Which Regular Savings Plan (RSP) Is The Cheapest? DBS vs FSMOne vs OCBC vs POEMS vs SAXO

Here’s one of the greatest misconceptions commonly held by Singaporeans:

I need to save up a huge amount to be able to start investing.

While that might be true in the past, have you heard of this little thing called the Regular Savings Plan (RSP)?

With as little as $50 to $100 a month, the average Singaporean with little to no knowledge of investing can take their first baby (Yoda) steps on their investment journey.

TL;DR: Which Is The Best Regular Savings Plan In Singapore?

The best Regular Savings Plan is usually the cheapest one because this way you get to keep as much of your returns as possible.

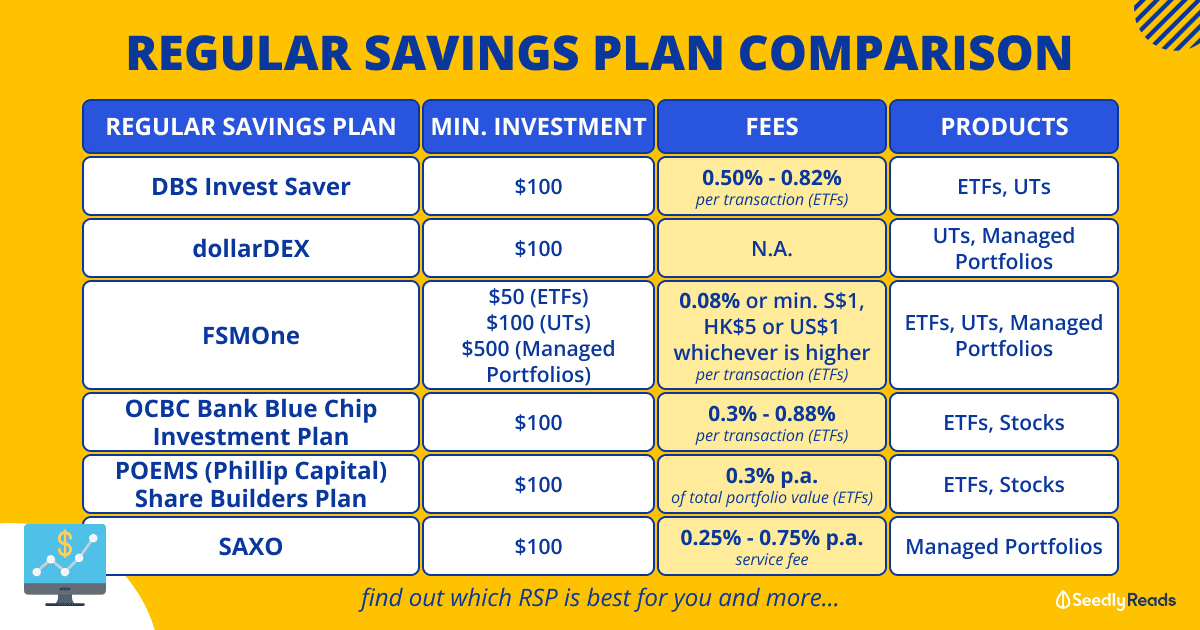

| Bank/ Financial Institute Regular Savings Plan | Minimum Investment Amount | Fees | Funds Available |

|---|---|---|---|

| DBS Invest Saver | $100 | ETFs: 0.50% or 0.82% per transaction Unit trusts: 0.82% per transaction | ETFs and Unit Trusts including: - Nikko AM STI ETF - ABF Singapore Bond Index Fund - Nikko AM-StraitsTrading Asia ex Japan REIT ETF - Nikko AM SGD Investment Grade Corporate Bond ETF |

| dollarDEX by Singlife Regular Savings Plan | $100 | Annual management fee for chosen funds No sales charge, switching fees and platform fees | Unit trusts, recommended investment portfolios |

| FSMOne Regular Savings Plan | ETFs: $50 Unit Trusts: $100 Managed portfolios: $500 | ETFs: 0.08% or min. S$1, HK$5 or US$1 whichever is higher Unit trusts: - 0% sales charge - Platform fee on cash/SRS investments only: 0.05 – 0.0875% per quarter Managed portfolio: - 0% sales charge - 0.35% - 0.50% management fee per annum | 125 ETFs listed on SGX, HKEX and US Markets 1780 Unit Trusts from 57 fund managers 10 Managed Portfolios |

| OCBC Bank Blue Chip Investment Plan | $100 | New customers below 30 years old with initial investment of up to $500 per counter: - Flat rate of 0.88% of total investment amount and total sales proceeds for buying and selling respectively Other customers: - 0.3% of total investment amount or $5 per counter, whichever is higher for buying and selling | 21 ETFs and stocks including: - Nikko AM Singapore STI ETF - Nikko AM SGD Investment Grade Corporate Bond ETF - Lion-Phillip S-REIT ETF - DBS Group Holdings Limited |

| POEMS (Phillip Capital) Share Builders Plan | $100 | 0.3% per annum of Total Portfolio Value (“TPV”) Min. S$1 per month | More than 50 counters |

| SAXO Regular Savings Plan | $100 | 0.25 - 0.75% per annum service fee 0.23% expected ETF cost No platform fee, entry fee, exit fee and custody fee | Managed portfolios by BlackRock and Lion Global |

From our comparisons, it seems like dollarDEX by Singlife is the cheapest (for Unit Trusts), followed by FSMONE (for ETFs).

But if you wish to have access to STI Component Stocks, then you’ll need to look at OCBC Blue Chip Investment Plan and POEMS (PhillipCapital) Share Builders Plan.

Jump to:

- What Is a Regular Savings Plan?

- What Are the Fees and Charges Associated With Regular Savings Plans?

- How Do I Choose The Right Regular Savings Plan For Me?

- Where Are The ETFs Which I Bought With My RSP Held?

- What About Dividends Crediting?

- Should I Invest With A Regular Savings Plan?

What Is a Regular Savings Plan?

A Regular Savings Plan (RSP) or Regular Shares Savings (RSS) Plan allows you to regularly invest a fixed amount of money (usually monthly) into a variety of financial products such as Exchange Traded Funds (ETFs), Unit Trusts (UTs), and blue-chip stocks.

By making a monthly investment, your Regular Savings Plan allows you to dollar-cost average your investment.

This means that when the prices of a blue-chip stock or an ETF are low, you’ll buy more. And conversely, you’ll buy lesser when prices are high.

In theory, the amount you pay to accumulate the stocks you want will average out over a long period of time.

This means that the price you pay for the stock will be much lower than taking a whole lump sum and buying the stock in one go.

Naturally, an RSP is designed for long-term investors.

What Are the Fees and Charges Associated With Regular Savings Plans?

Ah yes, the super annoying part is whenever you want to invest. The fees.

With RSPs, there are several fees such as sales charges, transaction fees, and platform fees.

If you’re going:

Relax!

Here is what they mean.

- Sales Charge/Transaction Fee: a fee imposed on you whenever you buy or sell a financial product

- Platform Fee/Service Fee: a fee imposed on you for using the financial institution’s platform to invest. This will usually be billed monthly and expressed as X% per annum.

- Management Fee: a fee imposed on you to pay their fund managers managing your portfolio if you choose to invest in a managed portfolio

How Do I Choose The Right Regular Savings Plan For Me?

One thing in common about Regular Savings Plans is that they allow you to invest in diversified financial products such as ETFs and/or Unit Trusts. But that’s where the similarities end.

While it is often marketed as a great way for beginner investors to get started, I personally see it as more of a tool rather than the silver bullet to long-term investment! You still need to understand what you are investing in before you put your money in! Remember, just because you’re setting aside money for investment, it doesn’t mean that it will always grow!

So before you select an RSP, you need to know what you want to invest in first. Do you want to invest in a Straits Time Index (STI) ETF that comprises the 30 largest stocks (by market capitalisation) listed in Singapore? Or do you want to invest in a specific STI component stock such as DBS Group Holdings Ltd (SGX: D05)?

Most RSPs do offer the Nikko AM Singapore STI ETF, with the exception of dollarDEX and SAXO. However, for STI component stocks, your options are limited to OCBC’s Bank Blue Chip Investment Plan and POEMS (Phillip Capital) Share Builders Plan.

Cheapest Regular Savings Plan

ETFs

If you prefer to invest in ETFs, FSMOne’s Regular Savings Plan would be the cheapest and has the widest selection too.

Unit Trusts

On paper, dollarDEX would be the cheapest as it does not charge you a fee to invest in Unit Trusts. However, Unit Trusts are managed by fund managers and have a fund-level management fee included.

Managed Portfolios

As for managed portfolios, there are management/service fees on top of any ETF costs. So the cheapest depends on the specific product you are looking for.

Features

Aside from having the specific financial product you want and the costs, you may also want to factor in the features of an RSP.

Most RSPs allow you to invest starting from $100. FSMOne stands out as you can start investing from $50 for ETFs.

If you’re looking for a joint account feature, the RSPs offered by FSMOne, OCBC, and PhillipCapital come with them too.

Where Are The ETFs Which I Bought With My RSP Held?

For all platforms, your ETFs are held in their respective custodian accounts.

This means that you do not need to open a CDP account in order to start investing.

This also means that if you wish to have the stocks or ETFs in your CDP account, you’ll need to apply for and pay the transfer fee to do so.

What About Dividends Crediting?

The whole point behind investing in a Regular Savings Plan is to get dividends.

| Bank/ Financial Institute | DBS Bank | FSMOne | OCBC Bank | PhillipCapital |

|---|---|---|---|---|

| Regular Shares Saving Plan | Invest Saver | Regular Savings Plan | Blue Chip Investment Plan | Share Builders Plan |

| How Are My Dividends Credited? | ||||

| Credited to | DBS/POSB debiting account | FSM cash account | Cash dividends will go to OCBC deposit account OR OCBC SRS account Stock dividend or bonus issues will be safe-kept with OCBC Securities Pte Ltd | Paid out in cash OR Reinvested into preferred counter |

The key takeaway here?

The only platform that allows dividend reinvestment is PhillipCapital.

For the rest of the platforms, you’ll have to do it manually.

Should I Invest With A Regular Savings Plan?

As mentioned, an RSP is a great tool for beginner investors, but only if you understand what you are investing in and the risks associated.

If you are a complete newbie to investing and want a bit more of a guided approach, you could also consider robo-advisors. But of course, they charge you much higher fees for their investment knowledge.

OR

You can just learn yourself by reading our articles and asking our community members! We don’t charge a cent for financial literacy 😉

Related Articles

Advertisement