shield Plan on your own,

- Still able to get covered by the company.

- In future, when purchasing an Integrated Shield Plan for yourself, the condition that you claimed previously might get excluded.

Should You Get an Integrated Shield Plan?

Only if you answered ‘Yes’ to these few questions:

- Do you want to stay in a Private Hospital or Public Hospital Class A/B1 wards?

- Do you wish to choose your own doctor?

- Can you afford your premiums in the long term?

Premiums increase periodically as you get older. It is also possible to downgrade your plan (e.g. from a ‘Private Hospital’ plan to a ‘Public Hospital Class B1 Ward’ plan).

Only If You Are Healthy

- Integrated Shield Plan policies will be accepted only if you are healthy.

(Some insurers will insure you for your pre-existing if you have not visited the hospital for the same pre-existing condition) - If not, your plan will either be rejected or the insurer will exclude your existing condition.

- In other words, do not switch plans if your current plan covers your pre-existing condition.

Do discuss your needs with a financial advisor that you can trust, or reach out to the Seedly Community for opinions!

Related Articles:

- ZHUN BO? Insurers Want Patients To Pay Part Of Hospital Bills

- Insurance Policies You Need in Singapore For Each Age Group

- Insurance: How To Review & Why You Should

- Best Insurance Options for Those With Pre-existing Conditions

- Health Insurance for Expats in Singapore Made Easy

Advertisement