Rising Healthcare Cost in Singapore Here’s the Steps To Take to Shield Yourself

Inflation. Prices are literally. increasing. everywhere.

If you’ve visited a doctor recently, you would have paid for consultation and medication, and perhaps outpatient fees if hospitalised.

Did you notice that medical fees has increased? Because it did.

In the first seven months of 2022, the cost of healthcare rose by 1.7 per cent year-on-year, based on data from July’s Consumer Price Index (CPI) report.

This compares with the 1.1 per cent increase for the whole of 2021.

Let’s take a look at why healthcare costs have increased and what you can do about it!

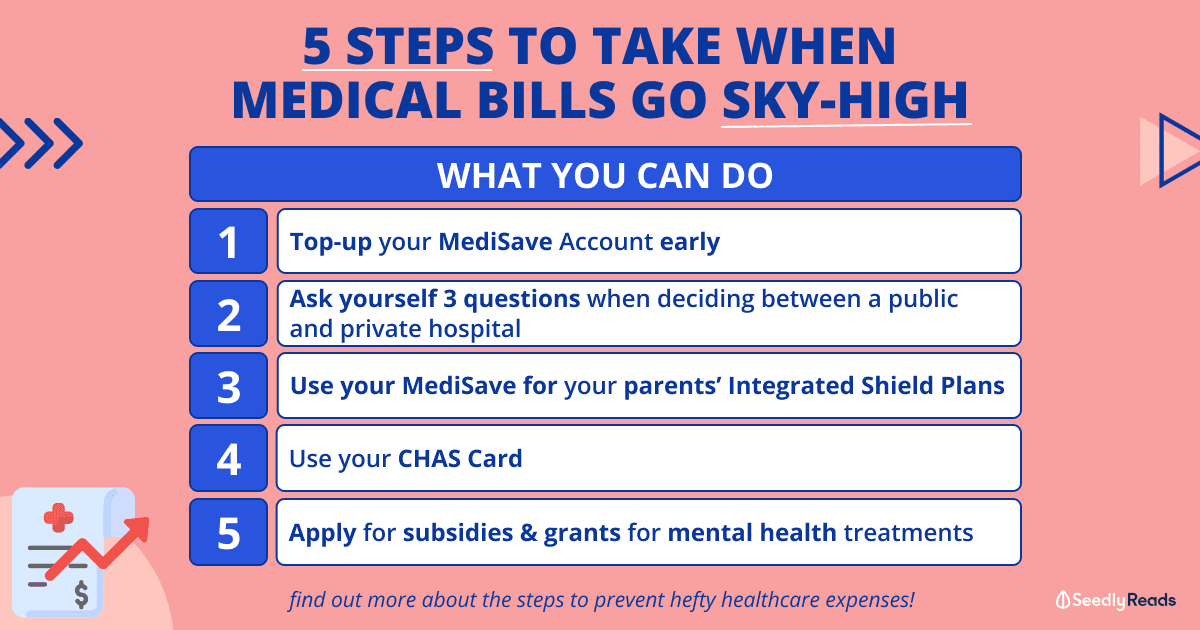

TL;DR: Rising Healthcare Costs And How to Shield Yourself Against It

Teleport Here:

- Why did healthcare costs increase?

- How to avoid higher healthcare costs?

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice to buy or sell any investment or insurance product. Readers should always do their own due diligence and consider their financial goals before investing and buying any products.

An Overview of Healthcare in Singapore

Singapore has long established itself as regional healthcare and medical hub, and each year, it draws people across the world with its efficiency and high-quality healthcare system.

Singapore was ranked top for having the most effective healthcare system during the COVID-19 period, according to the Bloomberg Health-Efficiency Index.

Not just this, Singaporeans also have one of the longest life expectancies in the world, at 83.6 years now, and is expected to increase to 85.4 years in 2040.

Why Did Healthcare Costs Increase?

It’s hard not to notice that the cost of living in Singapore is relatively high because after all, Singapore was named the second most expensive city in the world by the Economist Intelligence Unit (EIU) in its Worldwide Cost of Living 2021 survey.

Having one of the most efficient healthcare systems in the world means that there’re costs too.

Changes to Medishield Life Claim Cap & Insurance Premiums

In fact, there’s an outpour of state resources in the healthcare industry, and this is estimated to be $27 billion or around 3.5 per cent of Gross Domestic Product (GDP) by 2030!

This, when put together with inflation, a change in population demographics and an increase in health insurance claims, are contributory factors to the rise in overall healthcare costs.

Being a Singapore Citizen means you’re covered by MediShield Life, Singapore’s national health insurance scheme.

From 2016 to 2019, the number of health insurance claimants shot up by almost 30 per cent, while the number of payouts surged by close to 40 per cent.

This is the percentage change in July 2022 (we will update the article in due time).

Broadly speaking, the spending on healthcare will further increase given that the Government has plans to build 12 new polyclinics by 2030, and the salaries of healthcare workers, including nurses, will be raised.

To fund the rising number of claims and healthcare costs, health insurance premiums – both private and public – have been on the rise.

For the uninitiated, several policy changes have also taken place which led to an increase in insurance premiums:

| Policy Changed | Summary |

|---|---|

| March 2021 (part of Medishield Life 2020 Review) | Private hospital claims using Medishield Life were capped at 25%, which means that Integrated Shield Plan (IP) insurers have to foot a larger share of such claims |

| April 2021 | The minimum co-payment is 5% and it will be capped at $3,000 if the IP policyholder visits a panel of approved doctors provided by their insurer |

| October 2022 | MediShield Life will cover only effective and cost-effective treatments on a new Cancer Drug List and IP insurers are expected to limit coverage to the approved cancer drugs from April 2023 |

Ageing Population

It’s inevitable that with age, older folks are more prone to ailments such as high blood pressure, diabetes, stroke etc. which without long-term care and medical attention, may lead to complications.

On a related note, outpatient services and rising costs of medicines have added to healthcare bills due to the ageing population and disability in old age.

The reason for this is that the need for medical services will rise as the population ages and there are more elderly, and in economic terms, when demand increases while supply remains the same, the price increases too.

Read more:

- Medishield Life: Premiums To Be Deferred for Some Policyholders Till End-December 2021 (Update!)

- A Beginner’s Guide To Health Insurance: All You Need To Know & Types Available

What Can You Do Against Higher Healthcare Costs?

There are small steps you can take to prevent a hefty bill.

Top-up MediSave Account

All Singapore Citizens will have a Central Provident Fund (CPF) MediSave account to fund medical expenses.

But, there are two camps here – either you let the money sit in your MediSave account and earn a CPF interest of 4 per cent OR use your MediSave and avoid upfront cash payment.

If you belong to the no cash upfront camp, know that you can use MediSave for these purposes:

Regardless of your choice, we can’t deny that topping up your MediSave account to earn interest as early as possible is in fact, the first step to building a bigger nest egg for heavy medical expenses in later years (if any).

The difference between your Basic Healthcare Sum (BHS) and your MediSave balance is the maximum amount that you can voluntarily top up to your MediSave account.

For those who are unfamiliar with this, BHS is the estimated amount of savings an individual needs in his MediSave Account for basic healthcare needs as he ages, and this is currently at $66,000 and will be adjusted yearly for those under 65 years old.

Choosing Between a Public or Private Hospital

Policyholders of hospitalisation insurance always have this struggle because you want quality and attentive care, but you don’t want to feel the pinch in your stomach when you pay the bills.

I know exactly how you feel.

While this ultimately boils down to personal choice, I do have a few guiding principles when I’m deliberating between the two options (note that these are personal tips that work for me, and are not personalised financial advice):

- Are you able to endure the long waiting time at the public Accident & Emergency (A&E) department?

- If your ailment is potentially life-threatening

- If what you’re going through is a relapse of a previous ailment, and if your previous experience in either hospital was a bad or good one

Remember to try getting a Polyclinic referral should you be required to visit a specialist.

By doing so, you’ll be considered a public hospital patient and be charged accordingly.

In addition to that, if you intend to claim from health insurance, check with your insurer if there’s a need for you to stay in the hospital for six hours before making your trip.

Should You Downgrade Your Integrated Shield Plan (IP Plan)?

Your Financial Advisor would likely advise you against downgrading.

This is because once you downgrade an IP plan to one with lower medical entitlements or to the basic coverage under MediShield Life, it will be difficult to apply for another IP plan as insurers will check if the person has any pre-existing conditions.

For any re-application, the burden of proof is usually on the applicant and you would have to prove that you don’t have any underlying conditions, or you’ve recovered fully (if any).

Should your parents ask you this question, you may want to consider using your own MediSave to help your elderly parents pay the premiums on their IP plan, subject to the additional withdrawal limits.

Premiums for MediShield Life, Eldershield or Careshield Life can be fully paid by MediSave.

For supplement plans such as Integrated Shield Plans and Careshield Life Supplements, MediSave can be partially used to pay for premiums as well, up to Additional Withdrawal Limits.

For instance, the Additional Withdrawal Limit for additional private insurance components of IP Plans is as follows:

- $300 per year for those at age 40 years and below on their next birthday

- $600 per year for those at age 41 to 70 years on their next birthday

- $900 per year for those at age 71 years and above on their next birthday

This alternative is still less expensive than having to pay hefty hospital bills compared to if they only have very basic coverage, or no coverage at all.

CHAS Cards

All Singapore Citizens have a Community Health Assist Scheme (CHAS) card which enables you, including Pioneer Generation (PG) and Merdeka Generation (MG) cardholders, to receive subsidies for medical and/or dental care at participating General Practitioner (GP) and dental clinics.

But the amount of subsidies you can receive varies and is ranked according to the CHAS cards you qualify for.

Much like the Goods and Services Tax Vouchers (GST Vouchers), the card tiers you qualify for are determined by the household monthly income per person or the Annual Value (AV) of your home or if you are an MG or PG senior.

By colour differentiation, the Blue CHAS card gets the most subsidies, followed by Orange then Green.

Subsidies for Mental Health Treatments

Mental health issues are widely prevalent today, and I’m sure many of us would know of someone who’s suffering from a mental health issue.

If anything, the CHAS card does have some coverage for conditions that are mental health related.

Here it is for your convenience:

| Common Illnesses* | Chronic Conditions | Dental Services* |

|---|---|---|

| • Abdominal pain • Cough, cold, flu • Diarrhoea • Fever • Headache • Skin infection and rashes • Sore eyes • Urinary tract infection (List is not exhaustive) | • Anxiety** • Asthma • Allergic Rhinitis • Benign Prostatic Hyperplasia • Bipolar Disorder** • Chronic Obstructive Pulmonary Disease • Chronic Hepatitis B • Dementia • Diabetes (including Pre-Diabetes) • Epilepsy • Gout • Hypertension (High blood pressure) • Ischaemic Heart Disease • Lipid Disorders (e.g. High cholesterol) • Major Depression** • Nephritis/Nephrosis • Osteoarthritis • Osteoporosis • Parkinson’s Disease • Psoriasis • Rheumatoid Arthritis • Schizophrenia** • Stroke | • Extraction^ • Filling^ • Removable Denture • Denture Reline/Repair • Permanent Crown • Re-cementation • Root Canal Treatment • Polishing^ • Scaling^ • Topical fluoride^ • X-Ray^ |

| * Not applicable for CHAS Green Tier | ||

| ** Only claimable at selected clinics. Please call the CHAS Hotline 1800-275-2427 (1800-ASK-CHAS) for more information. | ||

| ^ Not applicable for CHAS Orange Tier | ||

If in doubt, you can call the CHAS Hotline (1800-275-2427) to get more information.

There are also other financial resources that can help one to reduce financial costs when seeking mental health treatments in Singapore.

Here’s what you need to know about the help available.

Afterthoughts

Health is something no amount of money can buy.

If we can prevent a certain ailment from escalating into something serious in our later years, it’s always a preferred option.

At the same time, battling against rising healthcare costs is something nobody wishes for.

What we can do during a period of economic uncertainties is to prepare ourselves early so that we can go through them without struggling financially (hopefully).

Do you know any other methods to shield yourself?

Tell us in the Seedly Community!

Read more:

- Affordable Health Screening Under $100 in Singapore

- Average Cost of Braces in Singapore – Metal, Invisalign, Ceramic & Lingual Braces

- Singaporean’s Guide To Cost Of Hospitalisation Treatment: Which Hospital Is The Cheapest?

- The True Cost Of Healthcare in Singapore That Every Singaporean Should Be Aware Of

- Health Insurance for Expats in Singapore Made Easy

Advertisement