It was good while it lasted.

Bank of China (BOC) SmartSaver is one of the best savings account in interest earned for the longest time.

With various savings account reducing making changes to their interest rates, it is inevitable that BOC SmartSaver is going to do the same too.

Find out about the change in the interest rate for other banks here:

- OCBC 360 Savings Account

- UOB One Savings Account

- DBS Multiplier Account

- CIMB FastSaver Savings Account

- Standard Chartered JumpStart Savings Account

- Standard Chartered Bonus$aver

Changes to Bank of China (BOC) SmartSaver From 1 August 2020

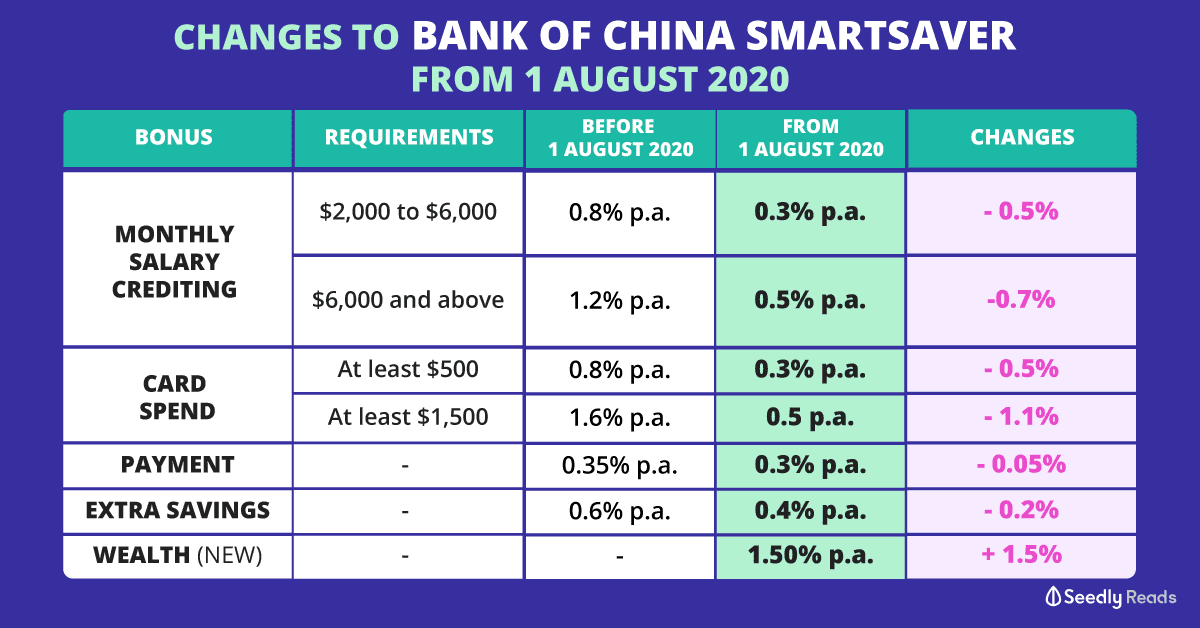

With effect from 1 August 2020, BOC SmartSaver will be making changes to their interest rate:

| Bonus Interest Categories | From 1 August 2020 |

|---|---|

| Wealth (Select insurance policies with varying min. premium amounts) | 1.50% p.a. for 12 consecutive months |

| Monthly Card Spend on Eligible BOC Debit or Credit Cards | 0.30% p.a. (Spend at least $500) |

| 0.50% p.a. (Spend at least $1,500) |

|

| Monthly Salary Crediting | 0.30% p.a. (from $2,000 to $6,000) |

| 0.50% p.a. ($6,000 and above) |

|

| Bill Payment (Successfully complete 3 bill payments of at least $30 each via GIRO or Internet Banking/ Mobile Banking Bill Payment function ONLY) | 0.30% p.a. |

| Extra Savings* | 0.40% p.a. |

A quick recap of BOC SmartSaver interest rate requirements:

Wealth Bonus Interest (New): Purchase any eligible BOC wealth products to earn this bonus interest for 12 months. Do note that the minimum amount to qualify for Wealth Bonus differs from product to product.

Card Spend: Spend at least $500 in a month using BOC cards to earn this bonus interest

Salary Crediting: Monthly salary crediting of at least $2,000 to earn this bonus interest

Payment: Have at least 3 bill payments of at least $30 each through GIRO and BOC internet banking/ BOC Mobile Banking bill payment function to earn bonus interest

Extra Savings: Simply fulfil at least one of the requirements for either Card Spend, Salary Crediting or Payment bonus interest to earn interest. Extra savings bonus is only applicable for account balance above $80,000 to $1,000,000. This is an increment from the previous $60,000.

On top of the changes above, the base interest for BOC SmartSaver is also reduced. Sadly.

| From 1 August 2020 | |

|---|---|

| Below $5,000 | 0.10% |

| $5,000 to $20,000 | 0.10% |

| $20,000 to $50,000 | 0.15% |

| $50,000 to $100,000 | 0.15% |

| $100,000 and above | 0.20% |

Is it Still Worth Opening a BOC SmartSaver Savings Account After 1 August 2020?

Going back to our most common example of a typical working adult in Singapore who has

- Has a starting minimum $10,000 savings account balance

- Has at least $2,000 in salary credited into the savings account after CPF contribution

- Spends a minimum of $500 a month via credit card on daily expenses (transport and food)

The BOC SmartSaver savings account will fetch him an interest rate of 0.70% per annum. While there is a reduction from the 1.85% per annum interest rate before 1 August 2020, the BOC SmartSaver still fetch a relatively high interest rate when compared to the some of the savings accounts available in the market right now.

Other than the interest rate, consumers should also read up on the real user reviews of BOC SmartSaver to find out more about the customer support and online banking interface of the savings account.

Advertisement